ASX Gold Stocks With Huge Upside Just Triggered - Buy Now?

By Dale Gillham, Janine Cox and Fil Tortevski

Gold has hit record highs in October 2025, reigniting investor interest across the Australian market. While the headlines focus on the major miners, several smaller ASX-listed gold producers are quietly taking off and few investors have noticed.

At Wealth Within, with over two decades of expertise and nationally accredited share trading education, our analysts are seeing technical and fundamental signals that point to further upside in select gold stocks. Whether you’re refining your portfolio or positioning for the next leg up in commodities, now may be the perfect time to learn how to identify and trade these emerging opportunities.

Why Gold’s Rally May Be Far From Over

The latest surge in gold prices has been fuelled by several macroeconomic drivers:

- Central bank buying: Sovereign reserves continue to stockpile gold at record rates.

- Falling interest rates: Global monetary easing cycles are shifting money away from cash into hard assets.

- Geopolitical uncertainty: From Middle East tensions to US political risk, investors are turning to gold as a safe haven.

These forces are aligning to support gold’s long-term growth trajectory. “When the world looks uncertain, capital flows to security and that means gold,” says Janine Cox, senior analyst at Wealth Within.

The Smart Money is Moving into Smaller Producers

While established giants like Newmont and Northern Star have already rallied, the real growth potential lies in mid-tier and small-scale producers. These second-tier miners typically benefit most from rising prices because their higher production costs turn into bigger margins as gold prices gain.

As Wealth Within’s analyst Fil Tortevski notes, “We’re seeing smaller ASX gold companies with margins up nearly 40%, double their 10-year average. Once institutional investors start rotating into these stocks, their re-ratings can be dramatic.”

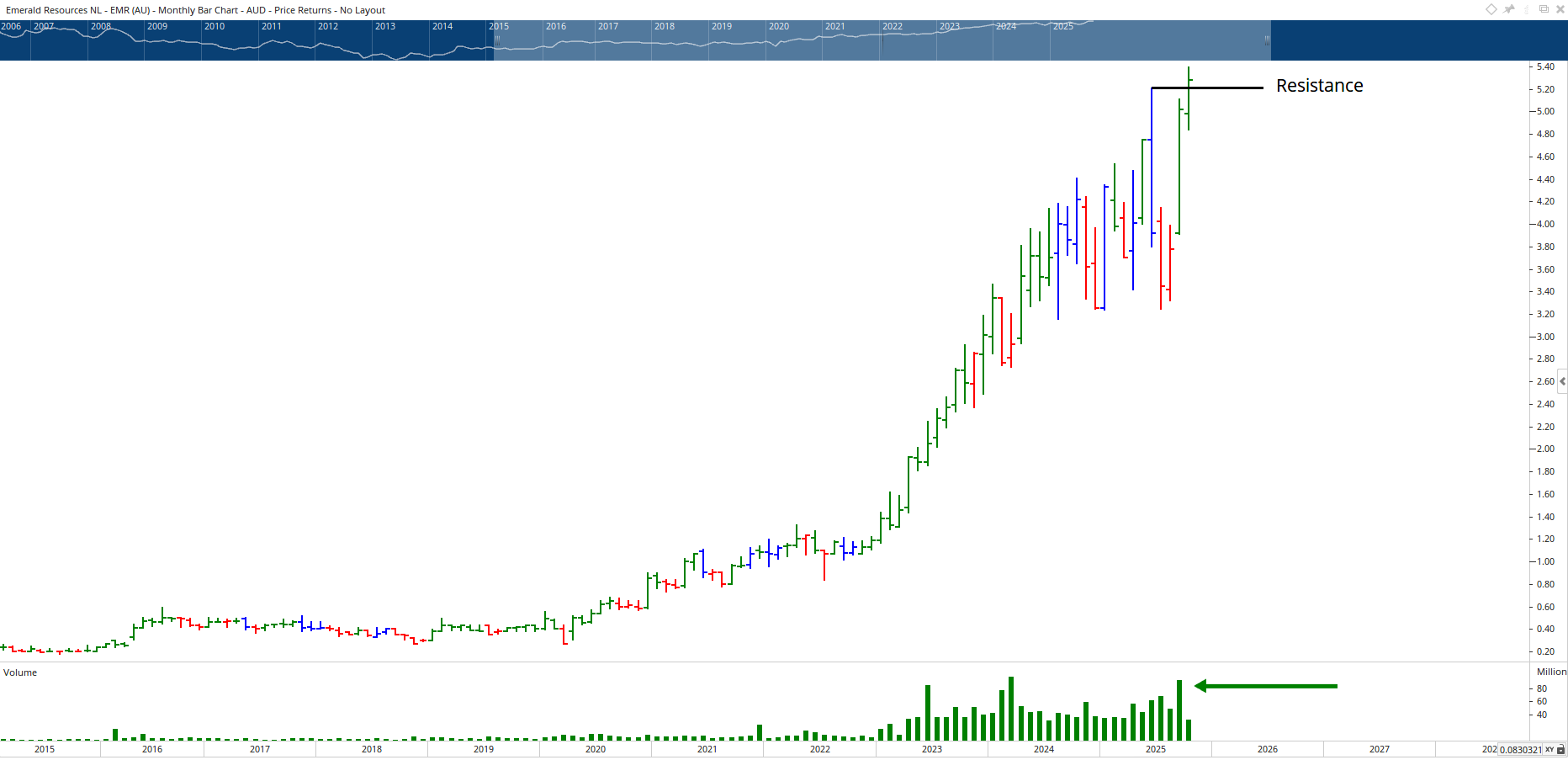

Emerald Resources (ASX: EMR): A Hidden Gold Leader

Emerald Resources is winning attention for its strong performance and low‑cost mine in Cambodia. The company is consistently profitable and, after years of consolidation, is breaking through to new all-time highs near $5.

Technical setup:

- The stock recently broke out from long-term resistance.

- Volume confirms strong institutional buying.

- Short-term pullbacks may create valuable entry opportunities for those following robust risk management rules.

As Wealth Within’s analyst Janine Cox observes, “Technically it’s done everything right - stabilised, consolidated, then launched. Momentum is on its side.”

Horizon Minerals (ASX: HRZ): Quiet Reversal in Play

Operating out of Kalgoorlie, Horizon Minerals is a small producer that hasn’t yet made the big headlines but the recent figures tell an encouraging story. After bottoming out in late 2023, Horizon has been steadily climbing, backed by increasing trading volume.

Currently testing resistance around 1 cent, the setup suggests early accumulation, with the potential for a breakout. For active traders, Horizon offers volatility and movement, this is ideal for learning timing and entry strategy through structured Trading courses.

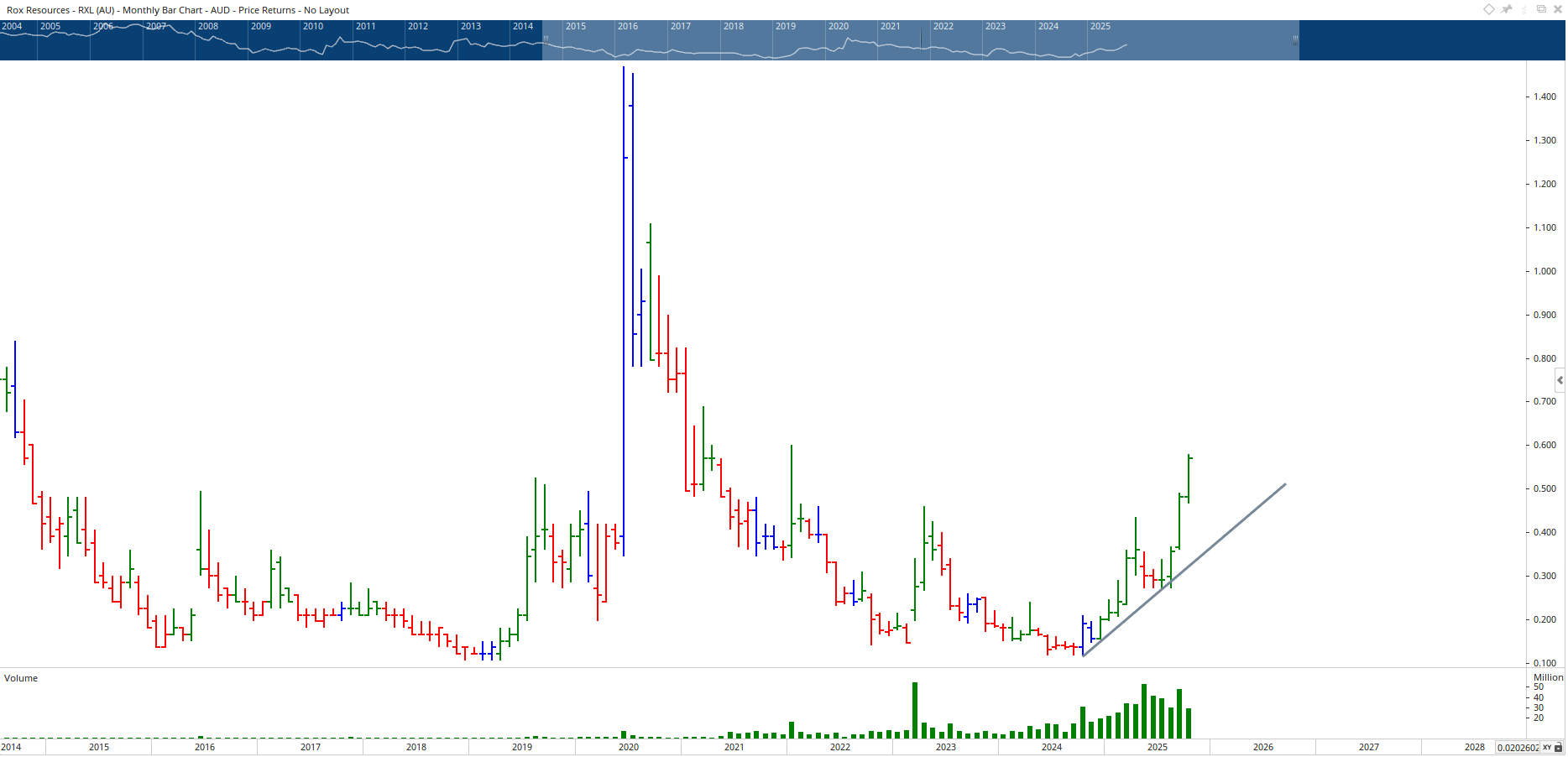

Rox Resources (ASX: RXL): Early Production Stage, Big Potential

Rox Resources operates at the early‑production stage and recently broke out of a multi‑month consolidation pattern. Currently around 55 cents, the stock has a strong trend structure and could mirror previous multi‑hundred‑per cent moves if the gold rally continues.

Key takeaway: These early-stage gold producers are volatile. Correct timing and entry discipline, not “buy and hope”, determine consistent profitability. That’s where training such as the Short Course in Share Trading helps investors establish effective strategy and rules.

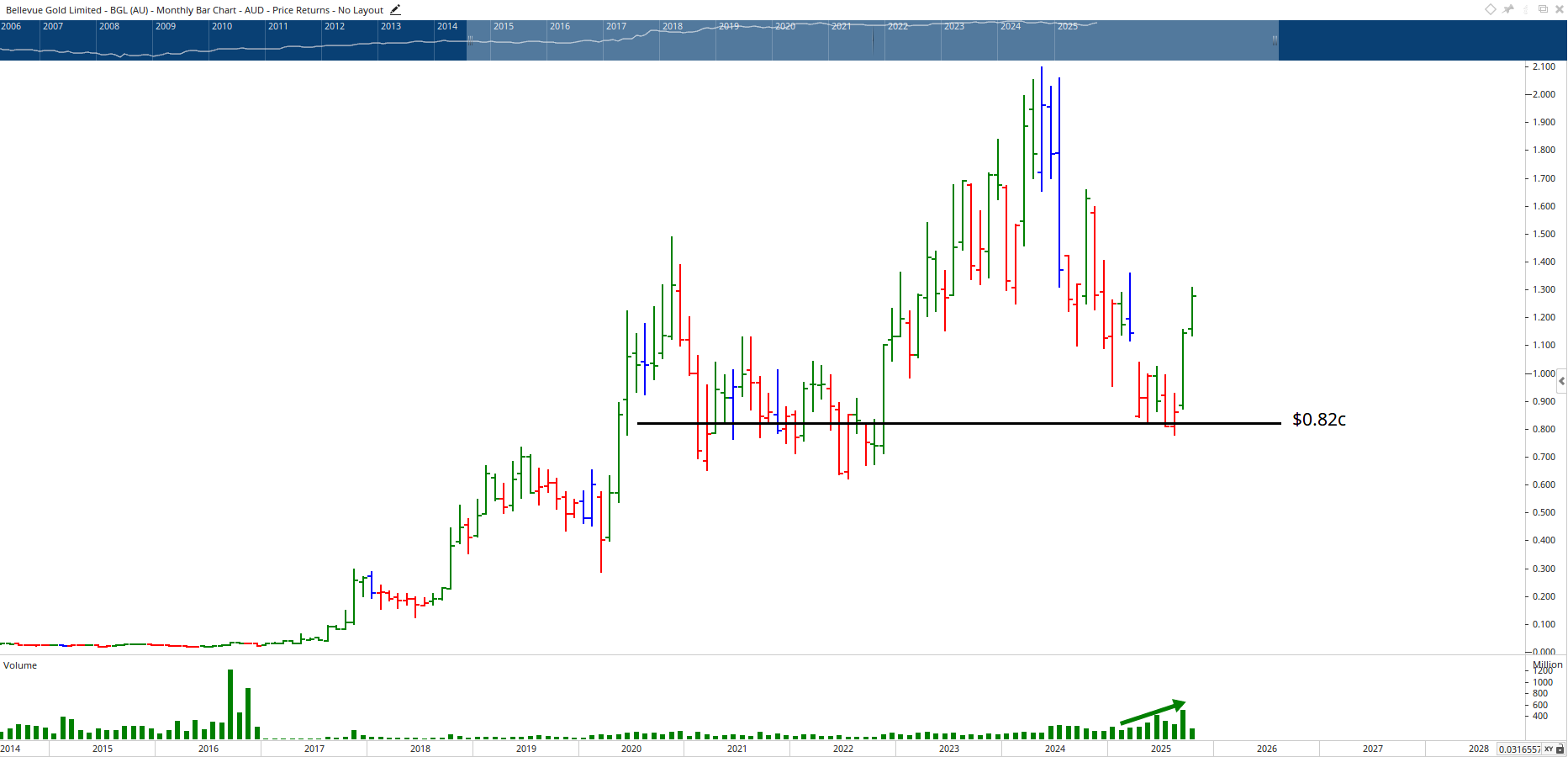

Bellevue Gold (ASX: BGL): The Institutional Favourite

Bellevue Gold is already an established Western Australian producer but still has further room to grow. It recently bounced strongly from its $0.82 support zone, a key historical level and is gaining strong volume typical of early institutional accumulation.

Technical signals suggest the beginning of a major new uptrend. As Fil explains, “When stocks break key resistance with growing volume, that’s often the start of the next expansion phase.”

Short-Term or Long-Term Trades? Understanding Gold’s Cycles

Gold producers often trade in cyclical patterns, where price surges are followed by healthy pullbacks. Learning to identify where we are in the cycle is fundamental to increasing profit probability.

These are not long-term hold-and-forget plays, but short-to-medium-term opportunities driven by price momentum and volume signals. Traders with structured plans and proven exit rules consistently outperform those chasing hype or FOMO.

If you’re new to technical analysis or want to manage risk better during these cycles, start with a formal Diploma of Share Trading and Investment - Australia’s only government-accredited trading qualification.

Bonus Pick: Paladin Energy (ASX: PDN): The Silent Winner

Although not a gold stock, Paladin Energy deserves an honourable mention for its technical strength and massive trading volume. Its uranium production in Namibia has reached record highs since restarting operations, positioning it for further gains in the clean-energy narrative.

Fil comments, “Production growth, clean balance sheet, and volume breakout – that’s a textbook setup. Paladin’s technical structure is exactly what you want to master when learning price behaviour.”

When to Buy and When to Sell - The Real Edge

Many traders know how to buy, yet few know when to sell. As Dale Gillham, founder of Wealth Within, explains, “You don’t make money until you sell, understanding this is the secret to bankable profits.”

Education is what separates consistent performers from speculators. Through our Advanced stock trading course, traders learn powerful technical tools such as Elliott Wave and time analysis, enabling precision entries and exits even in volatile markets.

Final Thoughts: Position Ahead of the Market

From Emerald Resources to Horizon Minerals, Australia’s smaller gold producers are showing strong technical signals and supportive fundamentals. Gold’s bull market still looks intact, but success will hinge on two factors: strategy and timing.

If you’re ready to take control of your own portfolio, explore Australia’s most trusted Share trading education and learn the same professional techniques our Wealth Within analysts use every day.

For weekly market insights, chart reviews, and forecasts on ASX stocks, visit our Hot Stock Tips videos, ASX video library. To learn more about our legacy of empowering self‑directed investors, visit About Wealth Within.

Important information

This content is provided for educational purposes only and is not personal financial advice. It does not take into account your objectives, financial situation or needs. Consider seeking advice from a licensed professional before acting on this information. Markets involve risk; past performance is not a reliable indicator of future performance.