Wealth Within Case Studies

Bamby Neilsen

Bamby Neilsen shares her review of Wealth Within having completed the Diploma. According to Bamby, trading is exciting as it challenges my brain and provides the income to live comfortably and do all the thinks we want to do.

Bamby has been a trader for 18 months and is currently undertaking the Advanced Trading Strategies Course. She managed the financial side of commercial cattle property for over 25 years in Central Queensland. She also worked outside of the office, raising orphaned or sick calves, driving machinery, fixing and maintaining fences, mustering, checking water pumps and weed control. She trades some ASX Top 200 and Top 50-100 Mid-Cap stocks.

Bamby says, “In 2013 my life was in a state of change as I left the rural enterprise I had helped build. I got divorced, moved to a new town and basically started a new life with a completely new outlook and a new relationship. I have always been a person who thinks outside the box and challenges in life are a way of pushing me to the next level. From that time, my life took a holistic and spiritual path of self-discovery, to healing, well-being and mindfulness, which has allowed me to accomplish anything I put my mind to”.

How and when did you first become interested in the markets?

I started becoming interested in shares and the market when I felt that I needed to invest my money. I found the stock market in the mid 1990's but was being coaxed by financial investment speculators and fundamental stats, and I read too many financial articles. Having a Self-Managed Super Fund (SMSF) which was monitored by an adviser, sparked an interest in keeping track of my portfolio and watching it grow.

And then what happened?

I was able to attend a couple of weekend workshops in the town of Emerald, Central Queensland, which were run to assist rural people in investing money into the stock market and provide advice on property and other investments. This was around the time when Ansett Airlines had crashed. The fallout was, we suddenly had access to the information that was given to the redundant airline staff to help them invest their money. This was done very professionally and it sparked a desire in me to learn more about where to invest.

I have always been a person who likes to be in charge of her own finances and have my finger on the pulse.

How have you been able to learn and educate yourself about the markets?

I did what most people probably do, i.e. read newspapers and the Money Magazine and mostly listened to radio stock reports. I had no idea about what books or courses were available. So, most of the stocks I purchased were based only on fundamental figures, gut instinct and some financial advice.

I was trying to find some way of learning about stocks, as I was making some good trades. However, I was missing the important details of how to exit a trade at the right time. It was not until 2014, that I came across the Wealth Within website and it looked too good to be true. In the past I had been harassed by other companies trying to sell me a trading platform where they would be in control of the software and the trades: I didn't like that idea, but I did like what I read on the website and so I enrolled in Diploma of Share Trading.

Doing this was a way to keep my mind focused on where I wanted to be in the future. I was finally being able to make sense of the market and the terms you hear all the time, but don't really understand until you start becoming educated.

The hardest part for me was getting myself back into a study routine, doing assignments and exams, which was quite a challenge for the first 6 months. Nevertheless, it was also rewarding because this process really helped me understand what I was learning and how to properly apply it.

Did you make mistakes when first starting out?

Mistakes are a part of learning and I made some, but luckily mine were not big losses. Patience is a big thing, when you have this new found information- you get very excited. You want to dive in headlong before you have enough experience or knowledge behind you. I have learnt how important it is to know your stocks inside-out and how you need to know the personality of each company so you can identify patterns, reversal signals and important price levels that can indicate what the stock is likely to do next.

When I have a loss, I study the trade and see why it happened. As long as I can work out how I could've prevented it, I believe I have learned from it. With my current knowledge, I can easily do this and continue improving.

Would you define yourself as a discretionary trader, a mechanical trader or a combination of both?

I probably lean more to the discretionary side of trading but with all the skills I have on hand, I am confident in knowing I have the mechanical side of the trading as a tool, which I still use on stocks.

Who have been some of your mentors and role models? What impact have these people made on you personally as well as on your trading style?

In doing the Diploma, the assessors Kay and Jennie were there all the way, supporting me when I got bogged down. The pep phone calls from Carl were just the thing to pick me up too, he always rang at the right time, i.e. when I was feeling a little overwhelmed. Then when Dale Gillham spoke at the first trading workshop, I was in awe of him. He is such a positive inspiration!

Since starting the Advanced Trading Strategies Course, Janine has also become my mentor and confidante in this journey. Each of these people have reinforced the concept that if you stick to your money management rules and back test your stock, the sky is the limit.

Can you give us a brief overview of your trading style?

I am an aggressive trader, which is why I like the Mid-Caps so much. Sometimes there are other stocks in the Top 200 that are a bit predictable and slow, but these stocks are still great to have in the portfolio. I am more of a short to medium term trader and my average trade is around three months.

I also have a small SMSF portfolio in which I trade medium to long-term stocks, so I have to switch the way I think when trading such stocks. When I trade short to medium term, I enter a trade as early as I can and then exit on a daily chart.

The technical side of trading has me hooked, I enjoy it so much that I spend around 2 or 3 hours analysing a new stock. I write lots of notes about what I observe in preparation to trade.

I have my trading logs with each stock listed alphabetically and it allows me to keep tabs on the stock’s history and add notes from trading reports.

Is there any one trade (win or loss) that had a profound effect on your development as a trader? If so, what did you learn from the trade?

When I first started trading seriously about 12 months ago, I had all my rules in play and placed a trade on FMG and HVN, exiting with profits of 40% for FMG (Fortescue Metal Group) and 35% for HVN (Harvey Norman). This boosted my confidence and made me realise that I had finally become a trader! I did have some minor losses, but I’ve always stuck to my stop losses and appropriate parcel sizes.

Can you tell us about your best and worst trades?

The best trades are when you simply follow your rules and the trade goes to plan without any hiccups and you exit at the right time and you know it’s right because the next day the share drops, so it reinforces your skill base constantly.

For me any trade that makes a profit is a great trade. In the early months of learning to trade I learnt to focus on producing a trade that I exited in profit rather than being focused on how much I would make out of it. The worst trades I have experienced were those where I was hesitant in my entry or when I didn’t have all my technical analysis done.

Would you classify yourself as a short-term or a long-term trader? What advice would you offer to people getting started as traders on the relative merits or otherwise of each?

I am becoming more of a short-term trader since I am more confident now, having gained the experience and skills to pick stocks more suited to my personality. In my SMSF, I am inclined to stick to the ASX Top 50-100 stocks. The more I practice the techniques, the more confident I become in selecting the right stocks to trade.

The best advice I have ever been given is, not to listen to advice from others when they offer you a tip on which stock to buy. If they do, I will have a quick look and then I can see why I would not even want to consider buying the stock recommended based on my own analysis.

What markets do you trade and which markets do you prefer? Do you have a favourite, and why?

I like trading ASX shares, particularly the mid-caps as they are more volatile and have higher volumes. Analysing them challenges me, though I will still have a couple of the top 50 stocks in my portfolio. Currently, I have three resource stocks in trades and I like these stocks. Now that I am familiar with how they move; I find them easy to trade.

What makes your trading style different from others? What sets you apart from other traders?

I do not know exactly what other traders know, but I do know that I have a proper education behind me and I think that would be a big point of difference as most traders think they are educated when the statistics indicate otherwise.

I feel that everyone is different in their trading and it is a combination of your personality and how you approach life, which defines you as a trader. I am a very organised person and need to have all my facts and details and record everything I do. I think it is important to keep things simple, don't over complicate things and have no emotional attachment to the trade. I see it as an equation that has a formula, which requires a result through calculation of analysis.

Do you have a favourite trading rule?

When I am trading, I like to use Gann’s 50% rule and trend lines if the rule suits the stock. I have found they are simple and effective.

Ed Seykota says, “Everybody gets what they want from the markets.” What do you ‘get’ from the markets?

Trading is exciting. I love it. It challenges my brain and provides the income for us to live comfortably and do all the things we want to do. What more could I want?

How has trading affected your lifestyle?

Trading has brought me together with other like-minded people and I can share the trials and tribulations of their trading journey. I am now more confident that I will be able to have a very comfortable lifestyle well into my older years.

What books, seminars and courses have you read or attended and which would you recommend?

Of course, I recommend the Diploma of Share Trading and Investment, and I have read all the books Dale has recommended and some of W.D Gann’s books like 'The Tunnel Through The Air'.

I don't read psychology books; I prefer to read books which relate to Conscious Awareness as I believe this is the quantum way to change one's behaviour. It requires consistent attention and observation on one's own self: it is a confronting and uplifting achievement when you decide to do this. I attend workshops which connect and fine tune the brain for higher thought processes.

What does the future hold for you?

The future is there and I am excited about it. As soon as I complete the Advanced Trading Strategies course I will also do the Forex and CFD Trading Course.

I will become a trader who will place a few trades a year and then for the rest of the time enjoy life and the adventures it offers.

Insights From Our Learning Centre

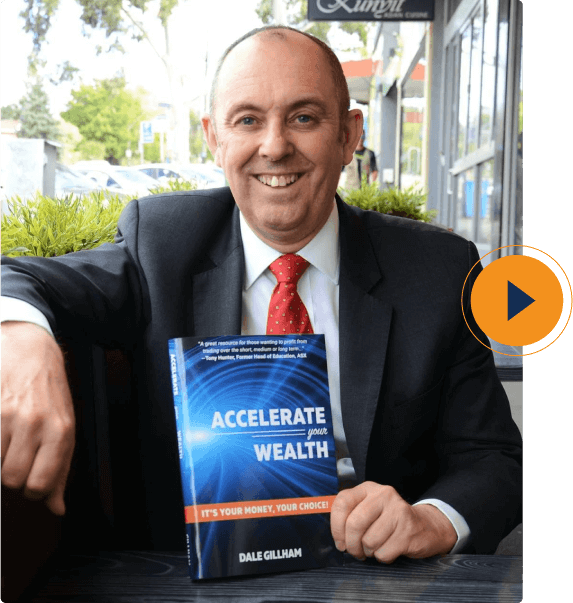

Learn the concepts as to how you can accelerate your wealth using simple DIY investment strategies that will enable you to take control of your investments. Dale Gillham, bestselling author, shows you how to invest with confidence to achieve very profitable returns.

Browse BooksOr Browse By Topic

5 Stars

Years in business delivering high-quality education

of students rate the quality of education as excellent or very good

of students recommend Wealth Within