Australia’s Cheapest Growth Stocks for 2026: Analyst Picks and Trading Strategies

By Janine Cox, Fil Tortevski and Pedro Banales

As investors prepare for 2026, market analysts from Wealth Within, including senior analyst Janine Cox and Filip Tortevski, and market strategist Pedro Banales, have shared their insights into which ASX stocks could become the next major winners.

From undervalued healthcare stocks to resource giants and tech opportunities, their analysis highlights the importance of preparation, technical analysis, and strategy for those serious about wealth creation in the Australian stock market.

Market Overview: Where Growth Could Come From in 2026

As the year draws to a close, Wealth Within’s analysts say December often marks the start of rallies across a number of sectors. Senior analyst Janine Cox expects 2026 to bring a broader market recovery, with several sectors poised for resurgence.

“Healthcare, energy, and materials have been lagging, but we’re now seeing a boom forming and there’s more to come,” Janine explained. “Utilities should perform well too, making 2026 a year of broad-based growth.”

Pedro Banales added that resources, minerals, and rare earths would likely remain the strongest performers:

“We’re going to need a lot more energy if the AI expansion continues. Technology has been heavily sold off, but that might actually make it the dark horse sector to watch in 2026.”

If you’re new to investing and want to understand how sector rotation affects stock performance, start with this guide to the Stock market for beginners.

ASX Stocks Set to Outperform in 2026

CSL Limited

Healthcare has underperformed through 2025, but CSL, one of Australia’s biggest biotechs, is showing a clear opportunity for a rebound. The Wealth Within team noted that the stock has declined by more than 50%, reaching strong technical support levels.

“It’s a great setup for short- to medium-term trading,” Janine said. “Even when investing through your super fund, you need proper rules and clear trend lines. Consistency and education make the difference.”

For traders who want to learn how to read price charts and identify smart entry points, Wealth Within offers professional Trading courses designed to help you learn to trade shares with confidence and discipline.

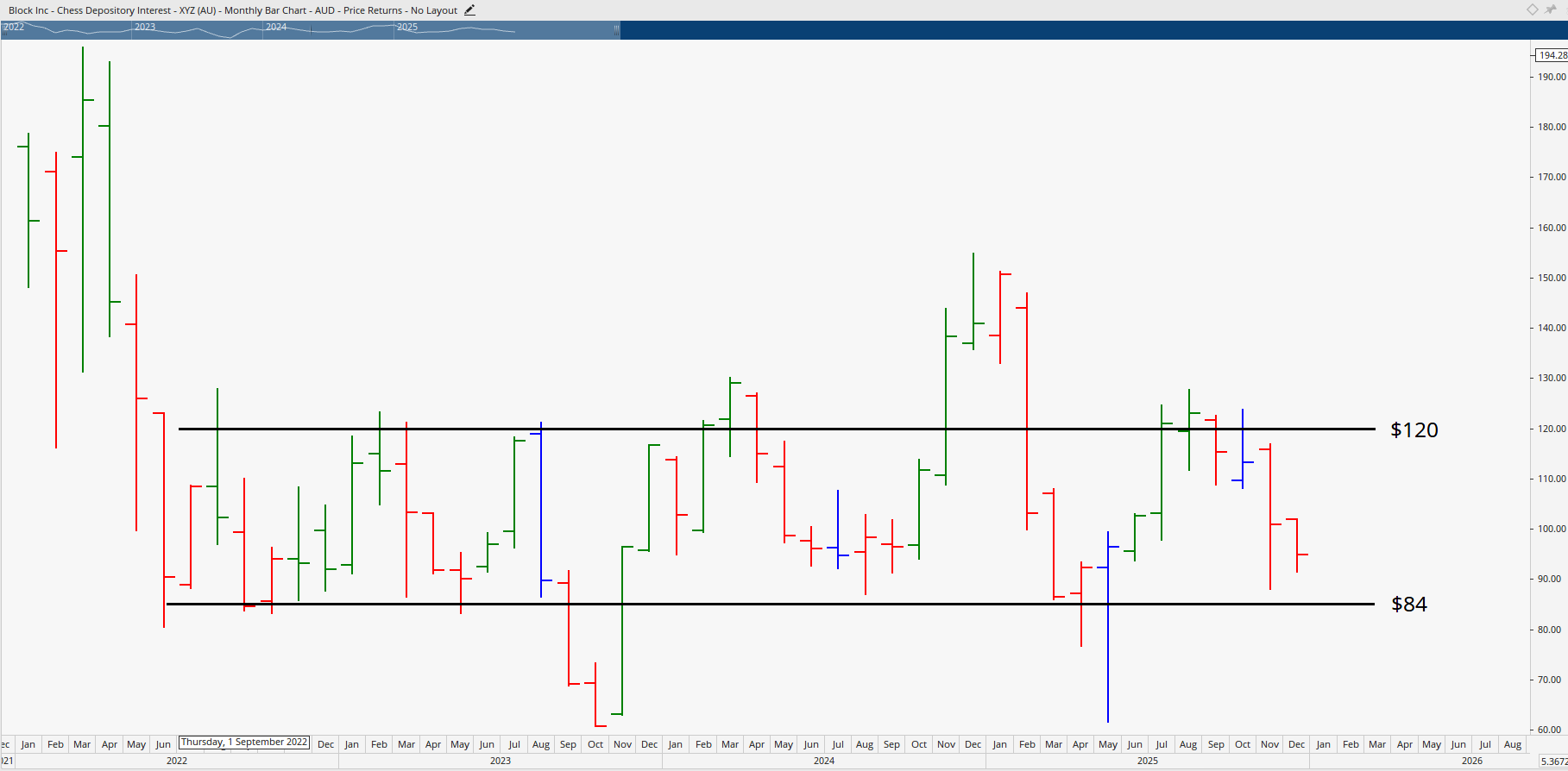

Block Inc

Despite being a major fintech, Block Inc has disappointed investors since listing, trading sideways for almost three years. But Pedro Banales believes the company is now near an important base.

He points out strong support near $84 and resistance around $120, noting that the P/E ratio below 10 makes it attractive to value investors.

“For 2026, this could be one to watch for a reversal,” Pedro said. “But as we always teach in our courses — trade on confirmation, not speculation.”

Pedro’s emphasis on using a proven, repeatable process reflects the techniques taught through the Diploma of Share Trading and Investment, which is Australia’s only government-accredited share trading education program.

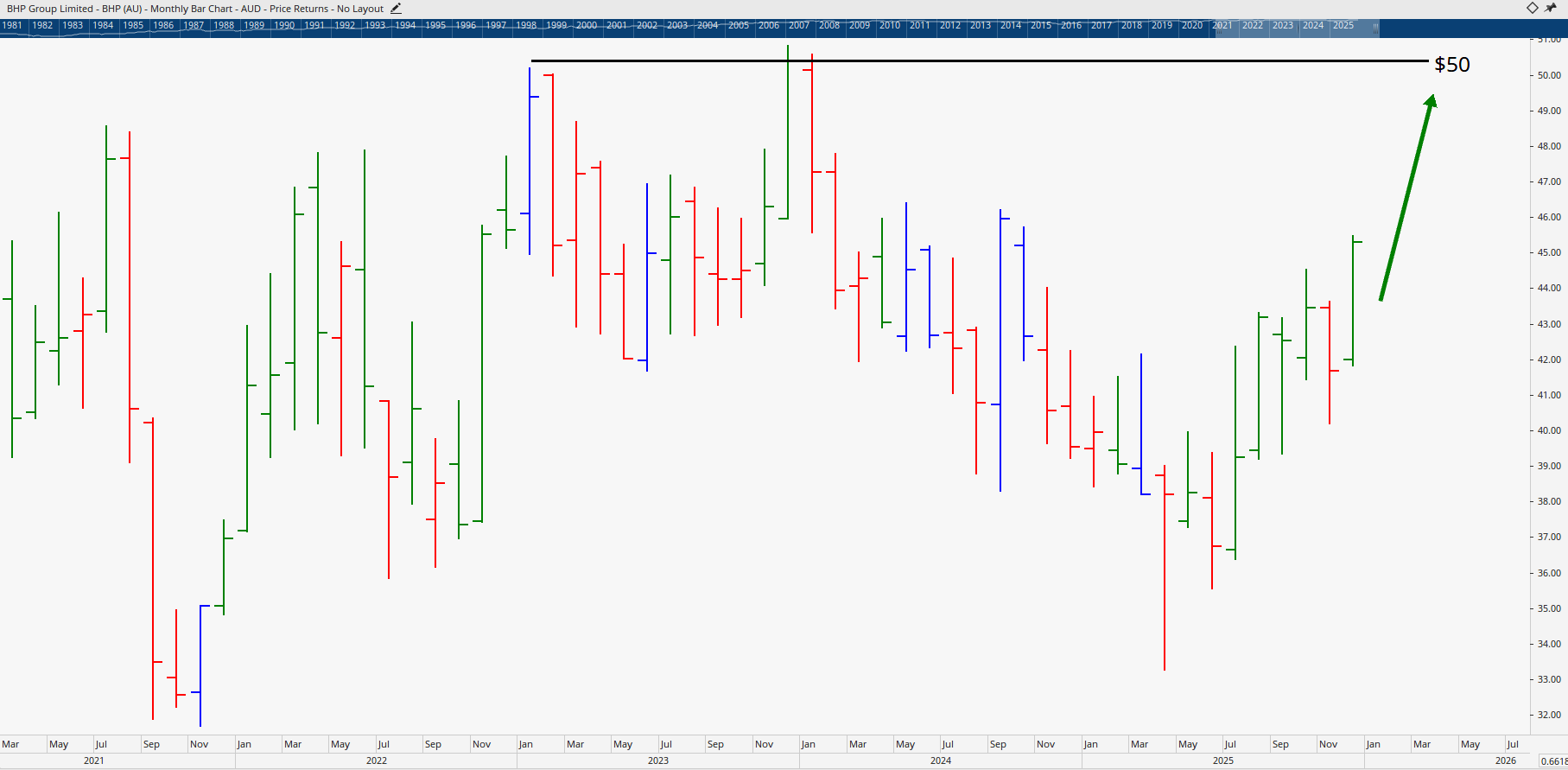

BHP Group

Mining giant BHP has begun turning around after a tough 12 months marred by weak commodity prices and headlines out of China. Price action on the weekly charts shows renewed strength, breaking out of a long-term downtrend with strong momentum.

“BHP has clearly turned a corner,” Pedro confirmed. “We’re expecting it to reach the $50 to $53 range in 2026, supported by copper demand and its diversified operations.”

The stock’s uniform trend and strong fundamentals make it a potential long-term buy for super funds and self-managed portfolios.

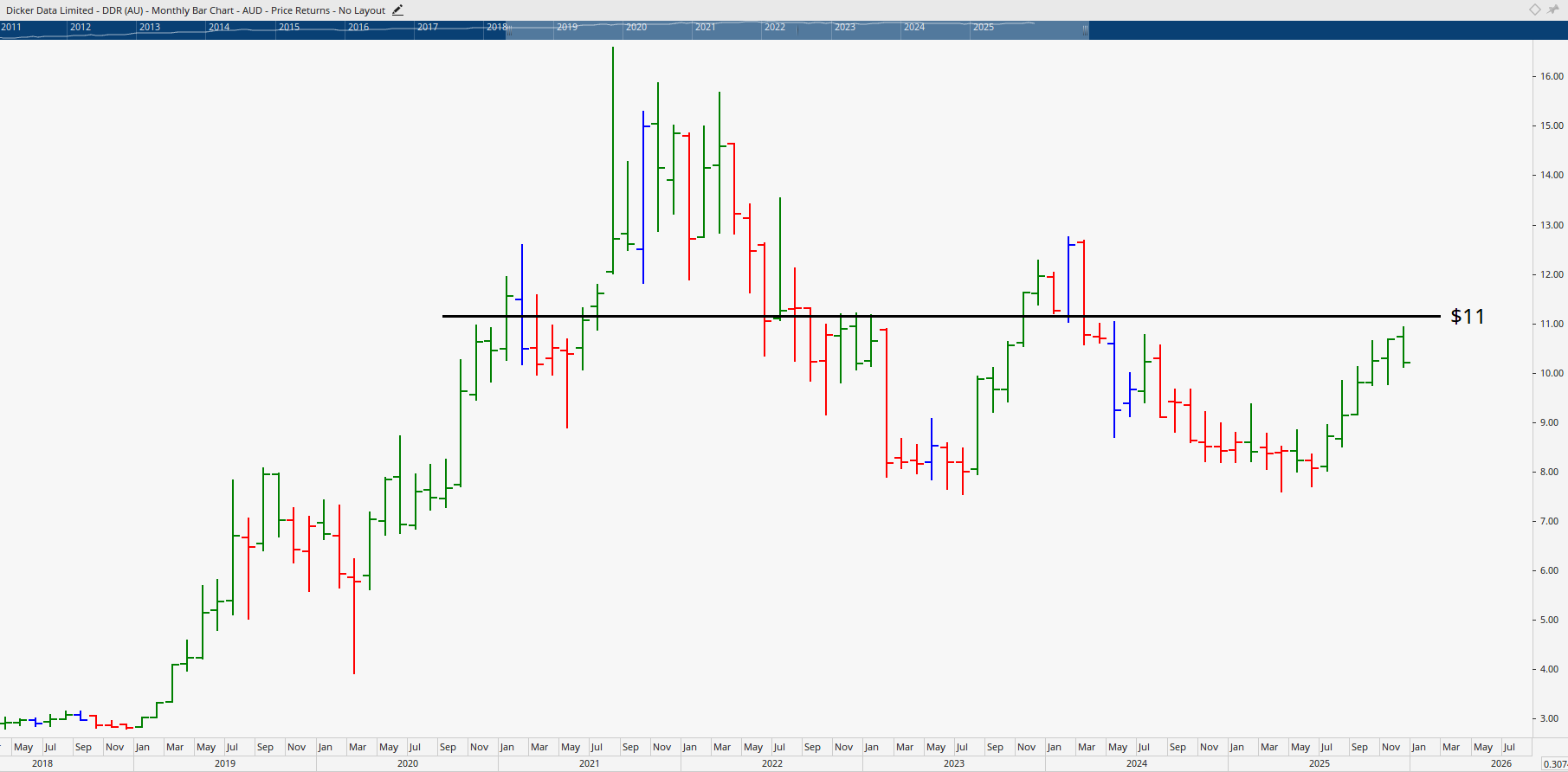

Dicker Data

One of the standout tech stocks heading into 2026 is Dicker Data, according to Pedro. Despite the broader tech sector being down 30%, Dicker Data has held steady and even powered higher, proving its resilience.

“On the charts, we’re seeing classic strength with consistent trend confirmation. If it breaks through $11, it could be one of the best-performing tech stocks of the year.”

Tech investors looking to refine strategy and timing can deepen their technical understanding through the Advanced stock trading course, which helps experienced traders master advanced tools like Elliott Wave and time analysis.

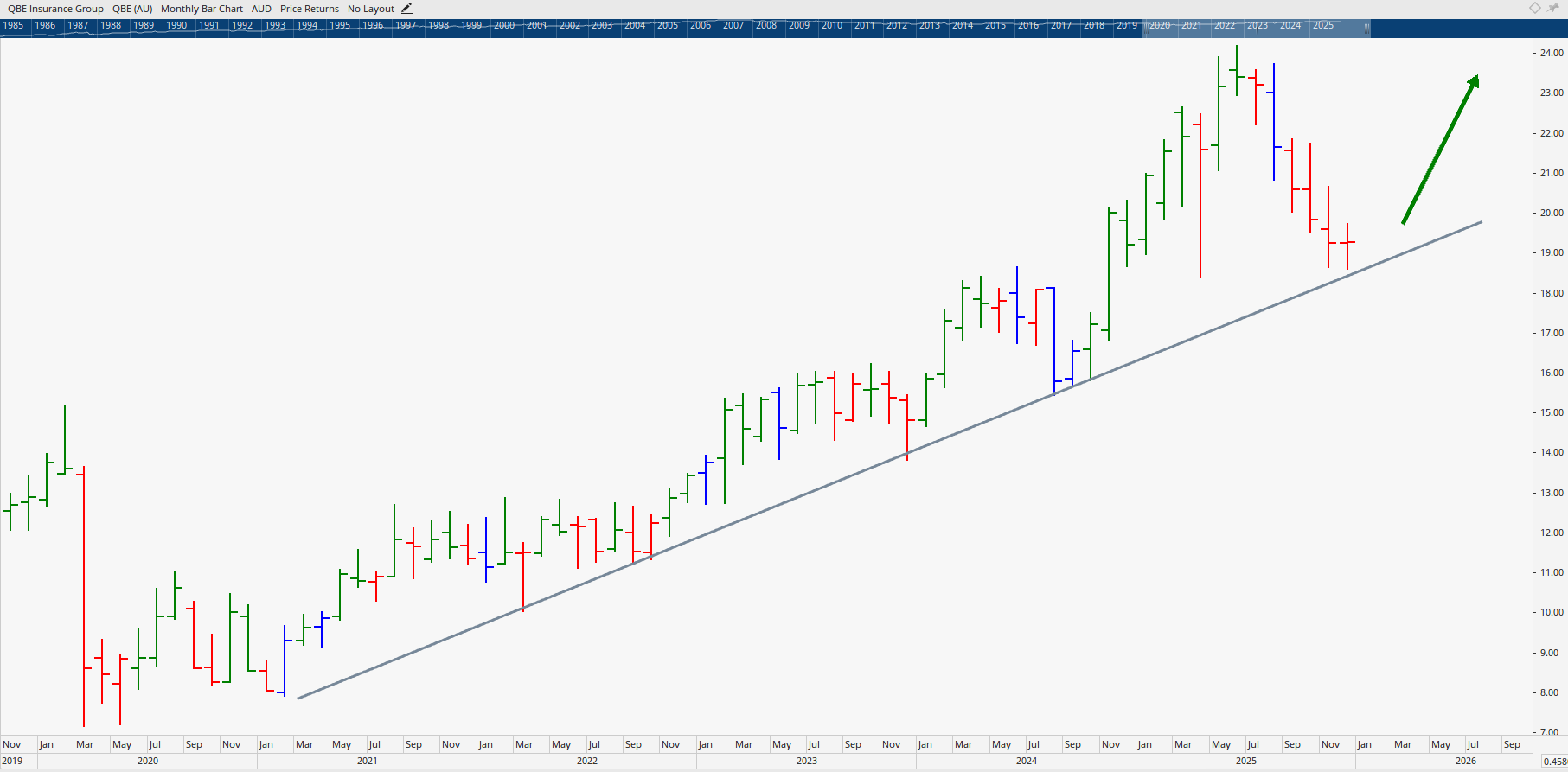

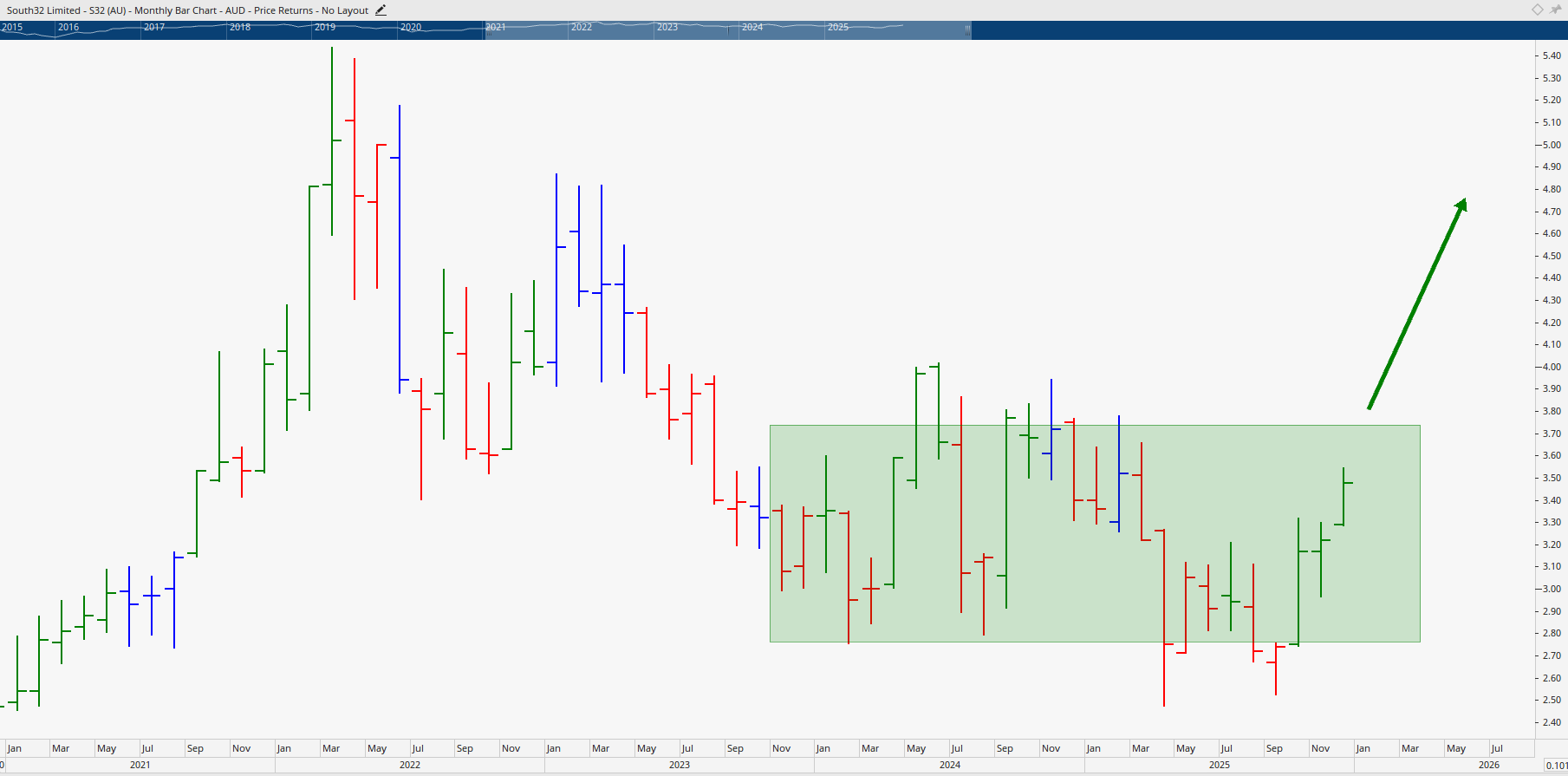

QBE Insurance and South32

Janine Cox highlighted QBE Insurance as a traditional financial play with a bright 2026 outlook, supported by stable interest rates:

“With a long history of recovery cycles, QBE is showing the classic ‘bouncing ball’ pattern — finding support and holding momentum well.”

Meanwhile, South32, which has long traded horizontally, may finally break out of its range. Janine notes that its current structure could mark the end of its consolidation phase, setting the stage for a strong recovery.

Both of these stocks share one key feature: they reward patient, educated investors who follow structured trading rules and risk management frameworks.

A Lesson for Traders: Volatility and Education Matter

When asked about volatility heading into 2026, Pedro explained that markets are unlikely to calm. Reporting seasons in February and August will remain highly active, a major risk for traders using emotion-driven decisions.

“Many beginners don’t know what kind of volatility they’re trading. The key is to identify the right kind — not too much, not too little — and that comes with experience and education.”

Whether you’re learning the basics or looking to enhance your mastery, Wealth Within offers nationally recognised pathways to success. from the beginner-level Short Course in Share Trading to the advanced analytic rigor of the Diploma of Share Trading and Investment.

To learn more about Australia’s most respected share trading educator, visit our About Wealth Within page. Discover how you can develop long-term profitability and confidence in every market condition.