ASX Tech Stocks: Are Australia’s Cheapest Tech Shares About to Rebound?

By Dale Gillham, Janine Cox and Fil Tortevski

After a tough few years of selling pressure, Australian tech stocks have officially become some of the cheapest in the world. But the question on every investor’s mind is whether this marks the turning point for the sector, or whether there’s more pain to come.

In a recent discussion on The Australian Stock Market Show, Wealth Within’s analysts Dale Gilham, Janine Cox, and Filip Tortevski explored the outlook for ASX technology stocks and shared their professional perspective on which opportunities could lead the next rally.

Why the ASX Tech Sector Has Been Oversold

Compared to global markets, Australia’s tech sector represents a much smaller slice of the market, around 3 to 5 per cent of the ASX, compared to more than 30 per cent in the S&P 500. This difference means local tech companies often experience sharper swings and higher volatility when sentiment turns negative.

According to Wealth Within’s analysts, the Australian information technology index has fallen roughly 45 per cent from its highs. By historical standards, that drop brings the sector into an area where a rebound has often begun in previous cycles. Historically, 40–50 per cent corrections have frequently signalled that selling may be exhausted, paving the way for new opportunities.

Despite short-term weakness, analysts agree that high-quality, locally listed companies could have enormous potential, particularly as global market sentiment improves.

How Global Tech Trends Are Shaping Local Opportunities

The team highlighted that while global giants like Apple, Microsoft, and NVIDIA dominate news headlines, artificial intelligence (AI) and data infrastructure innovation could level the playing field.

AI is making advanced technologies more accessible, potentially helping emerging companies grow faster than before.

When global momentum returns, Australian tech stocks, now trading near historically low valuations, may see stronger relative growth because they are starting from a lower base.

Expert Insights on Key Australian Tech Stocks

The discussion looked at several prominent ASX-listed technology and data infrastructure stocks that could gather strength when the rally begins.

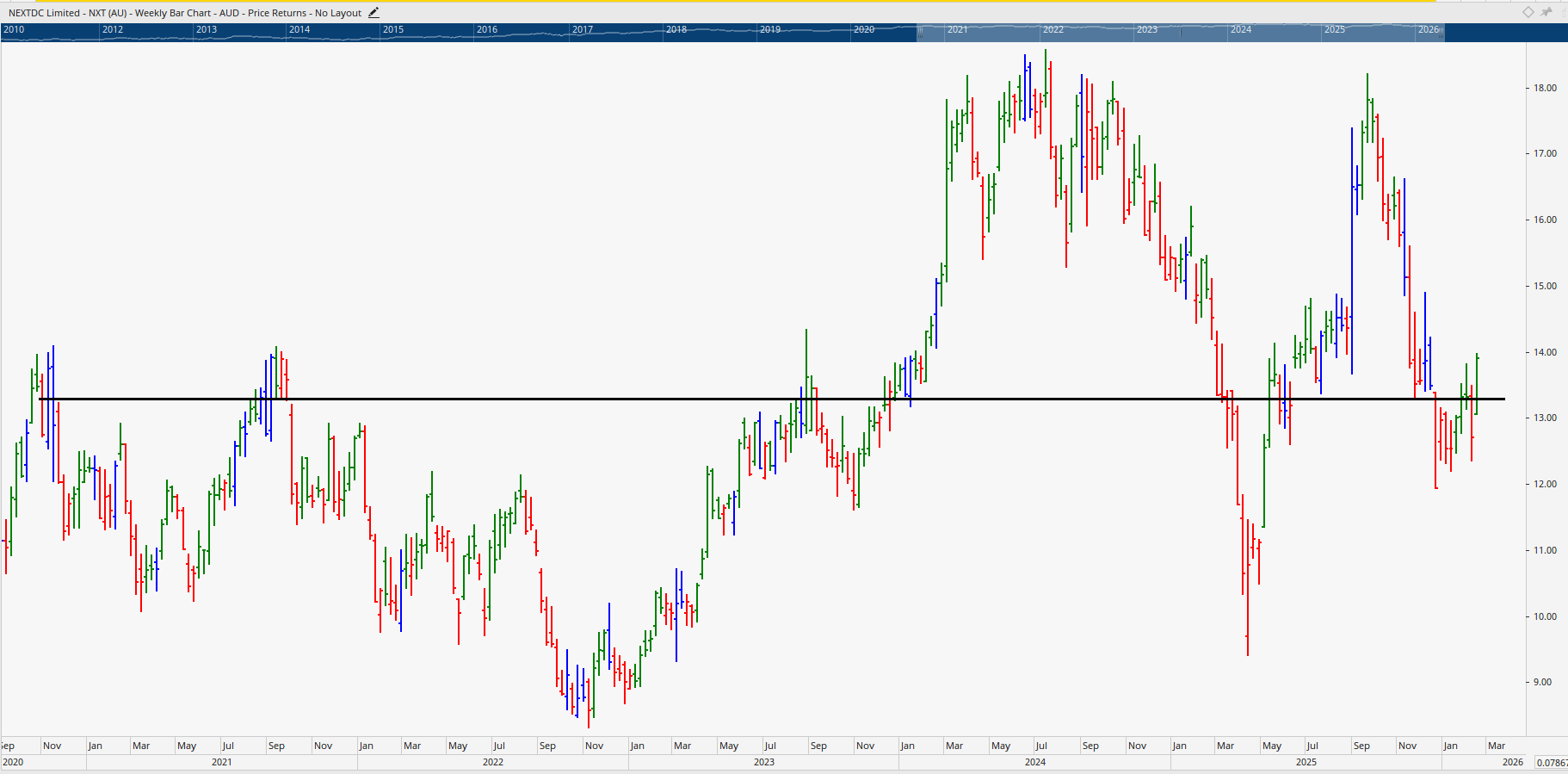

One such company was NextDC, a data-centre operator that designs and builds large-scale facilities supporting AI and enterprise computing. While still consolidating after a major pullback, analysts describe it as a potential opportunity once clear signs of turning appear.

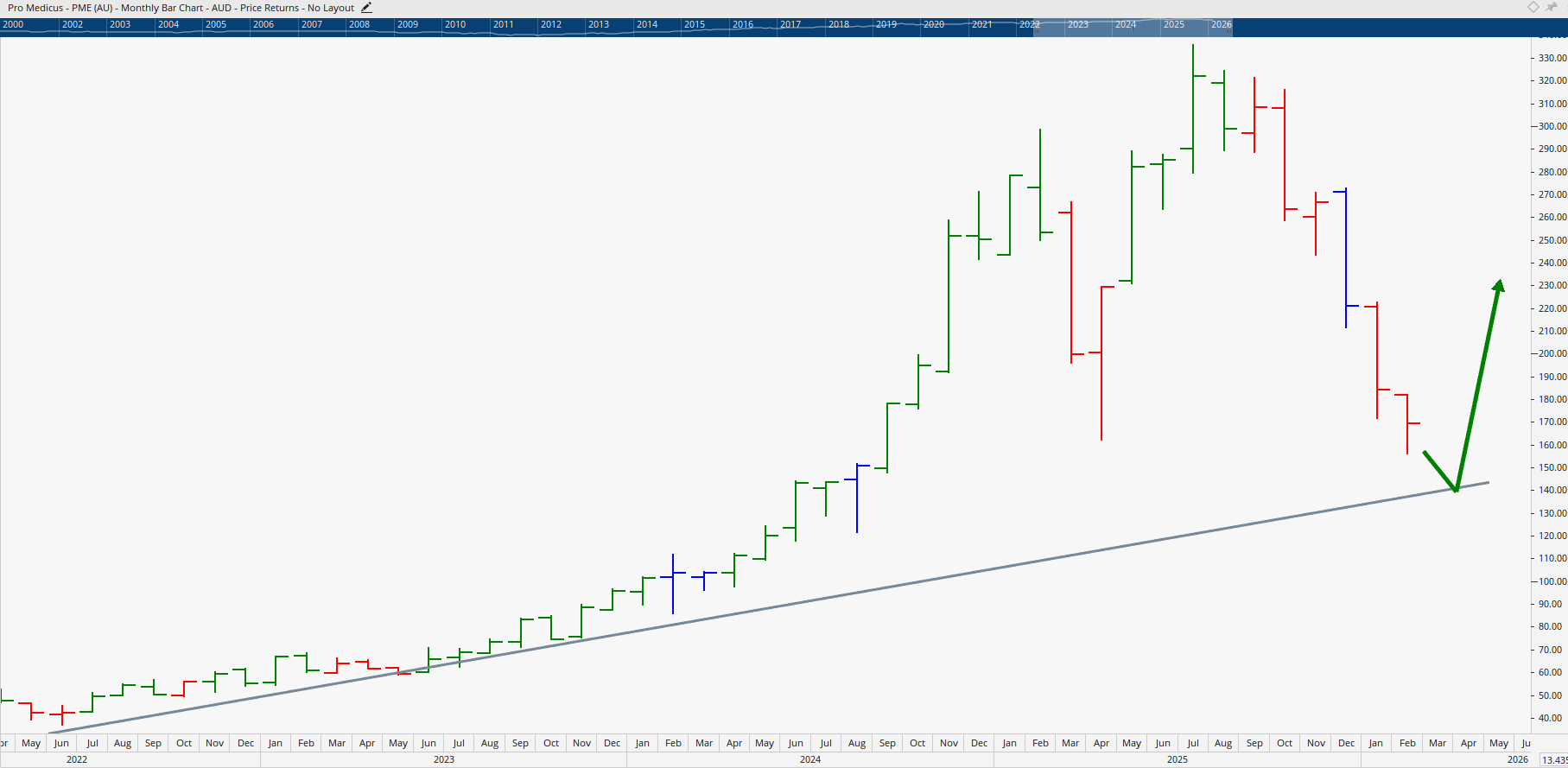

Other local tech names showing promise included Pro Medicus, which delivers medical imaging technology, and Weebit Nano, a semiconductor innovator focused on advanced memory technology. These stocks, while volatile, may represent the new growth frontier for investors who understand price confirmation and risk management.

If you’d like to develop the skills to analyse stocks like these yourself, consider exploring Wealth Within’s range of accredited Trading courses, designed for all experience levels.

What the Charts Reveal About Market Psychology

Throughout the program, the analysts reinforced a principle that every trader should understand: the market tells its story through price action. Long-term trendlines and support levels reveal investor psychology and help identify turning points before they’re confirmed by the crowd.

As Dale Gilham explained, successful traders operate with patience and strategy rather than emotion. This approach allows them to buy quality stocks when others are fearful, and exit before sentiment collapses, an approach built into the nationally recognised Diploma of Share Trading and Investment.

Hot Stocks That Could Drive the Next Tech Recovery

Among the stocks discussed in this special episode of The Australian Stock Market Show were:

- NextDC (NXT) – Showing signs of consolidation with potential upside when demand for cloud and data services expands again.

- Pro Medicus (PME) – Recent corrections may represent renewed buying zones for long-term portfolios as AI-driven medical imaging grows.

- Megaport (MP1) – A volatile performer that could offer sharp gains once a new trend confirms.

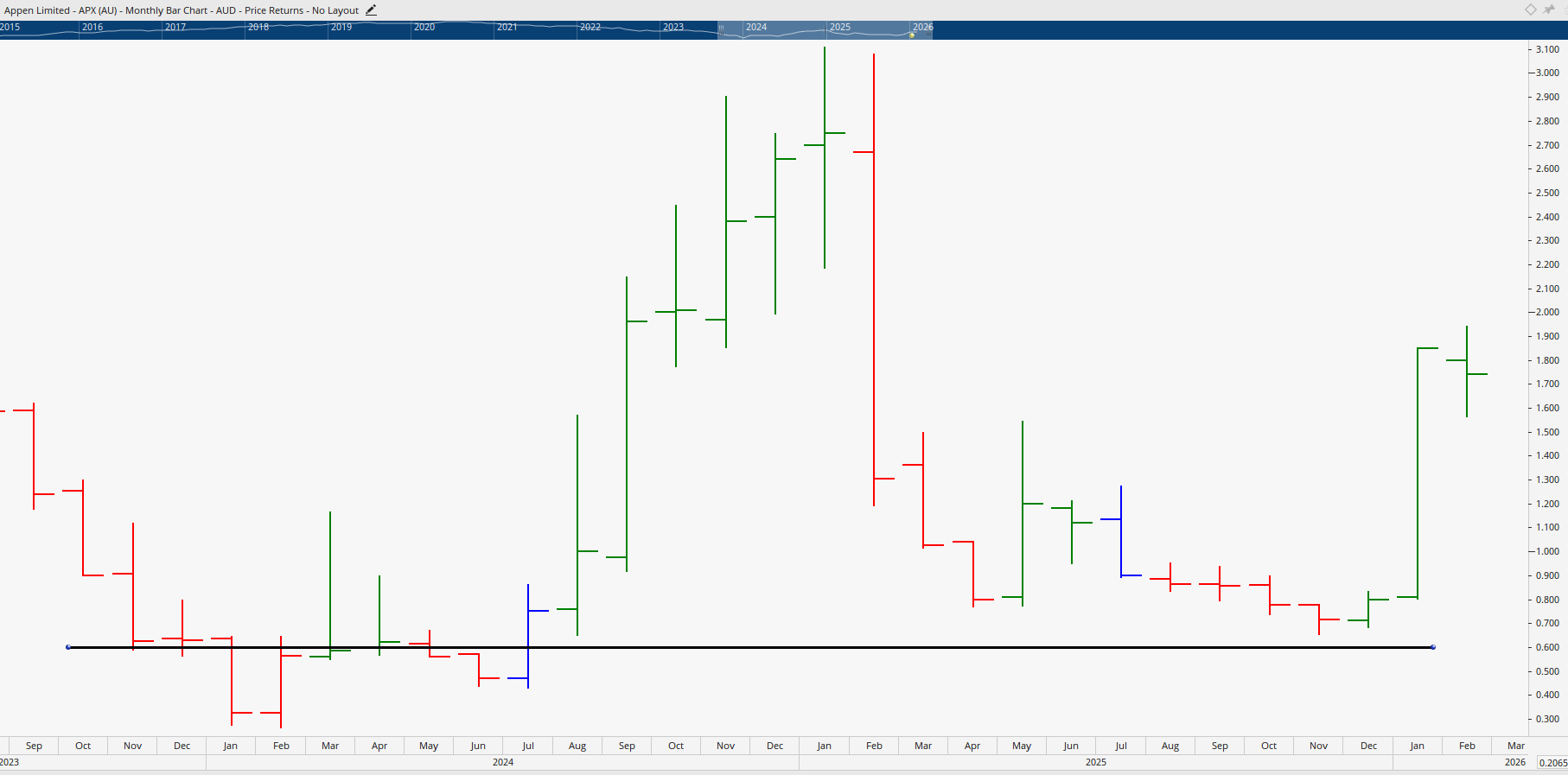

- Appen (APX) – Despite recent struggles, analysts believe a turnaround could present a speculative opportunity for skilled traders.

For those interested in watching the full analyst discussions and updates on these shares, explore our Hot Stock Tips videos and ASX video library.

Why Education Is the Edge for Every Investor

While investors often ask “what stock should I buy today,” the Wealth Within team reminds viewers that the more important question is how to buy and manage risk. The ability to interpret market movements is what separates consistent traders from gamblers.

Wealth Within’s educational pathway begins with the Short Course in Share Trading, which is perfect for beginners who want practical knowledge. The pathway extends to the Advanced stock trading course for those seeking professional-level strategy and precision timing. For an accessible introduction, beginners can also explore the Stock Market for Beginners guide, a great place to start your journey.

Final Take: Are ASX Tech Stocks Ready to Lead Again?

After falling to some of their lowest price levels in years, Australian tech shares could be on the verge of a meaningful rebound. While timing any sector’s recovery is never exact, the evidence suggests the risk-reward profile is improving, particularly for well-managed companies in the data, AI, and infrastructure segments.

For investors ready to prepare for that opportunity, structured education and data-driven skillsets remain the most valuable investment they can make.

To learn more about Wealth Within’s values, experience, and 20-year legacy of empowering individuals to achieve financial independence, visit About Wealth Within or contact us today.