3 ASX Data Centre Stocks Set to Surge in 2026

By Fil Tortevski and Pedro Banales

Australia’s data centre sector is heating up, fast. According to a powerful new report by Jones Lang LaSalle, global demand for high-performance computing is expected to nearly double over the coming years, creating a wave of opportunity for well-positioned ASX-listed companies.

This week on The Australian Stock Market Show, Wealth Within analysts unpacked the data centre boom and revealed three key stocks they believe could benefit most from this global trend.

Let’s dive into them.

1. Infratil Limited (ASX: IFT)

One of the most exciting names in this space is Infratil Limited (IFT), a global infrastructure investment company with major stakes in CDC Data Centres and UK-based Kao Data.

This isn’t just a local play, Infratil offers strong European exposure, aligning with the growing AI and data infrastructure spending across the region.

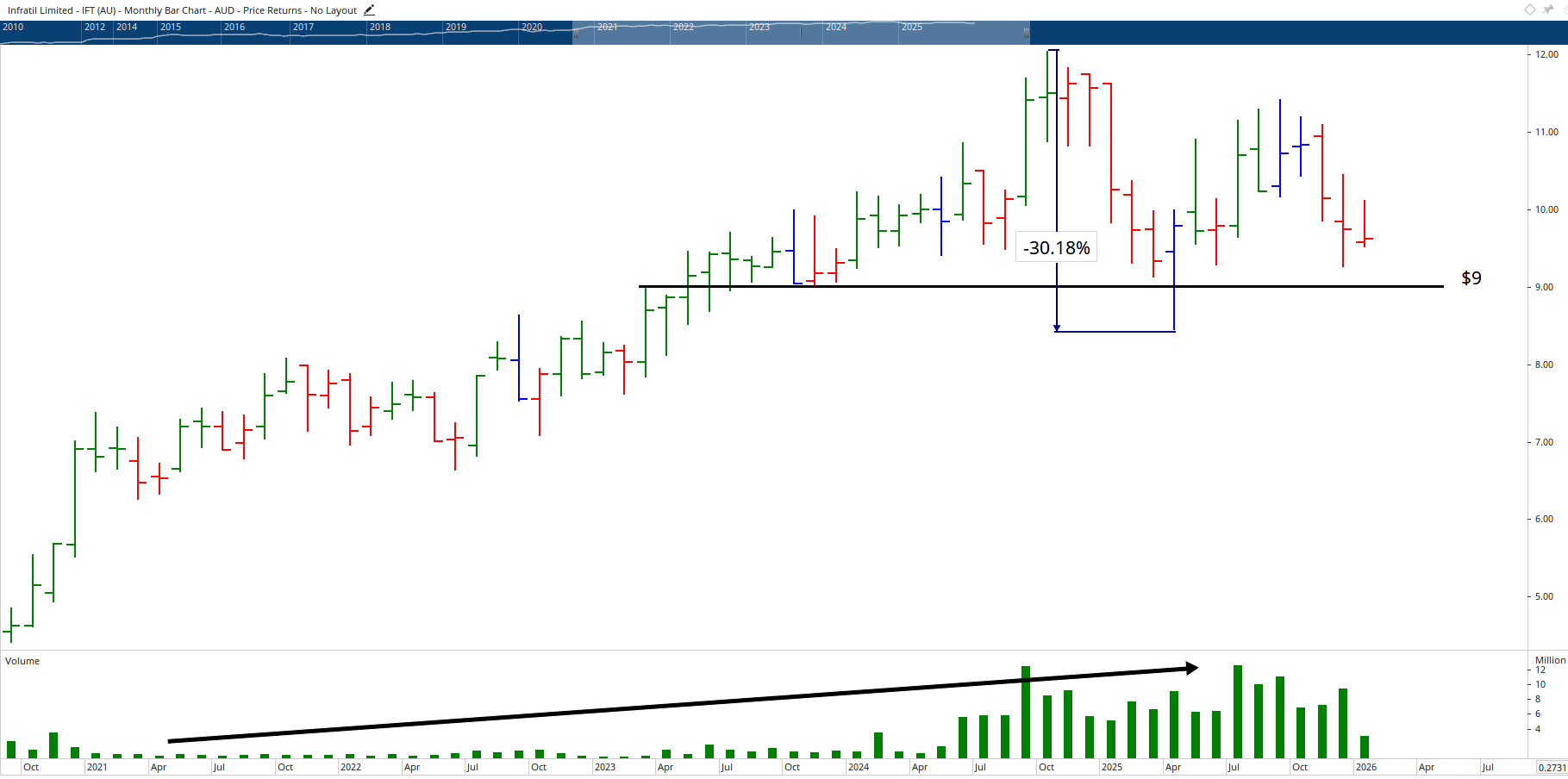

From a technical perspective, Wealth Within’s analysts noted that Infratil has been trending upward since early 2020, with recent pullbacks around the $9 mark potentially presenting new buying opportunities for educated traders.

The chart reveals buying momentum building again, supported by increasing volume which is often an early sign that institutions are getting active. Historically, pullbacks of around 30–38% have marked consolidation periods before further upside. If the stock can hold above $9 and push toward $10, the team believes it could signal the next major move higher.

2. DigiCo Infrastructure REIT (ASX: DGT)

Next up is DigiCo Infrastructure REIT (DGT), a newer entrant to the ASX, providing pure exposure to the data centre and digital infrastructure sector.

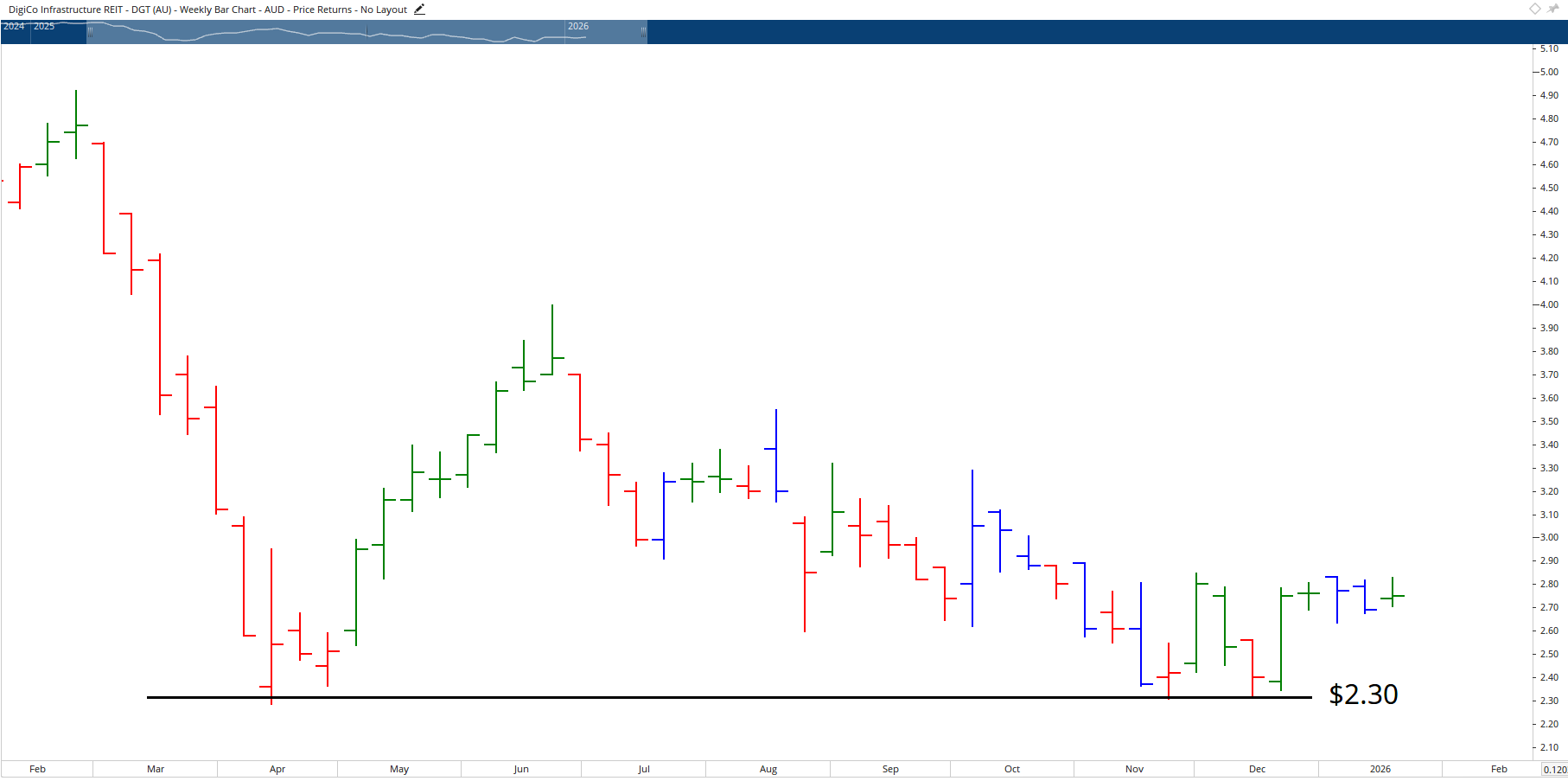

Launched in late 2024, the stock faced the usual teething issues common to fresh IPOs. Yet, repeated support around $2.30 has given bullish traders something to watch closely.

Our analysts highlighted how DGT has consistently tested these levels throughout 2025 without breaking down.

The risk-to-reward setup here looks attractive, with potential downside limited to around 12–13%, but much more upside potential should the price confirm a reversal.

Wealth Within emphasises that this kind of early-stage momentum demands solid technical understanding and risk management which are skills built through structured trading courses and practical analysis training.

3. Megaport Limited (ASX: MP1)

Megaport Limited (MP1) operates slightly differently to the first two, rather than owning hard infrastructure, Megaport provides network services that connect enterprises and massive cloud providers across hundreds of data centres worldwide.

While this isn’t a pure-play data centre stock, its position in enabling AI and cloud connectivity makes it a key beneficiary of global digitisation trends.

From a charting point of view, Megaport’s price has respected the critical $11.70 level multiple times since 2021, making it a pivotal area to watch. Big volume spikes near recent lows have caught analysts’ eyes, indicating renewed institutional interest and the potential for another run if prices break through $14.

Volatile? Definitely. But with the right technical approach, one taught in Wealth Within’s share trading education and Advanced stock trading course, traders can learn how to identify such setups with precision.

Why Data Centres Are Australia’s Next Big Growth Engine

The acceleration of artificial intelligence, cloud computing, and edge networks has created unprecedented demand for data storage and processing capacity.

With major institutions like Macquarie Group financing billion-dollar AI data centre projects in Europe and the U.S., it’s clear this is an infrastructure story with legs, not a speculative bubble.

Australia’s own footprint is expanding fast, with operators such as Infratil’s CDC Data Centres leading the charge in high-performance, scalable capacity.

As global demand surges, the potential profits for investors who understand how to identify quality stocks at the right time could be significant.

Trading Opportunities in a Changing Market

2026 is shaping up as a pivotal year for traders. Markets are being driven by themes like AI, energy transformation, and infrastructure expansion, and each behaves differently at various stages of their cycles.

Knowing when to buy into established uptrends and when to take advantage of early reversals is where technical understanding makes all the difference.

Wealth Within’s structured Short Course in Share Trading and nationally accredited Diploma of Share Trading and Investment are designed to help you trade confidently in all market conditions.

If you’re new to the market, our Stock Market for Beginners guide is a great starting point.

Discover More Hot Stock Tips

For more insights, watch the full episode of The Australian Stock Market Show, where analysts break down technical setups, trading psychology, and weekly opportunities in real time.

You can explore our Hot Stock Tips videos and ASX video library for market trend analysis and strategies shared by Australia’s most trusted share trading educators.

To learn more about our mission and 20+ years of helping traders succeed, visit About Wealth Within.

Take the Next Step Toward Smarter Trading

Opportunities like the data centre boom don’t come around every year, but knowing how to spot them, time them, and trade them profitably is what separates confident investors from hopeful speculators.

If you’re ready to start trading with structure and confidence, not guesswork, it’s time to invest in yourself. Explore Wealth Within’s Trading courses to develop the same proven strategies our analysts use every day.

Learn to read the charts, understand market cycles, and build a skill set that pays you back for decades to come.

Because at the end of the day, the smartest trade you’ll ever make is in your own education.