ASX Small Cap Stocks on Fire: Top 3 to Watch in 2025

By Fil Tortevski and Pedro Banales

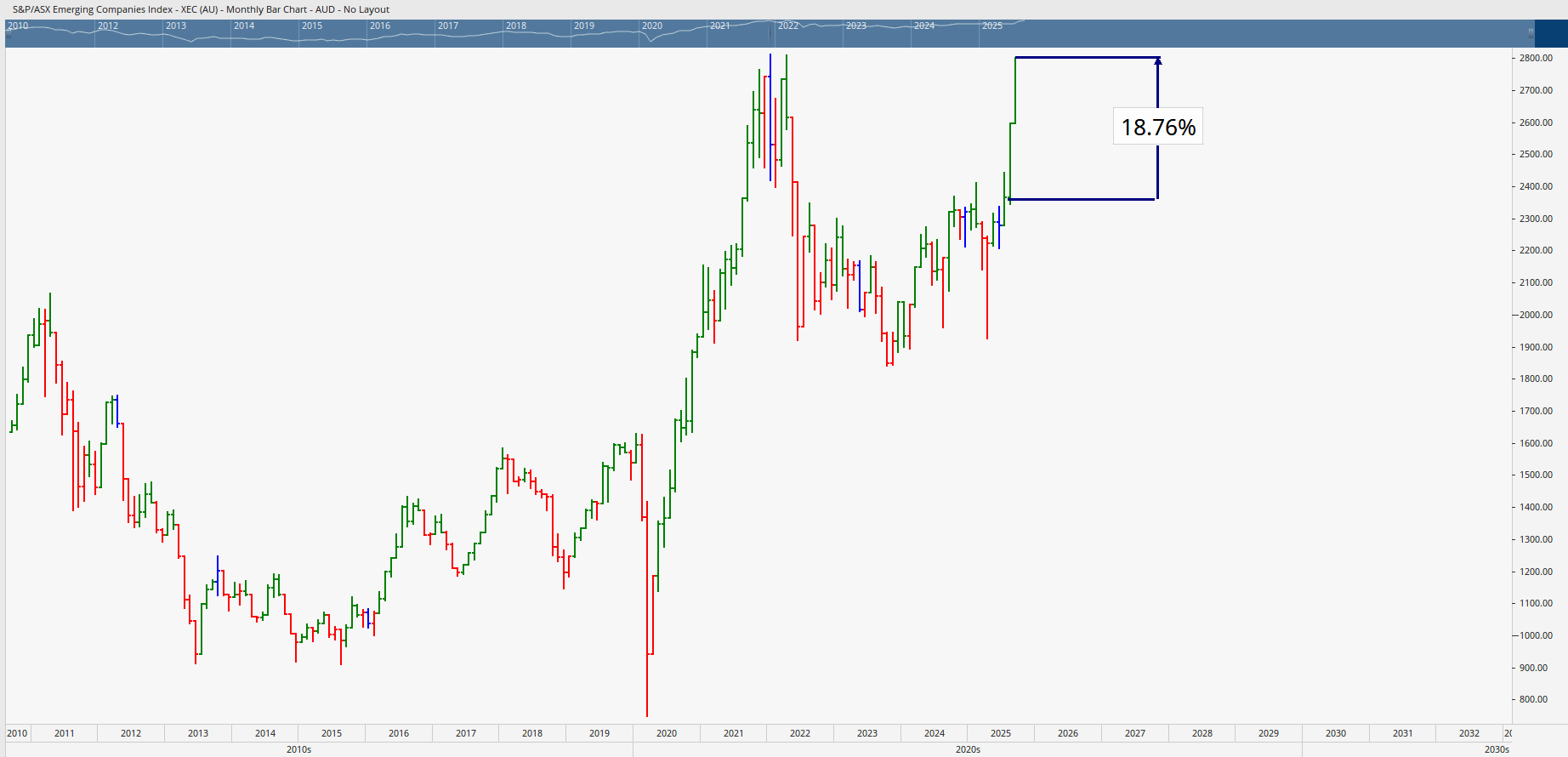

Australia’s ASX small cap stocks are heating up, showing explosive buying power we haven’t seen in years. According to technical analysis shared in our Hot Stock Tips videos, recent moves in the Emerging Companies Index (XEC) and the Small Ordinaries Index are pointing to a powerful new bull cycle for 2025 and beyond.

In this blog, we’ll break down three exciting opportunities shaping up right now, along with the price levels and strategies that matter most.

Why Small Caps Are Erupting

The Emerging Companies Index (XEC) has surged more than 20% in recent months, which is the strongest run since the market rebound of May 2020. Historically, large caps lead during a bull phase, followed by micro and small caps. The current breakout suggests it’s “the little guys’ turn,” and traders who nail their timing may capture extraordinary gains.

Companies with a market cap between $100m–$600m are showing strong technical setups, supported by macro themes like defense, water security, and advanced manufacturing.

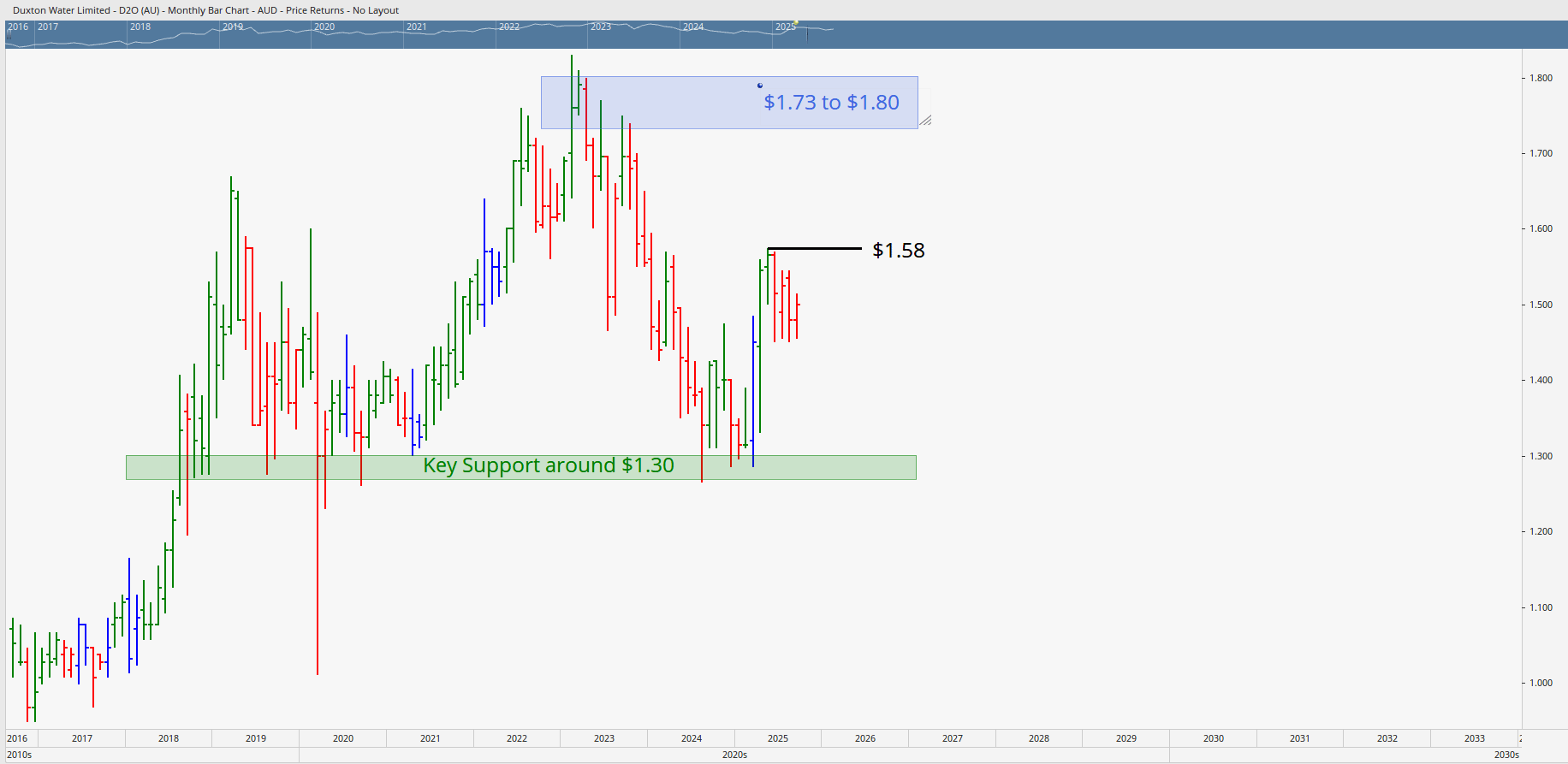

1. Duxton Water (D2O)

Sector: Water management in the Murray-Darling Basin

Duxton Water manages water entitlements and trades them in the spot market - a resource becoming increasingly scarce. With strong cyclical behaviour and key support levels around $1.30, analysts say the bullish breakout above $1.58 could project the stock toward $1.73–$1.80 in the longer term.

Why it matters: Controlling access to water ties into a major long-term theme. Combined with textbook technical patterns, this makes D2O a compelling stock to watch closely.

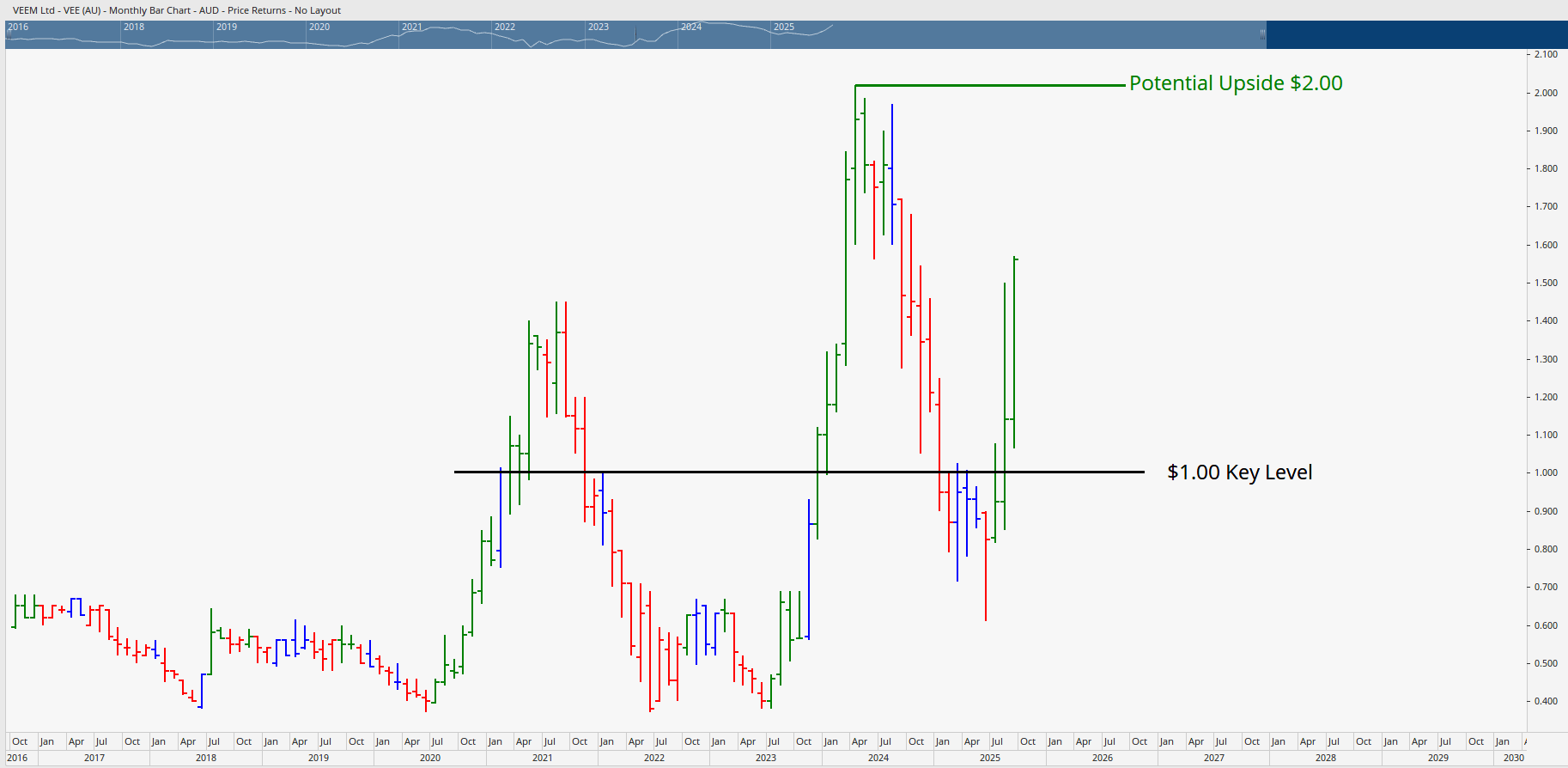

2. VEEM Limited (VEE)

Sector: Marine propulsion & stabilization systems

VEEM manufactures marine systems for yachts, ferries, and critical defense vessels. With Australia set to invest heavily in naval expansion, this aligns with one of the strongest macro trends of the decade. The chart has broken above $1 resistance, retested, and is trending strongly higher.

Opportunity: Long-term projections show price targets up to $2.80, representing substantial upside potential.

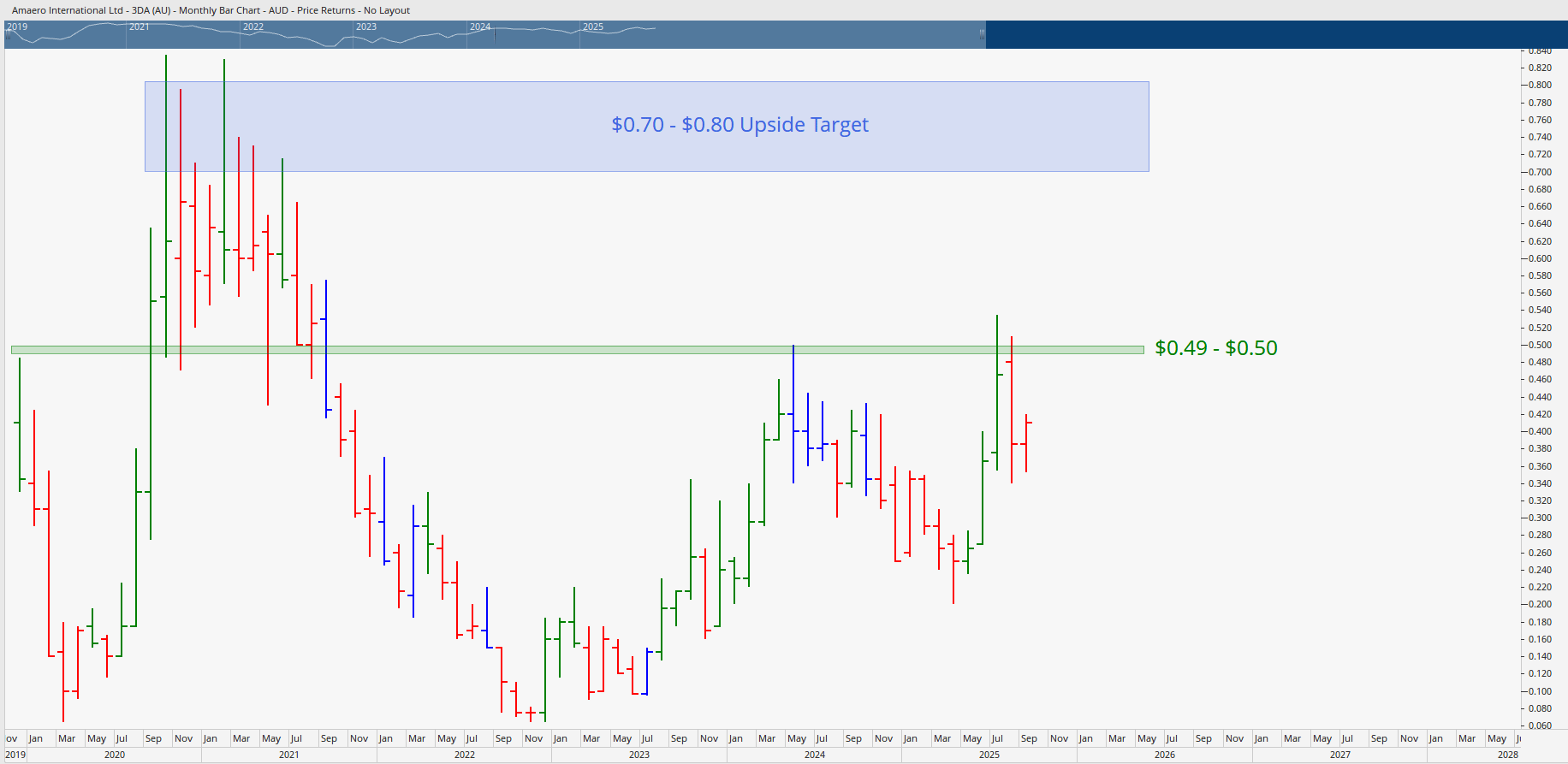

3. Amaero International (3DA)

Sector: Aerospace, defense & advanced manufacturing

Amaero develops specialty metal powders for 3D printing solutions in defense and aerospace. Recent breakout patterns, supported by record trading volumes, show bullish confirmation. If the stock clears $0.49–$0.50, analysts see upside to $0.70 or even $0.80.

Key takeaway: The stock is forming higher bases and respecting its long-term trendline. While volatile, it’s shaping as one of the most exciting small cap plays into 2025.

How to Trade Opportunities Like These

Trading small caps requires more than luck. To profit consistently, you need structured trading rules, psychological resilience, and strategies that cut through the noise.

At Wealth Within, we teach these techniques through our government-accredited Diploma of Share Trading and Investment, as well as our beginner-friendly Short Course in Share Trading.

If you’ve already got experience, you can refine your edge even further with our Advanced stock trading course. Each program is built on proven methodologies that have helped thousands of traders trade more confidently and profitably.

The Bottom Line for Small Cap Investors

The momentum in ASX small cap stocks is undeniable and the three companies highlighted here could be at the forefront of the next bull wave. But ultimately, it’s not just about picking the right stocks, it’s about having the right strategy and mindset.

Want to learn more about how to trade opportunities like these? Explore our Trading courses and take the first step towards mastering your share trading education. And if you want ongoing analysis of stocks setting up for explosive moves, visit our ASX video library for the latest insights.

About Wealth Within

Since 2002, Wealth Within has been empowering traders to take control of their financial future with accredited trading education and industry-leading support.

Important information

This content is provided for educational purposes only and is not personal financial advice. It does not take into account your objectives, financial situation or needs. Consider seeking advice from a licensed professional before acting on this information. Markets involve risk; past performance is not a reliable indicator of future performance.