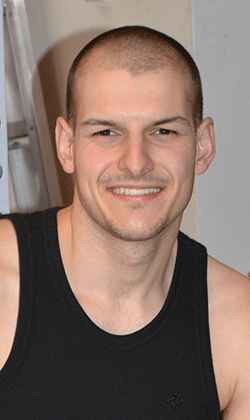

Luka Tumbas reviews his time while studying at Wealth Within. According to Luka, the education he has gained in his trajectory as a trader has had a profound effect on his life in a very positive way and in all areas of his life.

Luka is 24 years old and works full time, and trades Australian stocks on the side. He has previously worked in the banking sector and has also worked as an assessor in the education industry. He lives in Melbourne, Victoria and has currently been trading for two and half years.

How and when did you first become interested in the markets?

Interestingly, my introduction into trading the markets was different to most people, as I was first introduced to share trading by my mother while I was studying at university. Due to work and study commitments at that time, I could not take a full interest in trading until after I had earned my degree. However, listening to and watching my mother during that time increasingly built my desire to really explore this industry in the future.

And then what happened?

Whilst I really enjoyed my time at university, I also felt that university had not adequately prepared me for the real world of money and finance. As I recall reading somewhere, E James Rohn aptly said, “formal education will make you a living, self-education will make you a fortune.” Now that I am profitably trading, I can really appreciate the importance of that statement. After completing my university degree, my mother strongly encouraged me to get some self-education. She encouraged me to complete the Diploma of Share Trading and Investment at Wealth Within so I could further my real world education in money and finance.

How have you been able to learn and to educate yourself about the markets?

I took the opportunity to complete the Diploma and Advanced Trading Strategies Course at Wealth Within, and then set my sights on developing the skills I had learnt towards becoming a professional trader. Further to this education, I went on to complete their Forex and CFD Course so I could get a better understanding of the risk and money management involved in trading the highly leveraged instrument of CFDs.

Did you make mistakes when first starting out?

Akin to anyone developing a new skill, I made many mistakes when I first started out, and I can honestly say that I am still in the learning process. However, my mistakes are fewer and farther between. To me mistakes are just a learning opportunity for something that I did not know previously. Therefore, I am not afraid to make them. Even though it’s early in my trading career, I have seen far too many traders play it really safe in order to prevent mistakes. However, most of them achieve little success.

In my experience, the mistakes I have made have been minimized due to the quality of education and support I have received.

Would you define yourself as a discretionary trader, a mechanical trader or a combination of both?

I would define myself as a mechanical trader. I like to have structure in my fundamental and technical analysis. With structure, I can develop a trading plan for each stock that I trade.

Further to this, I analyse stocks on my watch list to determine the highest probability trades with the lowest risk. The most important component of my trading is back testing each stock that I choose to trade, in fact this is a critical component, as it gives me the confidence to know exactly which entry and exit rules provide the highest probability of success. There is an art to getting this right and unfortunately most people will struggle without the right training. The back testing also ties in to my risk and money management, as protection of capital is my number one priority above all else.

Who have been some of your mentors and role models? What impact have these people made on you personally as well as on your trading style?

It might sound a little corny but my mother has been a great inspiration and support to me. I would say the team at Wealth Within have not only been great mentors but have also had a profound effect on my personal trading. They have given me so much more than I ever expected from a trading course. It is also important to have mentors outside of trading. I have mentors who are entrepreneurs and investors from various industries including the health industry, network marketing, construction, and real estate. These various mentors come from different walks of life; however, they have the same goal and inspire me towards my ultimate objective of health, wealth, and financial freedom.

Can you give us a brief overview of your trading style?

Whilst I am a mechanical trader, my trading style is very flexible. It can change over time to factor in the changing conditions of the marketplace. The training I have received has given me the framework and structure to do this with confidence. In simple terms, I predominantly trade trending stocks on the long side that have a definable and repetitive cycle. I then enter into trades once these stocks have a significant retracement and give me confirmation of a new uptrend starting.

Is there any one trade (win or loss) that had a profound effect on your development as a trader? If so, what did you learn from the trade?

One trade that had a profound effect on my development as a trader was a position that I took in FLT in March 2015. At the time FLT had impressive fundamentals and my technical analysis indicated that it would have a strong uptrend. It appeared that the stock was trading nicely, however, several weeks later it was revealed that FLT would have lower earnings (but still profitable). This resulted in a strong sell off in the market and I incurred a considerable loss.

Whilst I exited the stock within my predetermined risk level, the most important thing that I learnt from this experience was that whilst a stock’s fundamentals may look great and the technical analysis is great, it does not guarantee a winner. When I trade, I do not believe I will win every time, however this trade taught me to be humble and remember that anything can happen unexpectedly in the market. It is important to be prepared for anything that may happen in the marketplace.

Can you tell us about your best and worst trades?

I believe my worst trade was FLT. However, the best trade as of now has been CTX. I had purchased CTX in early 2014. I held the stock from $21 in March 2014 to about $34 in April 2015, which resulted in a 60% rise. This trade taught me that if you follow a plan, stick to your rules, are patient and do your due-diligence, your hard work can pay off.

Would you classify yourself as a short-term or a long-term trader? What advice would you offer to people getting started as traders on the relative merits or otherwise of each?

I would consider myself a medium term trader holding positions on average anywhere between 3 to 18 months. As far as my advice to new traders is concerned, I see many who simply play it safe by just reading a few books and hoping they would magically learn how to trade. They don’t really commit to learning. Don’t get me wrong, books are great but learning to trade takes so much more than reading a few books. This is why I thank my mother who recommended I get a proper education. So my advice to amateur traders: Do yourself a favour and get a proper education before using the trial and error method. The market can be a harsh teacher, that is why it is important to have the right education to not only trade confidently but to also understand the importance of risk and money management.

What markets do you trade and which markets do you prefer? Do you have a favourite, and why?

I prefer to trade stocks from the ASX Top 200. I like trading stocks on a medium term basis as I can do thorough preparation before I put my money on the line. Remember trading is about probability, so I want to trade the best stocks with the lowest risk. Therefore, I win more than I lose. Moreover, I tend to keep busy, so I prefer to have the market, my trading style, and my portfolio work for me.

What makes your trading style different from others? What sets you apart from other traders?

Statistically, we all know that 90% of traders either lose or don’t make money in the market. Therefore, being a part of the 10% means I do things differently than the majority. My trading style is not fancy; in fact I would say it is pretty simple and easy to use. However, the number one difference between myself and the other 90% is that I perform back testing of various different trading rules including Dow Theory, Gann Swing, and trend lines on all my trades. I do this because the best traders I personally know, and the best in the world that I have read about, back test their strategies time and again before they implement them.

Do you have a favourite trading rule?

My favourite trading rule is entering and exiting on trend lines. It is so simple yet so many people ignore this great tool, preferring to concentrate on fancy indicators that, in my opinion, are not as effective. I think many software platforms give people a false sense of security or confidence by allowing them access to hundreds of tools and indicators, when all you need is a few simple rules and tools to be very successful.

Ed Seykota says, “Everybody gets what they want from the markets.” What do you ‘get’ from the markets?

I think the easy answer is money, but to me making money is a by-product of trading well. What I get from the market is important ‘lessons’ that assist me in refining my trading so that I become a better trader not just in a technique sense but in all aspects of trading, including understanding myself as a trader. This is especially significant with my losing trades, as they provide me with the best learning experience, or opportunity, to refine my trading and my trading style for future trades.

How has trading affected your lifestyle?

The education that I have gained in my trajectory as a trader has had a profound effect on my life in a very positive way and in all areas of my life. It has definitely made me a lot happier and more fulfilled. I am a goal-orientated person and there is nothing I like more than achieving them. Trading allows me to move confidently towards my goal of building wealth at a young age. This puts me ahead of many people in my generation and gives me choices that others don’t have.

What books, seminars and courses have you read or attended and which would you recommend?

Whilst there are many great books, seminars, and courses out there, I would highly recommend the Wealth Within Diploma of Share Trading and Investment. In terms of books I can’t go past Robert Kiyosaki’s ‘Rich Dad Poor Dad’ because creating wealth whether it’s from trading or another way really begins with changing your mind frame on how you approach money. Changing your mindset will place you among the 10% of traders that make money.

What does the future hold for you?

Quite simply anything I choose, but as I mentioned above health, wealth, and financial freedom. I will also continue my education in trading as not only do I believe that lifelong self-learning is the key to financial freedom, I simply love trading and learning more about it.