February Could Be Huge for ASX Stocks: 3 to Watch Now

By Fil Tortevski and Pedro Banales

February is just around the corner, and with major CPI data, crucial interest rate decisions, and the corporate reporting season lining up, it’s shaping up to be one of the most important months investors have seen in years.

Market volatility looks set to surge and as every seasoned trader knows, wild moves can bring exceptional trading opportunities if you know where to look.

In this week’s episode of Wealth Within’s Hot Stock Tips Show, analysts Filip Tortevski and Pedro Banales highlighted three ASX-listed stocks that could be gearing up for major breakouts in February 2026.

As Australia’s leader in share trading education, Wealth Within brings professional-level insights to help everyday investors learn how to read the market with greater confidence.

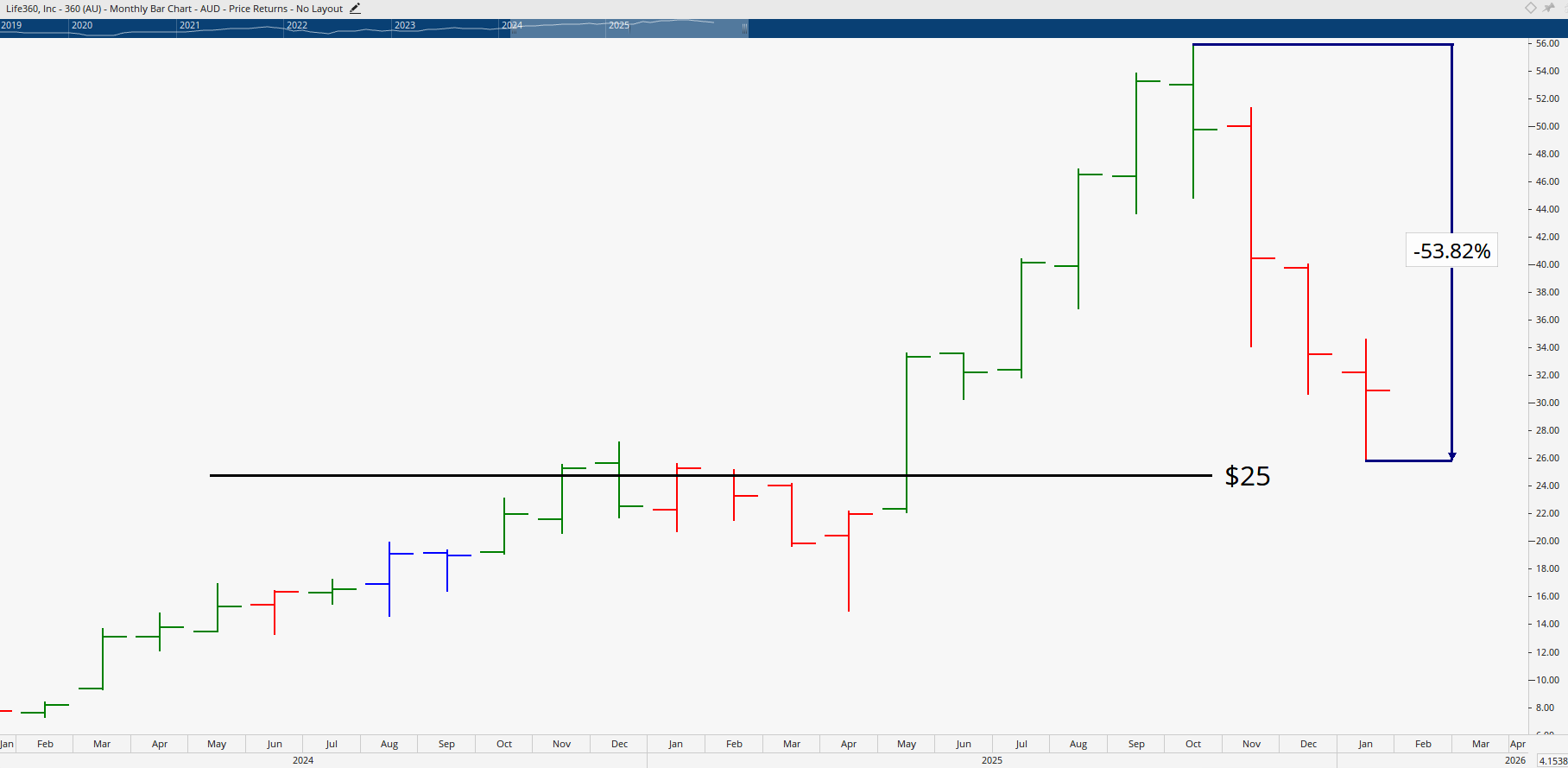

1. Life360: Growth Tech Making a Comeback

First up is Life360, the US-based family-safety software company listed on the ASX. The team revealed that Life360’s latest results showed record performance, with user growth up 20% year-on-year and its share price surging almost 30% in a single session.

While some investors may worry they’ve missed the move, technical analysis suggests the stock might still have plenty of upside. After pulling back nearly 50% from its October 2025 highs, the stock found strong support around the $25 level, a key technical zone highlighted by Pedro.

From there, buying momentum has returned, suggesting another leg higher could unfold if the pattern continues.

By analysing longer-term price structures and patterns, the Wealth Within analysts projected that Life360 could potentially test the $70 region if the strength holds, a level consistent with its historical price cycles.

However, as Filip pointed out, confirmation remains key. A disciplined trader waits for the market to validate a move rather than rushing in too soon, which is one of the essential principles taught throughout Wealth Within’s comprehensive Trading Courses.

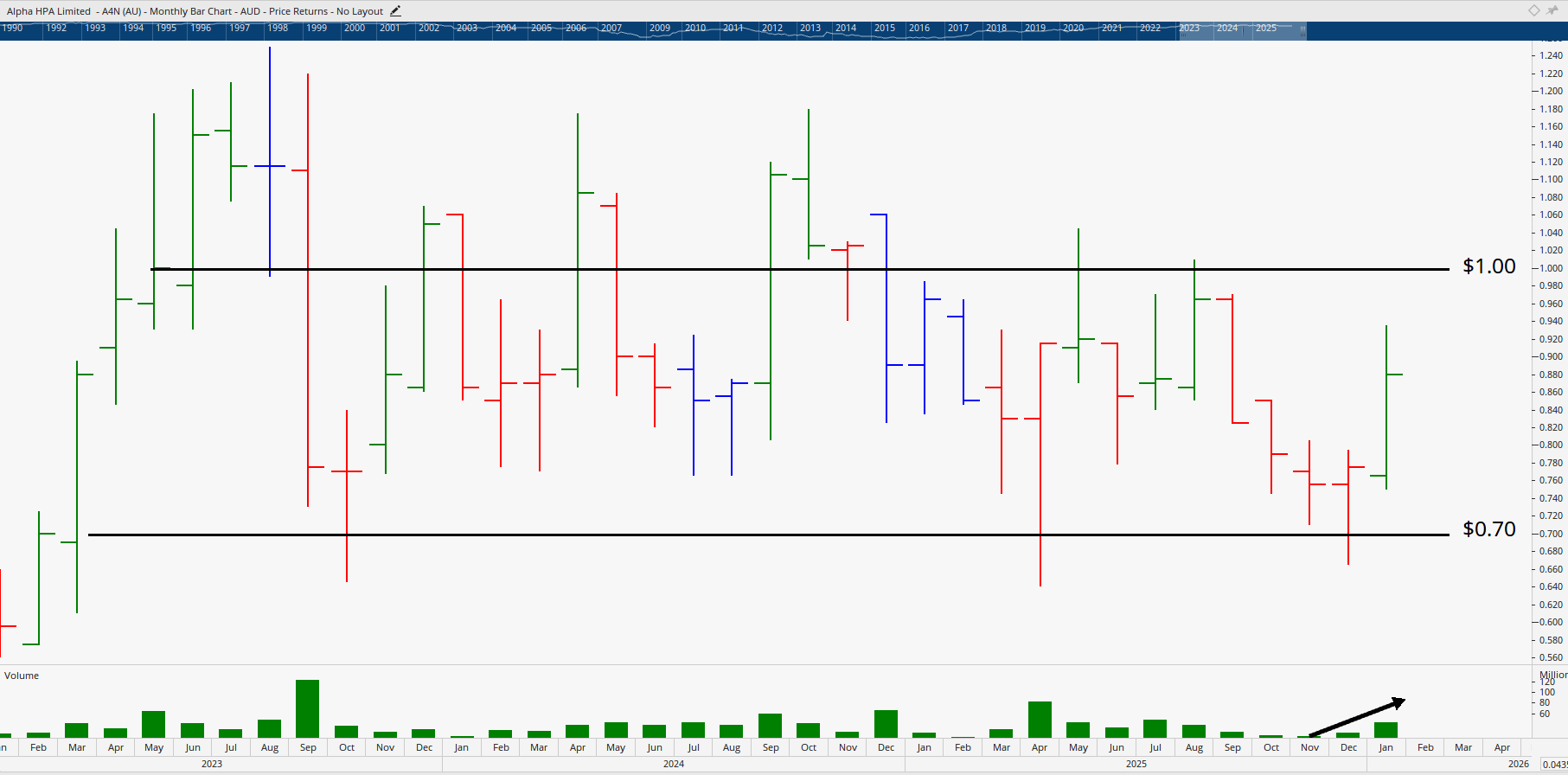

2. Alpha HPA Limited: A Quiet Performer in Industrial Tech

Next on the list was Alpha HPA, a high-purity alumina producer for semiconductor and advanced materials markets. While the stock has yet to take off like peers in its sector, such as South32, early signs of accumulation are appearing on the charts.

Alpha HPA’s price has been consolidating between 70 cents and $1 for some time. These consolidation zones often precede strong directional moves once traders start positioning for breakouts. Since late December 2025, consistent buying pressure has pushed the price higher, forming, as Pedro described, a “crucial make-or-break setup.”

Both analysts agreed that the recent uptick in volume since December shows renewed institutional interest, suggesting momentum could soon build. For traders who understand how to identify key levels and structure their entries around them, setups like this present excellent learning opportunities which is exactly the sort of approach covered in Wealth Within’s Short Course in Share Trading.

Filip also stressed a timeless principle: it’s not just “time in the market” that matters, but having the timing right. Knowing how to recognise turning points and manage risk can make the difference between riding a profitable breakout and being stuck in a sideways drift.

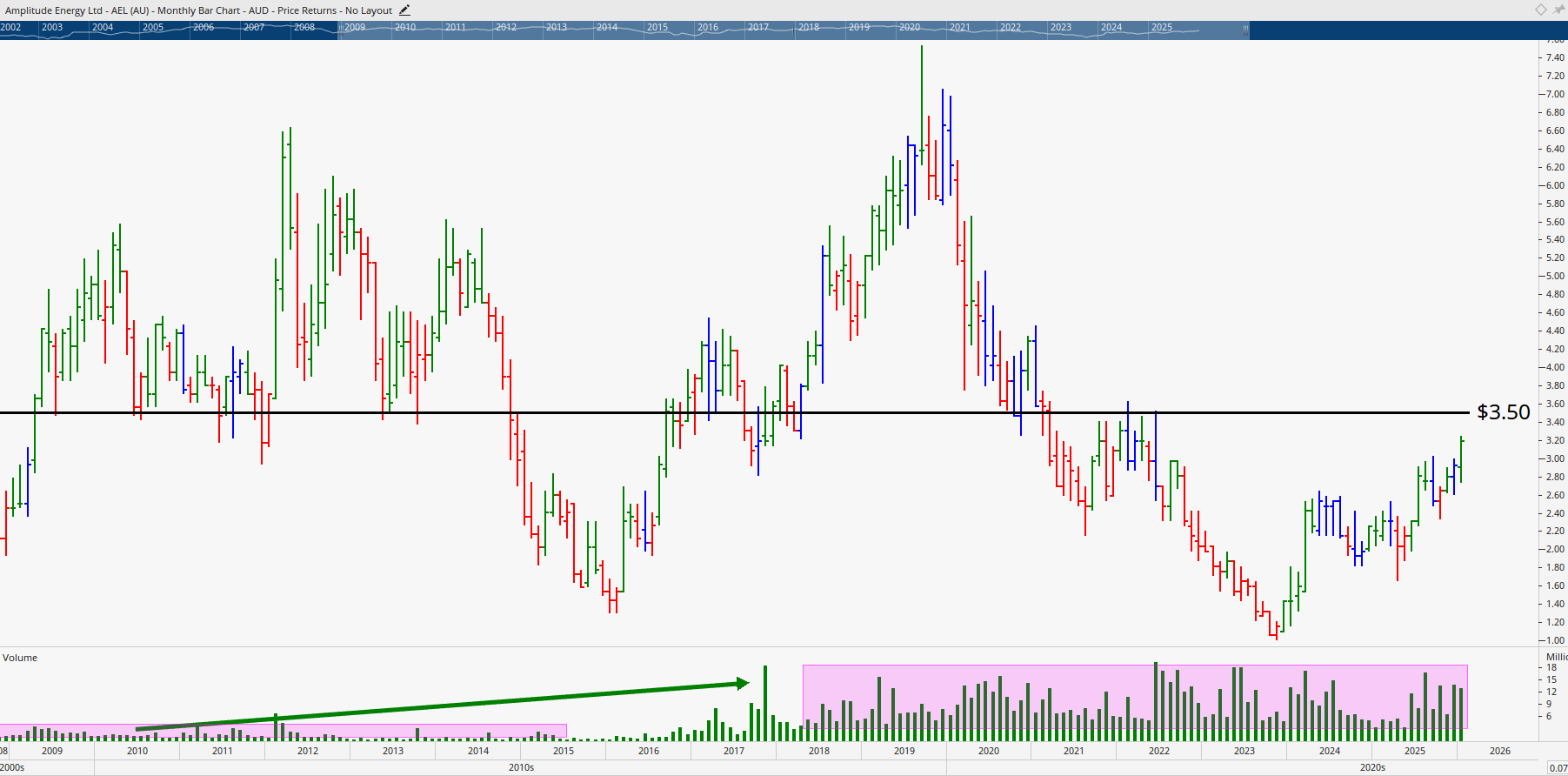

3. Amplitude Energy: A Textbook Technical Setup

The final stock discussed was Amplitude Energy, an Australian oil and gas producer showing strong technical signals after years of consolidation.

This stock recently rebounded from long-term support levels that have held since 2004, 2008, and again in 2016, levels that have historically marked major turning points.

On the chart, the pattern looks like a “textbook” for traders: a gradual base followed by a technical breakout early in 2026. With resistance near $3.50, a breakout above that level could pave the way for a potential move toward $6.

Pedro highlighted that this stock is now showing improved liquidity and personality, meaning price bars are cleaner, volume is building, and the stock’s trading characteristics are maturing, which are often signs that larger investors are taking notice.

Studying patterns like these gives traders a practical edge and reinforces the value of structured education for identifying low-risk opportunities.

Learning the Patterns of Professional Traders

Throughout their discussion, the Wealth Within team reiterated that identifying patterns and key price zones isn’t about predicting the future; it’s about stacking probabilities in your favour. While many traders chase hot tips or quick gains, those who understand how to analyse charts using price, volume, and confirmation signals tend to achieve more consistent success.

That’s why Wealth Within’s Diploma of Share Trading and Investment is Australia’s only government-accredited share trading qualification, teaching a proven, structured 5-step method for profitable trading.

For those ready to move beyond basics, the Advanced Stock Trading Course takes this foundation even further into mastery-level analysis.

If you’re completely new to the market and looking for a simple roadmap to get started, our Stock Market for Beginners guide is the perfect place to begin.

Trade Smart, Stay Ahead of the Game

February 2026 could be a defining month for Australian investors. From tech to industrials to energy, opportunities are forming across the market, but as always, success depends on knowledge, timing, and discipline.

As Filip and Pedro reminded viewers, the goal isn’t to chase tips. It’s about understanding the setups and applyinga sound trading strategy tailored to your goals.

For more insights and weekly analysis from Australia’s most trusted trading educators, explore our Hot Stock Tips videos or ASX video library, where the Wealth Within team breaks down current market setups so you can see these techniques applied in real time.

To learn more about our trading education or how we’ve helped thousands of Australians trade with confidence, visit our About Wealth Within page.