This Trend Will Be Bigger Than AI in 2026: 3 ASX Stocks to Watch Now

By Fil Tortevski and Pedro Banales

Artificial intelligence has dominated headlines for years, but according to expert analysts at Wealth Within, the next big investment boom may not be AI at all. A new global megatrend, cybersecurity, is quietly reshaping the technology landscape and offering a wave of opportunities for smart traders and investors.

In this week’s Hot Stock Tips, Wealth Within analysts Filip Tortevski and Pedro Banales uncovered why cybersecurity could be the biggest market driver of 2026 and highlighted three promising investments to watch, including two ASX‑listed stocks and a global ETF.

The Hidden Tech Megatrend: Cybersecurity

While everyone’s attention turns to artificial intelligence, the cybersecurity industry is accelerating faster than cloud computing as well as data centers and is on pace to match AI’s growth rates by 2026.

Every modern business depends on a secure data infrastructure. As Tortevski explains, “You can’t have data centers, AI, or software without cybersecurity, it’s compulsory now.” With cybercrime estimated to exceed $10 trillion annually, corporations and governments are forced to increase spending on security systems, compliance, and risk management, driving massive investment demand across the sector.

For traders and investors, this surge represents one of the few must-have technology sectors of the decade, offering defensive stability and strong upside potential.

ASX Stock Pick #1 – Qoria Limited (ASX: QOR)

Wealth Within’s first pick, Qoria Limited, trades on the ASX in the cybersecurity sector. The company has shown historical resistance and support levels around 20¢ and 80¢, making it a technically intriguing stock.

The analysis revealed:

- Three major tests of the 80¢ level since 2020

- A firm higher base forming near 50¢

- Record trading volume not seen since the stock’s 2020 low

These signals could indicate renewed investor confidence and potential momentum heading into 2026. As Tortevski notes, “If Qoria can hold 50¢, it could mark the beginning of a breakout, supported by strong buyer volume.”

ASX Stock Pick #2 – archTIS Limited (ASX: AR9)

Next up is archTIS Limited, another emerging cybersecurity player. Listed in 2018, the stock rose more than 800% between its early lows and 2021 high before retreating to form a base near 5¢.

Banales pointed out that buyers are re‑entering at the same level, suggesting renewed optimism. Recent volume spikes also reflect improving liquidity, a positive for active traders.

He adds that this setup mirrors the pattern seen before the stock’s previous major rally. “The last time we saw record volume was before its biggest move in history,” says Banales.

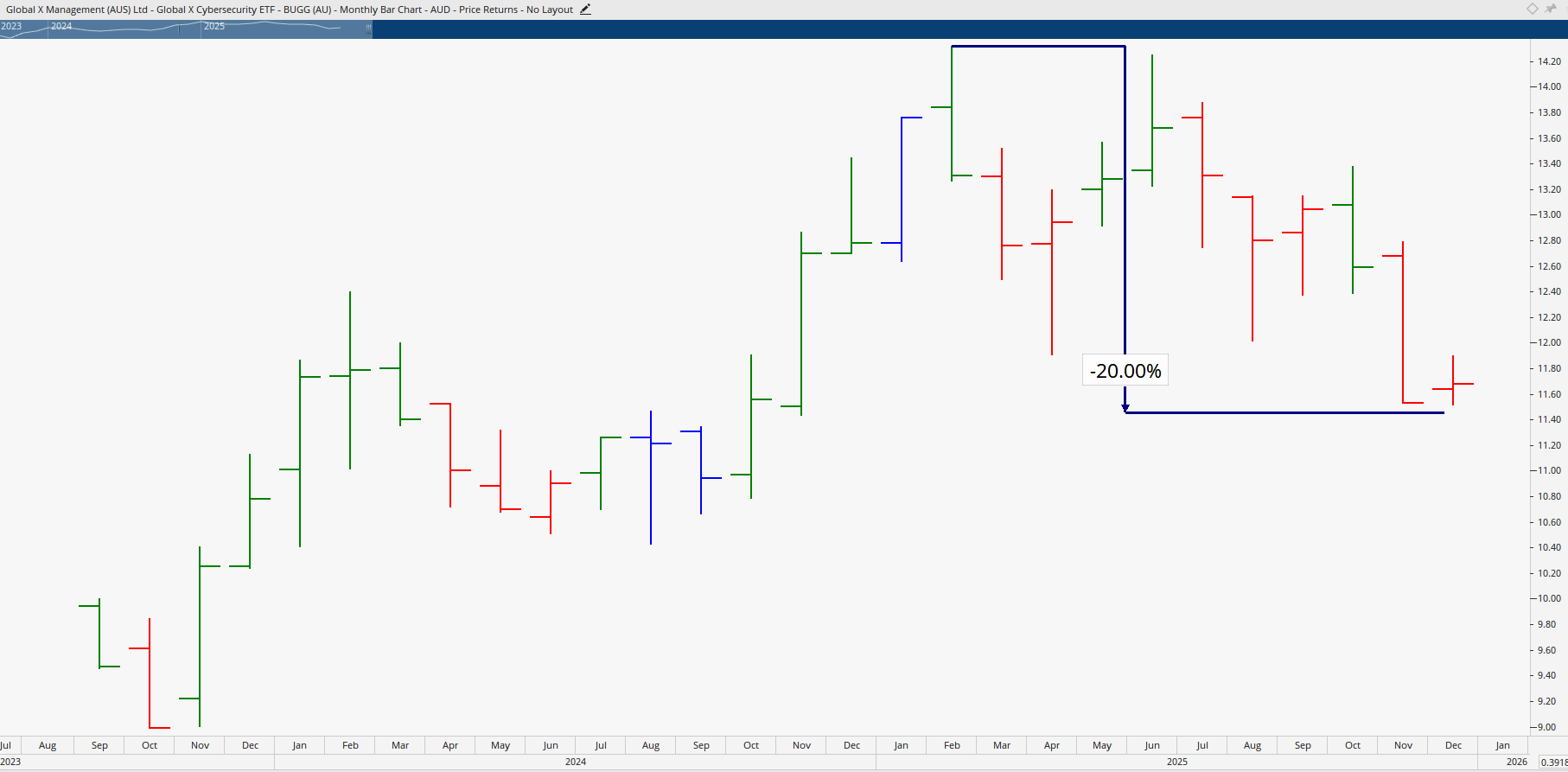

ETF Pick – BETASHARES Global Cybersecurity ETF (BUGG)

For those preferring diversified exposure, the analysts spotlighted a global cybersecurity ETF listed in Australia. Holding major international firms like CrowdStrike, the fund offers a broad play on the sector’s explosive growth without the single‑stock risk.

After a recent 20% retracement, BUGG could be primed for recovery as global demand for cybersecurity surges. “Specialised ETFs like this let you capture volatility and upside from major cybersecurity names,” Tortevski explains.

For long‑term investors, BUGG provides global diversification with the simplicity of a single ASX‑listed security.

Why Cybersecurity Could Outpace AI

Artificial intelligence relies on vast networks, data storage, and cloud infrastructure, all of which require protection. That’s where cybersecurity comes in. It’s the invisible backbone supporting the digital economy.

From Fortune 500 firms to small businesses, every organisation now considers cybersecurity essential. Increasing legislation also holds CEOs personally liable for data breaches, ensuring consistent and compounding demand across industries.

For traders, this translates into more stable earnings growth for cybersecurity leaders and higher market valuations in the coming years.

Learn to Identify the Next Big Trend Like a Professional

Timing is everything in trading. As Tortevski reminded viewers, “You can talk about trends all you want, but if you don’t get the timing right, you’ll miss the real opportunity.”

At Wealth Within, Australia’s only government‑accredited share trading educator, you can learn how to identify these opportunities before the broader market catches on. Through structured, competency‑based learning, you’ll gain the confidence to trade bull and bear markets alike.

Explore our Trading Courses to master strategies that deliver consistent results. New to investing? Start with the Short Course in Share Trading or consider the nationally recognised Diploma of Share Trading and Investment to develop a professional‑grade trading plan.

If you’re a beginner, our Stock Market for Beginners guide offers the perfect foundation to understand the ASX and start building wealth with confidence.

To learn advanced technical strategies such as time and pattern analysis, explore the Advanced Stock Trading Course.

Or, if you prefer continuous learning, tune in every Tuesday night for our Hot Stock Tips videos, ASX video library where we share weekly insights into emerging market trends.

Profit from the Future of Cybersecurity

While AI continues to dominate tech headlines, cybersecurity may quietly become the real moneymaker for 2026 and beyond. As spending accelerates and digital threats grow, companies securing the world’s data are in line for massive growth.

Whether you choose individual ASX shares like Qoria Limited and archTIS Limited or the Global Cybersecurity ETF (BUGG), the key is to approach these opportunities with knowledge, discipline, and a solid trading strategy.

To see how Australia’s leading accredited trading educator can help you identify market winners early, visit About Wealth Within and take the next step in your investment journey.