8 ASX Stocks to Buy Before the Fed Cuts Rates

Markets are on edge, waiting for the moment when the US Federal Reserve finally pivots to cutting interest rates. History shows that when rates fall, money moves fast meaning certain sectors and companies stand to benefit disproportionately.

In this post, Wealth Within analysts break down 8 ASX stocks with significant US exposure that could be primed for growth once the Fed acts.

Why Fed Rate Cuts Matter for Australian Investors

When the Fed lowers US rates, the effects ripple through global markets. Borrowing becomes cheaper, cash flows improve for companies with debt exposure, and investor appetite for yield often increases.

For Australian investors, this means select ASX-listed companies with earnings or leverage tied to the US economy may see strengthened profitability and renewed investor demand.

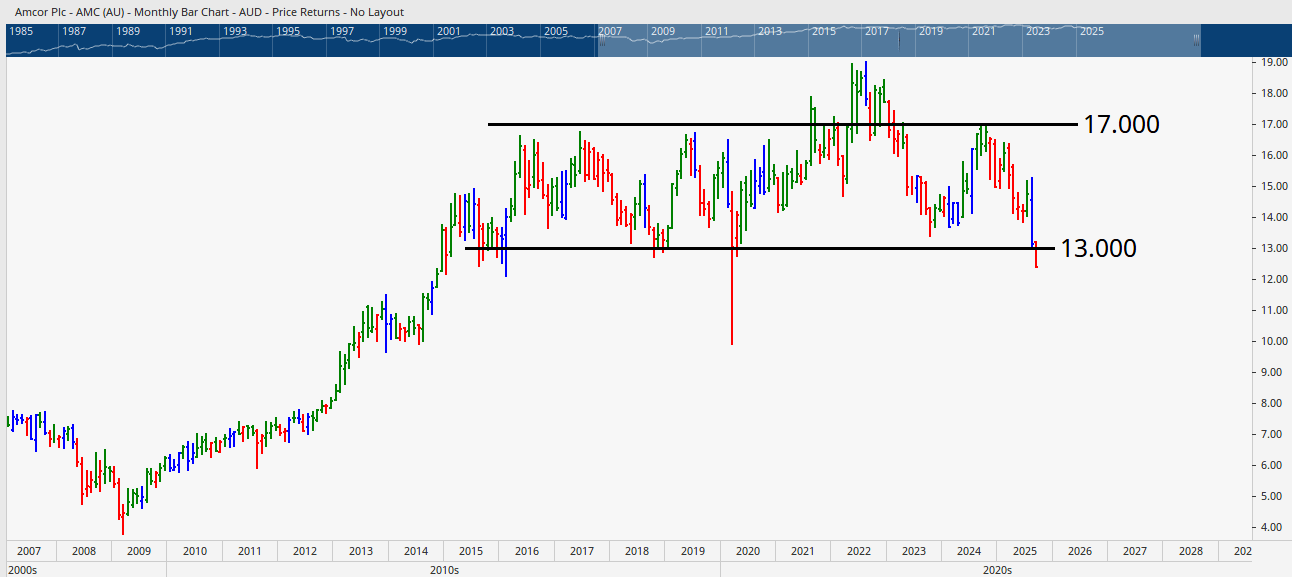

Amcor (AMC)

Packaging giant Amcor earns a large chunk of revenue in North America. A Fed rate cut could:

- Reduce US‑dollar denominated borrowing costs

- Strengthen cash flows in its core region

- Potentially boost earnings and investor appetite

Technically, Amcor has tested support around $13 multiple times since 2015. Analysts suggest a possible short-term 25% trade opportunity if it can hold above key support levels and push toward $17.

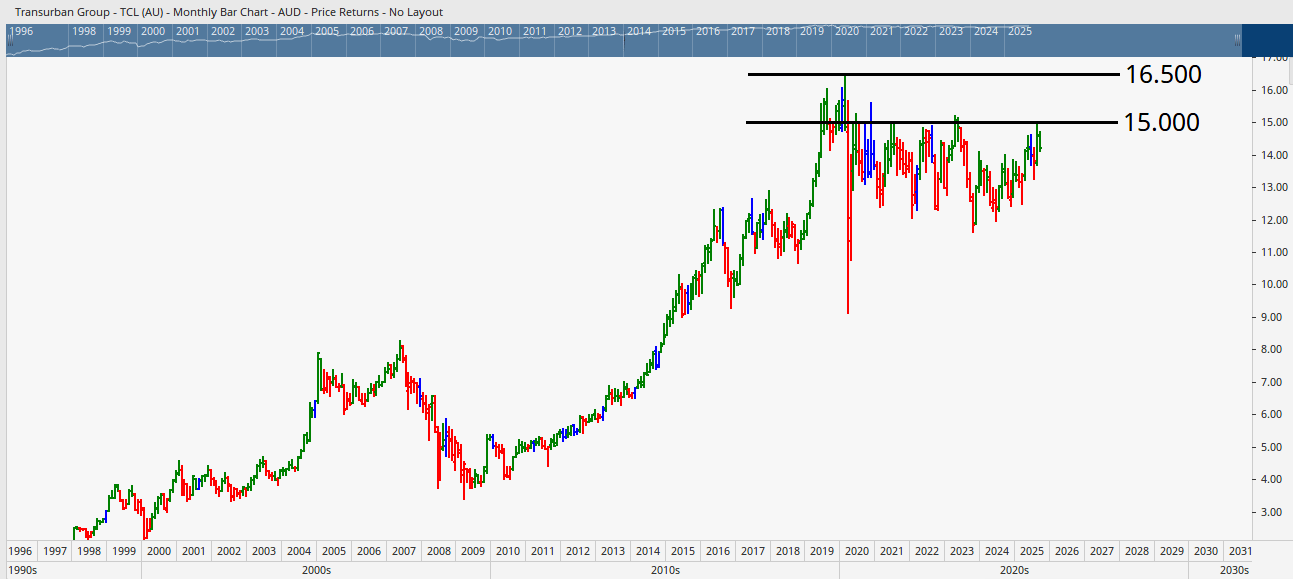

Transurban Group (TCL)

With major toll road operations across the US, Transurban could attract more yield-hungry investors as lower rates make infrastructure assets more desirable.

- Lower long‑term borrowing costs could lift profits

- The chart shows a healthy uptrend since October 2023

- Resistance sits around $15, with longer‑term potential near $16.50

Technically, Amcor has tested support around $13 multiple times since 2015. Analysts suggest a possible short-term 25% trade opportunity if it can hold above key support levels and push toward $17.

For dividend investors, Transurban remains one to watch closely.

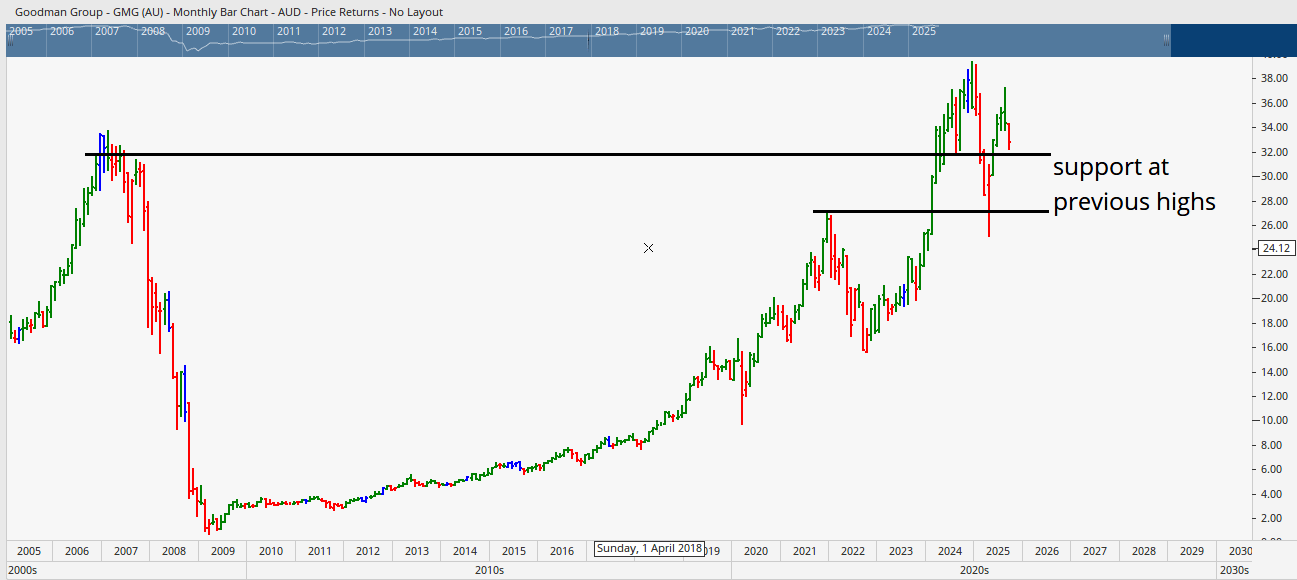

Goodman Group (GMG)

Property heavyweight Goodman Group benefits when falling bond yields make high‑yielding shares more attractive. While the stock has already run significantly since late 2023, analysts highlight:

- Pullbacks that suggest consolidation after a strong rally

- Support at previous highs, indicating renewed buying interest

- Long‑term growth potential if stability continues

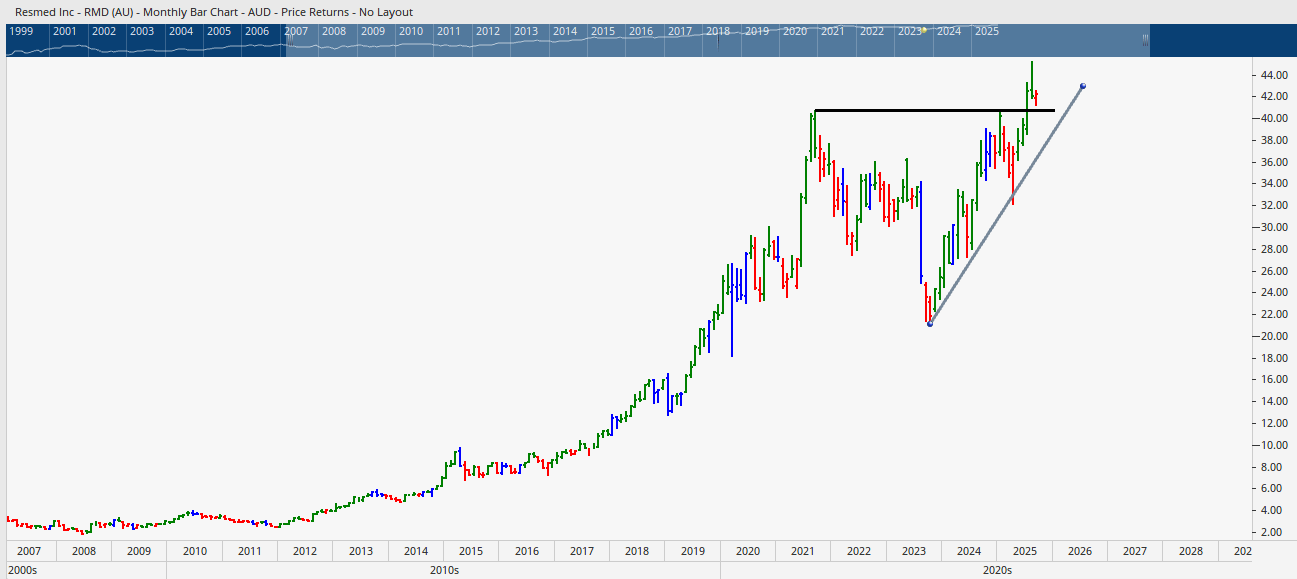

ResMed (RMD)

US‑based healthcare company ResMed stands out as a favourite. Lower rates mean insurers and patients in the US find it easier to afford medical equipment like sleep machines.

- Broken all‑time highs suggest ongoing bullishness

- Recent pullbacks appear to be consolidation rather than weakness

- Both long‑term investors and short‑term traders could find opportunities here

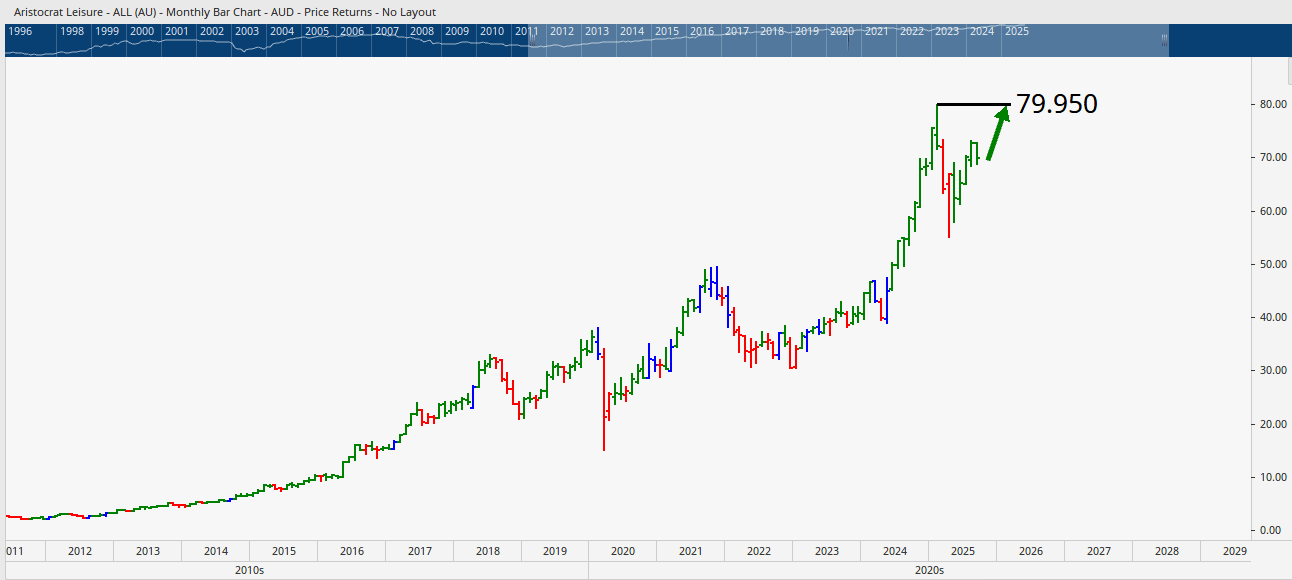

Aristocrat Leisure (ALL)

Gaming and entertainment giant Aristocrat Leisure thrives when US consumers feel more confident. Cheaper borrowing costs often translate into more discretionary spending.

- Casinos purchase more machines

- Gaming spend tends to rise during easier credit environments

- The stock is trending positively with upside towards $79.95 all‑time highs

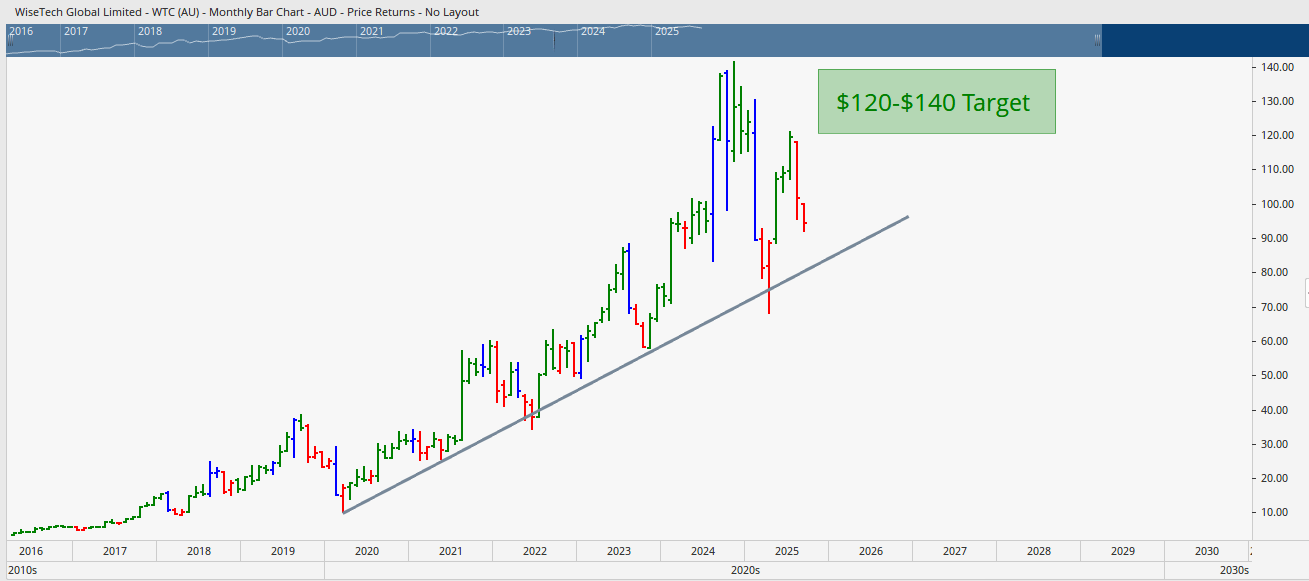

WiseTech Global (WTC)

WiseTech has expanded heavily into the US, acquiring logistics software company E2Open for $4.6B. Lower rates could encourage faster adoption of its supply‑chain solutions.

- Technicals show strong recovery after recent challenges

- Consolidation near momentum lines signals readiness to move higher

- Potential for major runs toward $120–140 levels if bullish support continues

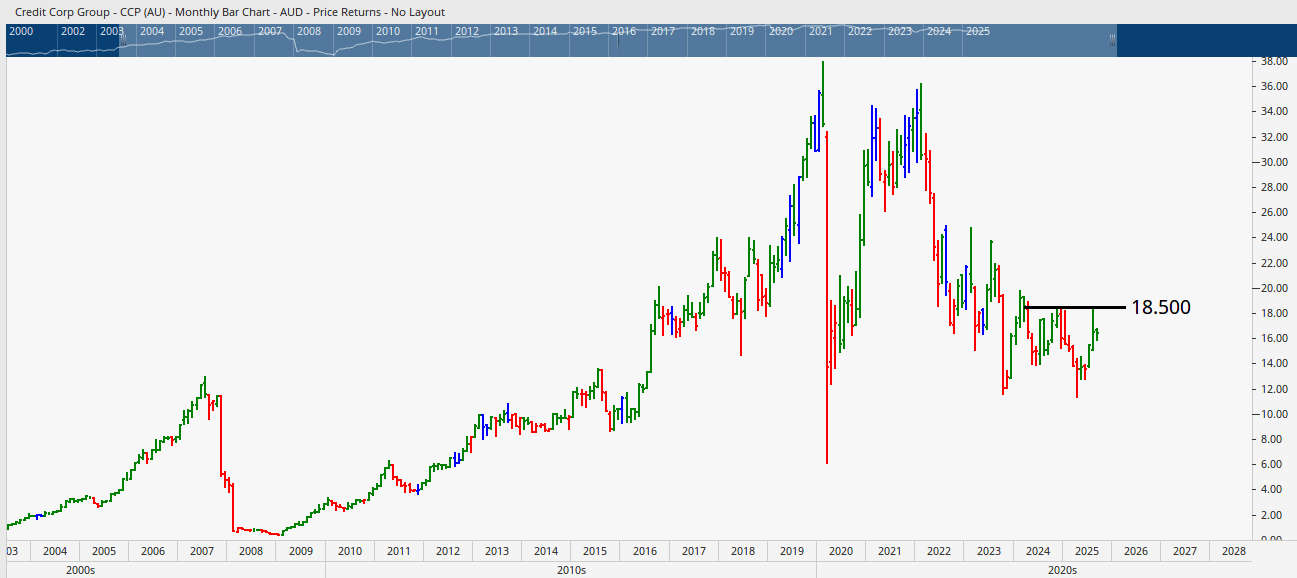

Credit Corp (CCP)

Debt collection firm Credit Corp is sensitive to US financial conditions. Easier repayment environments when rates fall:

- Improve collection rates

- Boost profitability

- Create opportunities for growth in its US division

After basing near $13.50, Credit Corp shows signs of recovery, with analysts eyeing $18.50 as the next resistance.

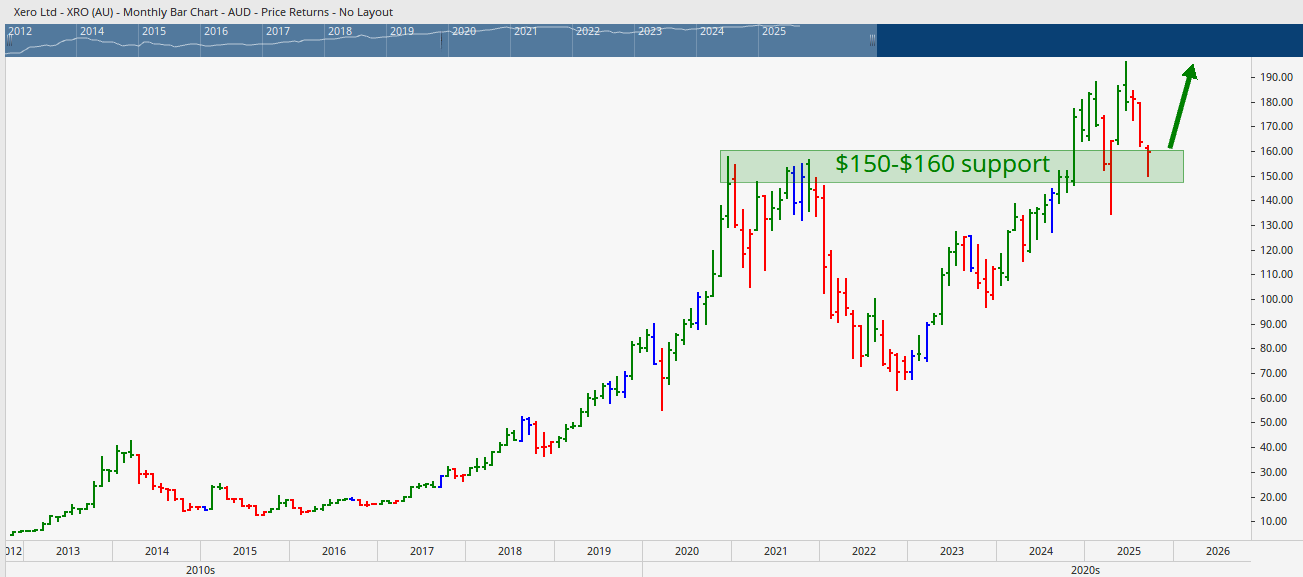

Xero (XRO)

Accounting software leader Xero continues its push into the US with major acquisitions. Fed rate cuts mean:

- More free cash flow for small businesses

- Greater adoption of subscription accounting tools

- Stronger prospects for integrated payments platforms

Technically, holding above $150–160 levels could set up another leg higher, with all‑time highs as the next logical target.

Key Takeaways for Traders

- Fed rate cuts create ripple effects that influence US and ASX markets.

- Stocks with high US exposure, from healthcare to logistics, may benefit most.

- Technical confirmation is key. Stocks like ResMed and Transurban show stronger setups, while others like Amcor require patience for basing and reversal signals.

Ready to Trade Smarter?

At Wealth Within, we specialise in empowering everyday investors with the skills and strategies to navigate markets confidently. Whether you want to Learn to trade shares, complete a nationally recognised Diploma of Share Trading and Investment, or refine your strategies through our Advanced stock trading course, we’ll help you trade with greater certainty.

If you are an absolute beginner, consider our complete guide in Investing in Shares or Stocks for Beginners blog, by Dale Gillham.

You can also watch our weekly Hot Stock Tips videos, ASX video library for ongoing insights directly from our experts.

To learn more about our mission and 20+ years of experience, visit About Wealth Within.