ASX Rare Earth Stocks Flying After New China Tariffs: Buy Now

By Fil Tortevski and Pedro Banales

Global markets have been shaken once again after China’s announcement of stricter export tariffs on rare earth elements. These critical minerals form the backbone of technology, defence, and clean energy industries, and Australia’s rare earth sector could be one of the biggest beneficiaries of this seismic shift.

At Wealth Within, our analysts have navigated major market cycles for decades, and moments like this often present once-in-a-generation opportunities. In this article, we explore three ASX-listed rare earth stocks poised to gain on the back of Beijing’s policy moves, and what traders should watch moving forward.

China’s Tariffs Set the Stage for an Australian Rare Earth Boom

The Chinese government recently imposed new export restrictions on an additional five rare earth elements, bringing the total number under limits to twelve out of seventeen globally traded rare earths. These minerals are essential to electric vehicles, batteries, turbines, and semiconductor manufacturing.

With tighter controls on global supply, Australian developers and producers are in the spotlight as reliable, politically stable alternatives. Whether you’re a short-term speculator or a long-term investor, the market is offering opportunities, but only for those who know how to read momentum, price levels, and volume correctly.

To learn how to take advantage of such opportunities, consider Wealth Within’s accredited Trading courses where you can learn to trade shares safely and strategically.

1. Arafura Rare Earths (ASX: ARU) — Leading the Charge

Arafura Resources has emerged as one of the standout developers in the rare earth sector, particularly as global investors seek non-China supply chains. Large government funding, over USD 530 million from the Australian Government, has significantly raised its credibility.

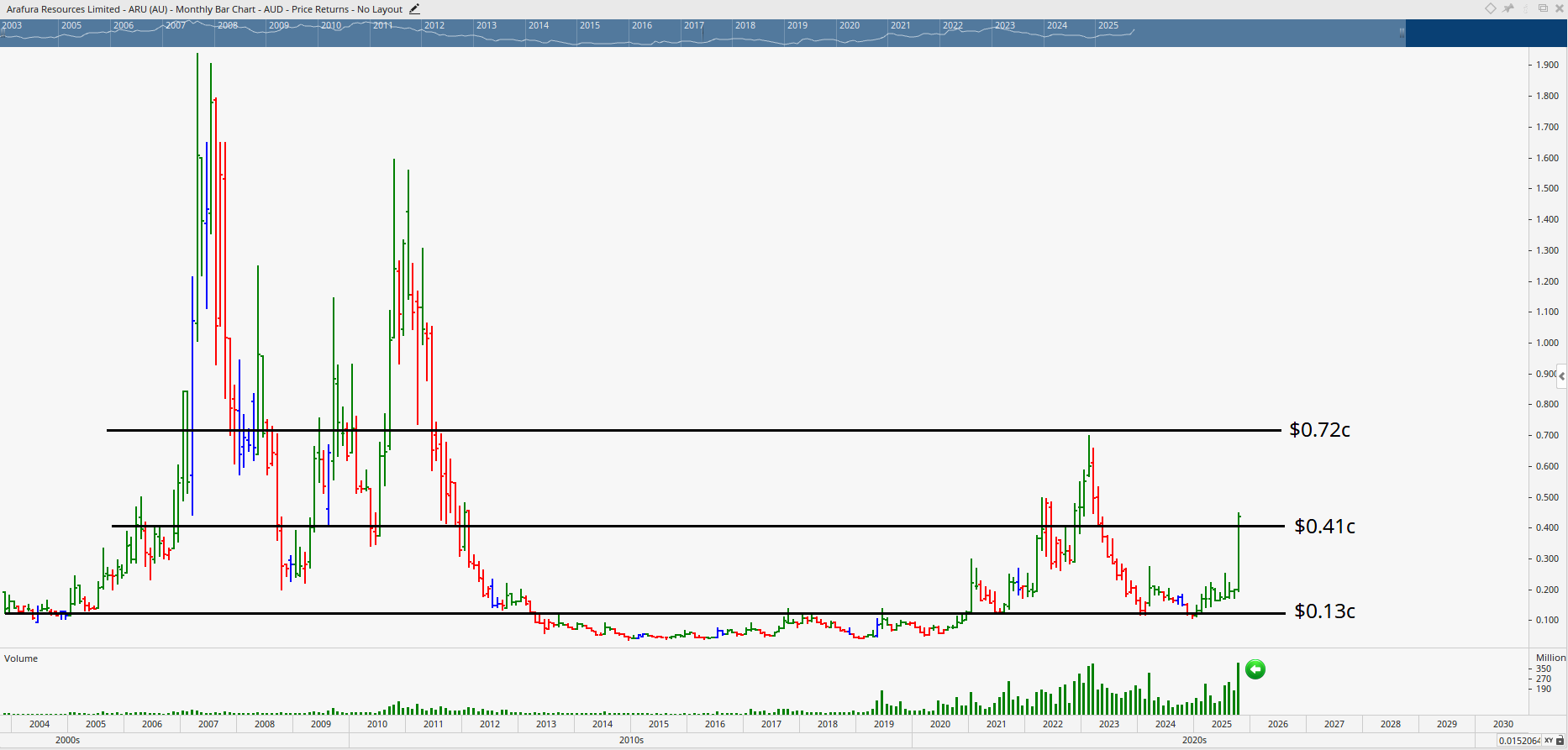

Technical insights:

- Price has broken out strongly from a long-term support level at around $0.13, supported by record volume.

- Next key resistance zones sit around $0.41 and $0.72, which could indicate medium-term targets if momentum continues.

- Long-term charts show classic expansion and contraction cycles, suggesting potential for significant upside.

However, as our analysts emphasise, timing is everything. Entering too early or chasing price at a peak can erode returns. Recognising accumulation phases, chart structures, and entry signals is central to consistent success, these skills are covered extensively in the Short Course in Share Trading.

2. Hastings Technology Metals (ASX: HAS) - From Mine to Magnet

Hastings Technology Metals is progressing a compelling “mine-to-magnet” model, extracting rare earth minerals and processing them into advanced materials crucial to renewable energy and defence.

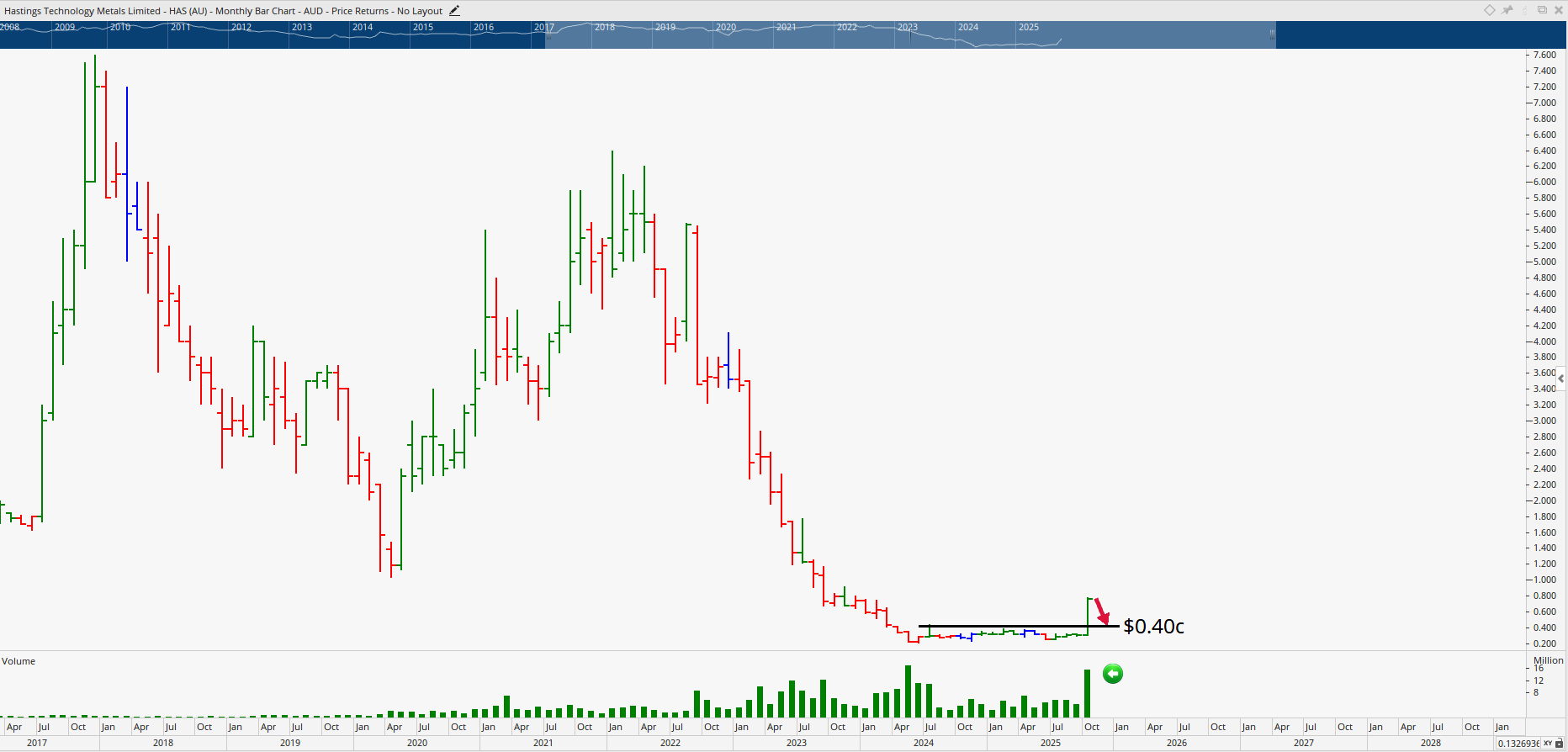

Why it matters:

- The company is approaching production readiness, targeting output by the end of 2025.

- Volume has surged dramatically, aligning with textbook accumulation patterns.

- A pullback to around $0.40 could provide a stronger risk/reward entry.

Our technical analysts suggest keeping a close eye on volume spikes and breakout confirmation signals, an advanced skill you can develop in the Advanced stock trading course.

3. Iluka Resources (ASX: ILU) - From Resources to Refinement

Iluka Resources—a name synonymous with mineral sands—has been quietly building its rare earth credentials through its integrated refinery capabilities. By refining its own stockpiles and offering third‑party processing capacity, Iluka stands out as one of the few companies transitioning beyond mining to downstream production.

Key levels:

- The critical battleground for Iluka has long been at $6.30, a level tested multiple times since 2011.

- With the recent breakout above this line, the stock could now target $10 in the coming quarters if momentum persists.

- Increasing volume and rising relative strength confirm bullish sentiment.

The secret to capturing such moves, however, lies in managing entry timing, capital risk, and exit discipline. This is precisely what we teach in our Diploma of Share Trading and Investment- Australia’s only government-accredited qualification in technical and fundamental trading.

Bonus Pick: Northern Minerals (ASX:NTU) — The Dark Horse

Our final spotlight stock, Northern Minerals, specialises in extracting and processing Dyprosium and Terbium, these are critical minerals for EV motors, wind turbines, and aerospace applications.

Why it’s worth watching:

- Trading near $0.05, the stock has tested long‑term support multiple times around $0.01, forming a stable base.

- Breakouts above $0.09 could initiate a 180% move if volume continues to rise.

- Recent trading has shown increasing strength, closing near highs, which is a sign of renewed institutional interest.

This micro‑cap opportunity carries higher volatility but also outsized potential. For traders willing to apply structured strategies, it may represent one of the sector’s most explosive setups.

How to Manage High‑Momentum Sectors Like Rare Earths

These stocks highlight the importance of understanding market psychology, structure, and execution. Buying into hype can lead to short‑term losses, while disciplined price analysis ensures smarter entries and safer profits.

That’s why proper education is the edge. The real money isn’t in speculation—it’s in pattern recognition, timing signals, and portfolio management.

If you’re serious about mastering these techniques, explore our Share trading education to see how Australia’s leading accredited training can help you grow your investment intelligence.

Get More Expert Insights from Wealth Within

For weekly updates, live analysis, and detailed market reviews, visit our Hot Stock Tips videos, ASX video library, part of our ongoing efforts to empower everyday Australians to trade with clarity and confidence.

To learn more about who we are and our two‑decade history of empowering self‑directed investors, visit About Wealth Within.

Take Control of Your Financial Future

China’s rare earth policy is reshaping global markets—but opportunity only belongs to those who act strategically.

Now is the perfect time to equip yourself with the knowledge, structure, and confidence to capitalise on these shifts.

Start your trading journey today with one of our government recognised Trading courses and start trading the market like a professional.

Important information

This content is provided for educational purposes only and is not personal financial advice. It does not take into account your objectives, financial situation or needs. Consider seeking advice from a licensed professional before acting on this information. Markets involve risk; past performance is not a reliable indicator of future performance.