3 ASX Oil Stocks to Win After the OPEC Shock

By Pedro Banales and Fil Tortevski

OPEC’s latest announcement has taken many by surprise. Instead of cutting production as they often do in October, the group has decided to increase supply. On the surface, this might look bearish for oil prices, but history shows moments like this can create powerful opportunities for the right stocks.

Our experts at Wealth Within break down what this means for the Australian market and highlight three ASX‑listed oil stocks poised to benefit from the changing landscape.

Why this OPEC Decision Matters

Traditionally, OPEC cuts supply to prevent prices from falling. This decision to boost output suggests something different: confidence in the market’s ability to absorb more oil. Combined with oversold conditions on the ASX, we believe this sets the scene for a recovery across quality oil stocks.

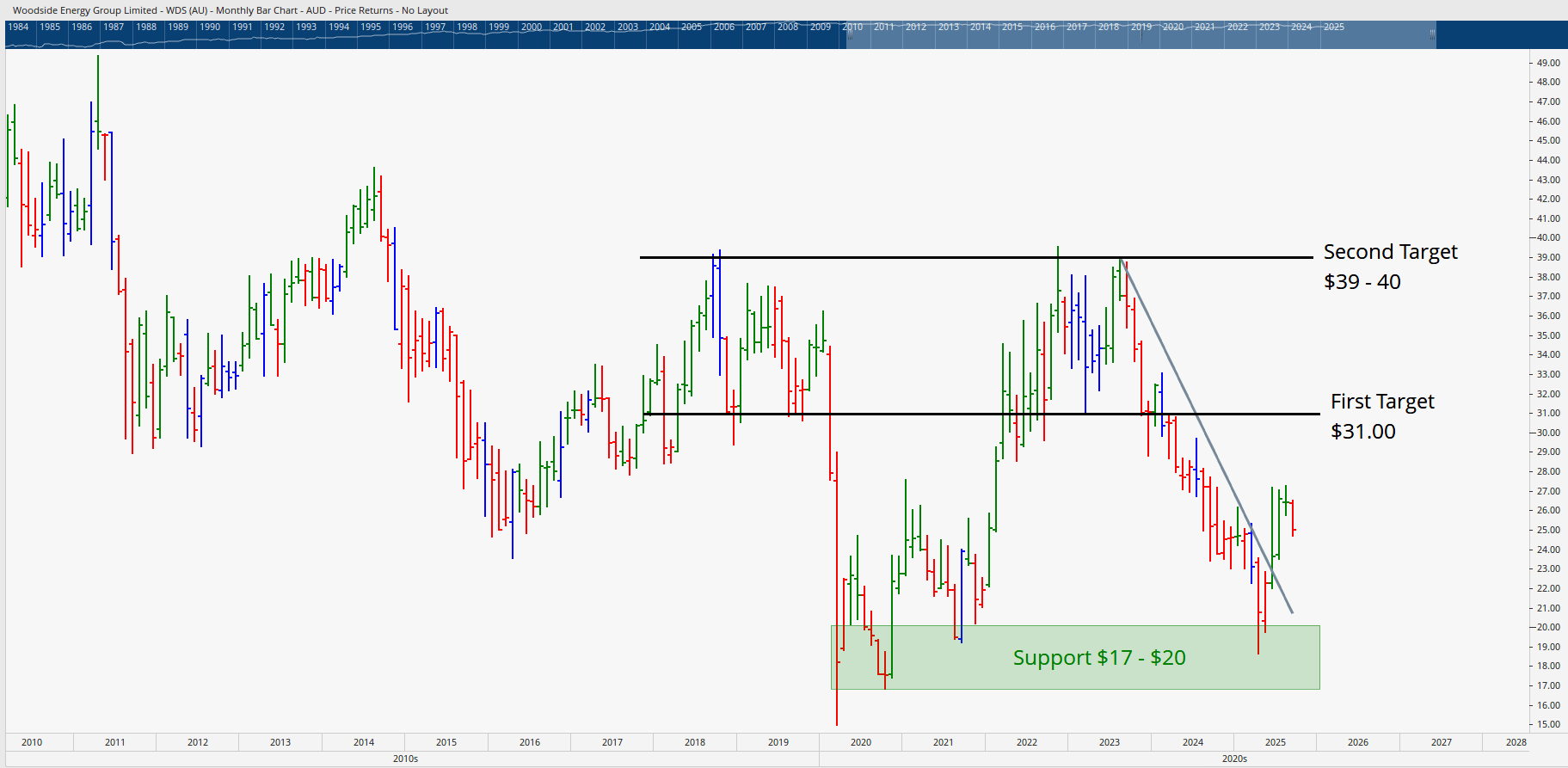

Stock 1: Woodside Energy (WDS)

Woodside is one of the ASX’s largest energy players, with substantial oil and gas operations. After a significant decline, the stock has been consolidating near long‑term support levels, and recent price action shows signs of a potential turning point.

- Strong support has held between $17–20 since COVID.

- Buyers recently broke above a key downtrend, suggesting momentum could shift.

- Upside potential: a medium‑term move towards $31, with resistance higher around $39–40.

For investors seeking stability in the oil and gas sector, Woodside represents a strong candidate.

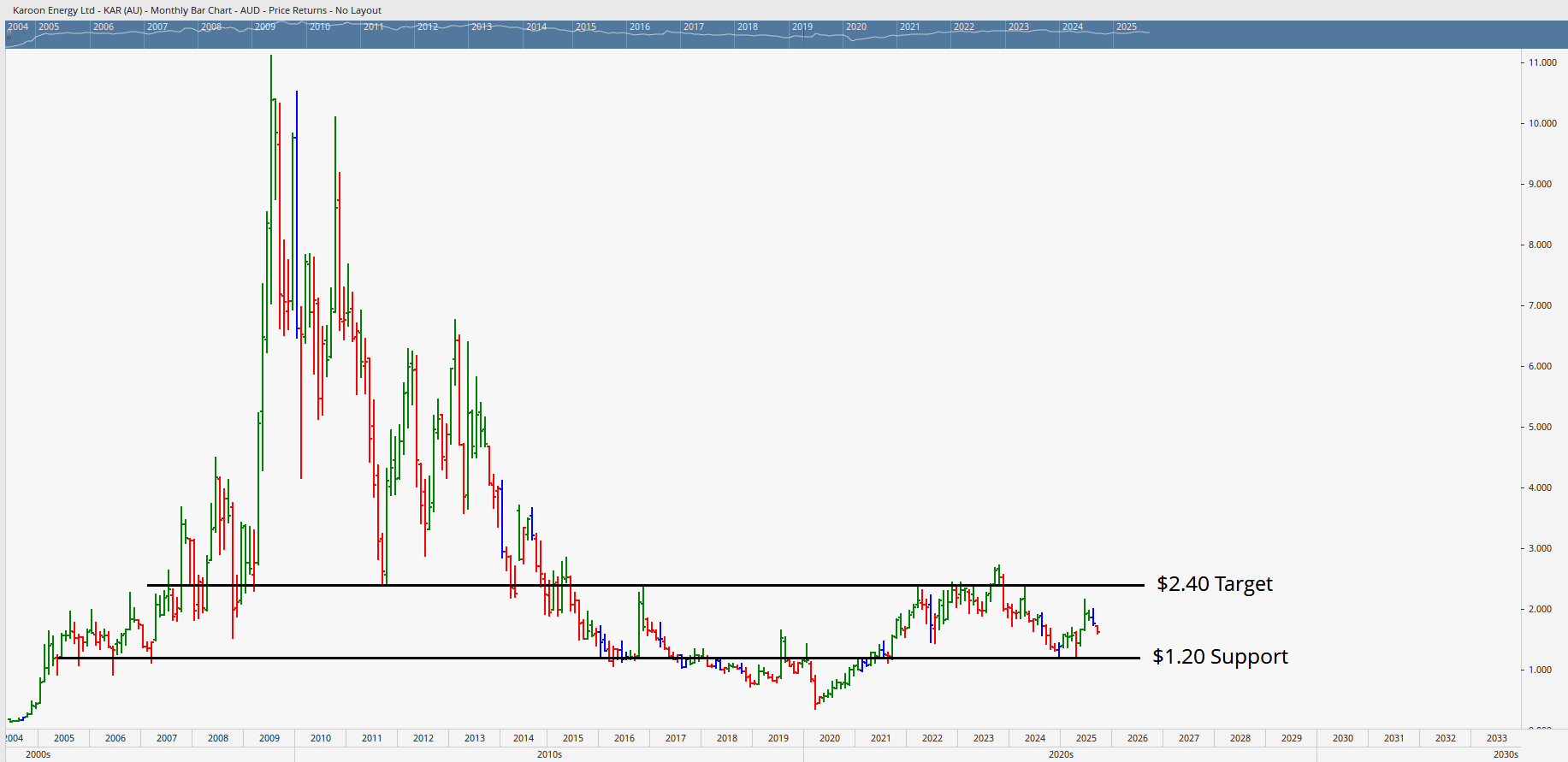

Stock 2: Karoon Energy (KAR)

Karoon Energy is known for its global assets, particularly in Brazil. From a technical standpoint, the stock has bounced strongly around the $1.20 support zone, a textbook reversal level.

- Double bounce at $1.20 highlights buying demand.

- A breakout above $1.60 could open the way to +30% gains in the short to medium term.

- Long‑term target levels near $2.40 remain in play if momentum builds.

Karoon remains volatile, but the risk-to-reward opportunity is compelling for active traders applying proper risk management.

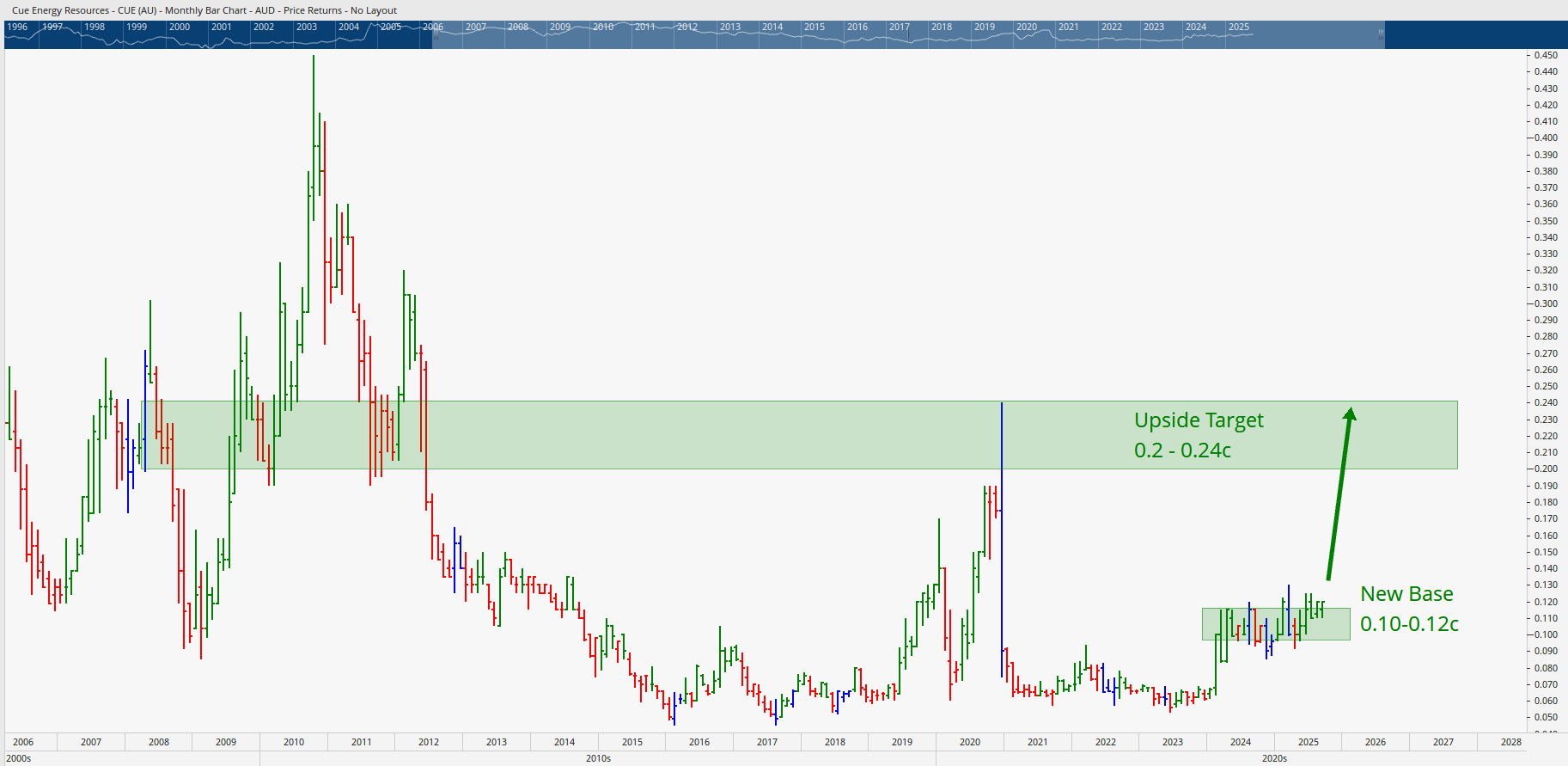

Stock 3: Cue Energy (CUE)

Cue Energy is a smaller, more speculative player in oil and gas, with projects across Australia, New Zealand and Indonesia. What stands out is the emerging base forming around 10–12 cents, which is unlike previous speculative spikes where prices quickly collapsed.

- A breakout above 13 cents could see upside towards 20–24 cents.

- New base formation suggests more sustainable growth potential this time.

- Smaller size means higher volatility, making disciplined trading essential.

Cue Energy isn’t for the faint‑hearted, but the potential rewards may be significant if momentum confirms.

What This Means for Traders

The OPEC supply shift challenges assumptions that more oil automatically means lower prices. Instead, confidence in demand and strong technical support levels present opportunities for Australian investors.

But here’s the key: these are not “buy and forget” stocks. Oil companies are cyclical and volatile, rewarding those who know how to time the market. That’s why developing the right skills and applying structured strategies gives you an edge.

Take the Next Step

At Wealth Within, we’ve spent over 20 years empowering Australians to trade with confidence. If you’re looking for quality trading courses, including a nationally recognised Diploma of Share Trading and Investment, or the Advanced stock trading course, we provide the knowledge, strategies, and mentoring to succeed.

You can also watch our weekly Hot Stock Tips videos in the ASX video library for the latest market insights.

To understand our mission and how we’ve helped thousands of traders take control of their financial destiny, visit About Wealth Within.

Final Word

OPEC’s latest move is a reminder that markets don’t always behave as expected, but opportunities exist for those prepared. Woodside, Karoon, and Cue Energy each present different risk‑reward profiles, offering investors a spectrum of choices in the oil and gas sector.

By combining sound technical analysis with disciplined trading strategies, you can turn uncertainty into profit potential.