3 Market Crash-Proof ASX Stocks to Buy Now: Telstra, APA Group & Cochlear

By Fil Tortevski and Pedro Banales

When the stock market dips, most investors panic, but seasoned traders know that volatility can also mean opportunity.

At Wealth Within, we believe market downturns are an ideal time to look at quality, resilient businesses that continue to perform even in uncertain conditions.

In a recent episode of our Hot Stock Tips videos, our analysts explored three ASX stocks that stand out for their long-term strength, reliable dividends, and ability to endure recessions: Telstra, APA Group, and Cochlear.

These aren’t speculative plays; they’re “crash-resilient” stocks with solid fundamentals, sustainable business models, and strong technical setups, meaning they don’t just survive market turbulence, they often thrive in it.

Telstra (ASX: TLS) – The Stable Backbone of Australian Connectivity

When markets shake, stability counts. That’s what makes Telstra a long-standing favourite among investors.

As Australia’s leading telecommunications provider, Telstra offers the consistency many traders look for in turbulent times. It provides essential services, owns vast infrastructure including towers other providers lease and has diversified into the technology and Internet of Things (IoT) space.

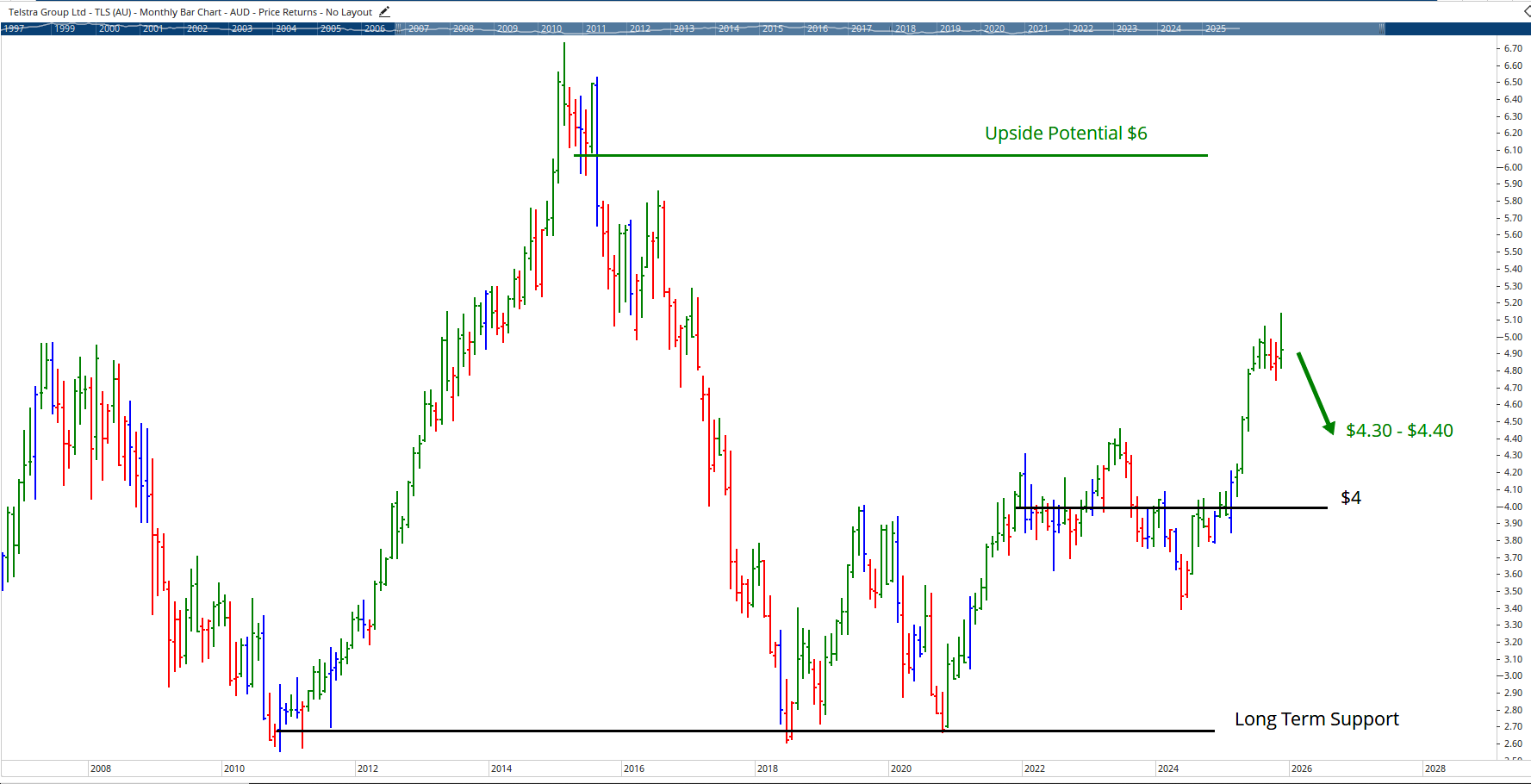

From a technical perspective, Telstra’s share price indicates a strong foundation, holding well above critical support levels established during major pullbacks such as 2010, 2018, and 2020. After consolidating near the $4 mark, the stock has shown encouraging upward movement, suggesting strong institutional buying at those levels.

Analysts at Wealth Within note that if the stock retraces to around $4.30–$4.40, it could present fresh opportunities for those looking to enter a resilient, dividend-paying stock before the next leg higher.

As our team discussed, Telstra could climb toward $6 in the coming years, making it an attractive medium-term investment in an otherwise volatile environment.

APA Group (ASX: APA) – Infrastructure Strength in Recession Times

Energy infrastructure operator APA Group is another standout performer when markets turn bearish. In uncertain economic conditions, utility and infrastructure providers often act as a buffer and APA’s position in the Australian energy landscape makes it one of the most dependable.

APA owns and operates gas pipelines and power infrastructure, assets that remain critical even as Australia shifts toward renewables. Gas remains a transitional necessity, and APA’s consistent performance shows why defensive investors often turn to companies with long-term, regulated income streams.

Price action tells the story here too: APA’s chart shows a textbook long-term uptrend supported by multiple historical bounce levels around $7.80–$8.00. The company has repeatedly recovered from 30–50% corrections over the past decade, underscoring its resilience.

Analysts suggest short-term traders might watch for an entry around $8.50–$9.00 on a potential pullback, while long-term investors can consider APA as part of a diversified, defensive portfolio.

This kind of analysis and timing comes down to proper technique, exactly the kind of strategy you’ll master in our Diploma of Share Trading and Investment or Short Course in Share Trading.

Cochlear (ASX: COH) – The Long-Term Winner in Healthcare Innovation

If there’s one company that consistently earns its place among Australia’s most defensive stocks, it’s Cochlear.

As a global leader in hearing implant technology and holding roughly 60% of the worldwide market share, Cochlear benefits from robust barriers to entry (around 15 years for any competitor to replicate its technology and expertise).

Combining a powerful moat with growing global demand, particularly from an aging population, Cochlear demonstrates that healthcare innovation can be both profitable and recession-resistant.

Since 2014, the stock has gained more than 375%, following a clear upward trajectory supported by technical bases around $60, $200, and now near $260. Analysts suggest that maintaining support in the $250–$270 range could trigger the next multi-year rally.

Cochlear’s sustained growth illustrates the importance of combining fundamental analysis with technical timing, a key principle we teach across our trading courses.

What These Three Stocks Tell Us About Market Resilience

The takeaway from these three companies isn’t just their individual merit; it’s what they represent for traders who want to grow wealth during downturns.

Each of these businesses:

- Operates in essential service sectors that remain strong in any economy.

- Has proven track records through recessions and global shocks.

- Offers long-term capital growth and potential income stability through dividends.

- Exhibits technical strength and sustained uptrends confirmed by price action analysis.

For investors with the right education and strategy, volatile markets often create the best entry points to buy quality businesses at discount prices. And that’s exactly where learning to trade properly becomes your greatest advantage.

How to Identify Crash-Proof Stocks Like These

Spotting opportunities like Telstra, APA Group, and Cochlear requires more than guesswork, it takes knowledge, discipline, and a structured process for reading the market.

That’s where Wealth Within’s proven educational pathway makes the difference. As Australia’s only government-accredited provider of trading education, our Share trading education offers you the skills and confidence to trade strategically rather than emotionally.

Whether you’re a beginner wanting to build confidence through our Short Course in Share Trading or an experienced trader ready to refine timing and strategy with our Advanced stock trading course, Wealth Within gives you the tools to identify opportunities others miss.

To learn about our journey, approach, and mission to empower traders since 2002, visit our About Wealth Within page.

Investing with Confidence Through Any Market

Market corrections are inevitable, but they don’t have to be damaging. By focusing on fundamentally sound, technically strong companies like Telstra, APA Group, and Cochlear, investors can not only protect their portfolios but also position for long-term growth.

Understanding how to interpret price action, recognise market cycles, and identify trend reversals can transform volatility into opportunity.

That’s the edge Wealth Within clients enjoy, the education that lets you trade with the same confidence as professionals.

If you’d like to see more in-depth analysis and actionable recommendations like these, check out our ASX video library for weekly insights from Australia’s most trusted trading educators.