Don’t Sell Your ASX Growth Stocks Before You See This

By Janine Cox, Fil Tortevski and Pedro Banales

If the recent market pullback has you wondering whether to sell your ASX growth stocks, you’re not alone. Many investors are questioning which stocks to hold, what might bounce back, and how to navigate short-term corrections without missing the next growth wave.

In this article, Wealth Within’s experienced analysts, regularly featured in major Australian financial media, share their insights on ten ASX growth stocks still showing real strength and break down what the pullback might really be telling you.

Understanding Market Pullbacks: Panic or Opportunity?

Before reacting to a sudden price drop, it’s crucial to identify whether what you’re seeing is simply a healthy pullback or the start of a deeper correction. According to the Wealth Within team, traders often focus too much on market headlines and not enough on reading the story that each stock’s price chart tells.

Growth stocks, especially those in sectors like tech, healthcare, and financials, move through cycles. Knowing the difference between short-term volatility and a genuine trend reversal gives traders a competitive edge and that’s where trading education and technical analysis come in.

For those new to trading, Wealth Within’s Short Course in Share Trading is designed to teach exactly this: how to analyse market movements, use risk management effectively, and trade with confidence.

Why Timing Matters More Than Ever

Timing is the number one skill that separates professional traders from amateurs. You can have the best fundamentals and economic insight, but if you buy or sell at the wrong time, profits can quickly evaporate.

This skill, knowing when to enter and exit with precision, is central to what’s taught in the Diploma of Share Trading and Investment. The course combines technical and fundamental analysis to help students recognise market cycles, identify ideal trade setups, and develop a repeatable strategy that works in all market conditions.

As Wealth Within analysts explain, orderly pullbacks are a normal and healthy part of a trend. Sharp declines driven by emotion, however, often create opportunities for the patient investor who understands how to interpret price structures.

ASX Growth Stocks to Watch Right Now

Recent analysis from Wealth Within’s Australian Stock Market Show highlights several standout growth stocks resisting downward pressure or preparing to rebound. Here are a few examples discussed by the expert panel:

- Metcash Limited (ASX: MTS): Despite broader market declines, Metcash has maintained strong price action, showing signs of a healthy uptrend. Consistent buying support suggests resilience, particularly if it stays above key trend levels.

- Telix Pharmaceuticals (ASX: TLX): After a strong rally in 2024, Telix experienced an almost 60% pullback in 2025. While short-term traders might see volatility, long-term charts indicate possible setup for renewed strength once confirmation appears.

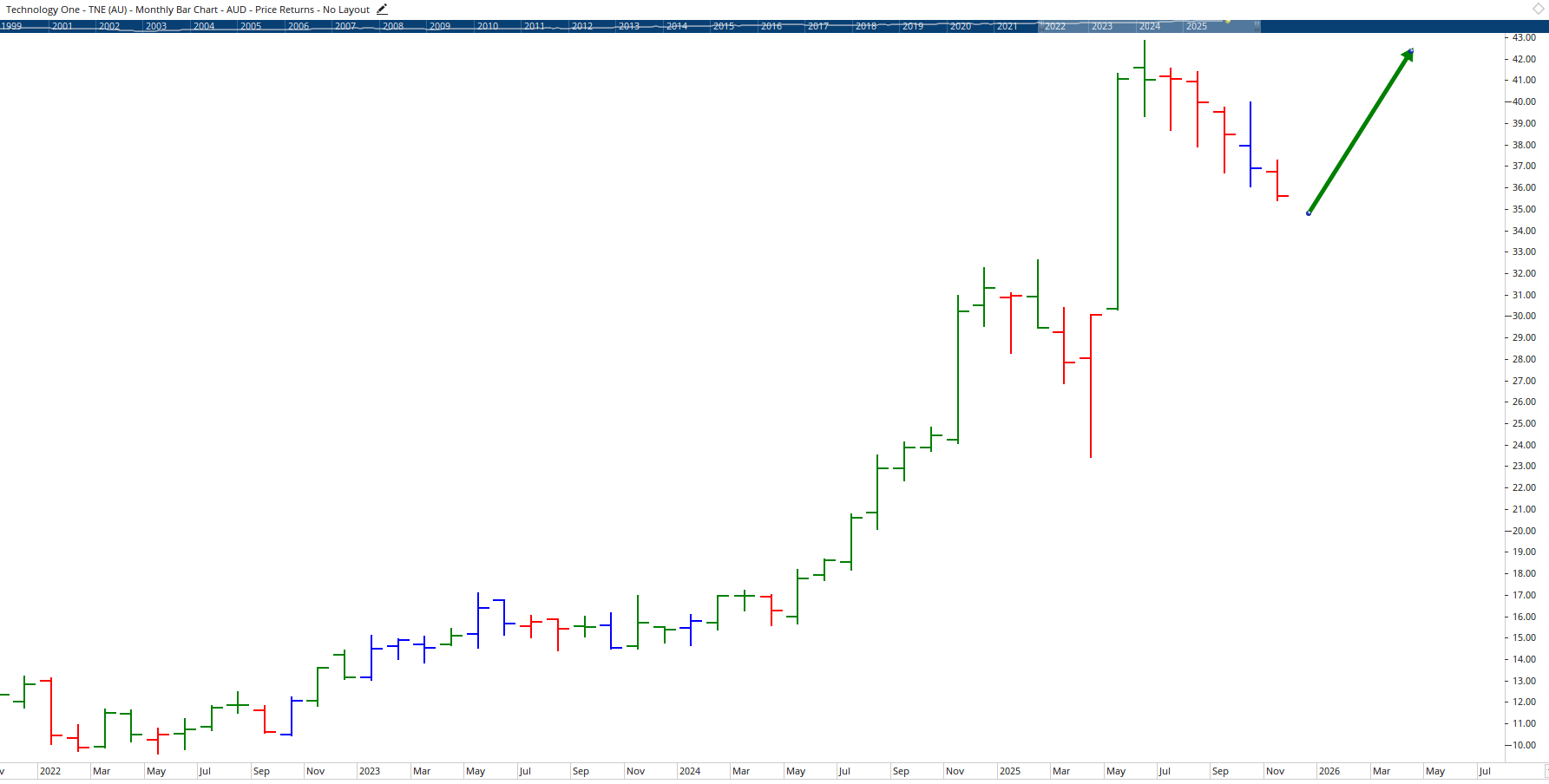

- TechnologyOne (ASX: TNE): With investors talking about an AI bubble, TNE remains a proven tech performer. Current movement suggests more of a short-term correction than a major crash, a potential opportunity for medium-term traders.

- AGL Energy (ASX: AGL): After bouncing off a significant $8 support level, AGL is now trading sideways and showing renewed strength, appealing to investors seeking long-term growth stability.

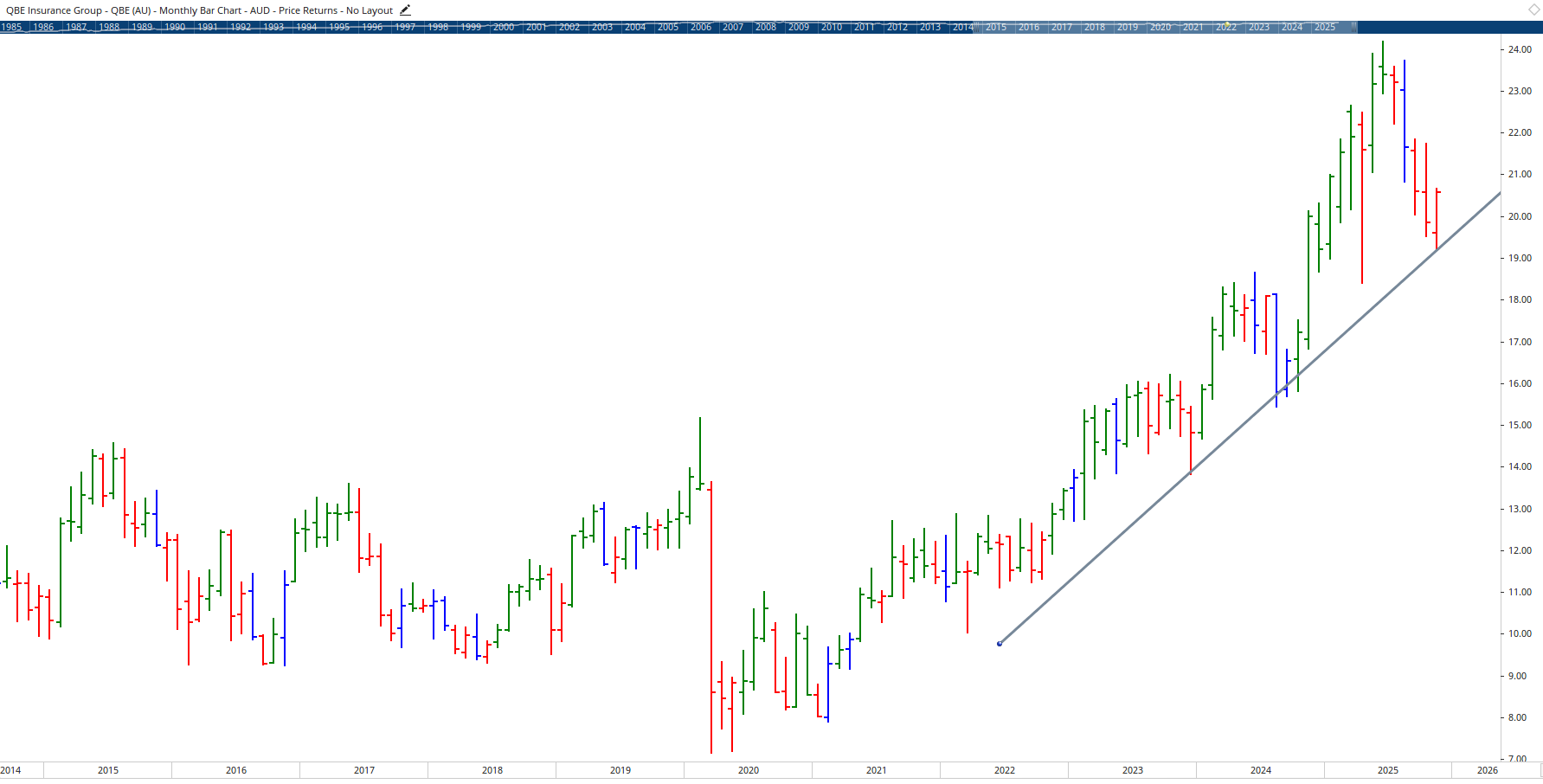

- ResMed (ASX: RMD) and QBE Insurance (ASX: QBE): Both stocks demonstrate that even in volatile markets, quality large-cap businesses maintain steady trends, offering balance for those managing diversified portfolios.

How to Manage Your Portfolio During Market Volatility

Analysts from Wealth Within emphasise that managing pullbacks is about preparation, not panic. Investors often sell too early from fear or hold too long out of hope, turning profitable positions into losses.

Having a structured plan complete with entry, stop-loss, and exit rules lets you act with confidence, even when markets get choppy. Inexperienced traders typically rely on news or online tips, but in reality, the market itself is always the best indicator.

Studying through one of Wealth Within’s Trading courses helps you gain a deeper understanding of market psychology, enabling more systematic and less emotional decision-making.

Advanced Insights for Experienced Traders

For those already trading confidently, Wealth Within’s Advanced stock trading course offers deeper techniques including time analysis, Elliott Wave theory, and portfolio construction.

These methods allow traders to time market moves with even greater precision, predict reversals ahead of others, and manage multi-asset trading strategies across different timeframes. Graduates consistently note substantial performance improvements once they learn to integrate these advanced tools.

Market Themes: Resources, Critical Minerals and AI

Beyond individual stock opportunities, global events continue to shape Australia’s investment landscape.

The show’s analysts recently discussed China and the US easing trade restrictions around critical minerals, a move that could position Australia as a key global supplier. Companies engaged in gallium, germanium, and antimony mining or refining may see more investor attention as nations diversify away from Chinese supply chains.

It’s a reminder that geopolitical and macroeconomic forces often trigger sector-wide shifts. The key for traders is not predicting headlines, but spotting how the market reacts to them, which are skills honed through structured share trading education.

Avoiding One of the Most Common Trader Mistakes

As discussed in the transcript, many investors hold onto losing positions purely out of hope, waiting for a rebound that may never come. Without a tested trading plan, what starts as a “temporary dip” can turn into a long-term loss.

Wealth Within’s Diploma of Share Trading and Investment teaches traders to remove emotion from the process, focus on high-quality setups, and cut losses early while letting profits run, which is an essential mindset for sustained success.

Final Takeaway: Education Is Your Best Investment

The lesson from the latest Hot Stock Tips videos episode is clear: understanding your stocks, having strong rules, and interpreting charts are far more valuable than guesswork or reacting to media noise.

Pullbacks happen to every trader, but those with education and structure treat them as opportunities, not threats.

If you’re ready to take control of your portfolio, gain professional-level skills, and learn how to trade the ASX confidently, find out more About Wealth Within: Australia’s most awarded and accredited trading educator.