ASX Tech Crash: Opportunity or Danger? The Smart Investor’s View

By Fil Tortevski, Janine Cox and Pedro Banales

If you’ve been panicking over the recent tech sector sell‑off, it may be time to think again. According to Wealth Within analysts, the latest pullback in the ASX tech index could mark the beginning of powerful new opportunities, not disaster.

Over the past few months, the Australian tech sector has slumped by nearly 30%, significantly more than its U.S. counterpart. Yet as history shows, major declines often set the stage for the strongest recoveries.

Why the ASX Tech Sector Has Fallen Harder

Over the past year, soaring AI valuations and speculative hype pushed tech stocks well ahead of their fundamentals. Now, the market is reassessing and asking a simple question: are these earnings sustainable over the next two to three years?

This “reality check” has triggered pullbacks in firms like Xero, Megaport, TechnologyOne, and NextDC, but Wealth Within experts point out that the fundamentals of the sector remain intact.

“Tech is volatile on the way up, and volatile on the way down. What we’re seeing now is a re‑rating — not structural collapse,” explains senior analyst Janine Cox.

The Market Overreaction Creates Buying Opportunities

Analyst Pedro Banales highlights that the Australian tech index has fallen faster than the U.S. Nasdaq Composite, an indication that our market might be overreacting to global sentiment.

When sectors fall sharply without fundamental deterioration, opportunities often emerge. Identifying those setups requires knowledge and confidence, something taught through Wealth Within’s professional trading courses that help everyday investors learn to trade shares with strategy and discipline.

Tech Stocks to Watch in 2025

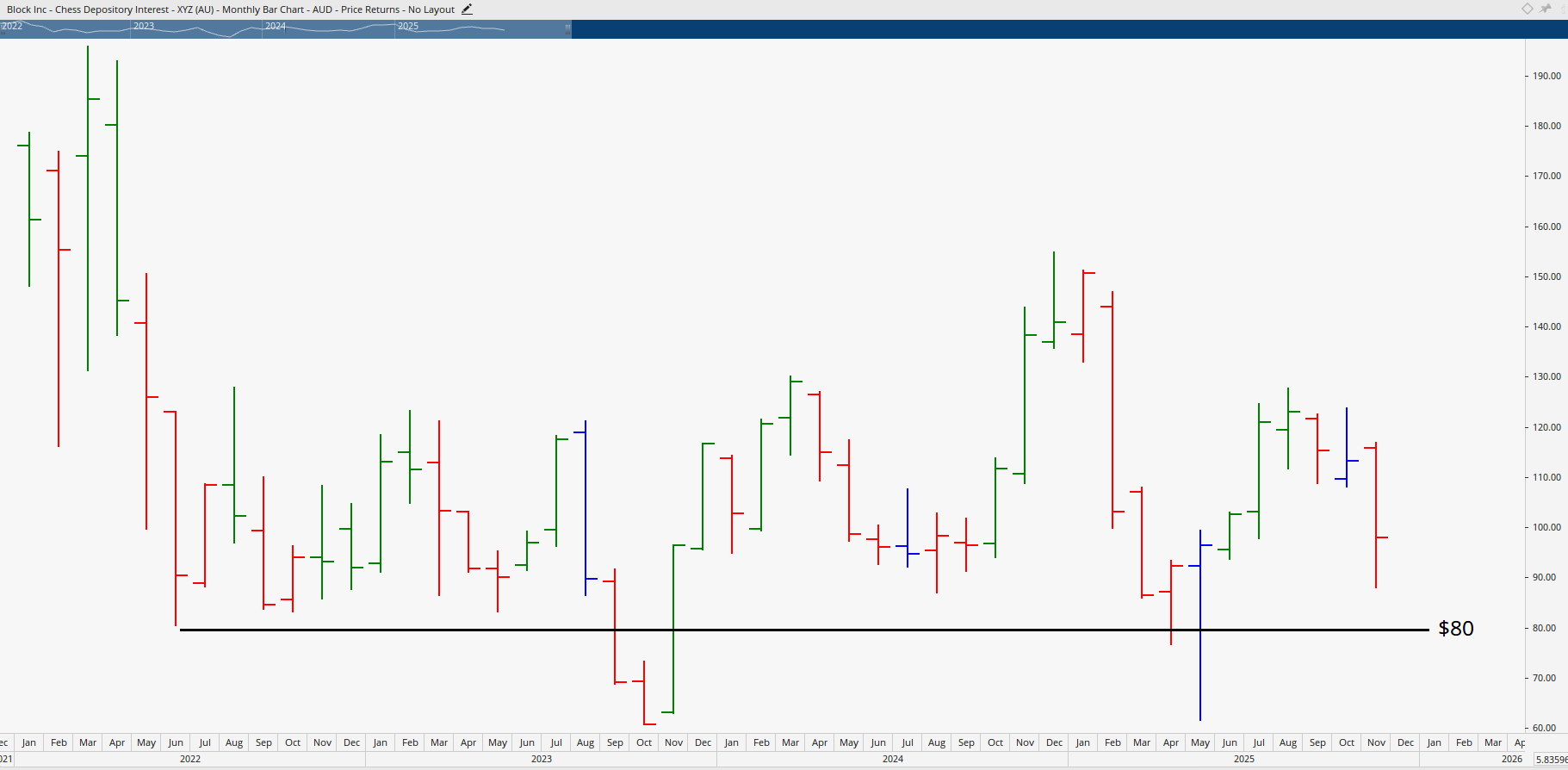

1. Block (ASX: XYZ)

After a steep fall, Block is showing early signs of forming a base near the $80 mark. If it rebounds through recent highs, it could deliver strong upside momentum. Traders should monitor its weekly trends and be prepared with strict entry and exit rules.

For investors starting out with technical patterns like these, our Short Course in Share Trading provides the mentorship and toolkit you need.

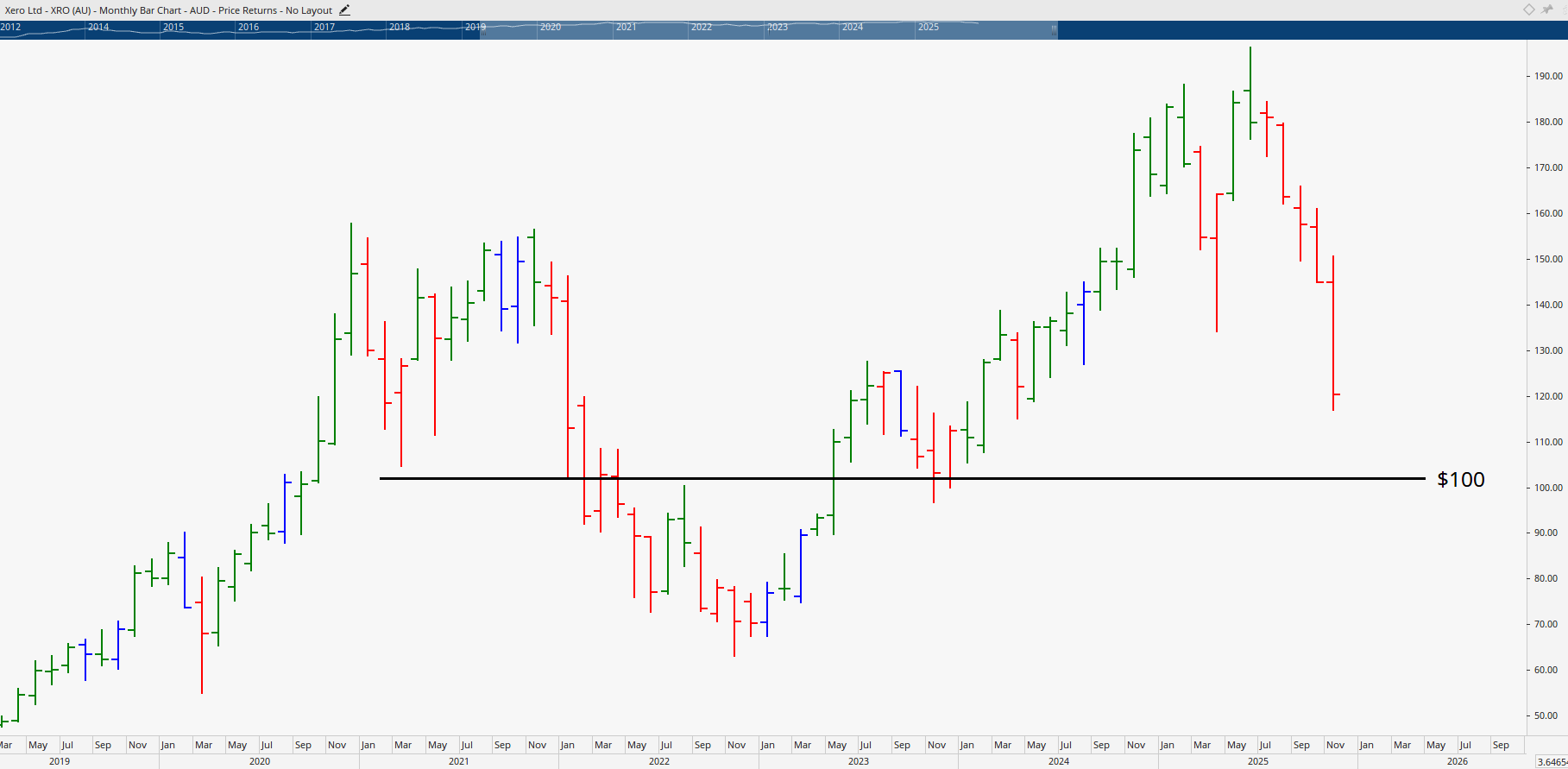

2. Xero (ASX: XRO)

Xero has dropped below a key support zone near $120, approaching the psychologically important $100 level. Historically, such retests often precede strong recoveries if buyers step in.

It’s one to back‑test and prepare for, as its clean price structure makes it a favourite among both short‑ and medium‑term traders.

3. TechnologyOne (ASX: TNE)

A consistent long‑term performer, TechnologyOne appears to be correcting after years of upside moves. Having now refilled a previous price gap, the stock may be nearing equilibrium, a zone from which institutional support could return.

Students in our Diploma of Share Trading and Investment learn how to assess these kinds of structural retracements, timing entry for optimal reward relative to risk.

4. NextDC (ASX: NXT)

A favourite among data‑centre investors, NextDC continues to respect key technical levels that have served as long‑term resistance since 2020. If prices stabilise above $13.50, and momentum rebuilds, it could challenge previous highs again in the coming months.

Seasoned traders can sharpen their edge in applying technical analysis through our Advanced stock trading course, focused on strategy adaptation to volatile sectors like technology.

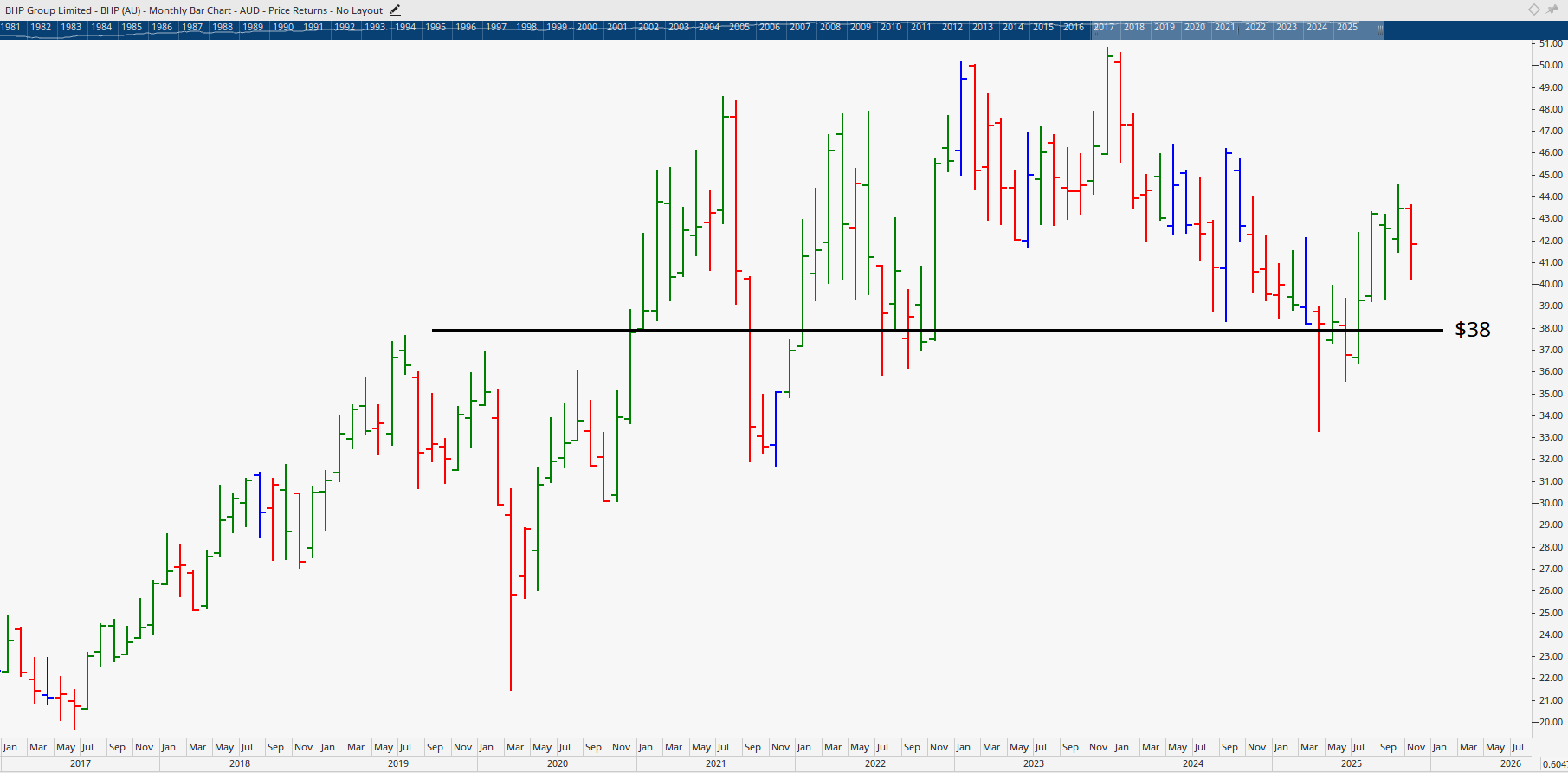

Beyond Tech: Is BHP a Post‑Sell‑Off Opportunity?

While tech has taken the spotlight, a parallel narrative is forming in commodities. BHP recently withdrew its takeover bid for Anglo American, an event that some investors misread as a negative.

However, charts show BHP’s share price has broken through a long‑term downtrend line, suggesting a new upward phase could be brewing. Analysts at Wealth Within note that:

- BHP’s retracement has brought it back 35% from recent highs, creating value zones around $37–38 per share.

- Copper exposure remains a growth theme, with projects such as the Resolution Copper Project in Arizona promising strong long‑term potential.

- Historically, BHP’s price behaviour after trend‑breakouts often leads to retests followed by sustained rallies.

For investors focused on dividends and stability, BHP’s fundamentals make it an anchor stock, particularly while tech remains volatile.

Lessons from the Market Cycle: Follow the Charts, Not the Headlines

The Wealth Within team routinely reminds traders that the media often reacts after the market does. When headlines warn of crashes, the smart money is already preparing to buy.

The ability to interpret these setups before they hit mainstream news comes from structured share trading education, understanding chart psychology, market cycles, and how to manage emotions under pressure.

You can see such principles demonstrated weekly in our Hot Stock Tips videos, part of the ASX video library, where our experts analyse current opportunities live on screen.

Why Many Prefer the ASX to the US Stock Market

In the latter part of the discussion, the experts addressed a common question: why focus on local markets when the U.S. seems more liquid?

The answer lies in control and context. Trading at home reduces currency risk, gives clearer access to company information, and still offers thousands of profitable setups every year.

As Filip Tortevski explains, “you don’t need Wall Street to achieve strong returns — you just need to understand how to read the market you’re in.”

With proper training, Australian investors can access growth from both established blue chips like BHP and renewable‑themed tech or mining stocks experiencing cyclical lows.

Markets Reward Education and Discipline

Tech slumps, mining rebounds, and sector rotations all have one thing in common: they test investor psychology. The difference between those who panic and those who profit is education.

If you’d like to improve your discipline, confidence, and technical skill, consider the nationally accredited programs at Wealth Within.

Visit About Wealth Within to learn more about the team that’s been helping Australians trade smarter for over two decades.