Best ASX Stocks to Watch Ahead of the December Rally

By Fil Tortevski and Pedro Banales

December has long been known as a powerful period for the market, often bringing one of the strongest seasonal rallies of the year. But with the broader ASX showing mixed sentiment, which stocks are set to gain, and which should you avoid?

In this week’s market insight from Wealth Within, our analysts reveal three standout companies positioned to benefit most from the December window: NextDC, APA Group, and Capstone Copper. Together, these stocks show strong trends, both technically and fundamentally, as traders position for an end-of-year boost.

If you’re looking to sharpen your stock selection process, explore our accredited Trading courses designed to help you learn to trade shares and build strategies with confidence.

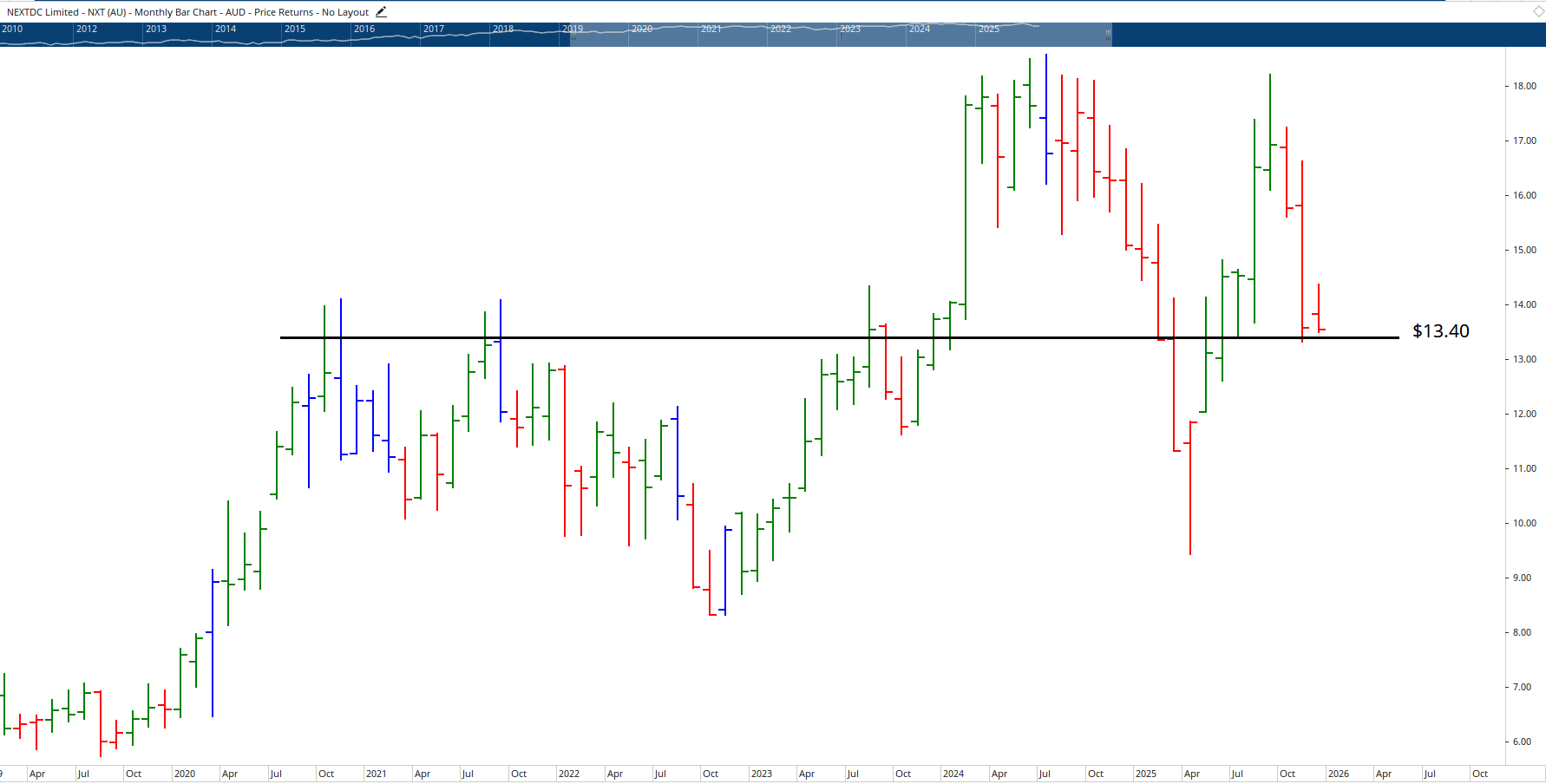

NextDC (ASX: NXT) — Data and AI Powering Growth

NextDC, one of Australia’s leading data centre providers, released a bullish guidance update in recent weeks. The company reported a 30% jump in customer demand and a 50% increase in future workloads, effectively locking in years of contracted revenue.

To support this expansion, NextDC plans to invest an additional $400 million in new data centres, a sign of confidence in the long-term growth of AI and cloud computing. Unlike speculative names, NextDC’s fundamentals remain solid, with no change to earnings forecasts even as spending ramps up.

Technically, analysts have identified $13.40–$13.50 as pivotal support levels. The stock’s ability to rebound from this range could set up a short-to-medium-term rally. If prices hold, this could provide an ideal entry point for astute traders seeking tactical exposure during December’s momentum phase.

Students of Wealth Within’s Short Course in Share Trading learn how to identify such confirmation zones, which are the signals that separate a market reversal from a “falling knife.” Understanding these principles is crucial for timing trades effectively while controlling risk.

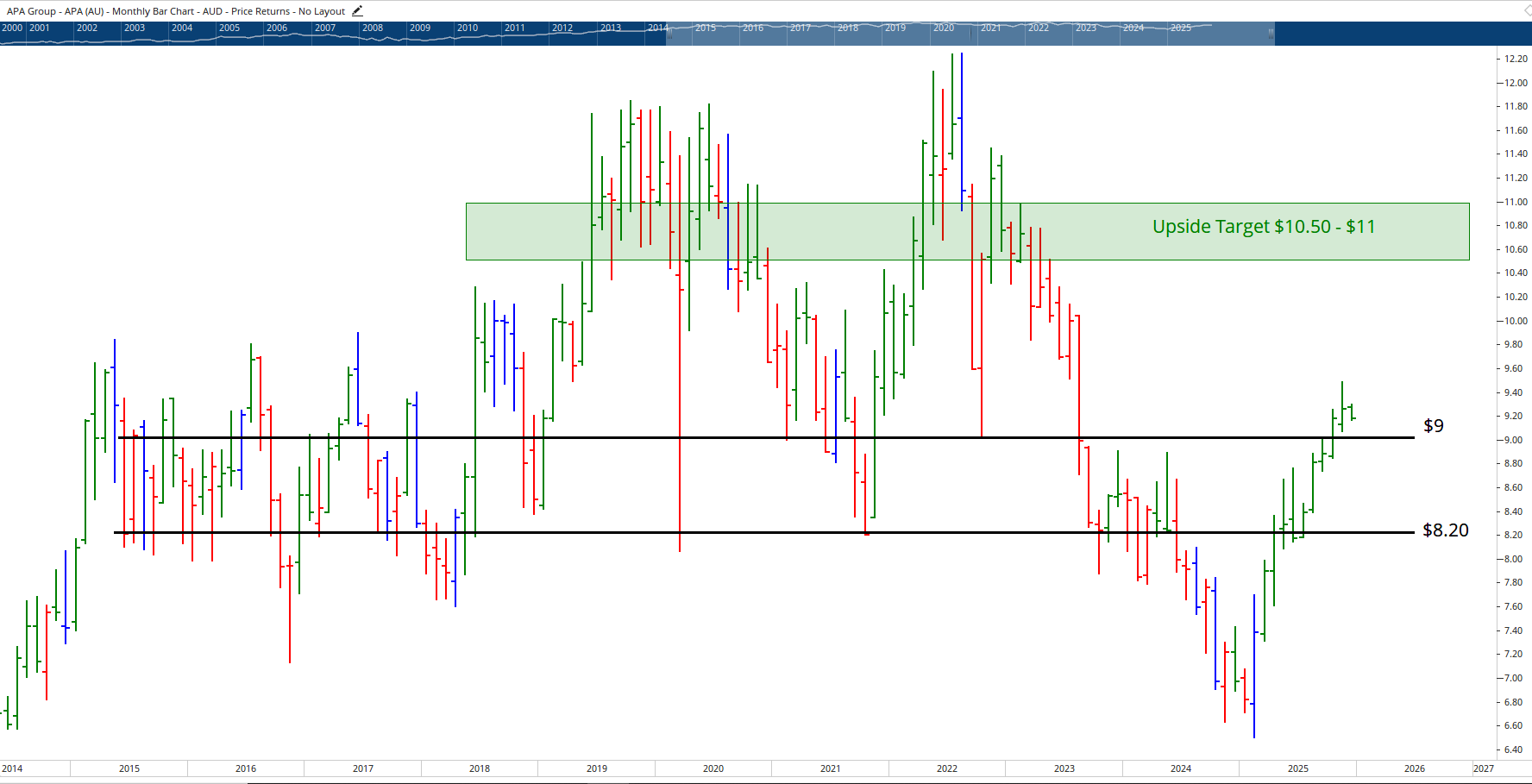

APA Group (ASX: APA) — Energy Stability and Long-Term Strength

APA Group continues to strengthen its position in Australia’s energy infrastructure sector. The recent announcement of a 400-megawatt power project in Queensland, in partnership with CS Energy, highlights the company’s expansion into firming capacity as renewables grow. Backed by a 25-year inflation-linked revenue agreement, this project reinforces APA’s reputation for delivering stable and predictable returns.

From a technical perspective, analysts note that $9.00 and $8.20 remain key zones of support, with potential upside toward $10.50–$11.00 if the stock breaks through the $9.50 mark. While APA’s monthly chart could benefit from a cooling pullback, maintaining this level of structure indicates the bulls are still in control.

This blend of solid fundamentals and steady technical strength makes APA an attractive option for risk-managed short-term traders and longer-term investors seeking yield with growth.

If you want the skills to analyse similar setups through actionable frameworks, Wealth Within’s Diploma of Share Trading and Investment provides structured, accredited share trading education built around proven technical and fundamental methodologies.

Capstone Copper (TSX: CS, ASX-listed) — The Resource Market’s Dark Horse

Capstone Copper is emerging as a quiet standout in the resource sector and could be a major performer heading into 2026. The company benefits from recent global supply disruptions, including mine closures at Mount Isa and production interruptions in Indonesia, which have reduced copper supply and driven prices higher.

Seasonally, copper tends to perform best from December to March, positioning Capstone at the right place and time for a strong cyclical move. The stock’s recent price action shows a bullish breakout from consolidation, supported by hefty buying volume which is a classic signal of institutional accumulation.

With trend alignment across short- and medium-term charts, Wealth Within analysts foresee potential for continued upside, provided momentum holds above recent breakout levels. Traders are cautiously watching how price reacts to short-term trend lines to confirm the continuation of the bullish structure.

Experienced traders wanting to evaluate such growth patterns in detail can progress to our Advanced stock trading course, where advanced charting tools such as Elliott Wave and time analysis are used to refine entries and maximise profits.

Why December Matters for Traders

Historically, December has delivered strong results across equities, driven by improved investor sentiment, fiscal reallocation, and “window dressing” from institutions. However, not every stock participates equally, which is why timing and strategy matter more than ever.

Understanding how to identify reversals from support zones, align your analysis with major momentum shifts, and manage risk properly can significantly improve your edge. These are precisely the skills taught within Wealth Within’s Trading courses, designed to equip both beginners and professionals with structured learning and real-world trading experience.

If you’re new to investing, our Stock Market for Beginners guide is the ideal starting point. It covers how the ASX works, how to pick quality stocks, and how to avoid costly mistakes many new traders make when the market becomes volatile.

The Key Principle: Confirmation Over Prediction

As our analysts often repeat on our weekly Hot Stock Tips videos, profitable trading isn’t about trying to predict the market, it’s about confirming what the market is already showing you.

For example, while NextDC and Capstone look technically strong, traders need clear follow-through above resistance levels before confirming new uptrends. Similarly, APA may need a brief pause or pullback to sustain longer-term continuation.

This idea of letting the market prove itself before you act, is the cornerstone of all Wealth Within training programs, grounding students in logic and evidence rather than emotion.

Invest in Knowledge Before You Invest in Stocks

The most consistent traders are not those chasing quick wins but those who understand structure, strategy, and psychology. Education remains the most powerful investment you can make in yourself.

Whether you’re learning the basics or looking to enhance your mastery, Wealth Within offers nationally recognised pathways to success. from the beginner-level Short Course in Share Trading to the advanced analytic rigor of the Diploma of Share Trading and Investment.

To learn more about Australia’s most respected share trading educator, visit our About Wealth Within page. Discover how you can develop long-term profitability and confidence in every market condition.

Final Thoughts: Prepare, Don’t Predict

The end-of-year rally can present rich opportunities, but only for those who are prepared. Stocks like NextDC, APA Group, and Capstone Copper showcase the kind of momentum-driven setups that reward discipline and patience.

As Wealth Within’s experts highlight each week, your best investment is in knowledge. Start building your skill set today with professional Share trading education that helps you trade with certainty, strategy, and structure.