ASX Copper Stocks Are on Fire: 3 to Watch for 2026

By Fil Tortevski and Pedro Banales

As gold and silver finish their runs, investors are asking a pressing question: Is copper the next big trade heading into 2026?

With copper prices soaring and global demand surging due to electrification, AI infrastructure, and EV expansion, it may well be the commodity of the year. Analysts from Wealth Within share their top copper picks and outline why timing, volume, and technical setups make these stocks so compelling right now.

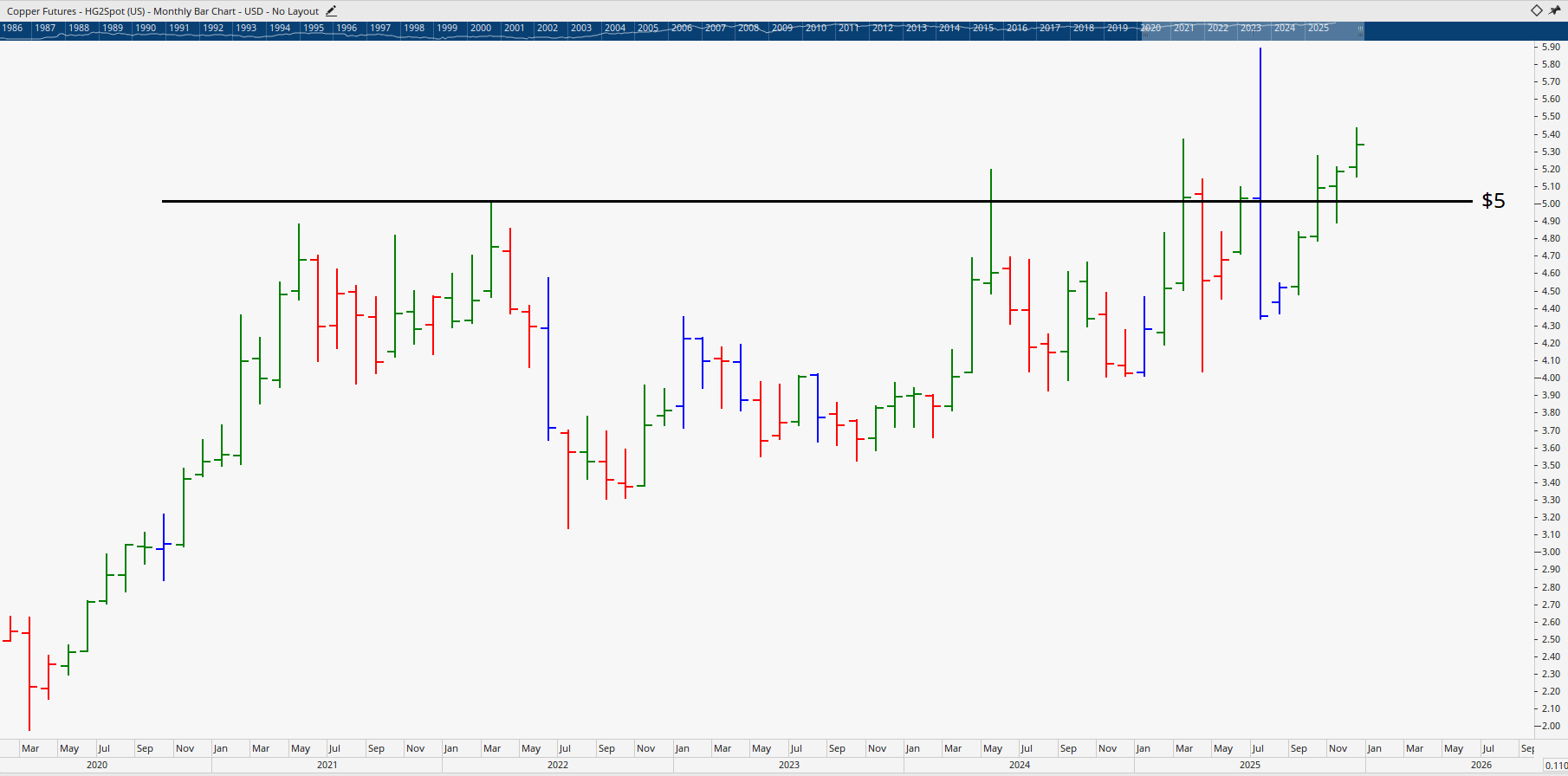

The Copper Market Outlook: Momentum is Building

Copper futures have been testing major resistance around the $5 mark, a level that has capped gains for a decade. However, recent monthly closes above this barrier are setting the stage for a strong upward trend.

The global supply side is tightening due to production slowdowns in Indonesia and mine closures in Australia are restricting output. Meanwhile, demand for copper is skyrocketing as the world transitions to renewable energy and electrified transport.

This setup is classic for a cyclical breakout, and the charts are confirming it. If prices hold above $5, it could trigger a significant move that savvy investors won’t want to miss.

Top 3 ASX Copper Stocks to Consider

Below are the three copper stocks analysts from Wealth Within believe could deliver strong returns in 2026.

1. 29Metals (ASX: 29M)

This emerging copper producer has been quietly bouncing back from its post‑IPO slump. After hitting lows near 20 cents, 29Metals is showing a V‑shaped recovery backed by strong buying volume.

While resistance lies near $0.60, the stock’s behaviour suggests accumulation from institutional players. For traders, patience and timing are key as waiting for a solid close above $0.60 could indicate the start of a sustained rally.

Learning how to time entries and exits based on price action and technical signals is crucial. Those eager to sharpen these skills should explore our Advanced stock trading course, which teaches techniques to maximise trading precision and profit consistency.

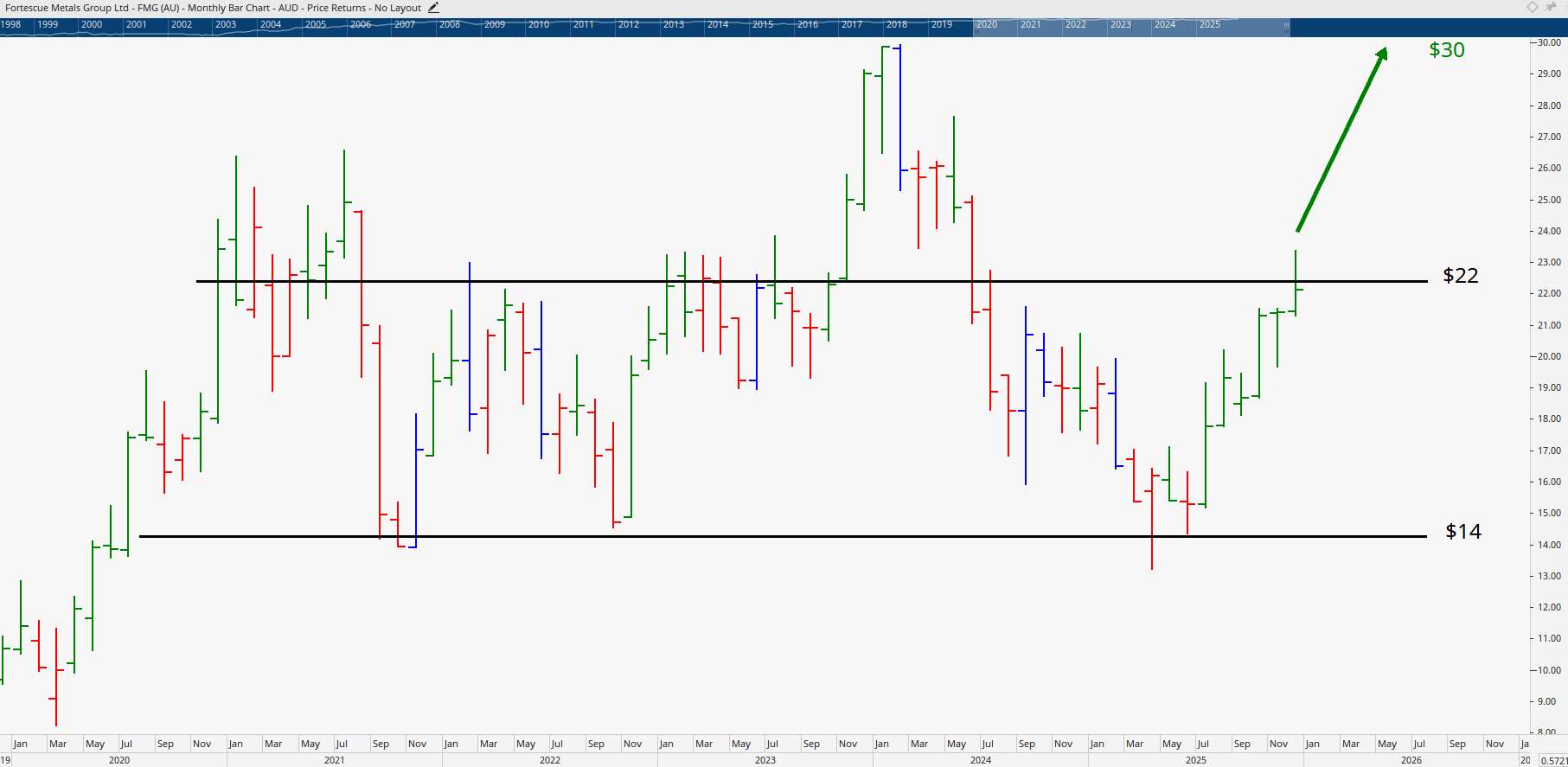

2. Fortescue Metals Group (ASX: FMG)

Already a household name in Australia, Fortescue recently announced the purchase of the remaining stake in Canadian miner Alta Copper for $101 million. This strategic move solidifies Fortescue’s expansion beyond iron ore into copper which is a sector expected to dominate global growth over the next decade.

Technically, FMG has strong upward momentum, bouncing from around $14 earlier in the year to recent highs near $22. Analysts see a potential move towards $30 in 2026 if the current trend continues.

With healthy fundamentals, reliable dividends, and renewed sector focus, Fortescue represents a relatively lower‑risk copper play among large‑caps, one that can anchor a well‑balanced trading portfolio.

To learn how to build and manage such a diversified portfolio, consider enrolling in the Diploma of Share Trading and Investment, Australia’s only government‑accredited trading qualification.

3. Aries Resources Limited (ASX: AIS)

For those who prefer more speculative opportunities, Aries Resources is a micro‑cap name showing record‑breaking trading volume and a possible trend reversal.

While the share price remains under a dollar, trading momentum has strengthened significantly. Analysts highlight that a sustained hold above $0.35–0.40 could confirm a new base, with short‑ to medium‑term upside possibly targeting the $0.70–0.80 zone.

However, risk management remains key for smaller‑cap stocks. Traders must plan exits carefully, as Wealth Within emphasises “trade well, not often”.

If you’re new to trading or trying to develop consistent strategies, see our Short Course in Share Trading, which equips you with practical tools to trade confidently and profitably.

Why Copper Could Define the 2026 Market Cycle

The unique combination of constrained supply, electrification demand, and inflation‑linked commodities makes copper a prime performer for years ahead.

But while the fundamentals appear strong, history shows that market timing and proper risk control separate profitable investors from average ones. Reading charts, understanding price action and applying discipline are not optional; they're essential.

Those looking to advance their technical understanding can explore Wealth Within’s wide range of Trading courses to learn to trade shares with confidence and mastery.

Hot Stock Tips and Market Education

To keep track of these emerging trends, tune into our Hot Stock Tips videos every Monday evening. Each episode features market analysis, trading psychology insights, and updates on current ASX opportunities, which are all designed to help investors succeed regardless of market conditions.

If you are new to the market and want to build foundational knowledge, our Stock Market for Beginners guide explains how to start investing in shares safely and effectively.

Learn to Trade with Confidence

Copper’s breakout could become one of the most lucrative stories of 2026. While picking the right stocks matters, success comes from a disciplined approach, sound education, and understanding when to act.

Whether you’re refining advanced strategies or just starting out, Wealth Within provides a clear pathway to trade confidently and profitably in any market condition.

If you’re ready to take control of your financial future and want to master the art of strategic trading, start your journey with Wealth Within.

Whether you’re a beginner exploring the Stock Market for Beginners or an active trader looking to refine your expertise, you’ll gain world-class support and proven methodologies to build long-term success.

To find out more about our trusted Trading courses or learn more About Wealth Within, visit our website and explore how thousands of Australians have already built profitable, sustainable trading careers.