3 ASX ETFs to Beat the Next Bull Run: Robotics, Hydrogen, and Crypto Infrastructure

By Fil Tortevski and Pedro Banales

Not all leaders of the next bull market will be banks or miners.

Our analysts break down three thematic ASX ETFs flying under the radar, yet aligned with powerful decade‑long trends.

Why these three ETFs now

After analysing the market’s shifting leadership, our team identified three areas with the potential to compound ahead of the broader index: global robotics and automation, the hydrogen value chain, and crypto infrastructure.

Each is supported by strong secular drivers and, importantly, tradable trends with clear momentum and liquidity.

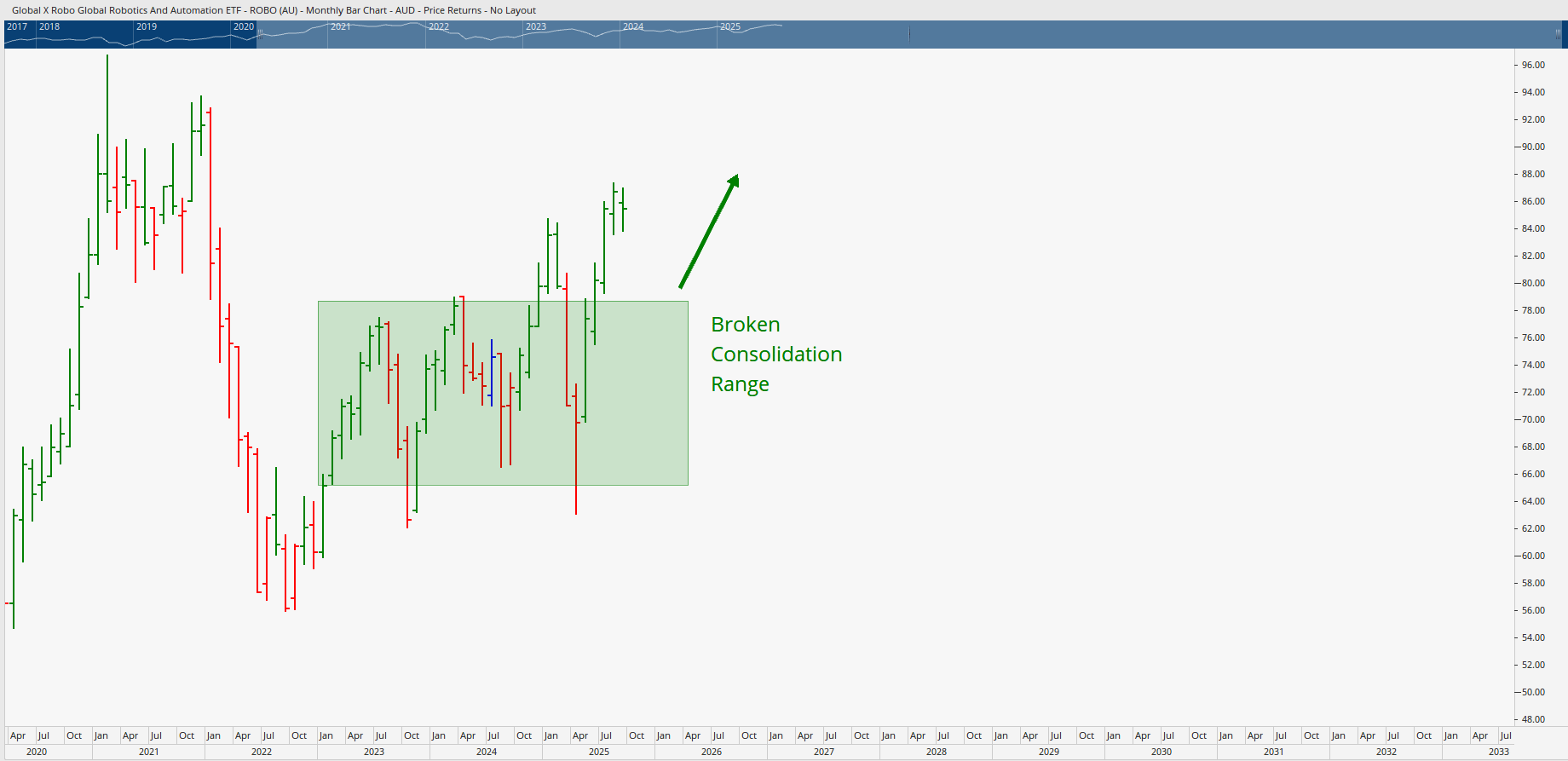

ETF 1: ROBO, Global Robotics & Automation

Robotics is moving from promise to deployment across manufacturing, logistics, healthcare, and consumer applications.

The global robotics market is projected to grow from approximately USD 64.8B in 2024 to around USD 375B by 2035, an estimated 17% CAGR, driven by automation, AI, and persistent labour shortages.

Price structure and tradability

- Post‑2023 consolidation between roughly 65–80 has broken to the upside, indicating renewed trend intent.

- Expect near‑term retests toward prior breakout zones; constructive pullbacks that hold higher lows can set up the next leg.

- Volatility profile is closer to quality growth stocks than broad index ETFs, offering multi‑month swings of 30–40% that can be actively traded.

Key takeaway: Thematisation plus trend structure makes ROBO a candidate for disciplined trend trading, provided you use rules for entries, exits, and risk.

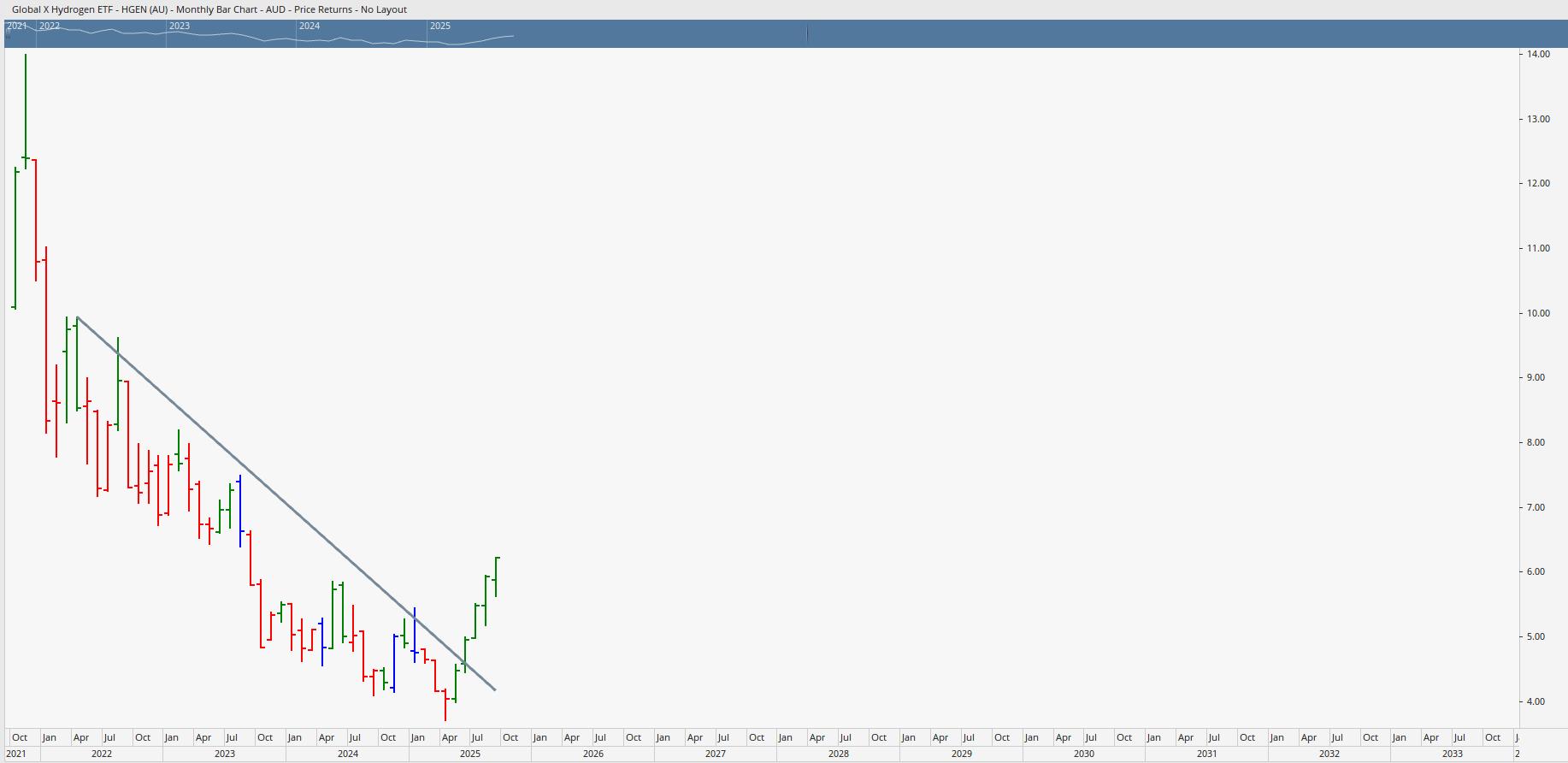

ETF 2: HGEN, Hydrogen Value Chain

HGEN provides diversified exposure across hydrogen production, fuel cells, electrolyzers, and integration, capturing multiple points of the value chain rather than a single niche.

Forecasts suggest the global hydrogen market could more than double from USD 262B in 2024 to USD 556B by 2034 as decarbonisation and industrial applications accelerate.

Trend signal

Break above a multi‑month momentum line with five consecutive up months, buyers sustaining control longer than prior rallies.

Trading plan

Watch for a healthy pause or dip to confirm support; a higher low followed by a reversal can signal the next, stronger leg up.

Why it matters: Hydrogen spans fertilisers, petrochemicals, steel, stationary energy and mobility, beyond a single use case.

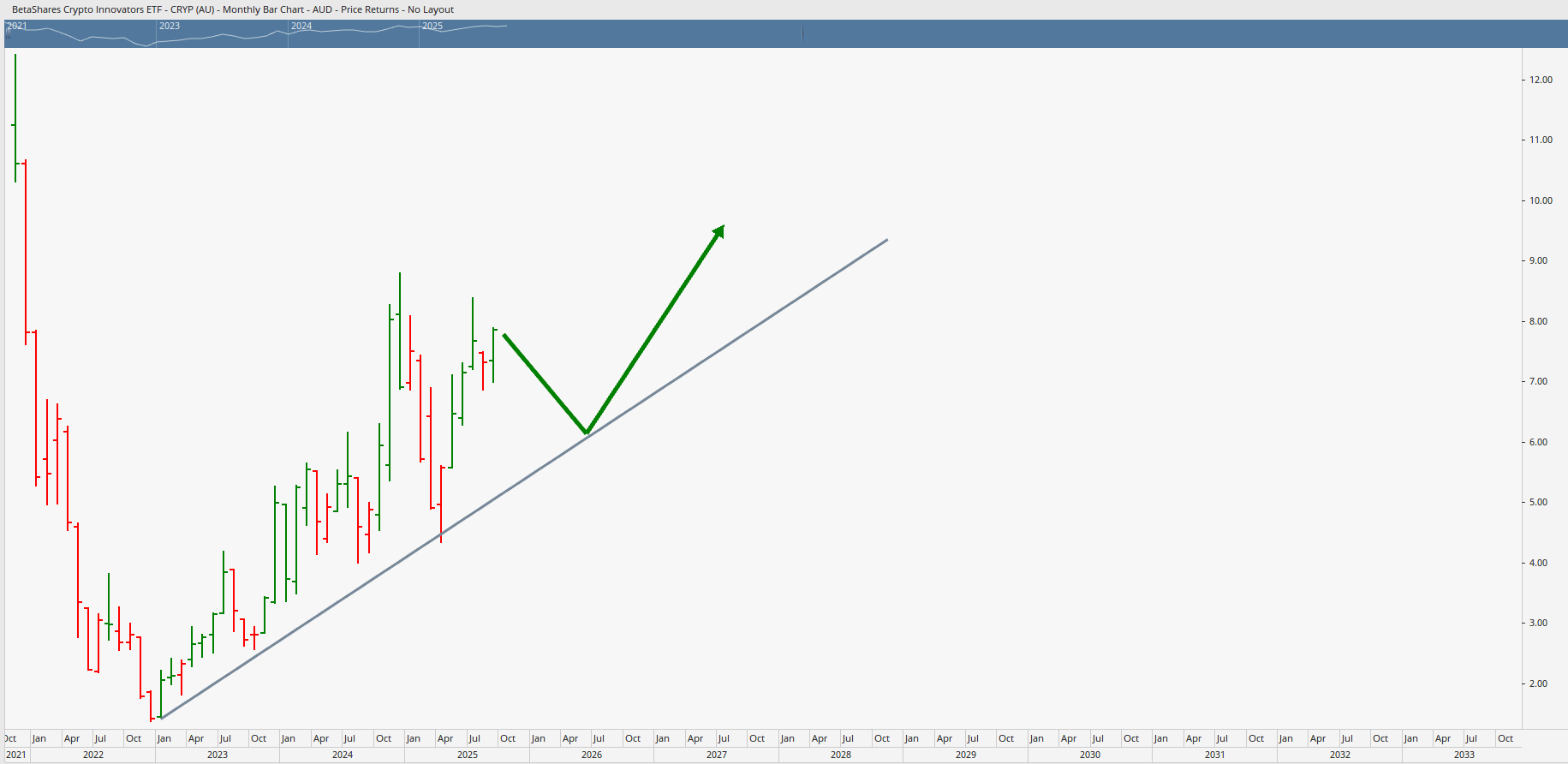

ETF 3: CRYP, Crypto Innovations (Infrastructure, Not Just Coins)

Rather than only tracking headline tokens, CRYP targets the companies building the ecosystem: exchanges, miners, and infrastructure providers.

This is akin to owning “the picks and shovels” of blockchain adoption, not just the commodities themselves.

Market backdrop and structure

- Institutional adoption and blockchain integration continue to broaden the addressable market, with estimates implying mid‑teens annualised growth for the ecosystem.

- Since listing, CRYP completed an initial decline typical of new issues and has since established higher highs and higher lows with expanding volume on rallies, classic bullish construction.

- Trading via regulated ASX brokers reduces custody and platform risks compared to offshore crypto venues.

Tactical note: Use defined pullback rules to “buy the dip” rather than catch falling knives, confirmation matters more than prediction.

Turn themes into results with a rules‑based edge

Themes create opportunity; process captures it. If you want to trade these ETFs with confidence, timing trends, managing risk, and maximising profits, build a competency‑based plan with Wealth Within’s Share trading education.

Start with the nationally recognised Diploma of Share Trading and Investment, then refine timing with our Advanced stock trading course. Prefer to watch first? Explore our Hot Stock Tips videos in the ASX video library. Learn more About Wealth Within.

How to approach thematic ETFs like a pro

- Define trend and context: Use multi‑timeframe analysis; favour ETFs making higher highs and higher lows with expanding volume.

- Plan entries: Look for pullbacks to prior breakout zones then wait for confirmation (bullish reversal bar or break of minor swing high).

- Set exits before entry: Place stops below invalidation levels; trail stops under higher swing lows to lock in gains.

- Position size wisely: Size to risk a fixed fraction of capital per trade; higher volatility warrants smaller initial sizing.

- Review and adapt: If the thesis changes (failed retest, breakdown on volume), reduce exposure or exit.

The bottom line

ROBO, HGEN, and CRYP each align with powerful secular trends, and their price action now supports a constructive outlook into the next bull phase.

With a disciplined, competency‑based process, thematic ETFs can be traded actively to pursue outsized, risk‑managed returns versus broad market index exposure.