Commodities Are Crashing: Is It Time to Buy the Dip on ASX Commodity Stocks?

By Janine Cox, Fil Tortevski and Pedro Banales

Every investor is asking the same pressing question: are the plunging commodity prices a sign to buy the dip or a warning to get out?

In a recent episode of Wealth Within’s Australian Stock Market Show, senior analysts Janine Cox, Pedro Banales, and host Filip Tortevski shared deep insights into what’s happening across major commodities, including gold, silver, and natural gas, as well as which ASX-listed stocks may hold the strongest rebound potential in 2026.

If you missed it, this breakdown covers their expert analysis, key takeaways from the show, and how investors can respond strategically rather than emotionally in today’s volatile environment.

Understanding the Current Commodity Sell-Off

Within a single week, gold and silver plunged by as much as 20%, while natural gas tumbled by 40%. According to Janine Cox, this sudden downturn is part of a cyclical correction, not necessarily the start of a prolonged bear market.

She explains, “Many investors are chasing the why, when the real question should be what to do next. As long as you’ve got sound rules and structured management in place, you have nothing to fear.”

Her comments highlight one of the core lessons taught in Wealth Within’s accredited Trading Courses: understanding price behaviour and following a repeatable plan are what separate consistent traders from reactive investors.

Pedro Banales added that sentiment swings quickly in commodities. A shift in weather forecasts and rising US dollar strength caused sharp reversals in natural gas prices, reminding traders that “volatility equals opportunity, but only if you know what you’re doing.”

ASX Stocks to Watch as Commodities Pull Back

While volatility has unnerved some investors, the Wealth Within team identified several potential buy the dip setups worth monitoring.

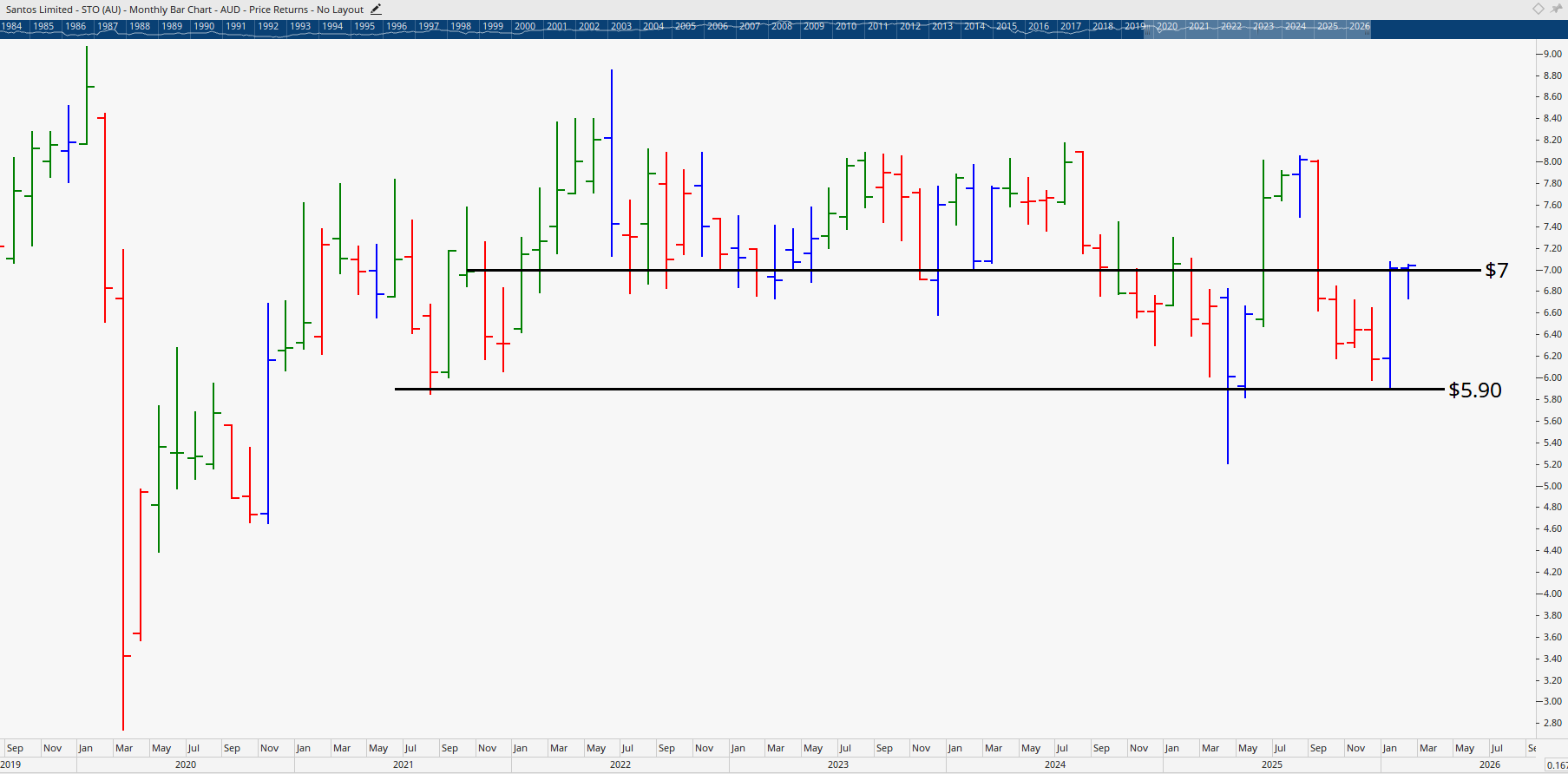

Santos (STO) topped the list. Janine Cox noted it has built “pent-up energy” following years of consolidation. She cautioned that while the current level near $7 presents speculative opportunity, traders should avoid seeing every dip as a bargain. “If it drops below $5.90, there’s room for a deeper sell-off first.”

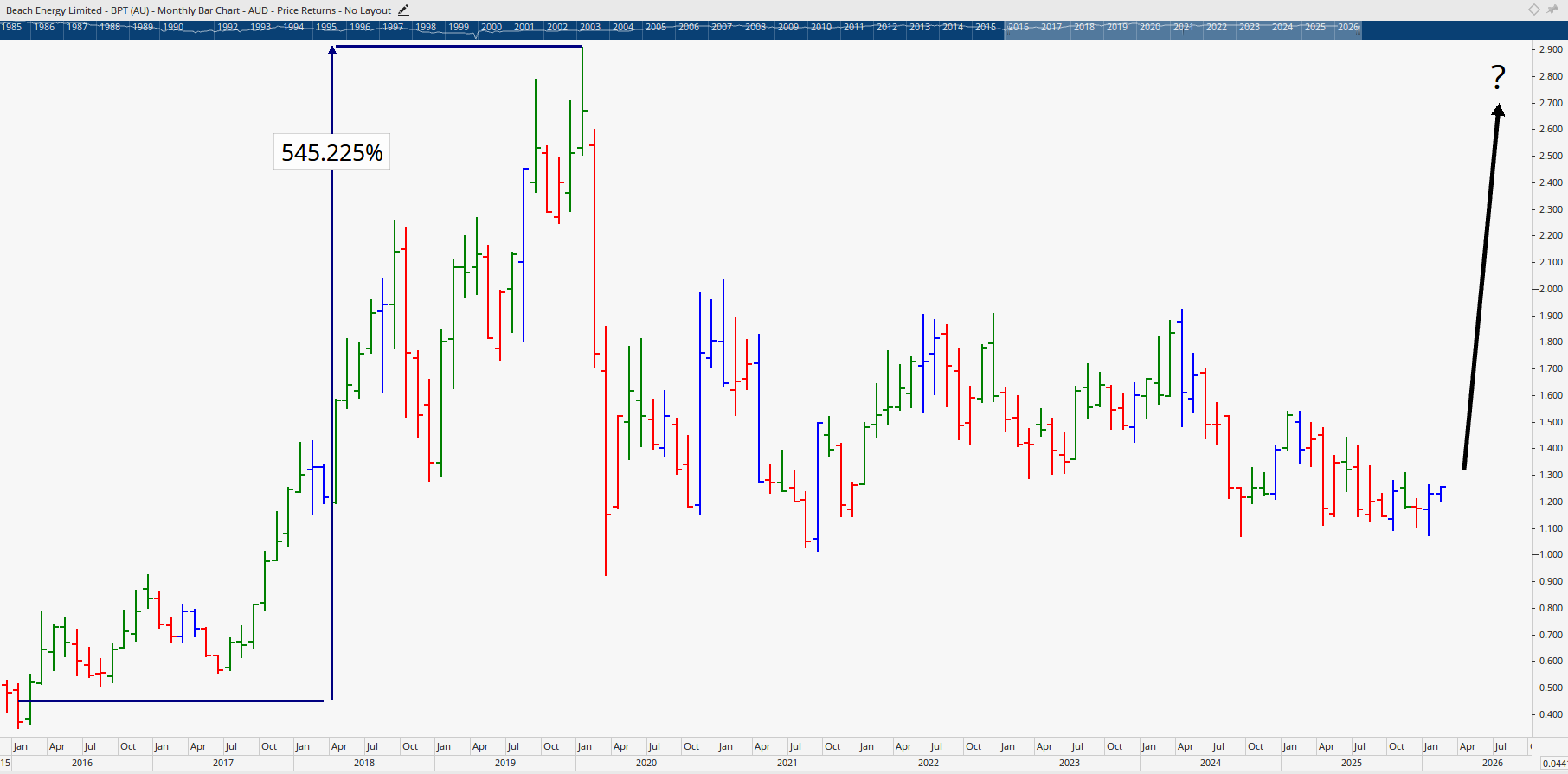

Beach Energy (BPT) was pitched as a more volatile play. Historically, it’s known for 500% surges during strong commodity cycles, making it ideal for short- to medium-term traders.

For beginners wanting structured techniques to identify these setups safely, Wealth Within’s Short Course in Share Trading teaches how to apply trend analysis and price strategies before risking real capital.

Hidden Gems Beyond Gas and Oil

Beyond energy, the analysts highlighted several emerging opportunities in metals and mining stocks, particularly those leveraged to cyclical rebounds.

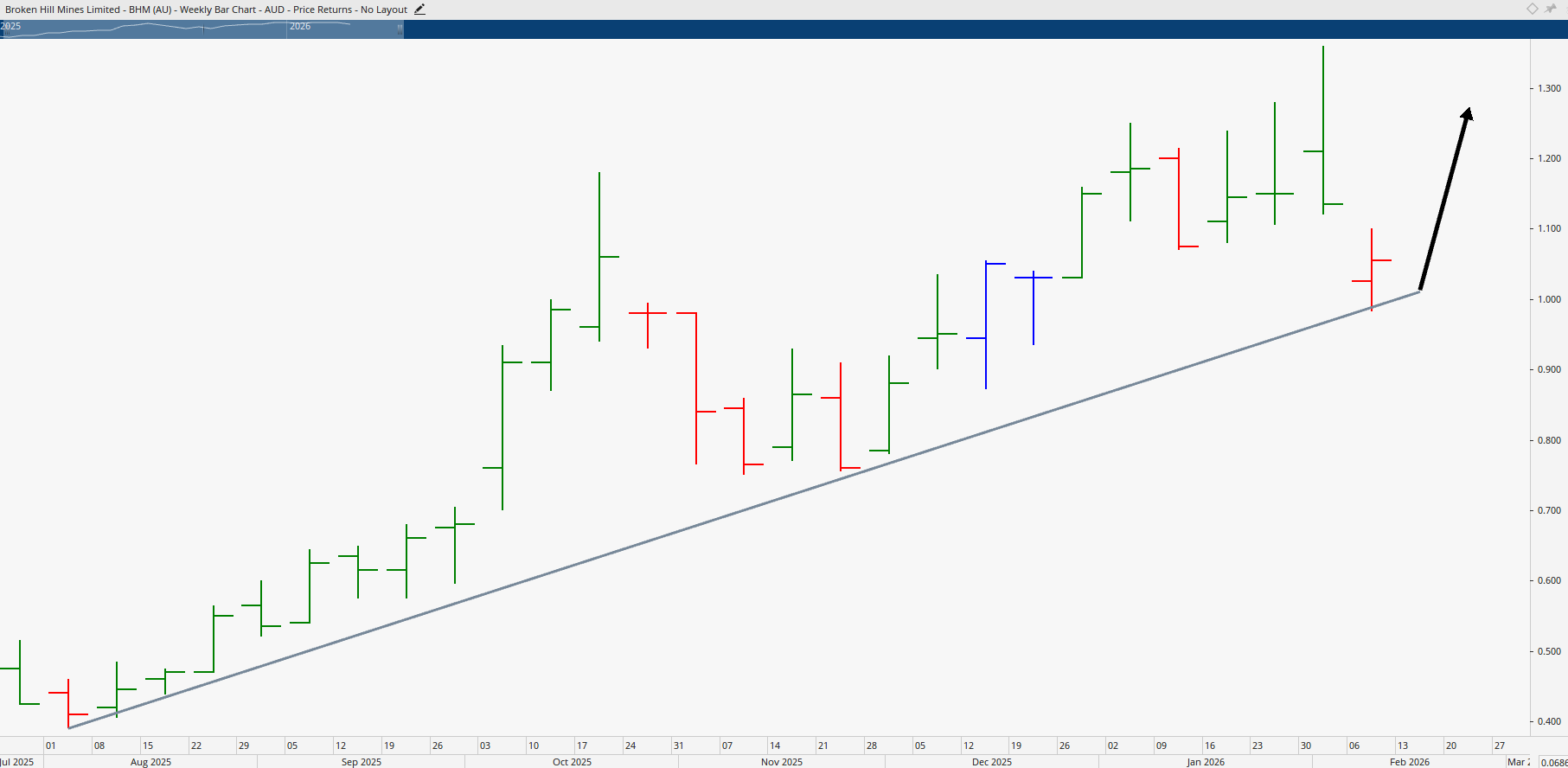

Broken Hill Mines (BHM), a relatively new listing, has shown strong correlation with silver prices and may rebound once the metal stabilises.

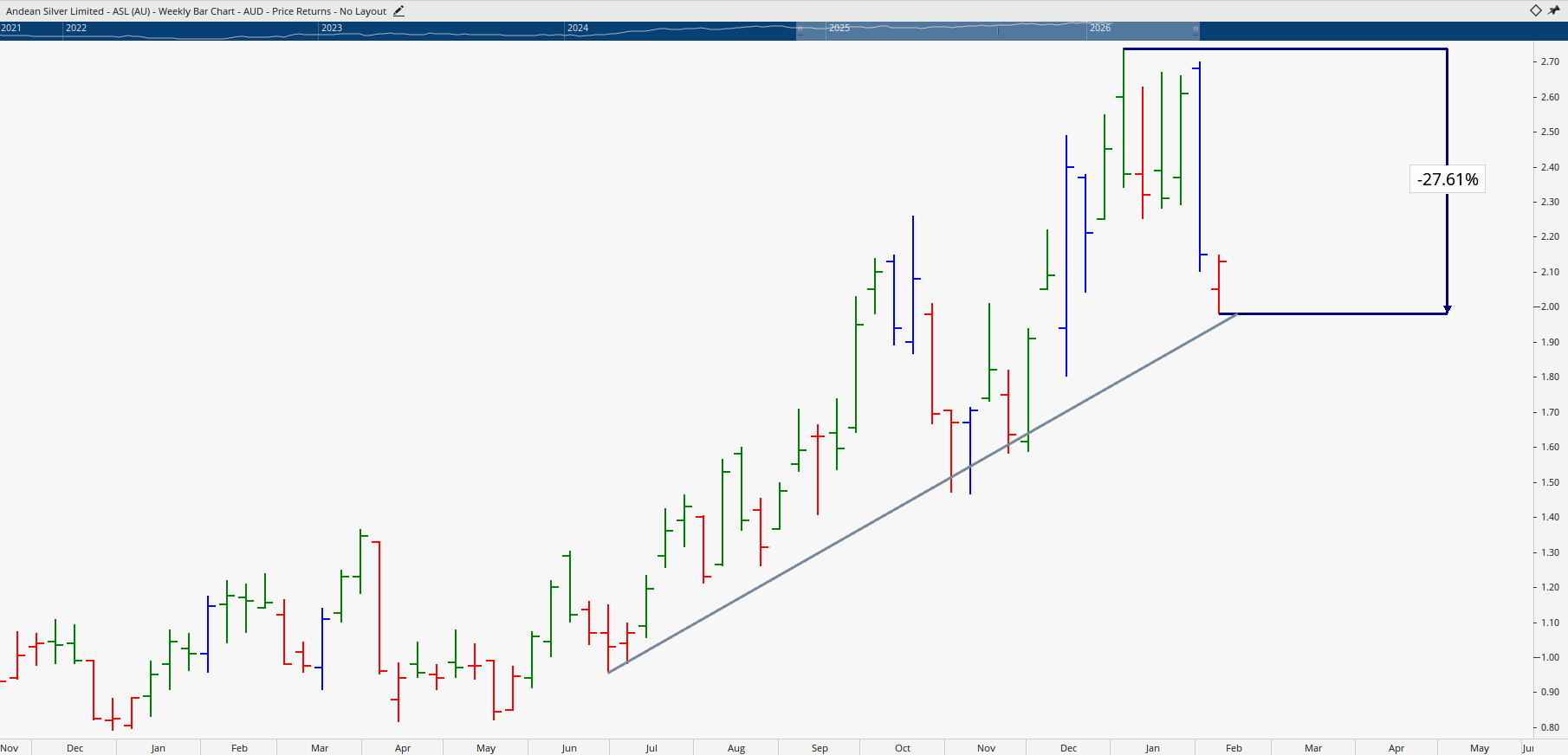

Andean Silver (ASL), which soared through 2025, is currently experiencing a healthy 25–30% consolidation. “Pullbacks like this are normal for momentum stocks,” explained Cox, “but confirmation is key, never buy before support is proven.”

These examples underline a key principle in professional Share Trading Education: discipline. The difference between a trader and a speculator lies in testing and applying proven rules rather than chasing headlines.

Gold, Inflation, and Interest Rates: What It All Means for 2026

The conversation later moved toward the Reserve Bank of Australia’s rate hikes, where Wealth Within analysts connected central bank decisions to market psychology.

Janine Cox remarked, “While the RBA’s moves may pressure borrowing costs, for active investors the share market can serve as a hedge against inflation, if you’re educated and prepared.”

Knowledge of macroeconomic cycles is a fundamental part of Wealth Within’s Diploma of Share Trading and Investment, which combines technical analysis with risk management to help traders make smarter, more confident decisions even when markets turn volatile.

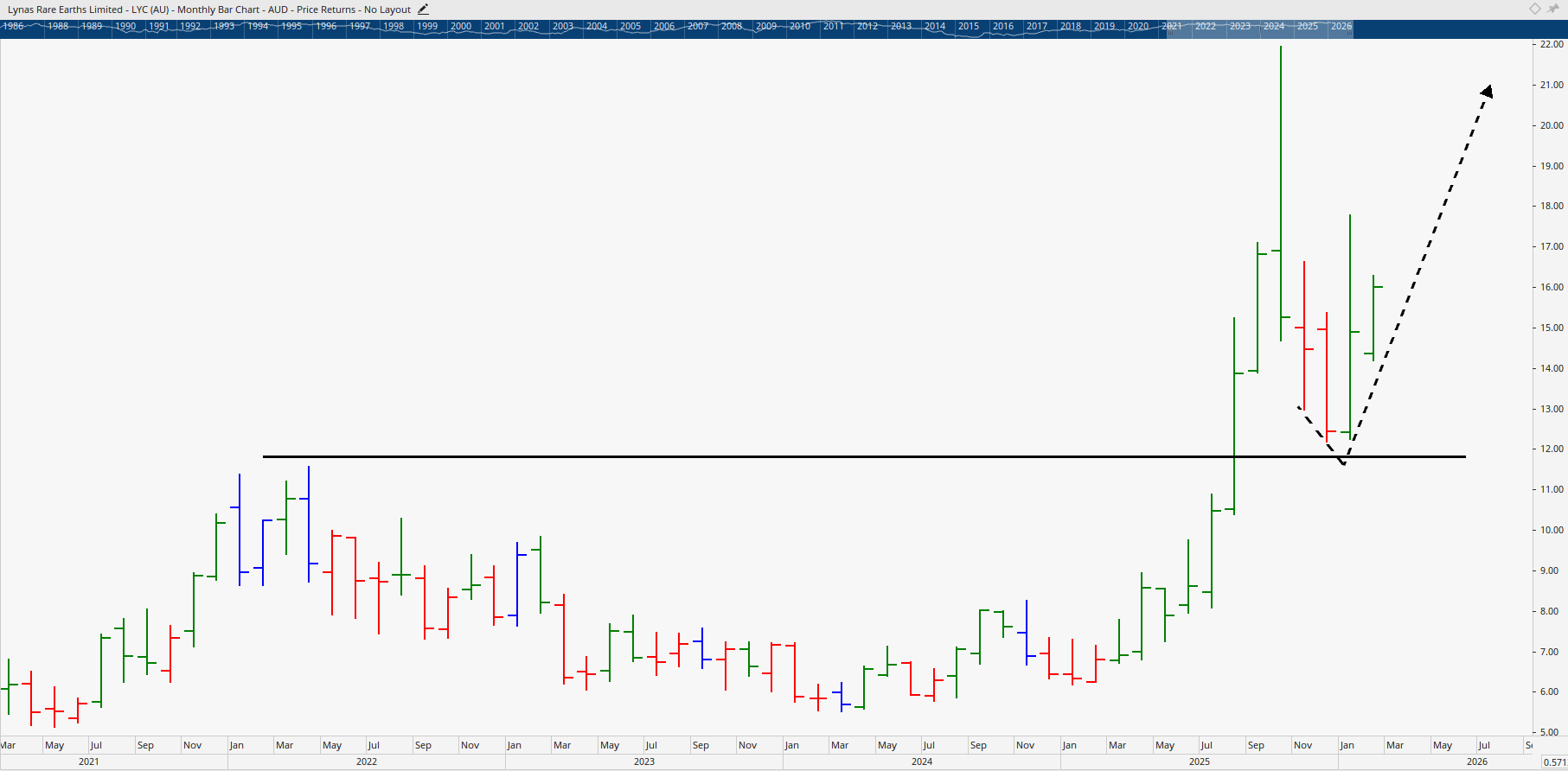

Stock Highlights: Lynas Steals the Spotlight

Among the top picks discussed, Lynas Rare Earths (LYC) stood out as the analysts’ favourite long-term buy the dip candidate. With its unique position in the global rare earth supply chain and a growing focus on critical metals, Linus may benefit as global demand for renewable technologies accelerates.

Both Pedro and Janine observed that although volatility remains high, investors who master timing strategies could capture some of the strongest follow-through moves of 2026.

Advanced traders who want to deepen their knowledge of Elliott Wave theory, time analysis, and portfolio construction can explore the Advanced stock trading course to refine their market edge.

Lessons for Investors: Patience, Process, and Education

A recurring message from all three Wealth Within analysts was the power of education over emotion. Markets are cyclical, but smart investors apply structured approaches, not gut feelings.

For beginners who are asking how to start, the team recommends the Stock Market for Beginners guide to understand the foundations of investing before transitioning to active trading.

Cox summarised it best: “Don’t get caught chasing falling knives. Wait for confirmation, have a plan, and use hard rules because those who treat trading like a profession build wealth; those who treat it like a gamble usually don’t.”

Final Takeaway: Turn Market Volatility Into Opportunity

The key to thriving during market corrections is not prediction, it’s preparation. With the right guidance, structure, and trading rules, you can confidently navigate volatility and find opportunities where others see risk.

Wealth Within’s reputation as Australia’s leading government-accredited trading educator ensures that when markets crash, you’re ready to buy smart, not blind.

The Wealth Within analysts concluded the show by reminding viewers that moments of panic often precede moments of profitability. Whether analysing Santos, Lynas, or smaller mining plays, the opportunity lies not in guessing market direction but in developing the skills to react with certainty when confirmation appears.

To master those skills and strengthen your confidence in analysing charts, trends, and market cycles, visit Wealth Within’s Trading Courses and learn directly from professionals who have guided Australian investors for over two decades.

You can also watch full episodes of the Hot Stock Tips videos and ASX video library to see live market discussions and stock breakdowns similar to this analysis.

For more insights on how Wealth Within empowers traders to achieve consistent results through education, visit About Wealth Within.