ASX Uranium Stocks Just Broke Out: Should You Buy Now?

By Janine Cox and Fil Tortevski

The uranium market has just delivered its strongest monthly gain in four years, with demand surging and investor confidence reignited. But the big question is: are these breakout moves the start of a longer rally, or just a short-term burst of excitement?

In this latest analysis from Wealth Within’s Hot Stock Tips, senior analyst Janine Cox and market strategist Filip Tortevski break down three leading ASX-listed uranium stocks showing bullish momentum and share what traders need to know about timing, risk management, and strategy before jumping in.

The Uranium Price Rally: A Sign of Market Maturity

The uranium price exploded in January 2026, marking its second-best performance since 2022. According to Filip, the price action signals a maturing trend:

“It’s not just about buy or sell signals; when you understand volatility and price maturity, you can recognise when the big moves are starting.”

Experienced traders know that when a commodity becomes more liquid, attracts new inflows, and builds consistent momentum, that’s often the beginning of a long-term trend.

For investors looking to build real confidence in analysing these market structures, Wealth Within’s accredited Trading courses provide the essential skills to trade methodically and profitably.

1. Deep Yellow (ASX: DYL)

The first uranium stock on the radar is Deep Yellow Limited (DYL), which is one of the sector’s biggest names and a long-time favourite among resource investors.

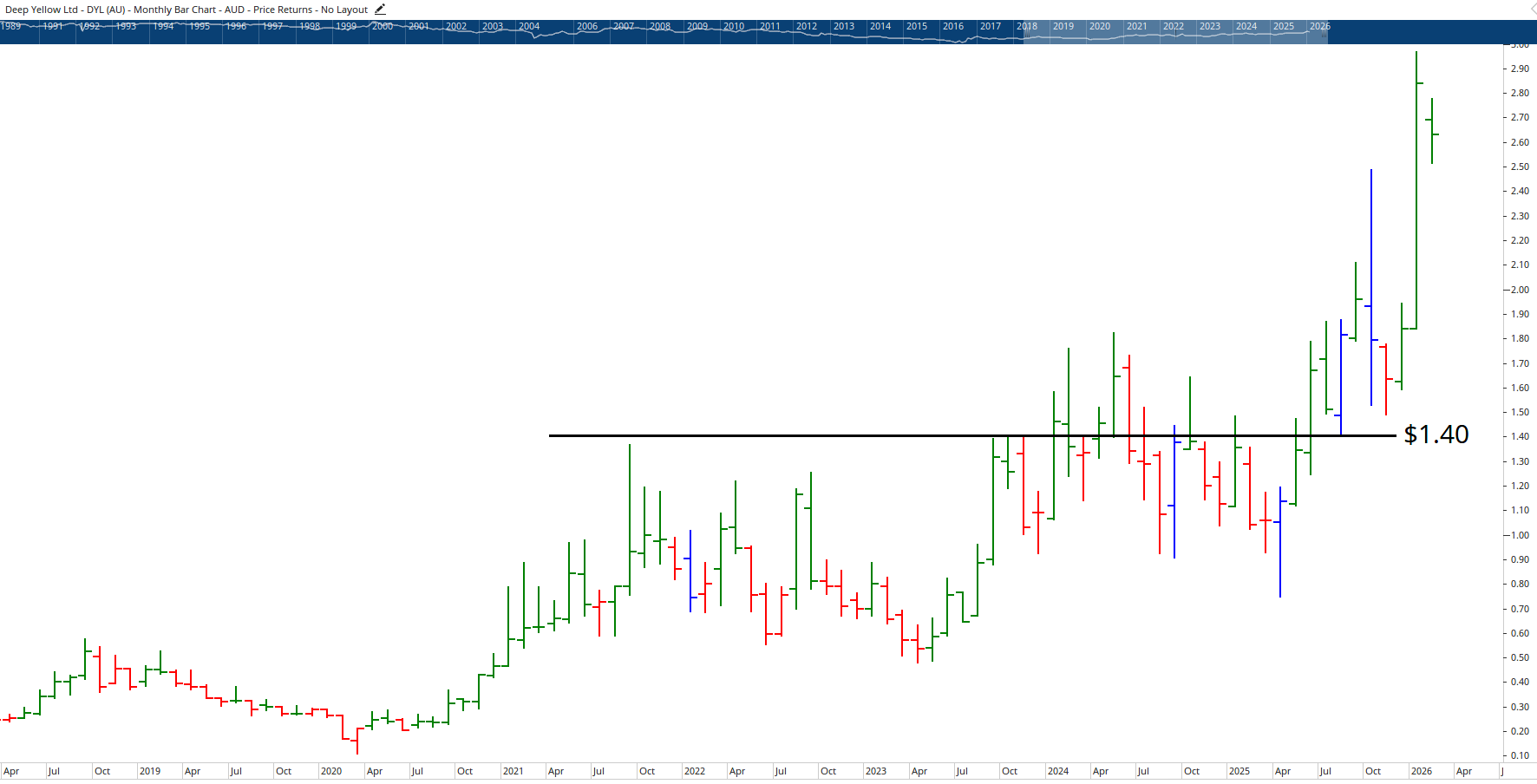

The stock has recently broken out after consolidating around the $1.30 level, forming a strong new base of support. Historically, DYL has shown extended periods of low volatility followed by major expansions, a classic sign of institutional interest building beneath the surface.

Filip highlights that key levels to watch include the $1.40 support and a potential long-term target near $6.00 if momentum continues. He also warns that traders should expect pullbacks, as parabolic runs often consolidate before resuming higher.

This analysis underscores the importance of patience and timing. As Janine adds, “Investors shouldn’t rush in out of fear of missing out, there’s plenty of opportunity once these trends stabilise.”

If you’re new to technical charts, Wealth Within’s Stock Market for Beginners guide offers valuable insights into recognising market signals safely.

2. Bannerman Energy (ASX: BMN)

Next up is Bannerman Energy (BMN), which has also pushed through a crucial resistance level in recent weeks. Janine points out that while the stock has surged strongly, it still looks early in its broader trend structure:

“This one’s just confirmed a breakout. It’s not too late, but it’s about being strategic and identifying the risk before you get in.”

The pair estimate a potential upside to around $10–$15, particularly if uranium fundamentals continue to strengthen globally. The caveat? Traders must remain vigilant about volatility, position sizing, and exit planning.

For those building strategies that balance short-term trading with long-term investing, enrolling in the Diploma of Share Trading and Investment can help formalise your approach with structured risk management, technical and fundamental analysis, and the use of price patterns for confirmation.

Janine also reminds traders that these stocks could become takeover targets, as interest in uranium and energy diversification accelerates. “Big money follows opportunity,” she says, “and the energy sector is definitely seeing that rotation right now.”

3. Alligator Energy (ASX: AGE)

The third uranium stock attracting attention is Alligator Energy (AGE). While smaller than the first two, AGE has shown encouraging signs of forming a stable base around the 3-cent level, which is a level it has held repeatedly since 2023.

According to the analysis, the stock appears to be building strength and consistency, rather than falling back into previous declines. Traders are watching for confirmation of support and potential breakout patterns.

However, as Janine cautions, “At this stage, it’s higher risk due to its size, so it may not suit new investors just starting out.”

Managing risk on volatile small-cap stocks requires having a trading plan, defined stop losses, and discipline which are principles that are central to Wealth Within’s Short Course in Share Trading.

Avoiding the FOMO Trap

Both analysts agree that one of the biggest mistakes traders make during commodity booms is acting on emotion rather than analysis. With uranium soaring, many investors feel compelled to “buy now,” but the professionals at Wealth Within emphasise strategy over speed.

Markets move in waves, prices rise, consolidate, and rise again but chasing moves too late often leads to poor entry points. As Filip explains:

“Patience will always outperform FOMO. Wait for confirmation, then plan your trade and manage your exit.”

If you’re looking to refine advanced techniques such as Elliott Wave and time analysis, consider Wealth Within’s Advanced stock trading course, which helps you spot high-probability setups and trade across multiple market conditions.

Education is the Key to Trading Success

Wealth Within’s analysts repeatedly remind viewers that knowledge, not luck, drives profitability. The firm’s philosophy: “education first, profits second” is backed by its position as Australia’s only government-accredited share trading educator.

Learning to recognise market maturity, manage volatility, and identify genuine opportunities requires structured training which are skills you can develop through Wealth Within’s Share trading education.

To read about their legacy and educational standards, visit the About Wealth Within page and see why over 30,000 clients have trusted their market expertise for more than two decades.

Staying Updated with Market Opportunities

If you enjoy timely company analysis like this, you can explore the latest Hot Stock Tips videos and our ASX video library, where the team reviews trending ASX stocks each week, from uranium and lithium to artificial intelligence and finance.

The uranium sector’s breakout has sparked excitement and opportunity across the ASX. Yet, as Wealth Within’s analysts remind us, successful trading is never about chasing hype. It’s about consistent, educated decision-making.

Before placing your next trade, take the time to learn the strategies, study the charts, and plan for both risk and reward. Whether you’re exploring uranium or any other sector, education remains your strongest investment.

To equip yourself with the knowledge and systems used by professional traders, learn how to learn to trade shares with Wealth Within and take control of your financial future today.