3 ASX Stocks to Buy Now and Profit from the AI Boom

By Fil Tortevski and Pedro Banales

Artificial intelligence (AI) stocks are surging globally, and while much of the spotlight is on the United States, few investors realise that Australia is having its own AI revolution. As tech leaders like NVIDIA and Palantir dominate headlines, the ASX is quietly producing a new wave of undervalued innovators in the AI space, companies with real potential to ride the next big growth wave.

In this week’s feature, our analysts from Wealth Within, Australia’s leading accredited trading educator, break down three local stocks set to capitalise on the AI trend and how traders can position themselves smartly amidst global “AI bubble” concerns.

AI Mania: Bubble or Opportunity?

The market buzz around AI has sparked debate globally. Some top investors, including the famed Big Short trader Michael Burry, have even placed billion-dollar bets against overvalued AI giants in the US.

However, Australia’s AI market is fundamentally different. The local tech sector is smaller, more diversified, and less inflated by mega-cap valuations. While the US may face correction risks driven by overconcentration, Australian investors are enjoying opportunities in smaller, high-potential companies that are integrating AI across real industries, from translation services to healthcare imaging.

1. AI-Media Technologies (ASX: AIM) – AI-Powered Captioning

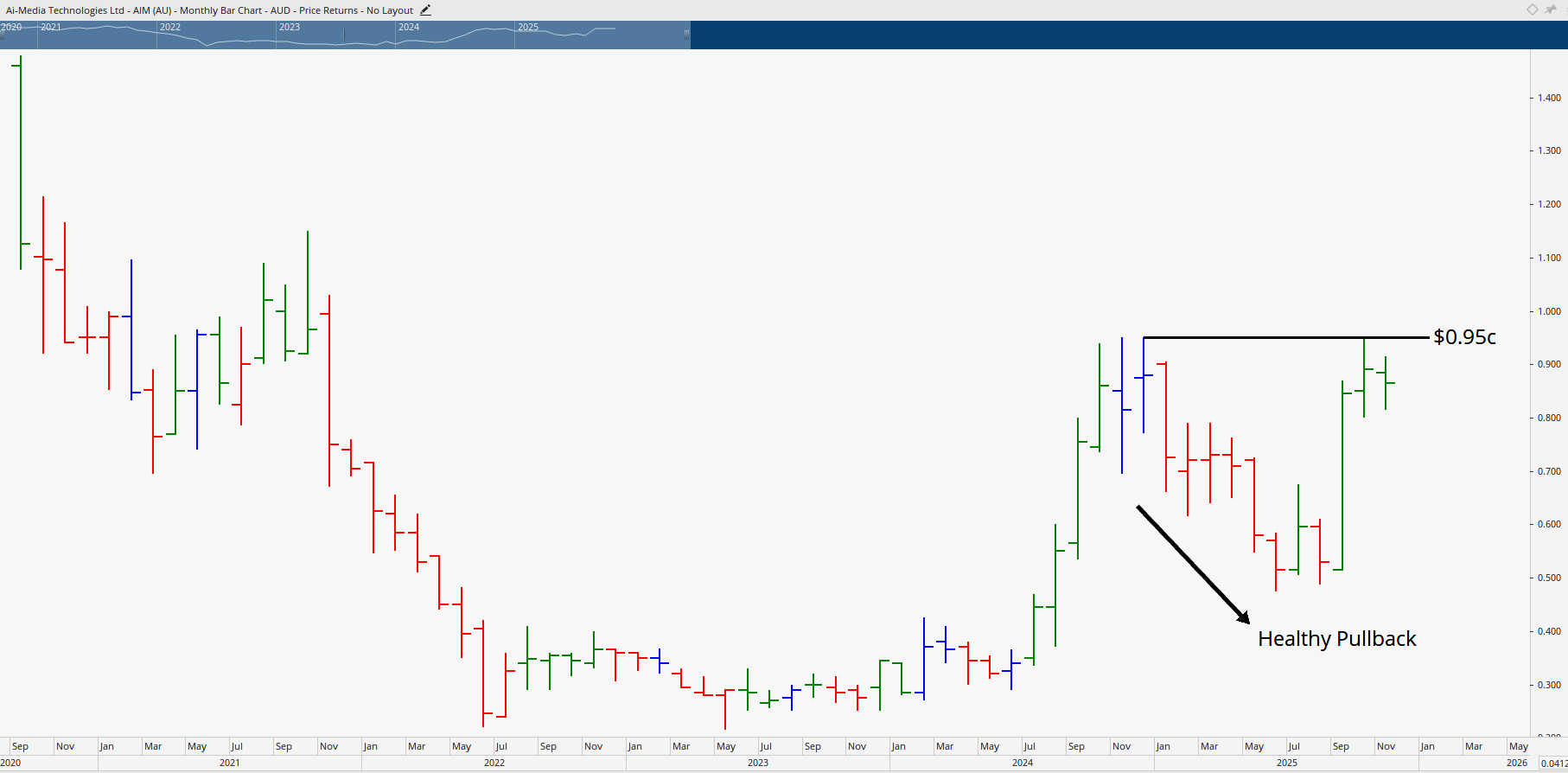

AI-Media Technologies stands out as a key player in real-time captioning and translation. Leveraging AI in broadcasting and live media environments, the company has demonstrated impressive growth recently, with its stock price soaring approximately 100% since mid-2024.

Our analysts note that the chart exhibits renewed momentum following a healthy pullback. As traders evaluate the risk-reward setup, price structure and timing become crucial and are cornerstones of disciplined trading taught throughout our Trading courses.

For short- to medium-term traders, any sustained break above 95 cents could confirm bullish potential, but understanding proper money management and technical confirmation remains essential before entering.

For those new to trading, our Short Course in Share Trading offers the perfect introduction to managing risk, reading charts, and building your first profitable strategies based on proven fundamentals.

2. PureProfile Limited (ASX: PPL) – AI-Powered Customer Insights

PureProfile is a data and analytics company using AI to transform how businesses understand consumers. It’s gaining rapid traction thanks to rising demand for predictive analytics and real-time data interpretation.

According to Wealth Within analysts, the technical setup for PureProfile displays a textbook pattern, often a precursor to major price expansions. A breakout above 5.5 cents with strong volume could open the door to a potential 70% or greater move.

With revenues climbing and fundamentals aligning with technical indicators, PureProfile’s story resembles earlier breakout cases that delivered significant returns to informed traders.

However, trading lower-liquidity stocks requires careful position sizing and timing which are skills that form part of the professional framework taught in our Diploma of Share Trading and Investment, Australia’s only government-accredited stock trading qualification.

3. Artrya Limited (ASX: AYA) – AI in Healthcare Innovation

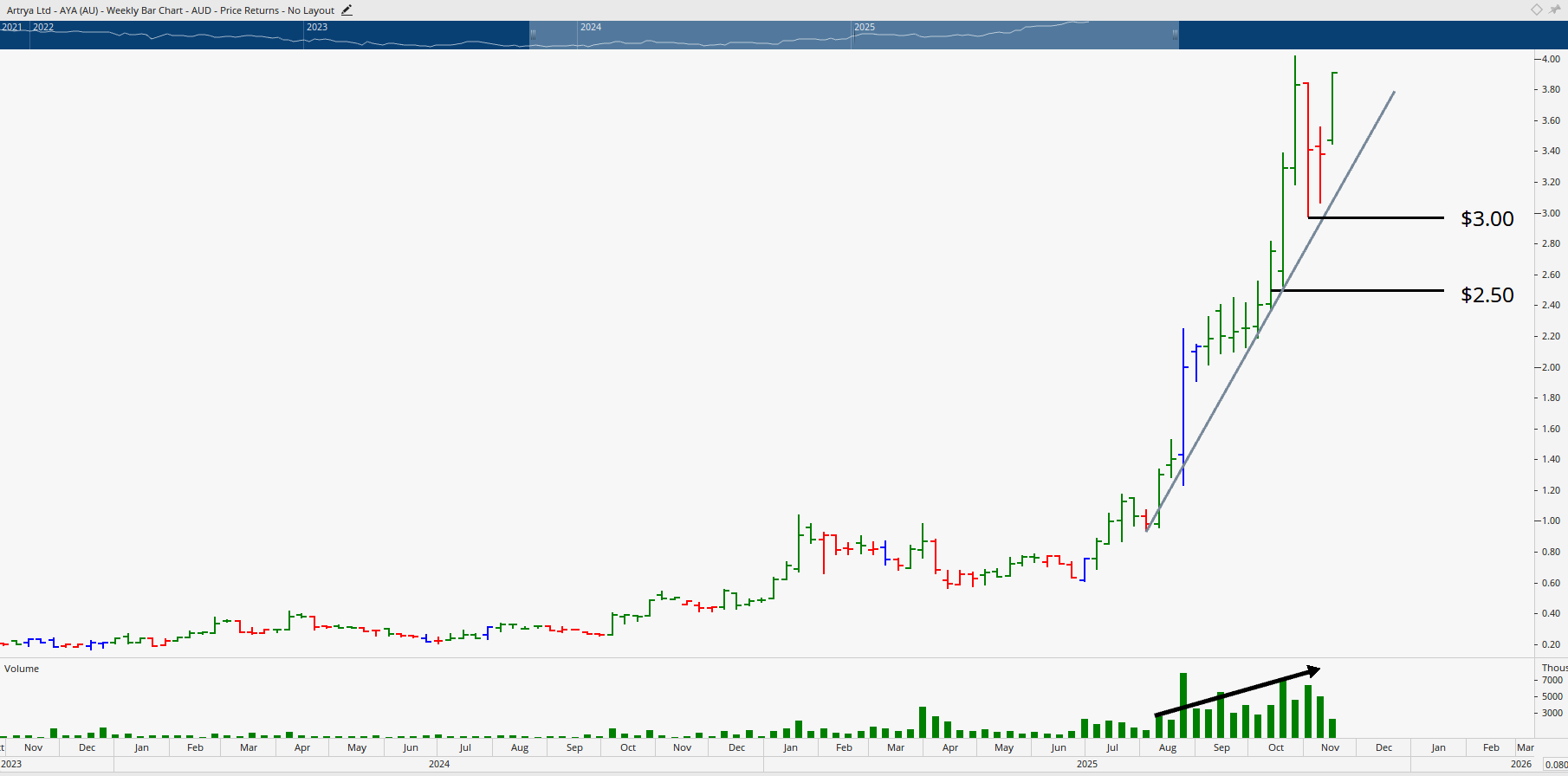

Artrya is an Australian medical technology company revolutionising AI-driven diagnostic imaging for coronary artery disease. As healthcare and AI converge, this sector is becoming one of the most promising frontiers on the ASX.

Artrya’s share price has already delivered strong gains since mid-2025, reflecting growing investor recognition of its cutting-edge technology. However, our analysts caution that the stock may require a more sustainable base, ideally around the $2.50 level, before offering a stable medium-term entry.

Short-term opportunities exist, especially with buyers defending the $3 region and strong volume activity suggesting building momentum. Timing remains key: entering too early can expose traders to volatility, while waiting for confirmation improves the probability of success.

At Wealth Within, we teach traders how to combine technical analysis, price structure, and confirmation signals to identify genuine opportunities like these. You can learn these methods through our online Advanced stock trading course, designed for those striving for professional-level trading precision.

Is There an AI Bubble on the ASX?

It’s true that speculative excess can creep into any hyped sector, but Australia’s AI trend appears grounded in practical innovation rather than pure speculation.

Even if some overvalued players stumble, the broader AI theme like the internet revolution of the early 2000s will survive and evolve. In fact, many of today’s most successful companies emerged from that same cycle of creative destruction.

AI is here to stay, and Australian innovators with robust intellectual property, product-market fit, and real utility are well-positioned to thrive long after the noise fades.

What Traders Can Learn from the AI Stock Surge

Trading AI stocks is not about chasing hype but instead it’s about understanding risk, reading confirmatory signals, and structuring trades with discipline. Many investors are guided by emotion, buying into narratives rather than using evidence-based strategies.

At Wealth Within, we specialise in teaching traders how to think, plan, and act like professionals. Our structured programs provide real-world trading education supported by professional mentoring and interactive analysis sessions.

- Start your journey with our foundational Short Course in Share Trading.

- Build advanced competence and confidence with the nationally recognised Diploma of Share Trading and Investment.

- Refine your mastery with our specialised Advanced stock trading course focusing on Elliott Wave, time analysis, and portfolio construction.

By combining technical expertise with psychological awareness and strategic execution, our graduates consistently outperform amateur traders stuck in cycles of guesswork or hype-chasing.

Watch, Learn, and Trade Smarter

For ongoing insights into emerging sectors, market analysis, and high-probability setups, check out our Hot Stock Tips videos. Each episode features expert commentary on trending ASX opportunities, including AI, resources, and financial markets.

You can also learn more about our legacy of empowering traders through Australia’s most trusted and accredited stock market educator on our About Wealth Within page.

Position Yourself for the Next Wave

The AI revolution is transforming industries and the ASX is no exception. From healthcare innovators to data-driven marketing firms, Australian companies are integrating AI to unlock new efficiencies and profits.

However, success in trading these trends requires strategy, patience, and education. Knowing when to buy and when to exit is what separates skilled traders from speculators.

If you’re ready to capitalise on the next growth phase of the market and take control of your financial future, now is the time to develop your skills with industry-recognised Share trading education from Wealth Within.

Start learning today, because the next AI rally belongs to informed traders.