In the Media

The following is a sample of where Wealth Within has been profiled in the media.

How to position investments for 2026: Expert advice on market cycles

Ticker News - 14 Jan. 26

As 2026 begins, investors are navigating an evolving market landscape. Experts stress that positioning your investments strategically is far more important than trying to predict market movements. Key factors include focusing on quality companies, maintaining strong cash flow, and diversifying intelligently. Dale Gillham from Wealth Within Group joins us to break down what defines a major market cycle and why understanding it can shape your investment approach...

Beyond ETFs: Why CY26 demands active stock picking

The Market Online - 05 Jan. 26

As the calendar turns toward 2026, most investors will make the exact same resolution they always do: set it, forget it, and trust the market to do the work. Money will continue flowing into index-tracking ETFs, built on the belief that passive investing remains the safest and smartest path forward. That approach worked well when markets moved in broad, rising waves. When growth was widespread, trends were durable, and most sectors advanced together...

RBA's message to Albanese: Interest rate hikes likely in 2026

Hot Copper - 19 Dec. 25

The Reserve Bank of Australia (RBA) may have left interest rates unchanged last week, but beneath the polite language and careful caveats, the governor delivered a far harsher message to Albanese. The warning was unmistakable: If inflation isn’t reined in, the RBA will do it themselves by raising interest rates. Australia’s inflation problem is now fully exposed. Temporary electricity bill rebates masked underlying price pressure...

Friends With Money: Stocks for your stocking 2025

Money Magazine - 10 Dec. 25

After a turbulent year for the local market, which Australian stocks could shine in 2026? This week on the Friends With Money podcast, Money's Tom Watson is joined by Dale Gillham, chief investment analyst at Wealth Within, to run through the Australian companies that investors may want to consider adding to their Christmas lists...

Australian economists blast Trump’s 50-year ‘game changer’ mortgage plan

Australian Broker - 09 Dec. 25

Dale Gillham from Wealth Within warned that stretching loan terms primarily benefits lenders and risks pushing property prices even further out of reach. “Increasing the mortgage length benefits the lenders far more than it benefits consumers,” Gillham said. “Australia has this unique love affair with property, and we need to look deeper into why this is. “Further, we need to look at what is driving prices to unrealistic levels...

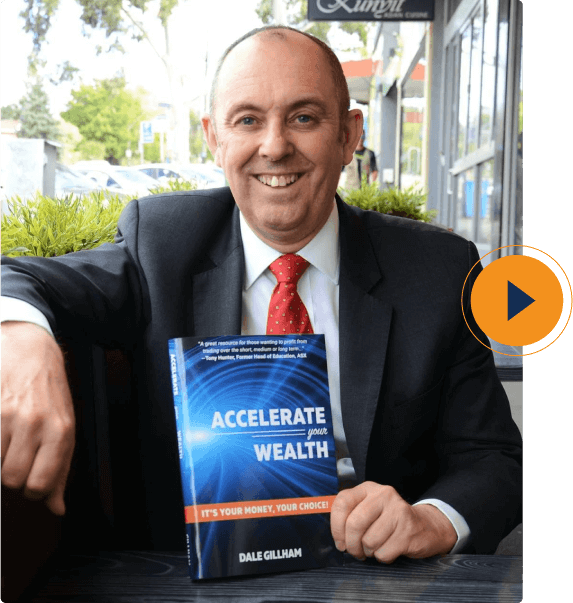

Making A Difference

Wealth Within was co-founded in 2002 by Dale Gillham to provide a range of solutions to support our clients achieve their financial goals.

Our mission has always been "customer first in everything we do" – which means breaking down a lot of the myths in the market that hold individuals back from achieving their financial goals.

How We Can Help You Grow

Trading Courses

Trading Courses Carefully curated educational courses from Australia's most independently recognised share trading educator.

View Courses Learning Center

Learning Center Our extensive library of world-class education accumulated from decades of experience and expertise.

Keep Reading Investment Shop

Investment Shop Accelerate your wealth with simple DIY investment strategies that let you take control of your investments.

View Investment Shop5 Stars

Years in business delivering high-quality education

of students rate the quality of education as excellent or very good

of students recommend Wealth Within