3 ASX Stocks to Buy in September: RIO, Deep Yellow and Vault Minerals

By Fil Tortevski and Pedro Banales

September has arrived, and historically it’s one of the ASX’s toughest months.

Yet volatility creates opportunity.

Here are three stocks our analysts highlighted for their potential setups this month, plus the key levels to watch and how to approach them with a trader’s mindset.

As seen on Bloomberg, CNBC, Sky News and major Australian outlets, Wealth Within brings a depth of analysis you can trust.

Why September matters

Seasonality suggests September and October can be challenging, but disciplined traders use that to their advantage.

The goal isn’t prediction, it’s preparation: define your key levels, plan your risk, and execute with consistency.

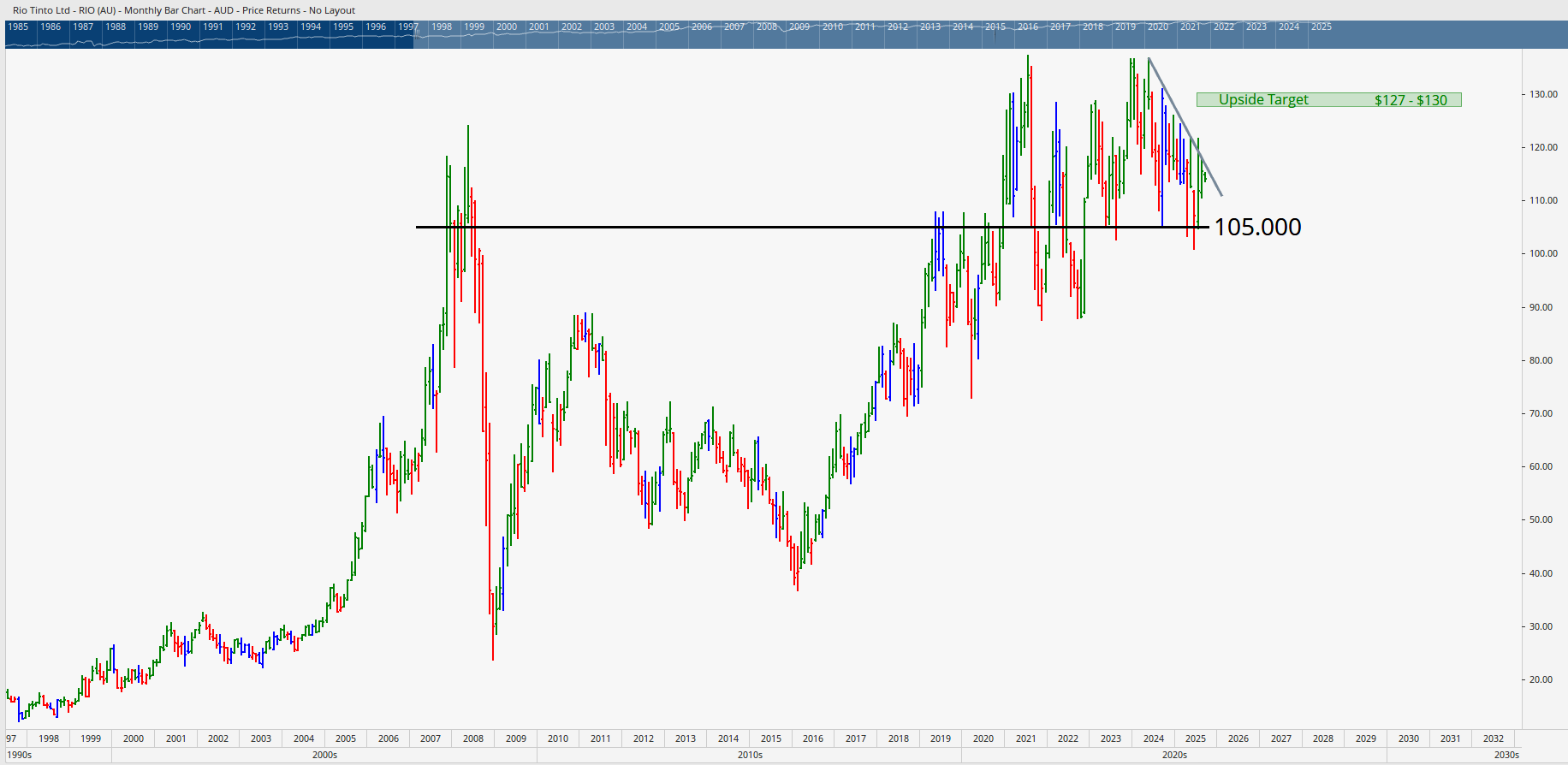

Stock 1: Rio Tinto (ASX: RIO)

Why it’s on the list

Materials outperformed through reporting season, surprising many who expected weakness.

With financials having led last year, materials now appear to be taking the baton, RIO, as a heavyweight, often leads the sector’s charge.

Key levels and structure

- $105: A critical long-term level with repeated support/resistance interactions (seen since 2019 and around the GFC era).

- Uptrend confluence: Price recently bounced at $105 in line with the prevailing uptrend.

- $118–$120: A weekly downtrend break above this zone sets up a potential September run.

- Upside markers: A move toward ~$127–$130 is feasible; a challenge of the all‑time high thereafter isn’t out of character for RIO.

Note the weekly gap risk, RIO is prone to gaps, so factor this into entries and stops.

Trading approach

RIO has been a “trading stock” for years. Long periods of sideways action reward active management over passive holding.

Follow price, not headlines: plan invalidation before entry, and let price confirm.

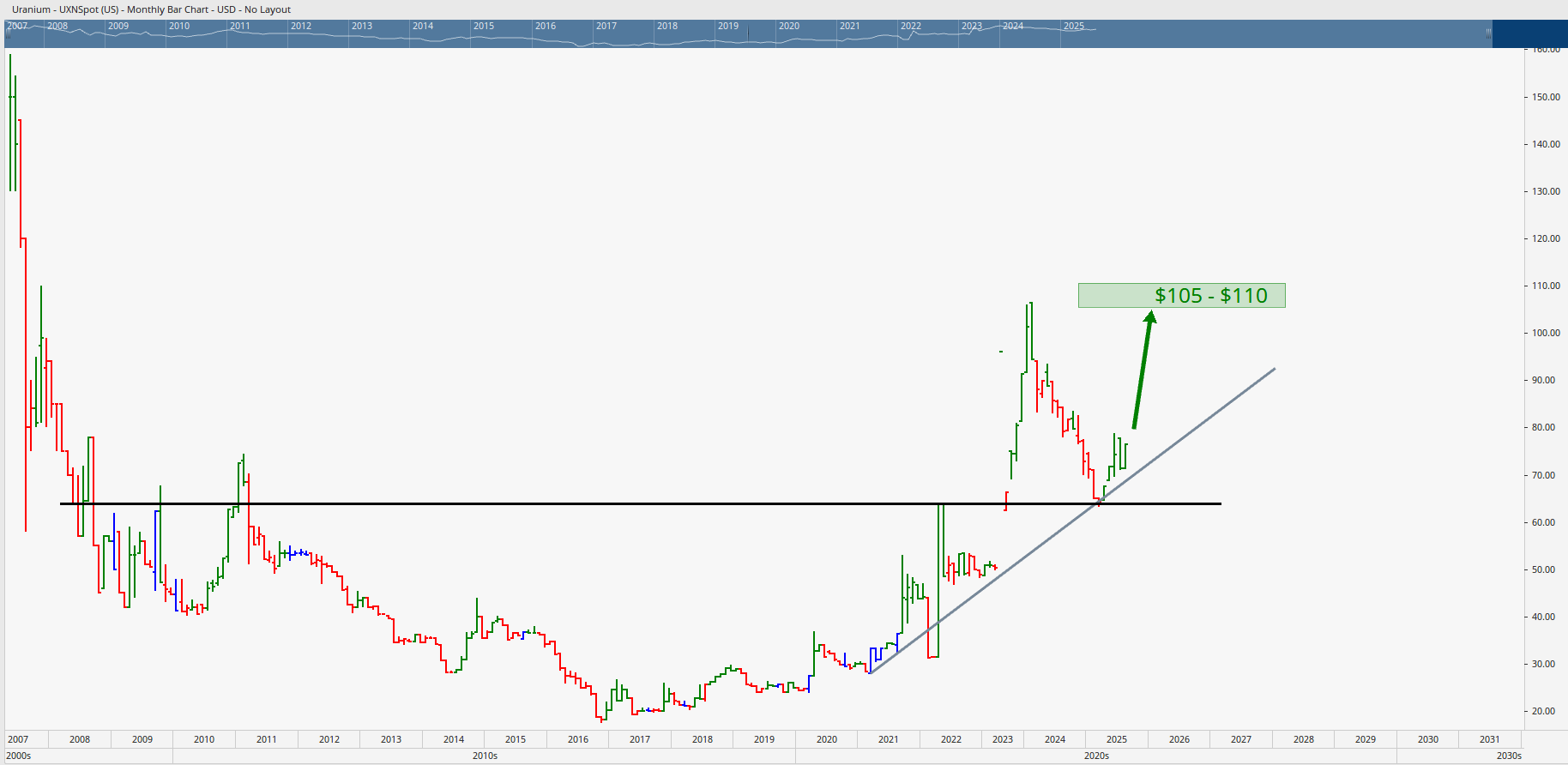

Stock 2: Deep Yellow (ASX: DYL)

Why it’s on the list

Uranium’s backdrop has improved: the spot price turned up from 2016 and last week produced a strongly bullish weekly bar around $70

If the uranium price advances toward ~$105–$110, DYL could benefit materially.

Key levels and structure

- $2.40: Important historical level from prior cycles—first target on strength.

- $7.40: A major long‑term reference if the cycle extends.

- Momentum profile: DYL has risen for 110 months—the longest in its history—suggesting a structural turn is well established.

- Pattern behaviour: Breakouts, tests, then similar structures reforming—a constructive sign for trend continuation.

Trading approach

Expect normal pullbacks after new highs; the strength of closes matters.

Watch for decisive moves above recent swing highs (e.g., ~$1.90–$2.00) and gauge volume for confirmation. First objective remains $2.40, with scope to reassess if uranium extends.

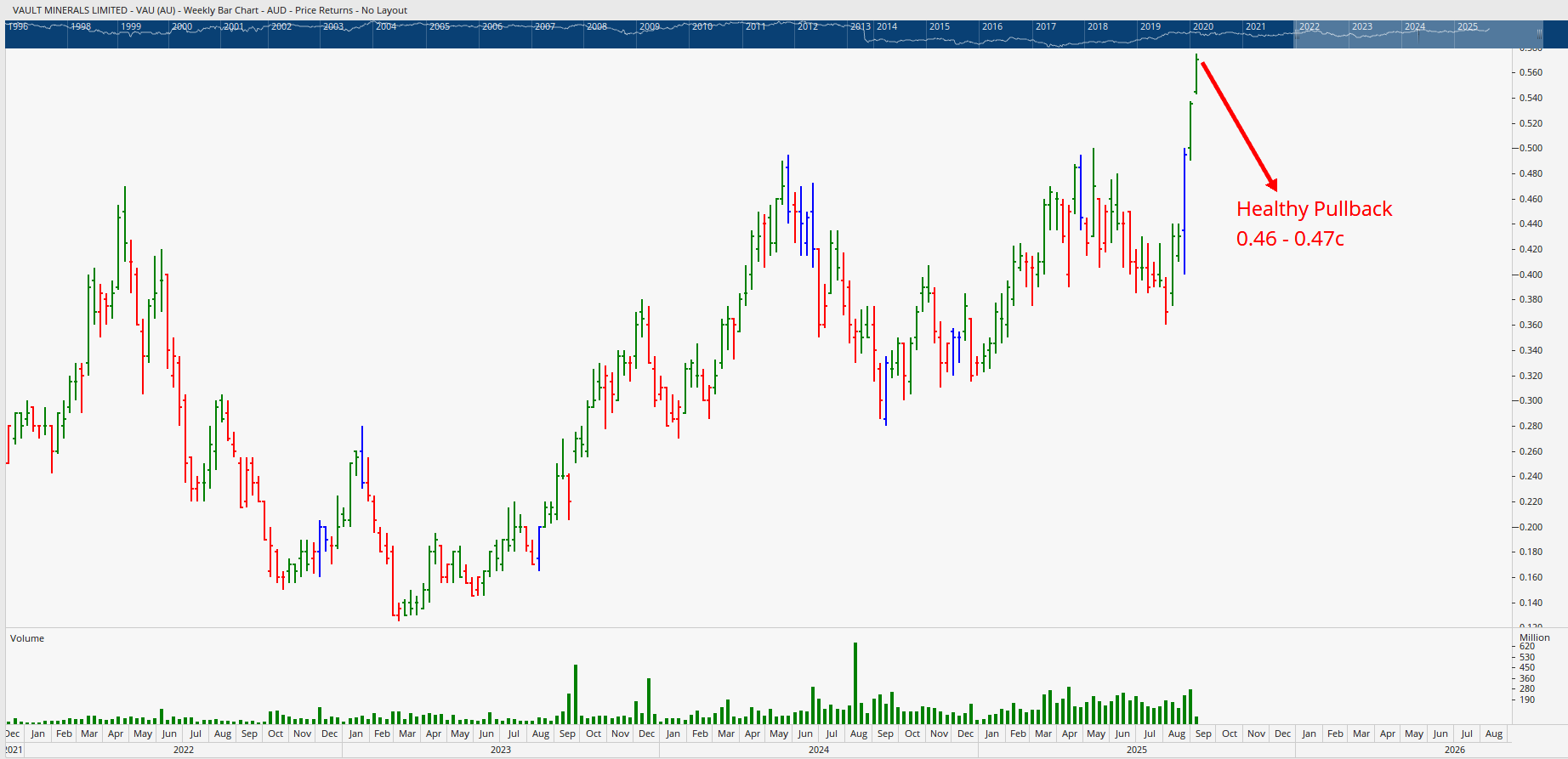

Stock 3: Vault Minerals (ASX: VML)

Why it’s on the list

Vault offers copper exposure, a key beneficiary of ongoing electrification trends.

Regardless of policy shifts, copper demand sits at the heart of energy transition infrastructure.

Key observations

- August breakout with a close on the monthly high, classic momentum signal.

- Weekly volume supports up‑moves, a healthy sign for continuation.

- Short‑term pullback risk after a strong three‑week run; a dip toward ~46–47c would be normal and potentially constructive.

Copper context

Since 2023, copper’s pullbacks have typically been in the ~19–26% range.

The most recent sharp decline of ~26% may mark the end of the downswing if the broader uptrend remains intact, another tailwind for VML if copper bounces.

Execution: Why selling well matters

Paper profits only become real when you sell.

A written plan with clear exit rules is essential. Decide how you’ll lock in gains, not just how you’ll enter. This is where structured education helps you move from ideas to execution.

Learn the methodology behind the setups

Build your foundation with accredited, competency‑based learning in the Diploma of Share Trading and Investment, then progress to timing tools like time analysis and Elliott Wave in our Advanced stock trading course.

Explore our full pathway of Trading courses, including options to Learn to trade shares with structured Share trading education.

For weekly market context and examples, dive into our Hot Stock Tips videos and browse the ASX video library.

Want to know more about our mission and track record? Read About Wealth Within.

Final word

September volatility can be a tailwind for prepared traders.

Focus on price, respect key levels, and let rules, not noise, guide your decisions.

Manage risk first, then let the upside take care of itself.

Related viewing

For more market ideas, watch “7 ASX Stocks You Must Own in the Q3 Pullback (Sept–Oct)” directly on our YouTube channel or in our ASX video library.

Important information

This content is provided for educational purposes only and is not personal financial advice. It does not take into account your objectives, financial situation or needs. Consider seeking advice from a licensed professional before acting on this information. Markets involve risk; past performance is not a reliable indicator of future performance.