The Best ASX Growth Stocks to Buy in Q1 2026: Insights from Wealth Within

By Dale Gillham, Janine Cox and Fil Tortevski

As we kick off the first quarter of 2026 which is historically the most active period for the Australian share market, many investors are focusing on potential growth opportunities. In the latest episode of Wealth Within’s Australian Stock Market Show, market experts Filip Tortevski, Janine Cox, and Dale Gillham broke down their 10 best ASX growth stocks to watch for the months ahead.

Wealth Within, Australia’s only government-accredited provider of share trading education, continues to help traders master consistency, risk management, and profitable trading across all market conditions.

Why Q1 2026 Could Be a Breakout Quarter for Traders

According to Chief Analyst Dale Gillham, “If January starts bullish, it often sets the tone for the entire year.” Historically, the Australian market performs strongest during January through March, often peaking around late February before a short-term pullback in April.

Gillham predicted that, despite potential rate fluctuations or global political factors such as renewed attention on the “Trump factor” and RBA decisions, the ASX is set for a positive year. Janine Cox added that seasonal trends remain intact and many sectors are showing renewed strength after a volatile 2025.

If you’re new to trading or want to understand how to align your entry timing with seasonal patterns, our Stock Market for Beginners guide offers an ideal starting point.

ASX Stocks Showing Strong Growth Potential

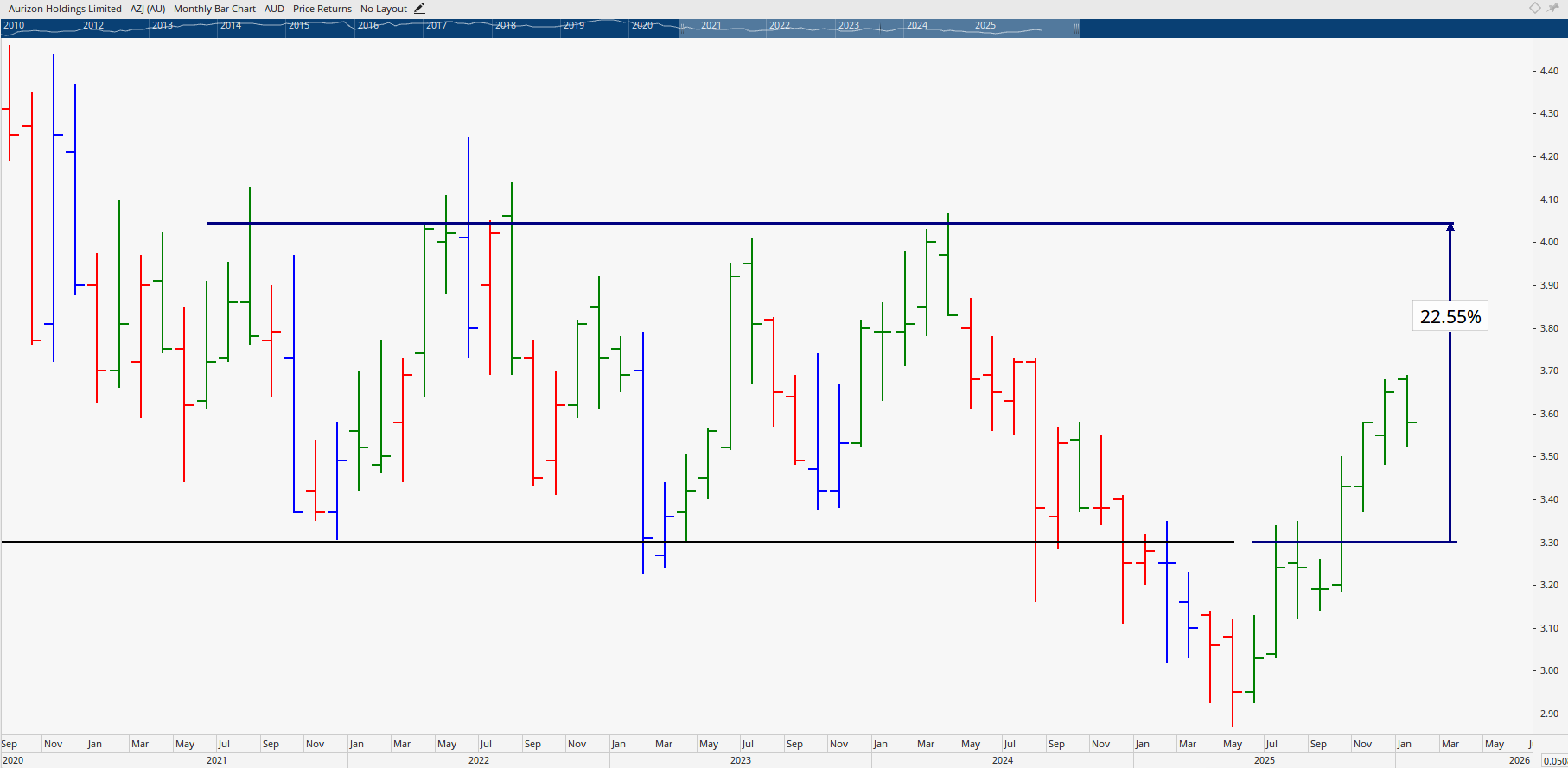

Aurizon Horizon Holdings (AZJ)

Aurizon Horizon Holdings is emerging from a long-term downtrend with solid technical support around $3.30. Analysts identified a potential 20–30% upside if the stock breaks through key resistance levels, making it an interesting mid-term watch.

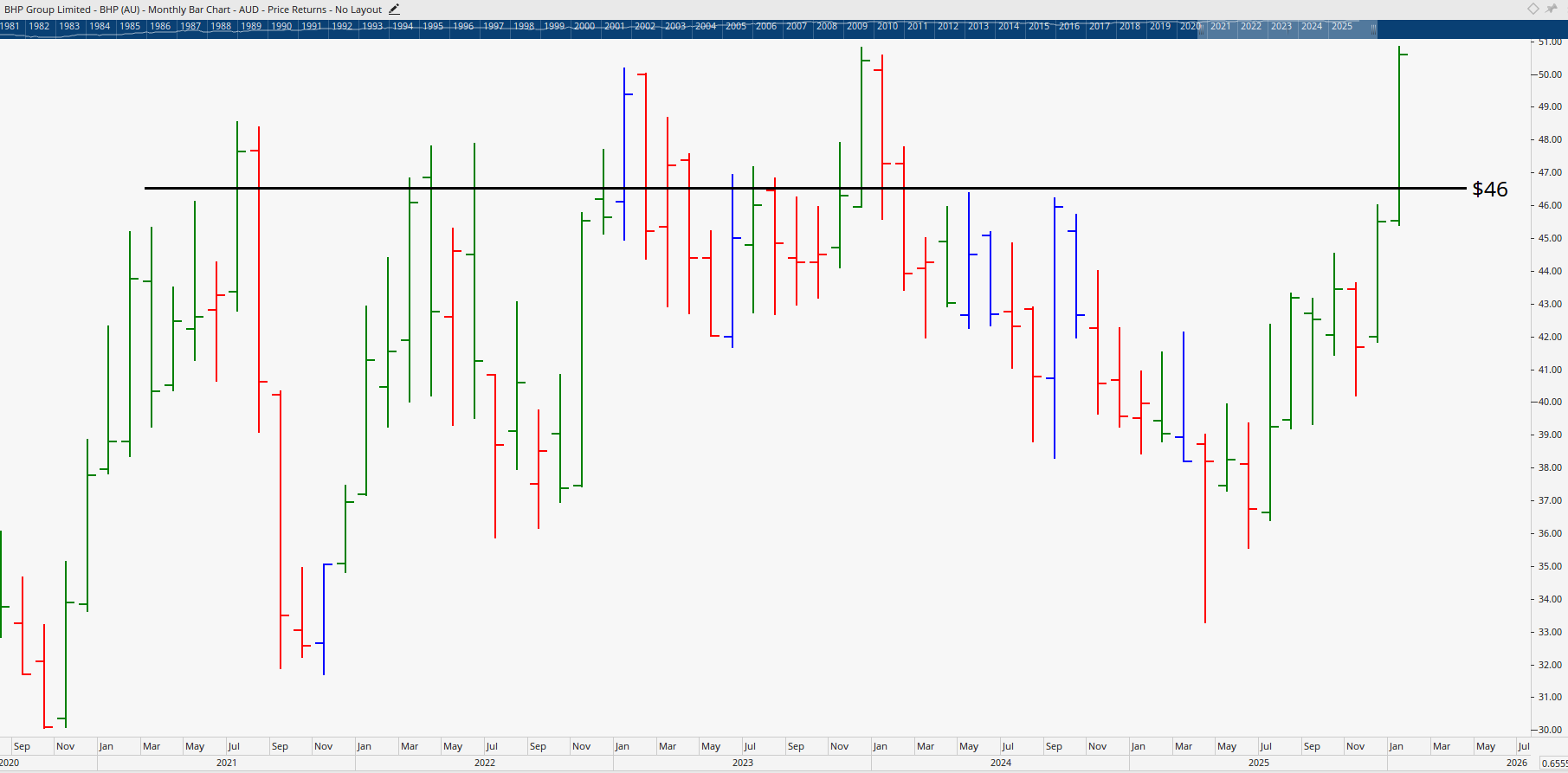

BHP Group (BHP)

As one of the most heavily traded stocks on the ASX, BHP remains a cornerstone for market confidence. With iron ore discoveries estimated at 55 billion tonnes, valued at approximately USD 6 trillion, the mining giant is well positioned to benefit from renewed resource optimism.

Janine Cox noted, “BHP looks like it’s ready to test resistance near $46, and once confirmed, it could kickstart another strong upward phase.”

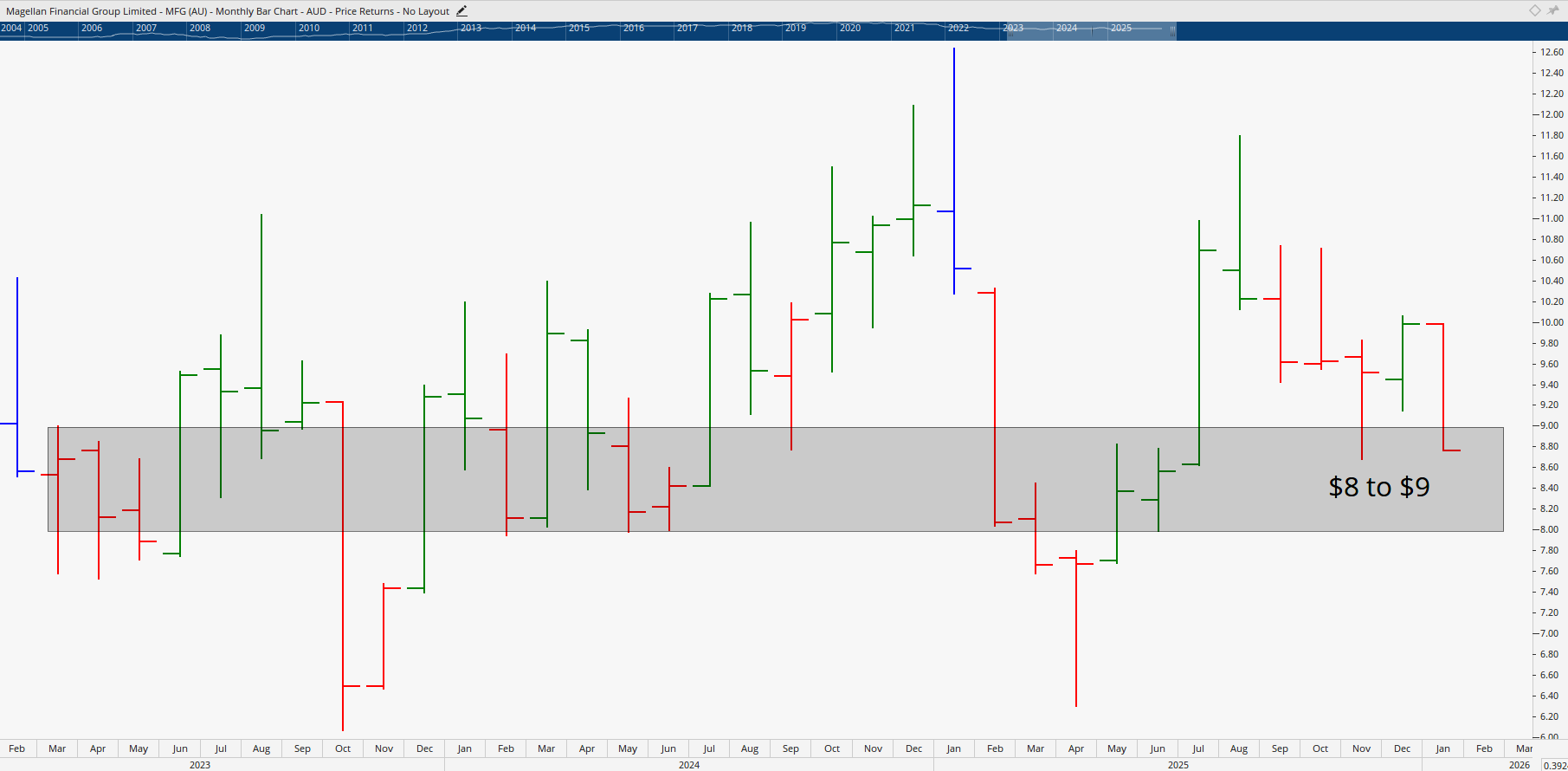

Magellan Financial (MFG)

After a dramatic 90% correction from its 2020 peak, Magellan has doubled from its 2023 lows and is now consolidating around $8–$9. Dale Gillham believes patient traders could see “a profitable long-term turnaround” if the current support levels hold.

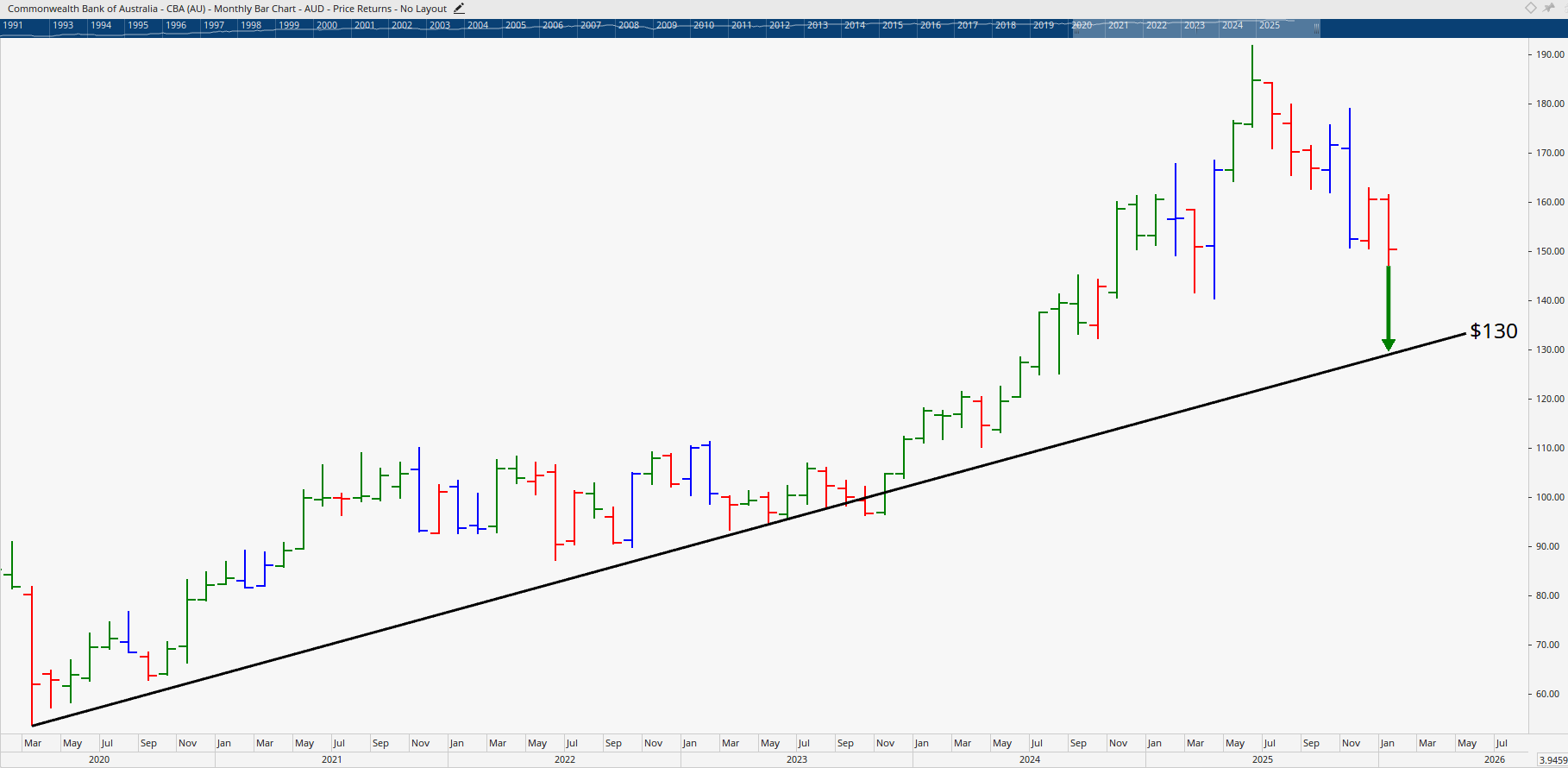

Commonwealth Bank of Australia (CBA)

Despite being traditionally a dividend stock, CBA has recently behaved like a growth stock. Janine Cox highlighted its strong resilience even as dividend yields compress. With technical support near $130 and renewed investor confidence, CBA’s next run could lead the banking sector higher.

If you’re interested in learning how to read market structures, patterns, and support levels like these, explore our Short Course in Share Trading. It provides practical, beginner-friendly insights used by professionals in the market today.

Energy and Resource Opportunities

The Wealth Within team spotlighted the energy and resource sectors as potential outperformers for 2026.

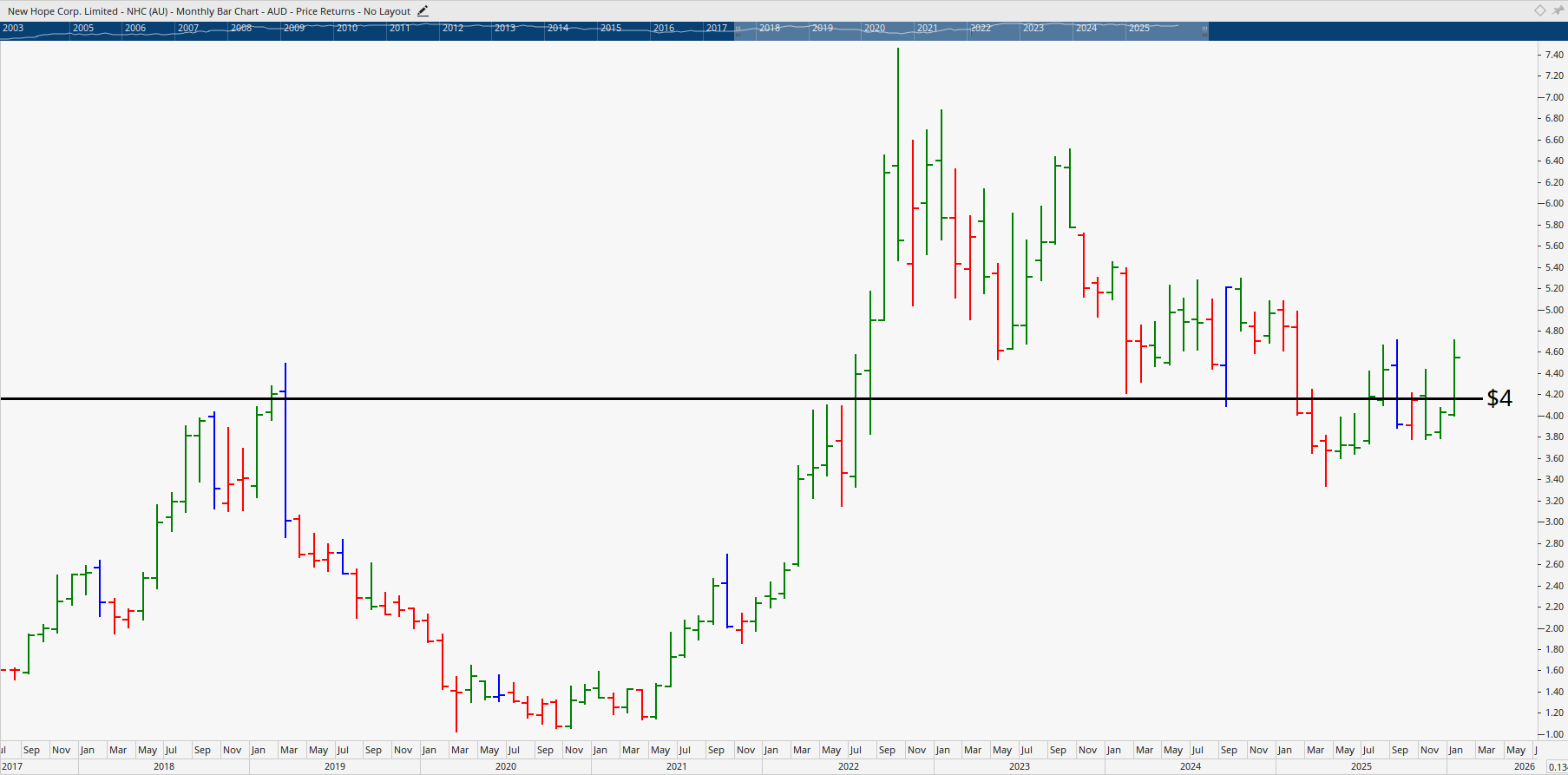

New Hope Corporation (NHC)

Despite being a coal stock, NHC is showing bullish momentum. Strong support around $4 has traders watching for the next breakout opportunity. “It’s one of those setups where patience pays,” Gillham explained, advising investors to wait for confirmation before entering positions.

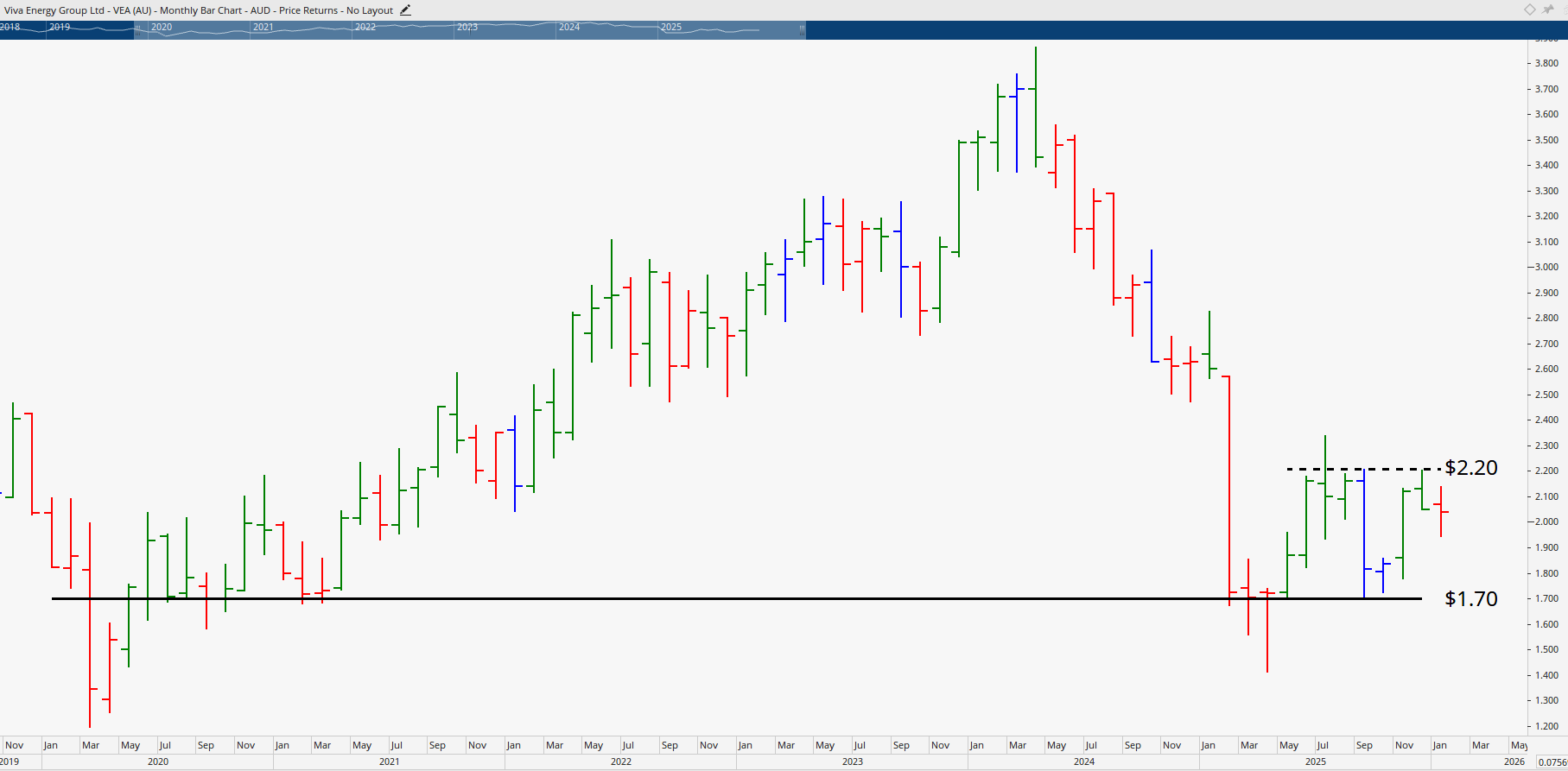

Viva Energy Group (VEA)

VEA has been trending strongly since 2020, moving in a clear upward pattern before falling heavily to the start of the big move up in 2020. The analysts noted strong support around $1.70 and expect a potential break above $2.20 to indicate a new bullish phase.

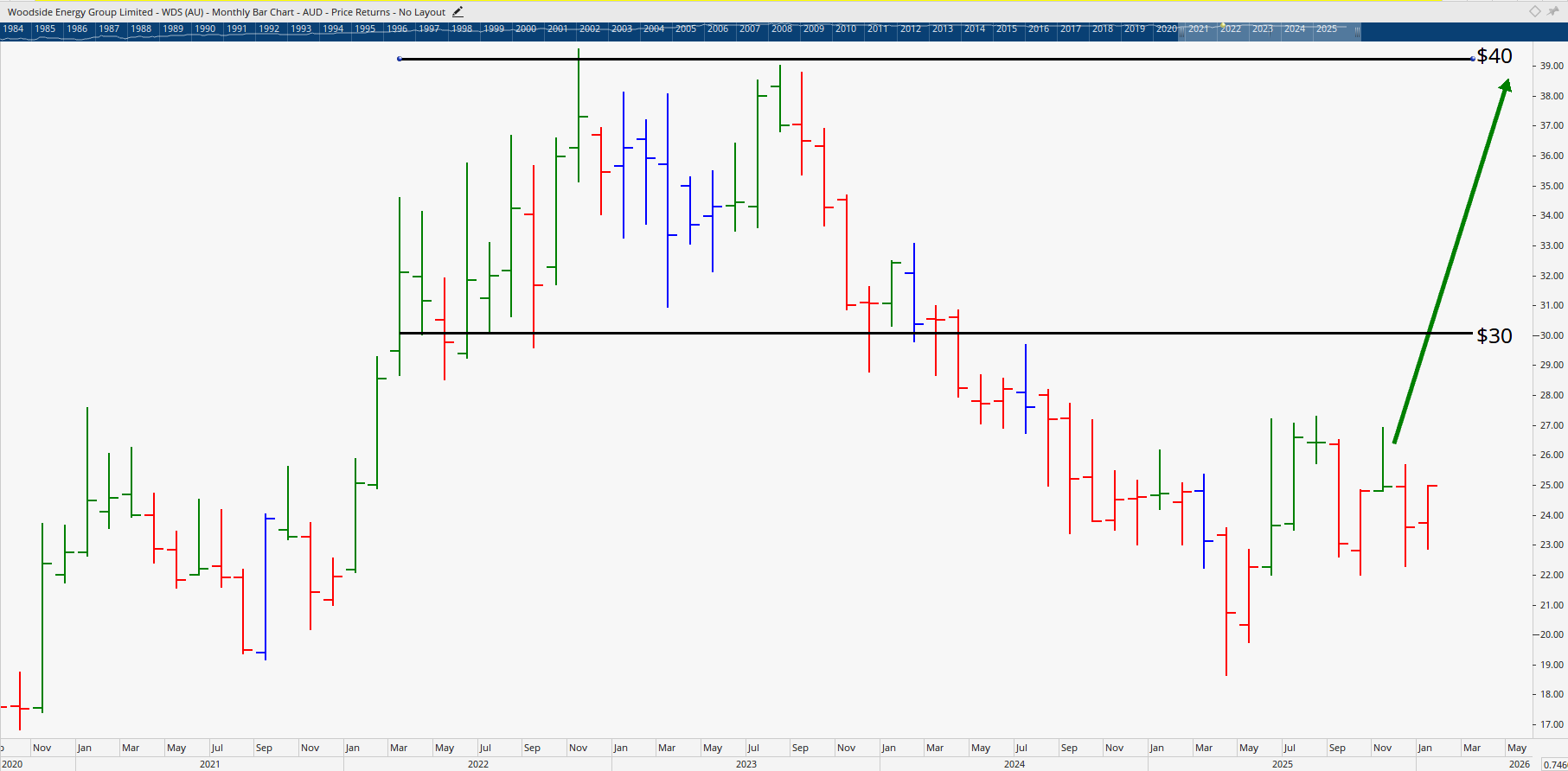

Woodside Energy (WDS)

After months of consolidation, Woodside may be gearing up for its next rally toward $30–$40. Janine Cox believes, “If it doesn’t break out within six months, momentum could stall, but the setup remains compelling.”

Mastering timing and entry confirmation in these high-potential sectors is fundamental to trading success. Advanced traders looking to refine their technical approach can benefit from Wealth Within’s Advanced stock trading course, which teaches how to combine price, time, and pattern analysis.

Technology and Emerging Growth Stocks

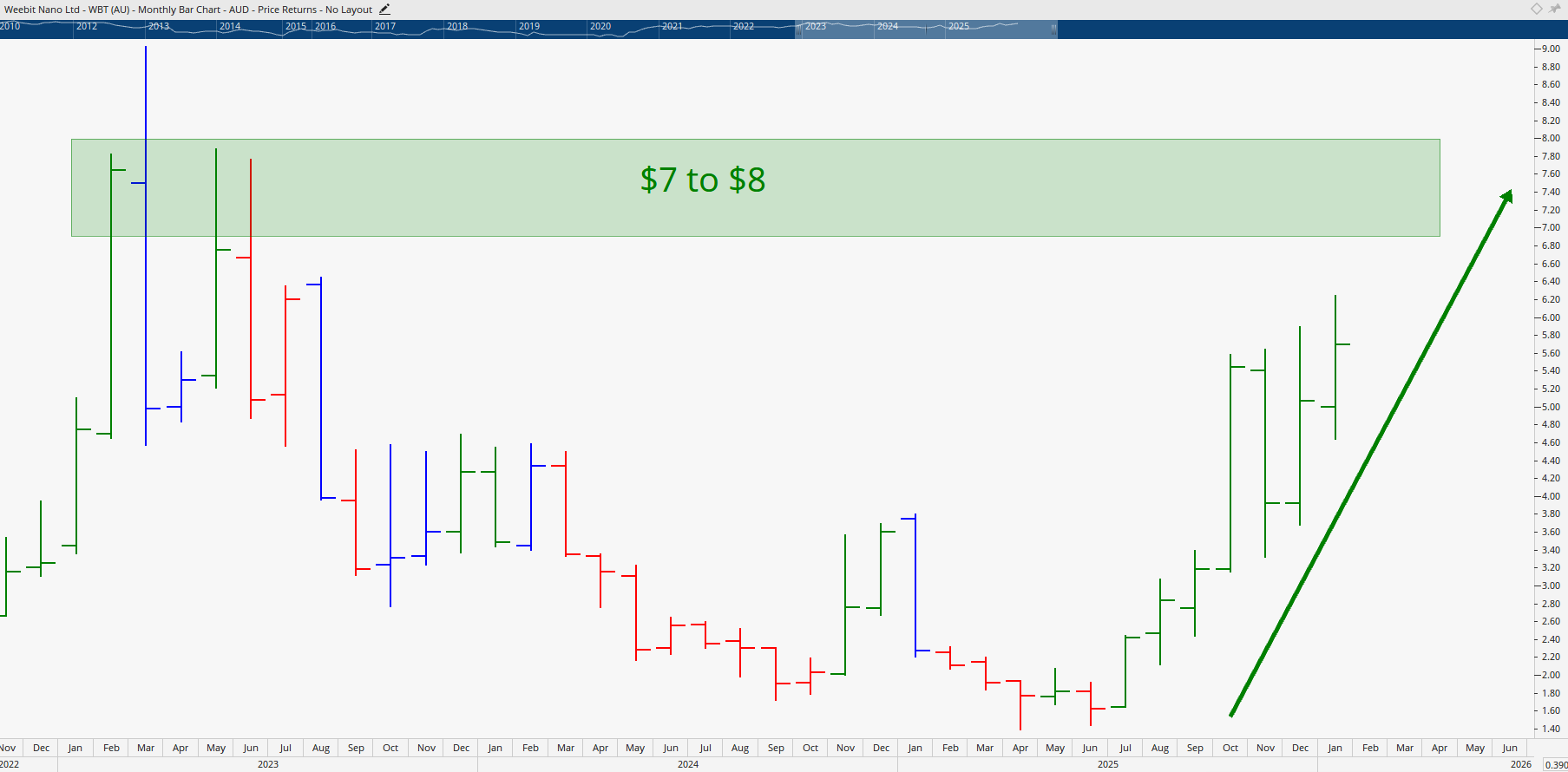

Weebit Nano (WBT)

After gaining over 300% in a year, WBT has matured from a speculative play into a strong trending stock. Consistent trading volumes and bullish structure suggest a potential long-term opportunity, with targets between $7–$8 in the short term.

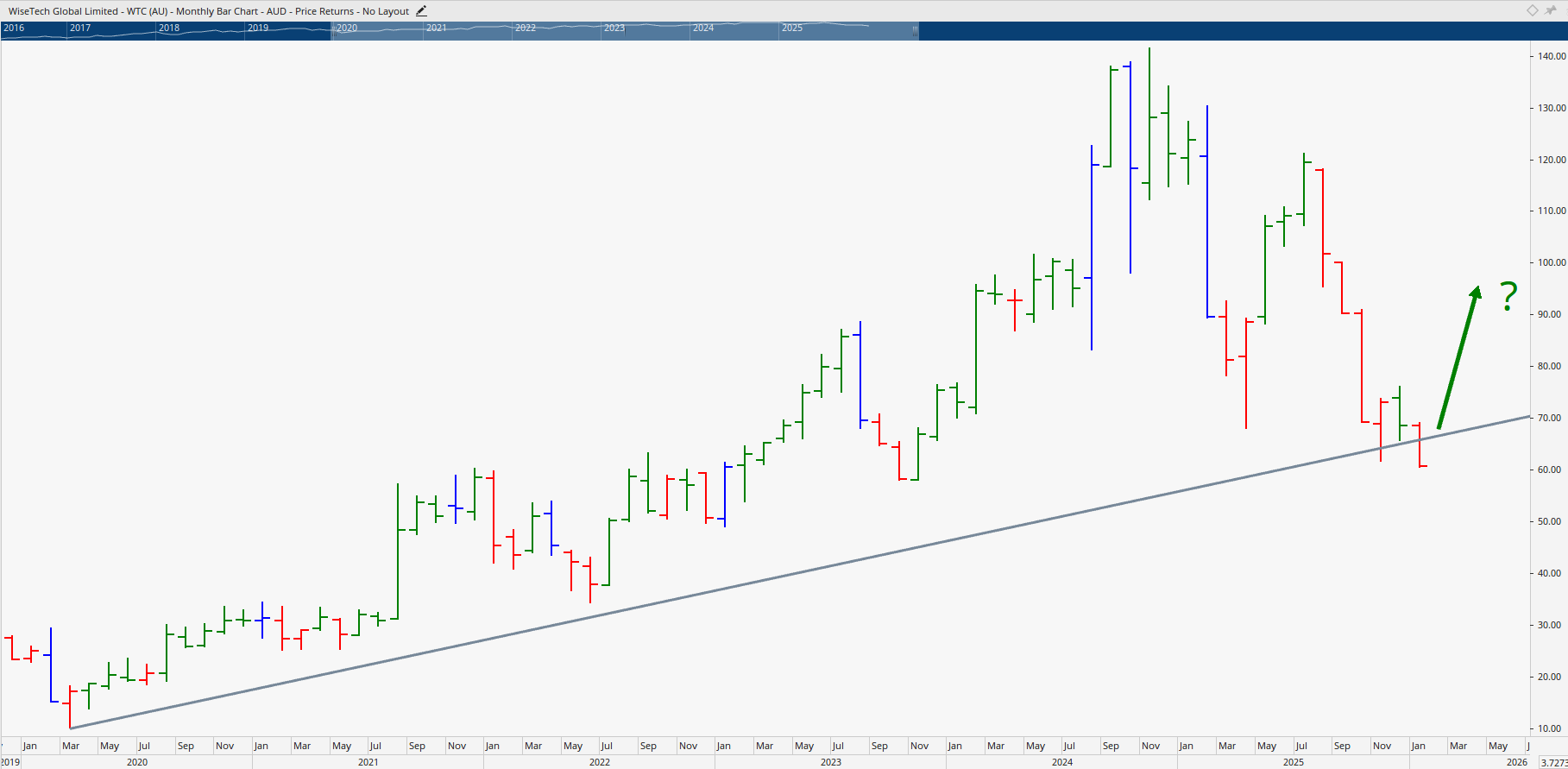

WiseTech Global (WTC)

Having fallen 57% from its peak of $141 in 2024, WiseTech is now attracting interest from contrarian investors. “It’s too early for entry,” warned Gillham, “but once price confirms a reversal, this could be an excellent recovery trade.”

These case studies reflect the importance of understanding both timing and confirmation before entering trades, which are skills that are central to our Diploma of Share Trading and Investment program, which blends fundamental and technical analysis within a structured, proven methodology.

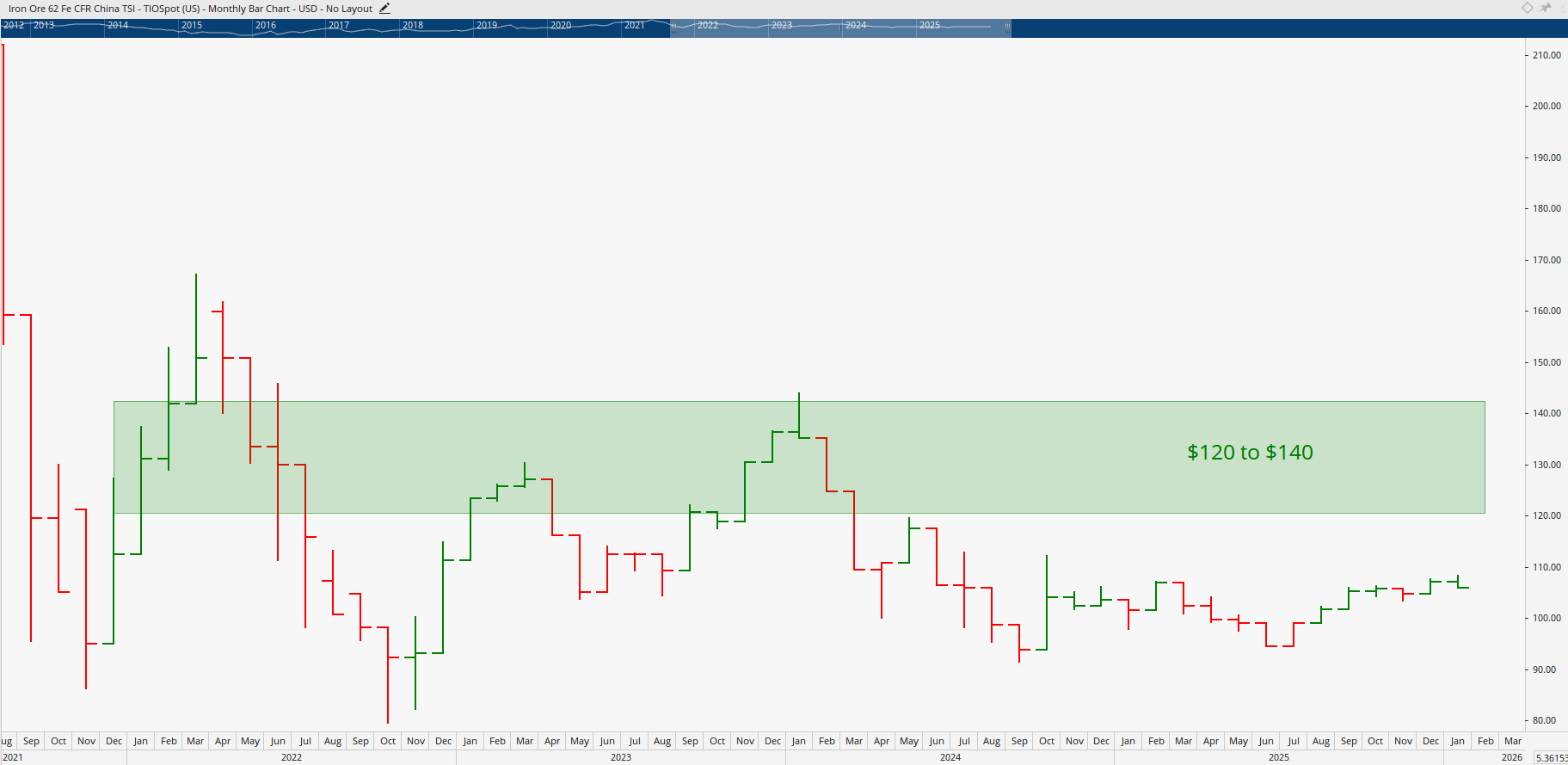

Iron Ore: Australia’s Game-Changing Discovery

The trending topic of the week focused on a newly identified 55-billion-tonne iron ore deposit, a find that could reshape Australia’s resource sector for decades. Barclays forecasts iron ore prices to average around $95 per tonne in 2026, but Janine Cox pointed out that chart analysis suggests potential moves towards $120–$140 over the next 12 months.

“With strong long-term demand and low extraction costs for majors like BHP and Rio Tinto, this discovery reinforces why the resources sector remains essential for Australia’s financial health,” Janine explained.

The Power of Patience and Precision in Trading

Throughout the discussion, patience emerged as a recurring theme. “The biggest lessons for traders,” said Gillham, “are to wait for confirmation and trade with a structured plan.” Many investors fail because they jump into stocks too early or react emotionally instead of following a proven strategy.

Wealth Within’s Trading courses are specifically designed to eliminate guesswork by teaching structured, repeatable techniques to build confidence and consistency in all market conditions.

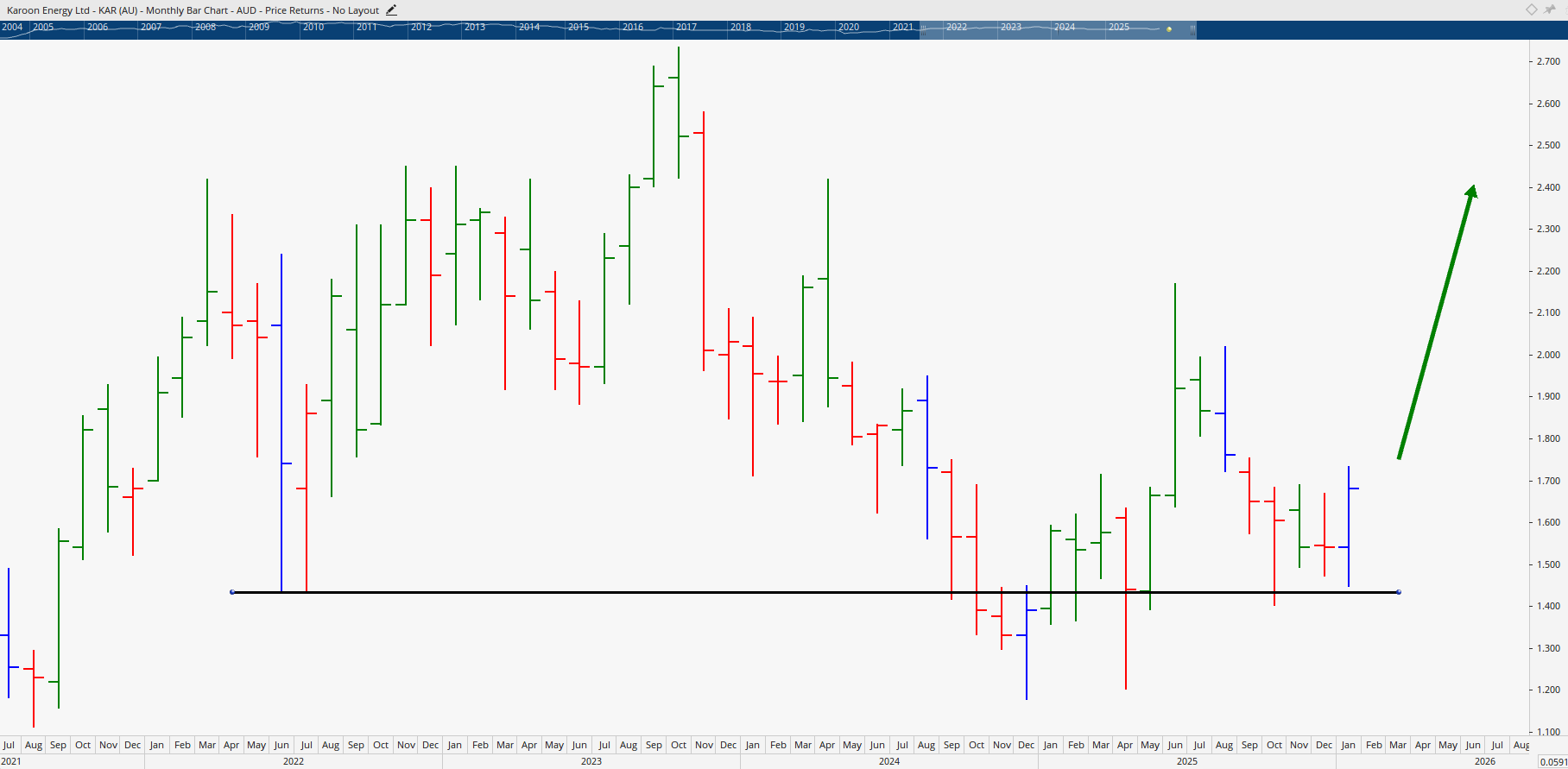

Hot Stock Tip: Karoon Energy (KAR)

The show concluded with the Hot Stock Tip of the week: Karoon Energy (KAR) which is an offshore oil producer seeing strong operational performance. With efficiency increasing from 92% to nearly 99% and output expected to expand in the second half of 2026, KAR is positioning itself for long-term growth.

Dale Gillham explained, “Technically, Karoon is forming a strong base. If prices close high by the end of the week, it could signal a powerful reversal and offer traders a solid buying opportunity.”

To explore more expert discussions and see weekly market analysis in action, visit our Hot Stock Tips videos and ASX video library where the Wealth Within team share deep insights into current market trends.

Empower Yourself With Proven Trading Knowledge

The 2026 trading year offers enormous opportunities for educated investors who understand timing, structure, and risk management. Whether you’re just beginning your wealth-building journey or looking to fine-tune your trading edge, Wealth Within has the experience and accredited programs to help you succeed.

Founded in 2002 by Wealth Within Chief Analyst Dale Gillham, the company has over two decades of industry leadership, empowering traders to take control of their financial future through practical, government-accredited education.

The markets may shift, but the power of knowledge endures. With the right strategy, consistent training, and a disciplined mindset, 2026 could be your most profitable year yet.