How to Profit from Huge News on BSL, A2 Milk and NAB

By Fil Tortevski and Dale Gillham

Insights from Chief Analyst Dale Gillham and Senior Analyst Philip Tortevski.

Big news has rattled the ASX: BlueScope’s earnings update, A2 Milk’s China expansion plans, and NAB’s costly payroll provision.

Here’s the smart play — fundamentals, technical levels, and how to position with discipline.

For more context on how we teach traders to execute with confidence, explore our trading courses and the nationally recognised Diploma of Share Trading and Investment (10943NAT).

Why this matters now

Markets react fast to headlines, but profits flow to traders who combine structured analysis with timing.

Our ASX video library of Hot Stock Tips videos shows how we translate news into rules-based trades.

If you’re ready to go deeper, our advanced stock trading course extends your edge with price, pattern and time.

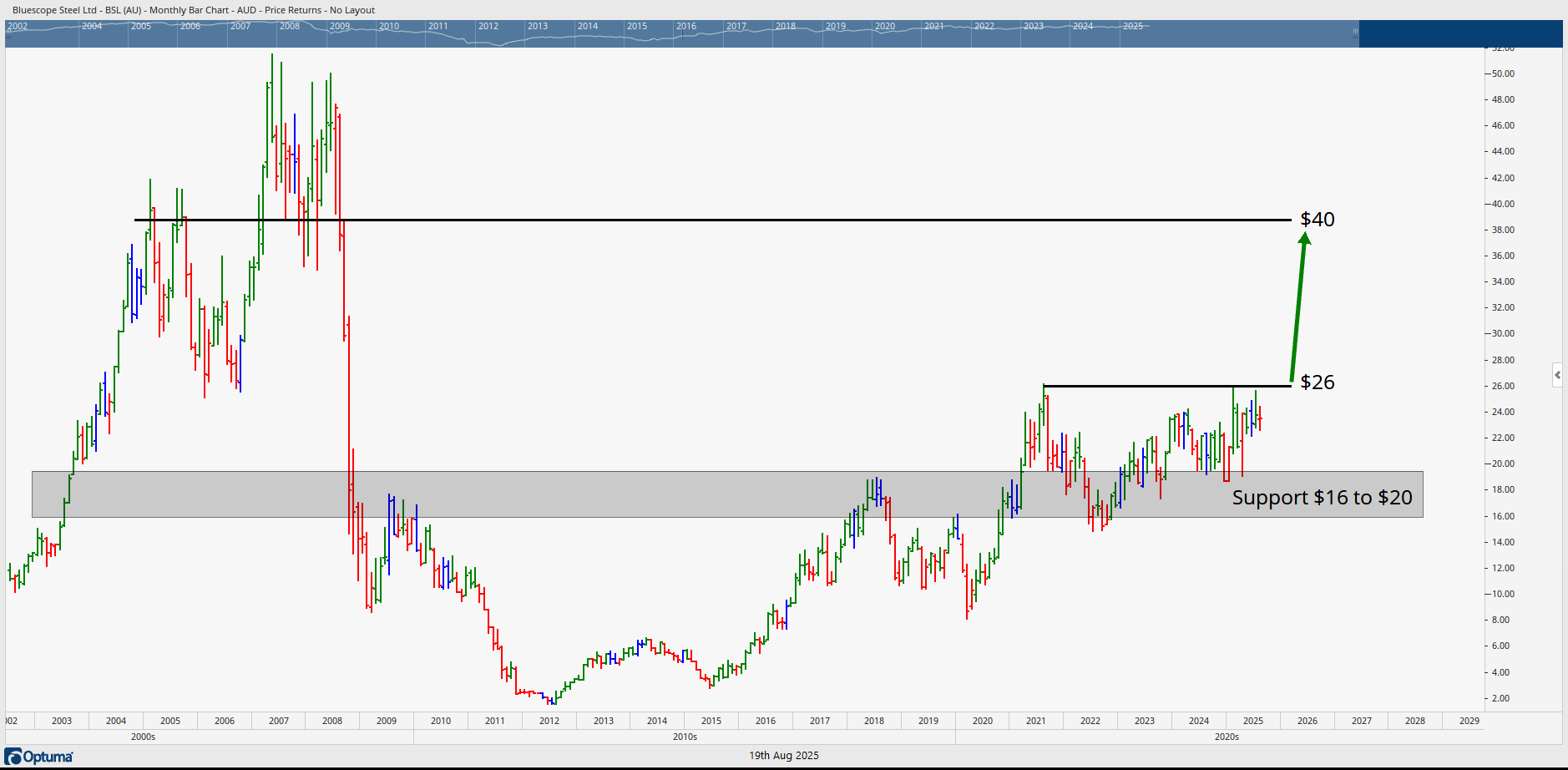

BlueScope Steel (ASX: BSL): earnings resilience and a breakout trigger

BlueScope delivered FY25 results and flagged confidence into FY26, citing cost-out and “through-the-cycle” earnings improvements despite softer commodities.

Management’s leverage-to-the-upside message aligns with the current setup.

Key technical levels to watch

- Structural support: $16–$20 zone (former resistance in 2009/2018 turned support).

- Line in the sand: a decisive break above $26 opens a pathway toward $30–$40 over time.

- Risk marker: failure to break $26 could result in a retest of prior support before any larger advance.

Trade idea framing: wait for confirmation above resistance or a proven reversal off support. Use pre-defined stops and avoid “buy-and-hope”.

If you want a structured approach to trend, price and pattern, start with our Diploma of Share Trading and Investment.

A2 Milk (ASX: A2M): China growth catalyst and a textbook pattern

A2 Milk reported a strong year with improving infant formula momentum and is seeking a New Zealand formula plant to scale China's growth.

Technically, the long-watched $7.10–$7.13 area flipped from resistance to support, with a bullish consolidation that our team describes as “textbook”.

Key technical levels to watch

- Support to hold: $7.10–$7.13.

- Momentum triggers: strength through $8–$9 signals the next leg higher.

- Measured move potential: pattern points toward a potential breakout to $14 if price takes the march 2025 high.

Execution tip: let price confirm. If you’re building rule-based entries and exits, our share trading education will help you systemise pattern recognition and risk control.

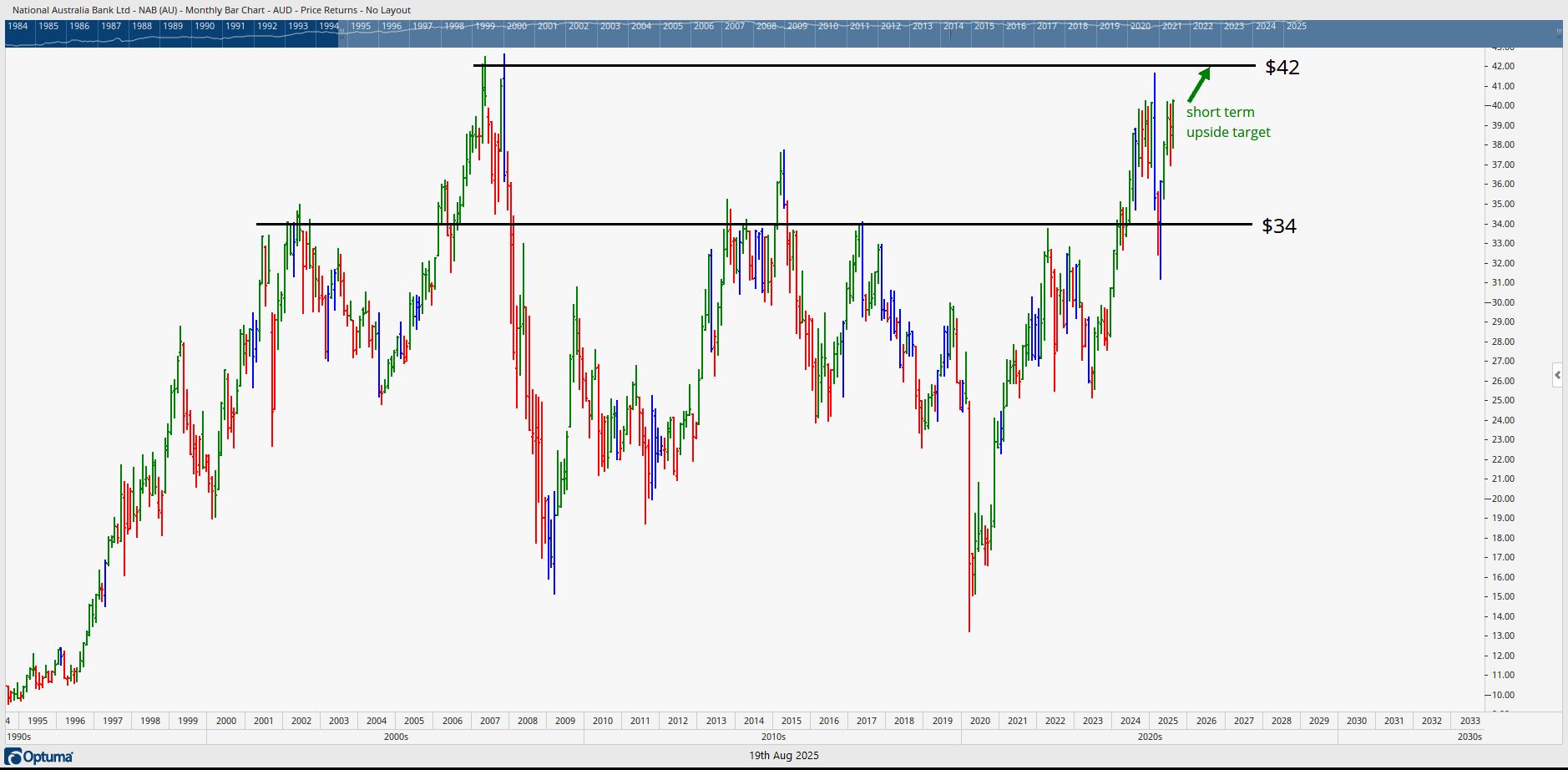

National Australia Bank (ASX: NAB): cost shock, resilient earnings and range behaviour

NAB booked a provisional $130m expense for staff underpayments (lifting FY costs by ~4.5% as the review continues), yet Q3 cash earnings were up 2%.

Since the GFC, NAB has largely traded a broad range between roughly $20 and $39, creating tradeable swings rather than long, smooth trends.

Key technical levels to watch

- Former hurdle: around $34. A sustained move above the June high keeps the bias positive.

- Upside map: room into the low-$40s if momentum holds; then reassess.

- Mindset: treat it as a trading stock — define targets and stops rather than relying on buy-and-hold.

Want to sharpen timing and risk-to-reward in financials? Explore our advanced stock trading course for integrating price, pattern and time into a cohesive plan.

Putting it all together: a rules-based playbook

- Let news inform, not dictate: align catalysts with technical confirmation.

- Use levels, not guesses: BSL $26, A2M $7.10–$7.13, NAB ~$34 are pivotal.

- Define risk first: pre-plan exits below invalidation; size positions for volatility.

- Prioritise momentum quality: rising trends and orderly consolidations outperform “cheap” stories.

- Keep learning: our Learn to trade shares pathway takes you from foundations to mastery.

Continue your edge with Wealth Within

We’re one of Australia’s few educators with both an AFSL and a government-accredited program.

Learn how our approach was built: About Wealth Within.

Watch us apply these principles live each week in our ASX video library of Hot Stock Tips videos.

Ready to formalise your skills? Start with the Diploma of Share Trading and Investment, then level up with our advanced stock trading course.

Important information

This content is provided for educational purposes only and is not personal financial advice. It does not take into account your objectives, financial situation or needs. Consider seeking advice from a licensed professional before acting on this information. Markets involve risk; past performance is not a reliable indicator of future performance.