These ASX Sectors Are Set to Boom in 2026: Buy Now

By Dale Gillham, Janine Cox and Fil Tortevski

What if the sectors most investors have ignored this year are actually the ones poised to deliver the biggest gains in 2026? According to Wealth Within’s experts, the next market winners may not be the flashy favourites, but the undervalued sectors gearing up for a powerful comeback.

In this week’s analysis, Wealth Within’s Dale Gillham, Janine Cox, and Filip Tortveski delve into three forgotten corners of the Australian market showing signs of a major turnaround: energy, healthcare, and consumer staples.

Energy on the Verge of a Rebound

After years of policy pressure, the energy sector is emerging as one of the most

promising areas for growth heading into 2026. Janine Cox believes the long period

of underperformance is setting the stage for a strong rebound.

“These stocks have been sold off and oversold, and now the pendulum is swinging back,” Janine explains.

From a technical perspective, the sector has climbed more than 30% off its April 2025 low and could have another 40% upside before testing major resistance.

However, as Filip Tortveski notes, investors must be strategic,

“Energy has been a trading market, not a buy-and-hold one. Without confirmation of a sustained uptrend, your best results will come from learning to time the cycles and knowing when to enter and exit.”

If you want to build these skills and learn to trade shares using disciplined strategies, consider Wealth Within’s Trading courses designed to help you navigate shifting market trends.

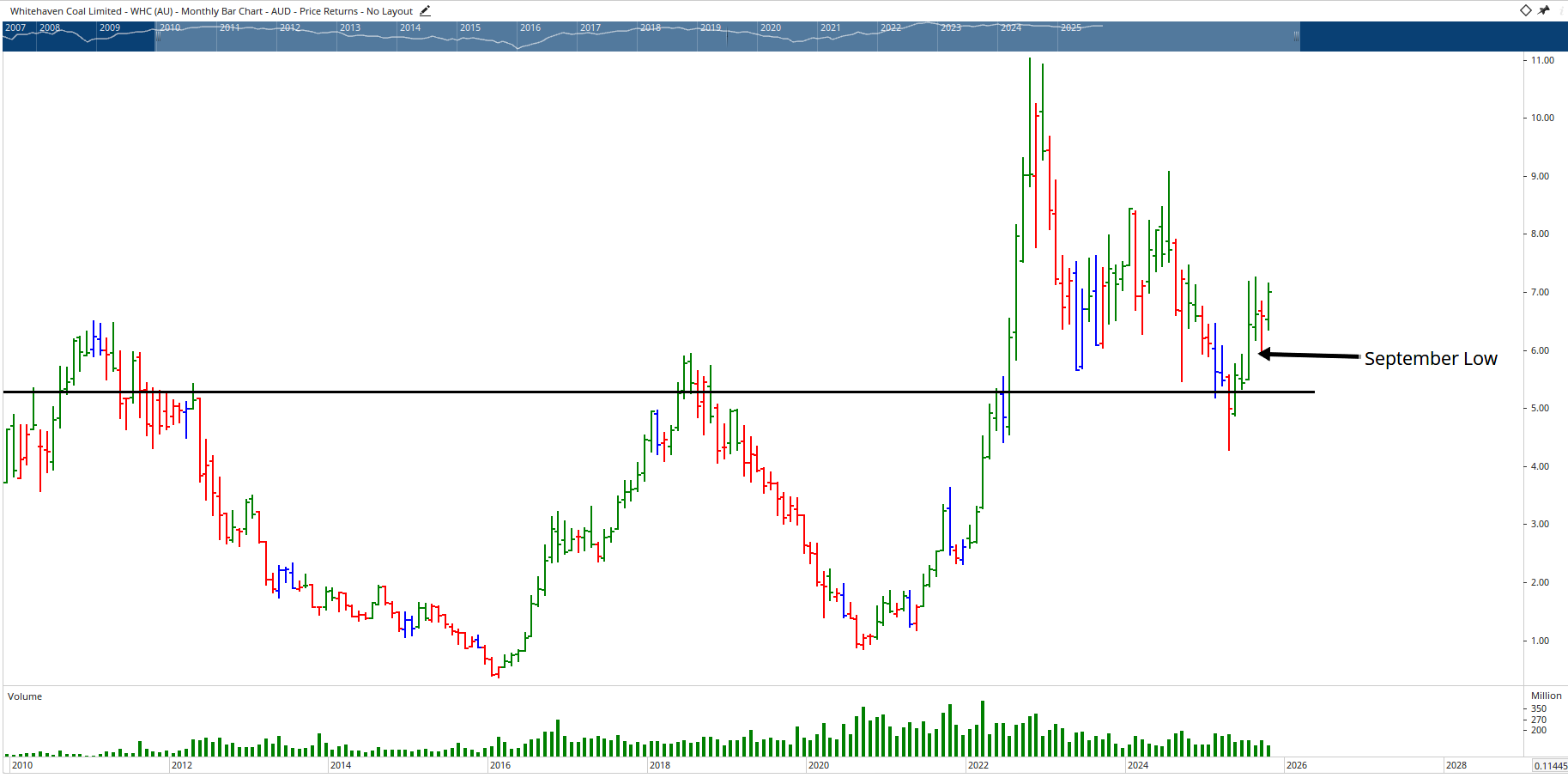

Stock Spotlight: Whitehaven Coal (ASX: WHC)

Whitehaven Coal remains one of the standouts within the traditional energy space. Despite growing environmental pressures, the chart suggests clear signs of accumulation and market strength. Strong institutional buying activity and rising volume hint that buyers are regaining control after years of losses.

Filip remarks, “Whitehaven is showing textbook price behaviour. As long as it holds above its September low, this stock offers excellent medium-term potential.”

For investors looking to understand how to identify early signals of reversal, you can gain these insights through the Short Course in Share Trading, which teaches proven entry and exit strategies for volatile markets.

Healthcare: Preparing for a Breakout in 2026

Healthcare has been another laggard, with leaders like CSL and Cochlear struggling since 2020. But this year’s slowdown could pave the way for a reversal.

The sector’s fundamentals remain strong, supported by demographic tailwinds such as an aging population and technological innovation in health-tech and AI.

“It’s about being selective,” Janine says. “Not all healthcare stocks will rise equally, but those with strong product pipelines and solid balance sheets are positioned well for 2026.”

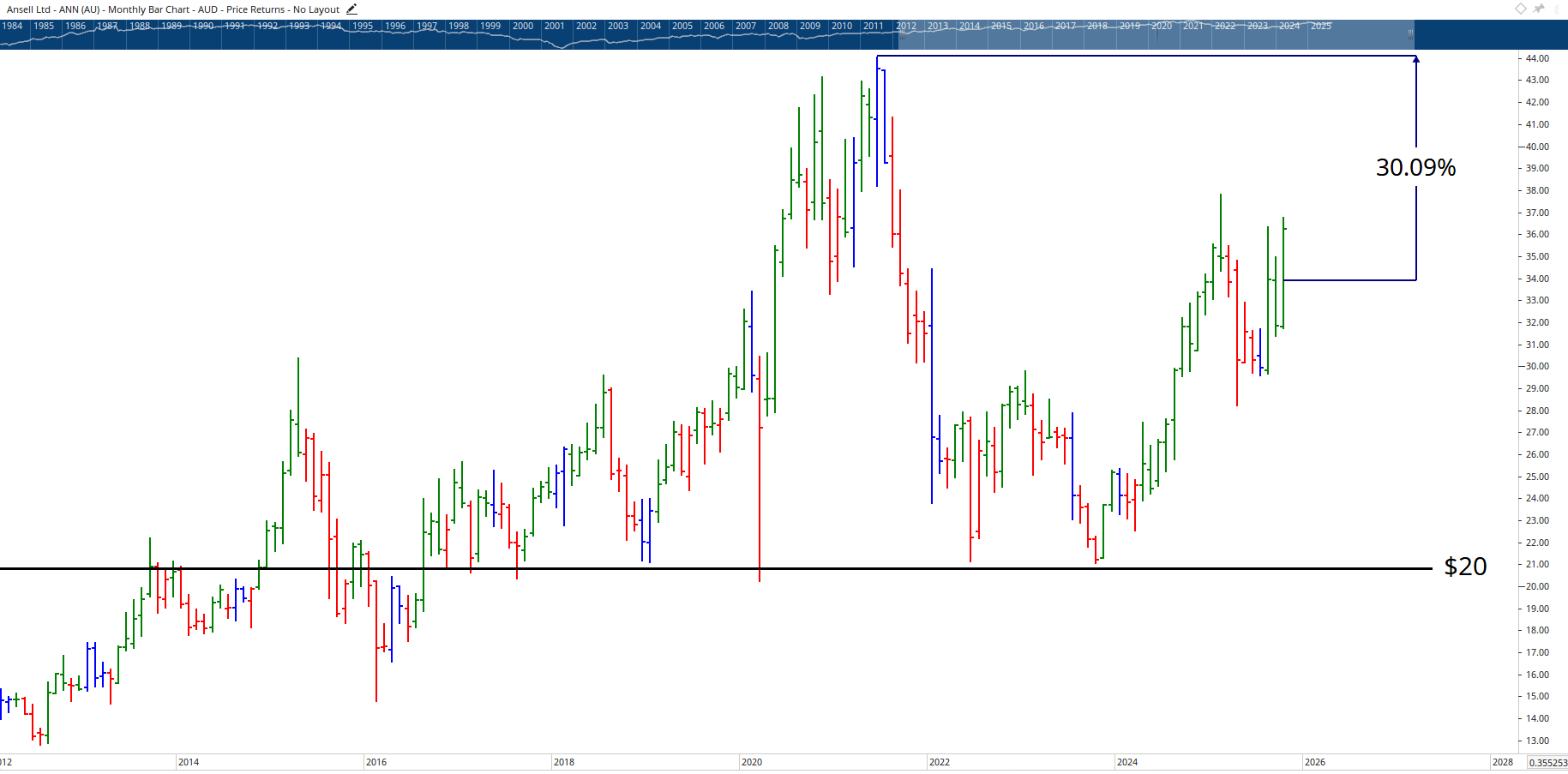

Ansel (ASX: ANN) – Defensive Strength with Growth Appeal

Ansel, which manufactures industrial and medical protective equipment, is showing early signs of another bullish phase. The stock has bounced off strong support near $20 and is tracking toward its all-time high with around 30% upside potential.

Ansel’s resurgence demonstrates how healthcare can offer both defensive stability and tradeable growth, particularly in companies benefiting from increased global hygiene awareness post-COVID.

Consumer Staples: Quiet Performers with Long-Term Resilience

While investors have been focused on mining and tech, consumer staples are forming a base for a potential rally. With interest rates expected to ease and inflation stabilising, 2026 could be the year that traditionally “boring” sectors make a comeback.

Janine points out that the sector has tested key support levels multiple times since 2023 and could soon break higher,

“Once the sector confirms a reversal, it could enter a strong upward phase, especially with improving conditions for cost management and supply pricing.”

Stock Standouts in Staples and Agribusiness

Ridley Corporation (ASX: RIC)

An overlooked player in Australia’s agribusiness industry, Ridley Corporation provides animal nutrition products and has quietly delivered steady growth. Its chart structure shows higher highs and higher lows—a sign of an established uptrend.

Filip advises caution, though: “Recognise when you’re in a trend and plan your exit early. Protecting profits through sound risk management is just as important as finding the right entry.”

Australian Agricultural Company (ASX: AAC)

AAC, one of the nation’s oldest cattle producers, is forming a strong cyclical base and appears set for another major upswing. With global demand for premium beef continuing to rise, analysts suggest this could be one of the more exciting consumer staples comeback stories in 2026.

“This stock demonstrates the power of understanding cycles,” Janine notes. “Once it clears $2 resistance, it could start a new bullish leg.”

Key Takeaway: 2026 Belongs to the Forgotten Sectors

While technology, mining, and finance have dominated headlines, the real opportunities for 2026 may lie in energy, healthcare, and consumer staples, areas currently ignored by most investors.

To take advantage of these setups, traders need more than luck; they need a strategy that aligns technical timing with confidence in execution. That’s where education comes in.

Wealth Within’s government-accredited Diploma of Share Trading and Investment can help you master these techniques, while their Advanced stock trading course is perfect for those who want to refine entry accuracy and cycle analysis.

Final Thoughts: Tech Still Has a Role

Although “old economy” sectors may dominate 2026, technology companies like Amazon and Australia’s rising tech stars are still key market drivers. Advances in AI, automation, and robotics continue to create ripple effects across multiple sectors, including healthcare and logistics.

To explore more market insights and weekly stock analysis, tune into Wealth Within’s Hot Stock Tips videos, ASX video library, where you can watch the team dissect real-time opportunities across the ASX.

And if you’d like to learn more about Australia’s most trusted share trading educators, explore About Wealth Within to find out how their expertise has helped thousands of traders take control of their financial future.

Important information

This content is provided for educational purposes only and is not personal financial advice. It does not take into account your objectives, financial situation or needs. Consider seeking advice from a licensed professional before acting on this information. Markets involve risk; past performance is not a reliable indicator of future performance.