Portfolio Diversification: A Guide to Building a Diversified Portfolio

By Dale Gillham |

Just about anyone can construct a diversified portfolio and achieve good returns. The key to being successful is understanding proper portfolio diversification.

What is portfolio diversification, and why is it important?

We've all heard the saying, "Don't put all your eggs in one basket". There is a good reason for this - if you put all your money in a single investment and it turns sour, you stand to lose all of it. Therefore, it makes sense to diversify your investments across different asset classes, such as stocks, property and the cash market.

However, many in the investment industry continue to reinforce that over-diversification across many individual stocks (typically 25 plus) and even into international markets will minimise risk and increase returns further. However, in reality, this dilutes your investment returns and increases risk.

Building a diversified portfolio

While it is true that diversification reduces risk, a portfolio of stocks that is over-diversified is exposed almost exclusively to market risk, which cannot be eliminated by diversification. Let me explain.

Market risk exposure in a diversified portfolio

An investor who chooses to invest in a particular market is exposed to the risks inherent in that market (also known as systematic risk), which include the influences of inflation, political events, commodity risk, and interest rates that affect the market as a whole. If you invest in international markets, you are also exposed to exchange rate risks.

As such, the market risk remains regardless of the degree of portfolio diversification.

Market Risk Factors

However, an investor must also contend with specific risk, which refers to the risks inherent in a company or particular events in a market sector that influence specific stocks. Therefore, the total portfolio risk is the sum of the market risk and the specific risk of the individual stocks.

Specific risk exposure in a diversified portfolio

The specific risk or unsystematic risk, as it is also referred to, is very high if an investor concentrates on only one security. However, the more a portfolio diversifies, the less it is exposed to specific risks. When deciding how to diversify a portfolio, it's essential to know how much each stock contributes to reducing the overall risk of a stock portfolio.

A stock from a different economic sector contributes more than stocks from the same sector because it is unlikely that all sectors in the stock market will perform the same over time. For example, if one of the major banks is performing poorly, they will likely all be performing poorly because they are subject to the same economic conditions. The inverse of this argument also applies.

Specific Risk Factors

This is why we are told that diversifying a portfolio with various stocks from different sectors can help lower the specific risk.

How over-diversifying increases risk and reduces portfolio returns

It is common to find individual investors holding 30 or more stocks in a portfolio. When I tell them that one-third of their portfolio is rising, one-third is going sideways, and one-third is going down, most people agree, like I’m some genius.

If you want to get better returns in the stock market, it makes sense to eliminate the stocks that are going sideways or down. Securities that move sideways or fall in price hurt your ability to create wealth. If a stock falls in price, it increases your risk and reduces your overall returns. Therefore, holding these types of assets should be minimised, if not eliminated.

Based on over 30 years of experience, if you want to achieve better-than-average returns, you need to concentrate on assets that rise in value and increase your wealth.

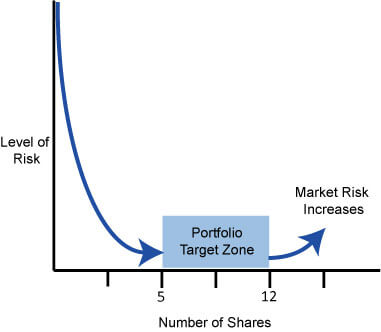

What is the ideal number of stocks to hold in a diversified portfolio?

As I state in my bestselling book "How to Beat the Managed Funds by 20%", an active trader or investor only needs to hold an asset allocation of between 5 and 12 stocks, which is one of my golden rules of good portfolio management. This allows individuals to achieve maximum diversification and minimise investment risk.

Risk Diversification Curve

If you're an active trader looking to achieve higher returns, you invariably need to take on a higher level of volatility to outperform the market. Therefore, you need to hold fewer stocks (between 5 and 8) to actively manage the specific risk.

If you're an active investor who doesn't have the time to manage the specific risk, holding a concentrated portfolio of between 8 and 12 stocks will enable you to reduce volatility without dramatically decreasing returns.

What is the justification for constructing a concentrated portfolio?

Increasing your holdings beyond 12 stocks exposes your portfolio to market risk, which cannot be eliminated by diversification. This is supported by John Evans and Stephen Archer, who published an article in 1968 in the Journal of Finance that became one of the most cited papers in Finance textbooks. They concluded that a passive investor only needs to hold between 10 to 15 stocks for a portfolio to be well-diversified.

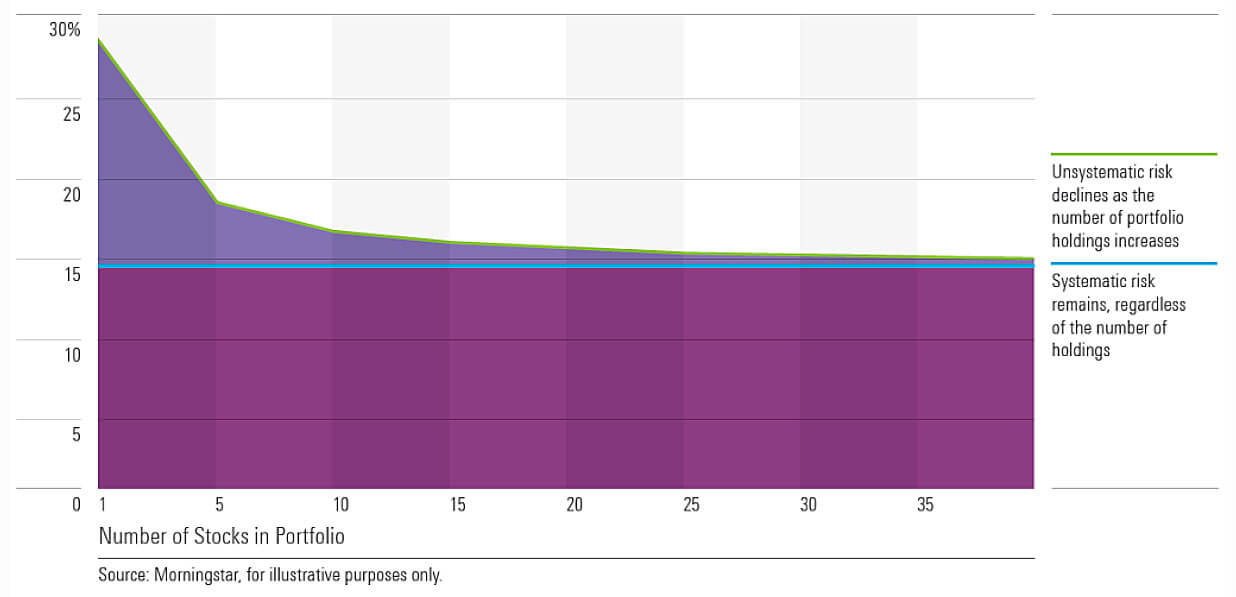

James Xiong, head of scientific investment management research for Morningstar Investment Management, also identified that the greatest reduction in risk occurs as the portfolio size increases from a single stock to 10 holdings and that only a slight reduction is seen beyond ten stocks.

Number of Stocks in a Portfolio Source: Morningstar Investment Management

The concept of a concentrated portfolio is also supported by investors questioning the conventional wisdom of over-diversification given the average returns achieved by fund managers over any 10-year period. Think of it this way - you don't get twice the benefit from holding 20 stocks as you do from having 10, and you certainly don't get ten times the benefit from holding 100 rather than ten stocks.

Given this, it seems unrealistic to justify why anyone would put in the additional time, effort and analysis to find stocks when the diversification benefit is so small.

What are the benefits of a concentrated portfolio?

The benefit of a concentrated portfolio is not to have lots of stocks with small amounts invested in each; instead, you only require a small number of the right stocks with higher amounts invested in each. This lessens your risk and has the potential to increase returns because:

- Smaller portfolios are easier to manage and represent lower risk. The more stocks you have in your portfolio, the more work you must do to manage your risk level.

- It is far easier to select a small number of stocks that are rising in price. The result is increased returns.

- You will have fewer transaction costs when buying and selling stocks simply because a smaller portfolio will have fewer transactions.

Selecting stocks for a diversified portfolio

Now that you have a basic framework for creating a concentrated and diversified portfolio let's investigate how to select the stocks that will give you a higher chance of being consistently profitable.

The list of stocks you select for your portfolio will depend on your available time, risk tolerance and the goal of your portfolio. That said, it's not recommended you stray too far outside the top 150 stocks on a stock exchange by market capitalisation unless you are a highly skilled trader, for the following reasons:

- The top 150 stocks are highly liquid - in other words, there is a lot of buying and selling taking place in these stocks every day, which means even in the event of a dramatic stock market crash, you will still be able to sell these companies quickly and easily;

- The top stocks are generally profitable businesses with some of the best managers, providing stability in the growth of the company and the stock price;

- The top stocks are purchased heavily by the institutions. Therefore, they are less likely to be affected by mass panic buying and selling;

- Reliable information about these stocks is much easier to obtain;

- The chances of any one of these companies going broke is very small, and

- Over a ten-year period, most of these stocks will produce strong returns from capital gains and income from dividends.

The bottom line is that you want to identify good growth stocks that deliver capital gains and income.

Investing outside the top 150

Unfortunately, many newcomers to the stock market mistakenly believe that investing in blue-chip stocks is too expensive and that buying small-cap stocks or stocks perceived as cheap is the best method for achieving higher returns.

However, this belief costs you money and hinders your ability to generate profits because you are speculating that a cheap stock subject to a high level of risk will outperform a solid blue chip stock. From experience, the opposite is true, which is why you want to buy quality stocks, not quantity because this is where you will get the highest gains at the lowest risk.

By taking a low-risk systematic approach to investing over the long term, nine times out of ten, you will achieve far higher returns than if you try to beat the market averages by picking the next boom stock.

Managing risk in a concentrated portfolio

Not only do you need to select quality stocks, but you also must apply solid money management and risk management strategies to achieve good returns when creating a concentrated portfolio.

This includes applying stop losses to manage the downside risk or to lock in profits. Regarding money management, you would never invest over 20 per cent of your total capital in any stock. If you invest in the stock market, you must accept that some stocks will fall in value. However, this rule helps reduce your exposure to risk while allowing you to achieve good returns simply because you are minimising the amount of capital you could lose at any time.

Money management rules for active traders

For example, if you're an active trader wanting to invest $50,000 in five different stocks, you would invest $10,000 in each stock or 20 per cent of your total capital.

If, at the end of the first year, one of the stocks has dropped by 50 per cent (hypothetically, as an active trader would have used a stop loss and exited well before this), you will have lost $5,000 of your initial capital. But if the other four stocks have all risen in value by 10 per cent, you will have made $4,000. Therefore, your total loss would be $1,000 or only 2 per cent of your initial capital.

As such, you will have minimised your exposure to risk by spreading your capital across several stocks.

Money management rules for active investors

If you are an active investor holding between 8 and 12 stocks, you would invest between 8 and 12 per cent of your total capital in each stock.

For example, if you invest 8 per cent in each share, you will have 12 stocks in your portfolio. On the other hand, if you invest 12 per cent in each share, this means you would hold eight stocks in your portfolio.

Constructing a well-diversified portfolio

While I am a big advocate of building wealth with equities, it's also wise for individual investors to consider investing in real estate and the cash market to achieve proper portfolio diversification and reduce their overall portfolio risk.

Diversifying with property

When investing in property, it is possible to leverage the growth potential and liquidity of shares to build up a deposit to purchase an investment property or a place to call home.

However, if housing prices are a barrier to buying into the Australian property market, Real Estate Investment Trusts (REITs) that own income-producing real estate offer investors diversified exposure requiring less capital than direct ownership. Alternatively, real estate exchange-traded funds that buy shares in REITs can be a good investment opportunity. However, it pays to research your options and only invest in one REIT or Real Estate ETF; otherwise, you may over-diversify your portfolio in this sector.

Diversifying in the cash market

It's also worth gaining exposure to bonds by investing in the bond market, as these assets act as a defensive investment against stock market volatility.

However, bond yields decrease when interest rates rise, so investing in a high-yielding term deposit may be better when interest rates rise. According to Canstar, banks currently pay as much as 5.25 per cent on a 12-month term deposit.

To sum up

From experience, if you follow the rules and strategies outlined in this article in building a diversified portfolio, you will reduce your risk and achieve greater returns than most in the stock market. Of course, you also need to reduce your exposure and the volatility of investing in the stock market by diversifying into other assets such as property and the cash market. This allows you to build up a nest egg to ensure you can enjoy yourself in retirement.

Dale Gillham is one of Australia's most respected analysts with over 30 years of experience in the investment industry, including banking, financial planning, share market education and professional trading. He is the best-selling author of multiple books. Dale is also passionate about ensuring clients receive the highest level of education in the stock market with Australia's only government-accredited course at the Diploma level.

Others who read this article also enjoyed reading:

- Learn How to Trade Stocks

- Trading the Stock Market - Why Most Traders Fail

- The Laws of Wealth Creation

Consider purchasing my latest award-winning book, Accelerate Your Wealth, It's Your Money, Your Choice. It's packed with simple but powerful investment strategies that will have you confidently trading the stock market.

To learn how you can profitability trade the share market on a consistent basis, check out our trading courses. You can also check out our clients' successes by viewing their reviews and testimonials.