Buy the September Dip? 8 ASX Stocks to Buy

By Janine Cox, Fil Tortevski and Pedro Banales

The Australian stock market is experiencing a seasonal pullback and, as always, investors are asking the important question: is this the start of something bigger or simply another buying opportunity?

In this post, we break down the current dip, analyse key index levels, and spotlight eight ASX stocks that look primed for the next move higher.

Market Pullback: Normal or Dangerous?

September is living up to its reputation as one of the weaker months for markets, with the All Ordinaries pulling back. While headlines may spark fear, Wealth Within analysts highlight that healthy pullbacks of 8–14% are normal.

The depth of this correction will determine how strong and how long the next bull run may be. A deeper correction could set up a more sustained rally, while a shallow dip may see the market rise but with less momentum

Why Pullbacks Are Buying Opportunities

Senior analysts at Wealth Within stress that pullbacks are not signals to panic. Instead, they are the moments traders should prepare for the next round of opportunities. For those who panic-sell, gains are often missed when markets inevitably recover.

If you want to build the skills to know when to buy dips and when to stay out, Wealth Within provides government-accredited Trading courses that give you repeatable strategies to trade confidently.

Eight Stocks to Watch

During the show, several standout stocks were highlighted as potential winners from this pullback. Here are a few key names discussed by the analysts:

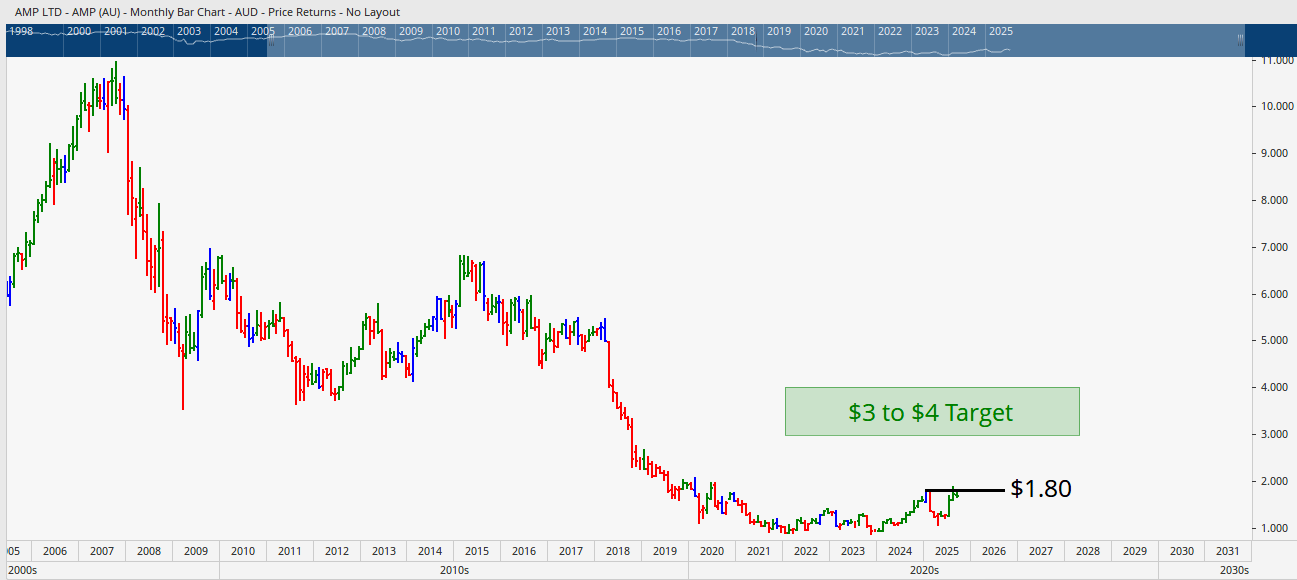

AMP Limited (AMP)

Once considered a “dog stock,” AMP has been basing for years and is now showing signs of reversal. If prices hold above $1.80, it could see a strong long-term recovery, with upside potential towards $3–$4 over time.

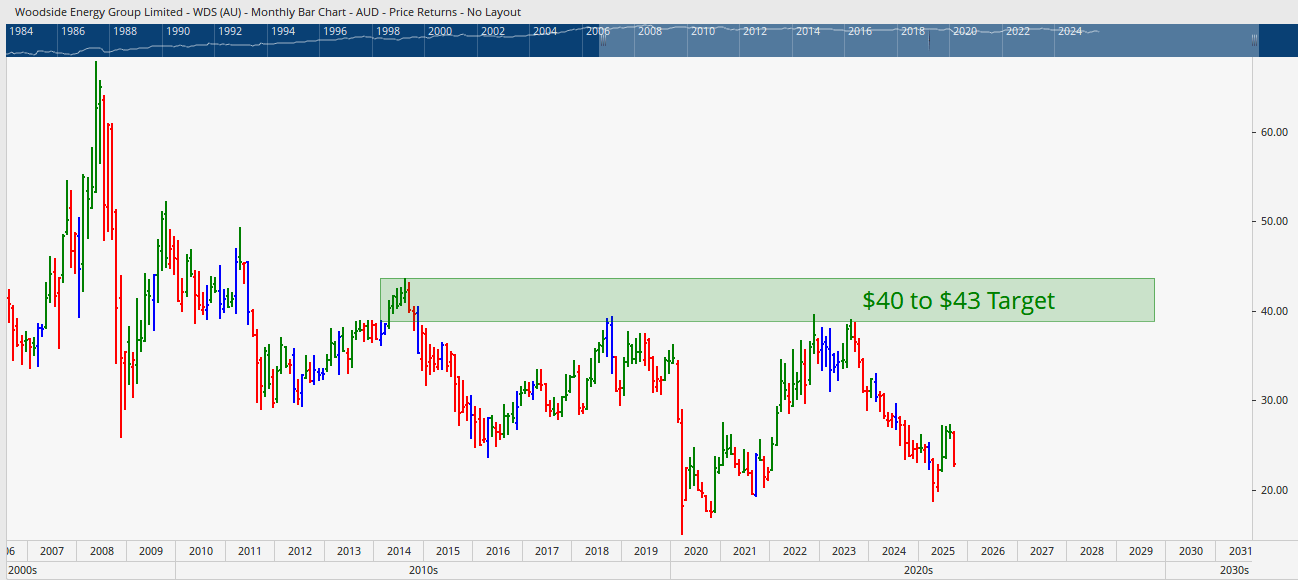

Woodside Energy (WDS)

Despite short-term weakness, Woodside remains fundamentally strong. Pullbacks to levels around $22 make the stock attractive. If it rallies from here, targets of $40–$43 are not unrealistic, replicating past moves.

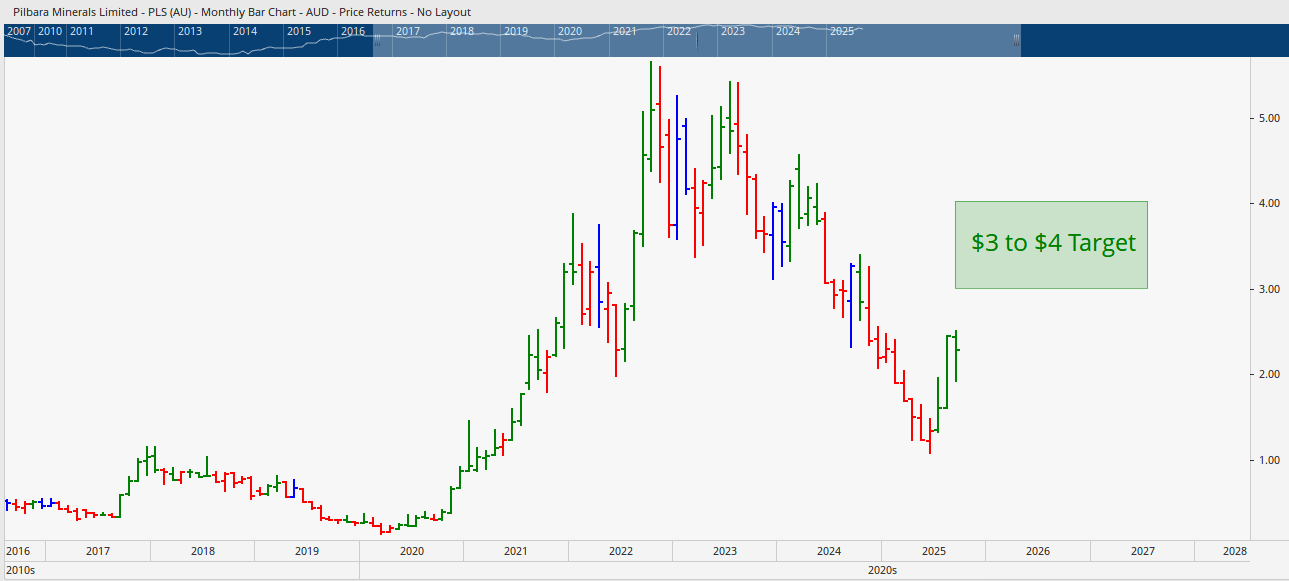

Pilbara Minerals (PLS)

Lithium favourite Pilbara has delivered multiple 100%+ rallies in past cycles. Current pullbacks may set up another strong leg to $3–$4, making it one of the more exciting mid-term plays.

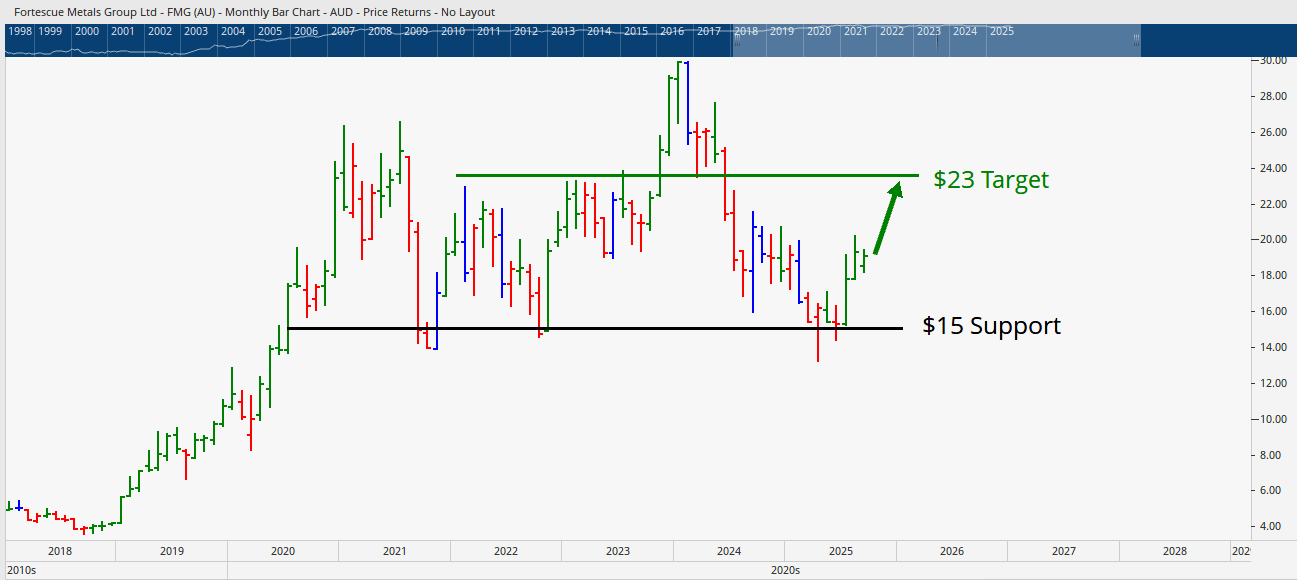

Fortescue Metals (FMG)

FMG has repeatedly bounced off the $15 level, with recoveries of 50%+ following each dip. If the pattern continues, a run towards $23 could be on the cards.

Others

Additional names on the radar included Bank of Queensland (BOQ), Horizon Holdings (AZJ), Woolworths (WOW), and New Hope Coal (NHC). Each offers potential once basing patterns confirm.

Beyond Stock Picks: Building Trading Confidence

While identifying bargain ASX stocks is exciting, successful investing requires more than just tips. The real advantage lies in having a structured system:

- Knowing how to read price trends

- Recognising basing patterns and reversals

- Applying stop-losses for risk management

- Controlling emotions during market dips

That’s why Wealth Within has become Australia’s most trusted name in Share trading education. With expert-led programs like the Short Course in Share Trading, the nationally recognised Diploma of Share Trading and Investment, and the Advanced stock trading course, you gain skills for both short-term dips and long-term success.

Learn From Real Experts

Each week, Wealth Within delivers practical chart insights, pattern recognition, and buy/sell strategies through our Hot Stock Tips videos. These episodes break down current market movements with step-by-step reasoning so you can learn to think like a professional trader.

Positioning for the Next Market Run

The current ASX pullback is not a reason to panic, it’s a chance to prepare. Whether it’s household names like Woodside and Woolworths, turnaround plays like AMP, or growth-focused miners such as Pilbara and Fortescue, opportunities are there for those who can spot them.

Investors with the right tools and trading rules are positioned to benefit most when the next leg higher begins.

Since 2002, Wealth Within has helped traders and investors build certainty in uncertain markets. With the right education, your next buying opportunity can be the start of long-term financial growth.

Important information

This content is provided for educational purposes only and is not personal financial advice. It does not take into account your objectives, financial situation or needs. Consider seeking advice from a licensed professional before acting on this information. Markets involve risk; past performance is not a reliable indicator of future performance.