Australia’s Hottest Microcap Stocks to Buy Now

By Dale Gillham and Fil Tortevski

If you enjoy spotting opportunities before the rest of the market does, then you’re going to want to take a close look at this. The Wealth Within team recently attended the 14th Annual Australian Microcap Conference in Melbourne, where dozens of exciting small-cap companies presented their growth strategies and future plans.

Dale Gillham, along with analysts Filip Tortevski and Alexandra Lowen from the ALX Report, shared their insights on some of the most promising ASX-listed microcap stocks. As experts in Share trading education, they highlighted several emerging opportunities worth watching closely.

Below, we explore the standout companies, their potential for long-term growth, and key lessons for traders looking to navigate the high-risk, high-reward world of microcap investments.

1. Intelligent Monitoring Group (ASX: IMB)

Industry: Security and AI surveillance

Focus: Smart monitoring and IoT protection solutions

Intelligent Monitoring Group operates across Australia and New Zealand, providing advanced AI-driven security monitoring services to over 180,000 customers. With 72% of its revenue coming from recurring subscriptions, the company has built a sustainable growth engine supported by over 800 local security partners and multiple monitoring centres.

What makes IMB particularly exciting is its integration of artificial intelligence to prevent crimes before they happen. By using real-time detection and automated alerts to law enforcement, the company has already stopped multiple attempted break-ins.

“This is a company that has evolved from acquisition-heavy growth to a mature, profit-driven model that’s now scaling nationwide,” says Dale Gillham.

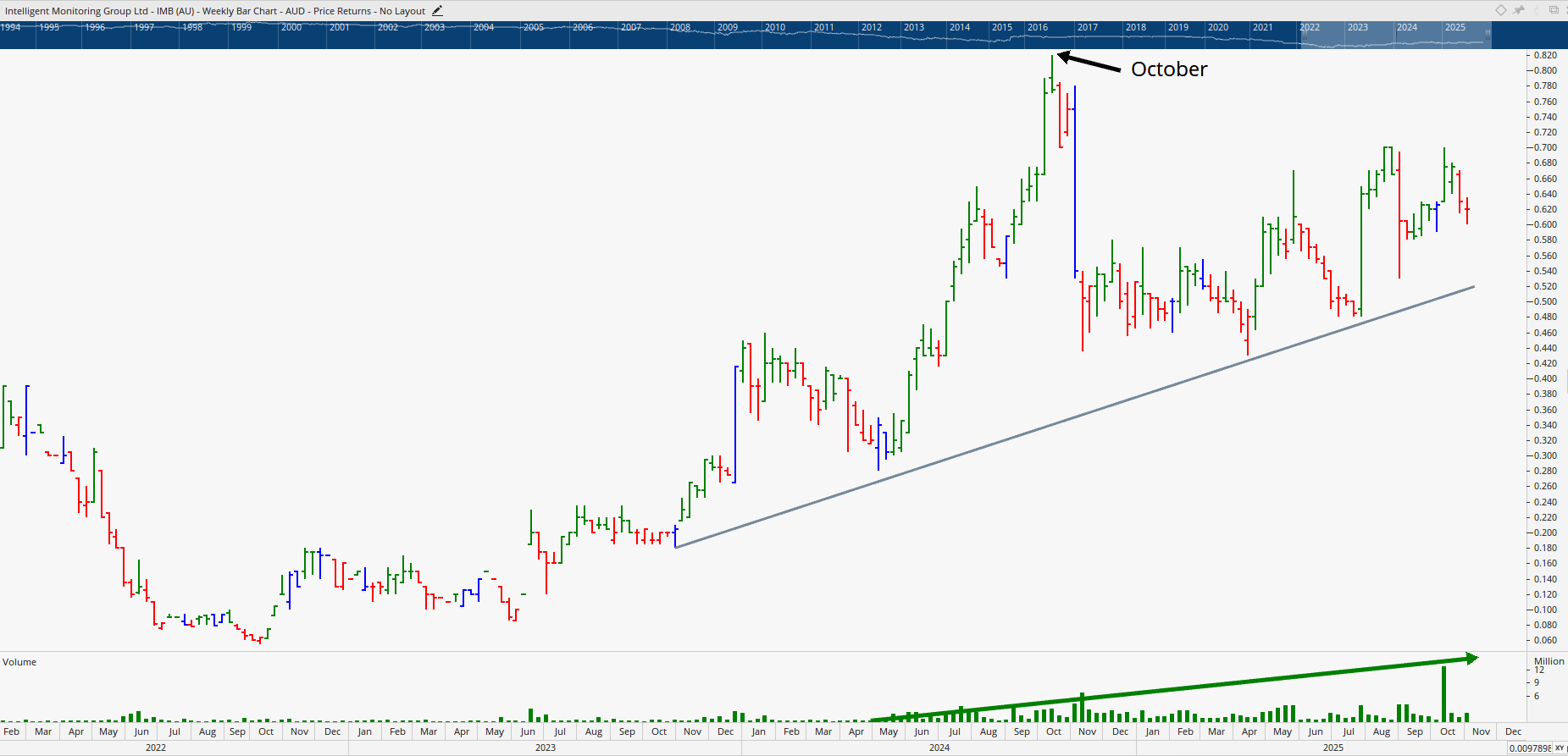

From a technical standpoint, the chart suggests a potential uptrend as buying momentum increases. A confirmed breakout above October highs could signal the start of a stronger medium-term move.

2. Global Health (ASX: GLH)

Industry: Healthcare software and technology

Focus: SaaS platforms for hospitals and clinicians

Global Health is a veteran in Australia’s health-tech space, providing software solutions to hospitals, general practices, and specialist medical centres since 1993. What’s particularly appealing is their move from system upgrades to revenue expansion and partnership growth, including a deal with Best Practice Software covering over 6,000 practices nationwide.

The company’s focus on digital health connectivity and patient monitoring positions it perfectly within an expanding global healthcare data ecosystem.

Alex Lowen highlighted, “This one feels ready to take off. The technology is strong, and the recurring revenue model adds real stability.”

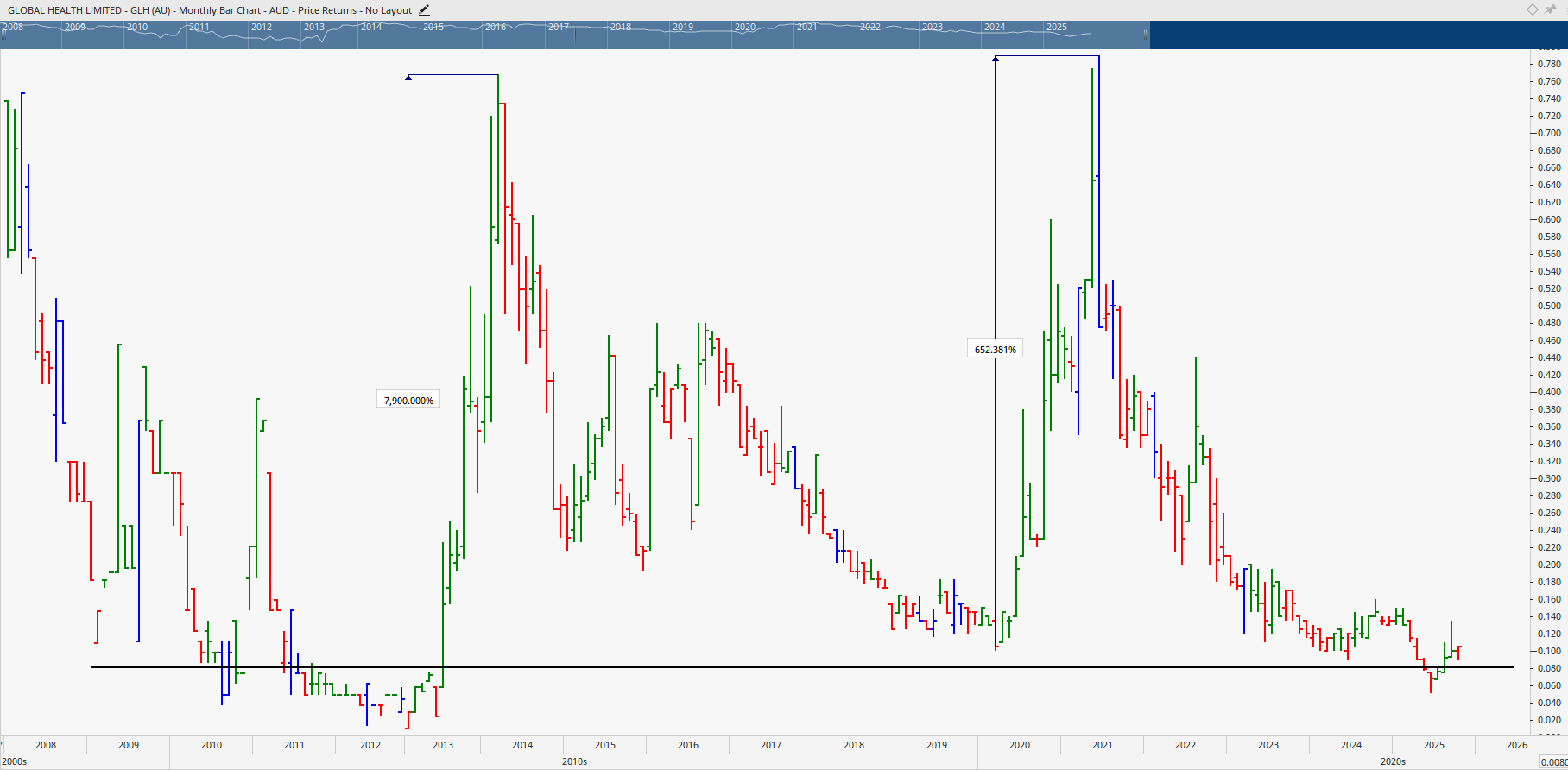

Historically, the stock has shown multiple explosive runs of 600%. With prices consolidating near key technical support, traders using well-timed entry strategies could identify early signs of another breakout.

For traders looking to learn how to build an evidence-based strategy around stocks like this, Wealth Within’s Short Course in Share Trading teaches proven, risk-managed trading techniques.

3. Hazer Group (ASX: HZR)

Industry: Clean energy and decarbonisation

Focus: Low-emission hydrogen and graphite production

Hazer Group impressed everyone at the conference with its world-first methane pyrolysis process, a low-emission technology that produces hydrogen and high-grade graphite using iron ore as a catalyst.

The technology has far-reaching implications for global decarbonisation and green hydrogen markets. With an addressable market exceeding USD $12 trillion by 2050, Hazer is positioned in one of the most lucrative future-facing industries.

A major highlight was the company’s licensing partnership with global engineering giant KBR, giving Hazer exclusive access to major international markets including Asia, North America, and Europe.

Filip Tortevski summed it up: “This is one of the strongest technical setups from the conference. Buyers are holding firm, and momentum looks ready to accelerate.”

4. Tryptamine Therapeutics (ASX: TYP)

Industry: Biopharmaceutical and mental health innovation

Focus: Psychedelic-based treatments for neuropsychiatric disorders

Tryptamine Therapeutics has drawn attention since its ASX listing in 2024. The company is pioneering precision psychedelic therapy, designed to address serious mental health conditions like PTSD and depression through controlled, rapid-onset treatments.

Unlike competitors, Tryptamine has developed a patented delivery system that ensures accurate, safe dosing during treatment sessions, a feature that could reshape the emerging psychedelic therapy market.

Clinical data shows highly promising results, including significant improvements for anxiety and eating disorders. The firm’s leadership includes former executives with strong pharmaceutical backgrounds, including connections to Johnson & Johnson.

“This is early-stage, but the fundamentals, the research, and the clinical outcomes make it one to watch,” says Gillham.

With participation and trading volume surging, a technical break above 5.7 cents could mark the beginning of a new upward phase.

5. Race Oncology (ASX: RAC)

Industry: Biotechnology and cancer research

Focus: Next-generation anti-cancer drugs with reduced heart risk

Race Oncology continues to impress with its breakthrough development of RC220, a heart-safe version of anthracycline chemotherapy, which is one of the world’s most widely used but toxic cancer drugs.

Unlike traditional treatments that can damage cardiovascular health, Race’s reformulation provides both tumor-killing power and cardiac protection. What makes this company stand out is its estimated 80% success rate, compared to the industry average of just 3%.

“The research results are extraordinary,” says Alex Lowen. “It’s one of the most progressive oncology developments to come out of Australia.”

Technically, RAC shares have climbed strongly from $1 to nearly $5 in recent months, proving strong investor confidence. While the stock may now be in a consolidation phase, future pullbacks could present strategic entry opportunities.

For investors aiming to refine their risk and entry timing when trading high-growth stocks, consider stepping up to the Diploma of Share Trading and Investment or our Advanced stock trading course.

Key Lessons for Trading Microcaps

Trading microcaps can be highly profitable but also extremely volatile. Here are the top tips from Wealth Within analysts for navigating this space successfully:

- Don’t chase the story, follow the price. A great idea means little without confirmation from market action.

- Assess leadership quality. Strong management often determines whether a company can scale successfully.

- Wait for confirmation. Patience is key. Let institutional money enter before you risk your own capital.

- Diversify and manage risk. Position sizing and stop-loss management are essential for survival in speculative markets.

If you’d like to learn to trade shares using structured, accredited techniques that remove the guesswork, explore our professional Trading courses taught by industry specialists.

Final Thoughts

The 2025 Microcap Conference revealed that innovation is alive and well across Australia’s small-cap market. Companies like Hazer Group and Race Oncology prove that visionary technology and strong execution can unlock world-changing potential and create serious wealth for early investors.

However, as Dale Gillham advises, “Being in the right place at the right time is only half the battle. Without proper education and timing, opportunities can turn into costly lessons.”

To develop a trading edge and stay ahead of the market, be sure to check out Wealth Within’s Hot Stock Tips videos, ASX video library, where our experts share weekly insights and analysis.

To learn more about our mission, history, and how we empower traders nationwide, visit About Wealth Within.

Important information

This content is provided for educational purposes only and is not personal financial advice. It does not take into account your objectives, financial situation or needs. Consider seeking advice from a licensed professional before acting on this information. Markets involve risk; past performance is not a reliable indicator of future performance.