Frequently Asked Questions

Course Related Questions

General Questions

This has to be the number one problem for people learning to trade - they get big promises only to find that the company does not deliver. IIn the end, it costs you money and time, and you still cannot trade.

Wealth Within specialises in helping people who have attended these types of educational courses. In fact, the vast majority of our clients have gone elsewhere to learn only to come back to us asking for help.

Our promise to you is that no matter where you have learned or what you have done in the past, we can and will help you achieve your goals in the share market.Check out the reviews, success stories and testimonials of our clients.

Many traders don't know where to start or how to apply the knowledge they may already have, and mistakes can be costly.

Our goal at Wealth Within is to enhance your knowledge and fill in the missing pieces to make your trading simple, easy and effective. You'll receive comprehensive, interactive support and guidance from professional traders to ensure you not only improve your knowledge and skills but also increase your profits.

This is one of the things that separates successful traders from those who are not and is a common problem among traders who know how to get into a stock but don't know where to get out.

Not knowing where to get out will cost you in two ways: one in lost profit because you get out too early or two in bigger losses as you get out too late.

Through our comprehensive education and support system we will show you how to confidently determine the best place for you to exit your trades. What we share with you will enable you to dramatically increase your profits and reduce your losses.

This often happens because of a lack of understanding about the direction of the market.

Quite often traders find they buy a stock only to see it fall in price after they bought it. Knowing the direction of the market is the primary objective of a trader. Our expert traders will show you how to simply and easily determine the direction of the market and trade with the trend.

This is quite common for traders who have been taught ineffective techniques and strategies.

Often traders use the wrong technique for the market they are trading. We show you the right type of stop loss to use for the market you are trading, as well how to use it for your style of trading.

Many traders start out by reading books in an effort to trade the market. However, most books are designed to give you only enough information to get your attention, not necessarily to trade.

Our uniquely designed trading courses give you the necessary education you need to trade like a professional. You will interact with professional traders who will work with you to comprehend and apply the information taught.

Wealth Within will also provide you with extensive ongoing support throughout the course to assist you in developing a trading methodology that suits your style of trading to ensure you are consistently profitable.

This is a common myth that can cost individuals a lot of money. Unfortunately, the cold reality for those who choose to day trade is that less than 20% are profitable, while for others, they are inconsistent, at best.

I was recently talking to a trader who had been day trading foreign exchange over the past three years and he communicated that he watched the markets all day from various computer screens. Now, you can imagine how stressful that would be. And given that he was enquiring about our trading courses, you would have to assume that he was not doing that well.

I actually said to him that, at a guess, if he added up all the hours in a week that he spent trading and then divided this into the returns he was making, he would get a better hourly rate working at McDonald's. He agreed. And the penny dropped.

The unfortunate reality is that many attempt to trade forex well before they have developed the foundations needed to be successful in the stock market.

So the question remains, would you prefer to trade more and make less, or trade less and make more?

The bottom line is that you will make far more money from strategies that enable you to trade well rather than often, which is what we teach you at Wealth Within

Many who venture down the path of learning to trade the stock market are taught to trade using traditional technical indicators, such a MACD's or moving averages, which became prevalent with the introduction of computers.

Unfortunately, for the most part, technical indicators are considered lagging indicators, as they only inform you after the market has already moved, which explains why individuals who use them generally place a lot more trades. And while this makes the brokers more money, it generally results in many achieving very mediocre returns, while for others it can result in an unprofitable trading system.

So, while trading can be easy, unfortunately, the majority have not learnt how to trade properly, which is why they are unprofitable, and often give up believing it is all too hard.

At Wealth Within, we focus on teaching the classical techniques of technical analysis, such as Dow, Gann and Elliott wave that have proven for more than 100 years to be the essence of success in the stock market.But more than this, we have refined these strategies over 30 years to make them more relevant in today's market to ensure you take more profits.

Our focus is on teaching you how to apply the right skills and knowledge using price, pattern and time because when all three areas converge at the same point on a chart, the probability of a move increases dramatically and reduces risk accordingly. The end result is that your trading becomes much easier and more profitable.

In fact, combining all three methods of analysis reduces the risk of getting caught out in false moves, which is a common problem many individuals struggle with. It also means you will trade less and make far more money.

In essence, combining price, pattern and time increases the probability that you enter or exit a stock at the earliest possible point and at the lowest possible risk.

We have students around the world completing our courses, as they are all delivered in an interactive, online environment.

We also teach you how to trade using a world-wide exchange, which means your focus is on learning how to apply the techniques and strategies being taught rather than on a particular stock or market.

That all depends on your goals for trading the markets. While we offer the Share Trading and Investment Course and the Short Course in Share Trading(which comprises the first three modules of the Share Trading and Investment Course), you may decide that the Trading Mentor Course is more suitable for you.

If you have a question we haven't answered, please feel free to email us.

Making A Difference

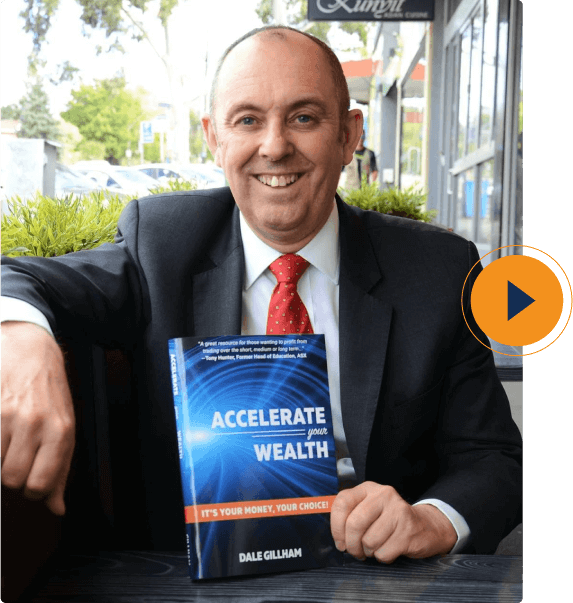

Wealth Within was co-founded in 2002 by Dale Gillham to provide a range of solutions to support our clients achieve their financial goals.

Our mission has always been "customer first in everything we do" – which means breaking down a lot of the myths in the market that hold individuals back from achieving their financial goals.

How We Can Help You Grow

Trading Courses

Trading Courses Carefully curated educational courses from Australia's most independently recognised share trading educator.

View Courses Learning Center

Learning Center Our extensive library of world-class education accumulated from decades of experience and expertise.

Keep Reading Investment Shop

Investment Shop Accelerate your wealth with simple DIY investment strategies that let you take control of your investments.

View Investment Shop5 Stars

Years in business delivering high-quality education

of students rate the quality of education as excellent or very good

of students recommend Wealth Within