The New Energy Boom: 8 ASX Gas Stocks to Watch as Natural Gas Surges

By Janine Cox and Fil Tortevski

The conversation in global energy markets is shifting fast. While oil continues to dominate the headlines, the real momentum appears to be building in natural gas. In a recent episode of Wealth Within’s Australian Stock Market Show, analysts Filip Tortevski, Janine Cox, and Zoran Kresovic broke down the emerging opportunities in the gas sector and revealed which ASX-listed companies might be the biggest beneficiaries of this quiet but powerful shift.

If you’d like to develop the expertise to spot such opportunities yourself, explore our Trading courses to gain the skills needed to trade confidently across all market sectors.

Why Natural Gas is Rising in 2026

While the world talks about oil supply concerns, countries like Japan, India, and Malaysia are quietly signing long-term liquified natural gas (LNG) import contracts that could redefine the energy landscape. Forecasts show that Asia’s LNG imports, particularly from China and India, are set to rise by 4%-7% in 2026, while Europe is expected to reachrecord import levels.

Janine Cox explained that the cyclical nature of commodities often sees gas trail oil before major rallies occur. “We’ve seen gold move, then silver, then oil... gas often follows,” she said. The stabilising global energy transition and rising industrial demand for cleaner fuels and power-hungry technologies further reinforce the sector’s long-term potential.

Risks in the LNG Story

Zoran Kresovic pointed out that while fundamentals look strong, investors should be aware of short-term risks such as oversupply and volatility in the U.S. market. Moreover, geopolitical tensions, from unrest in the Middle East to global trade disputes, could create unexpected swings in price.

However, both analysts agreed that the shift toward diversified energy sourcing and rising demand from tech-driven economies creates a compelling medium-term narrative for gas.

Eight ASX Gas Stocks to Watch in 2026

Below are the standout companies Wealth Within analysts discussed, along with key insights into their setup and potential market positioning.

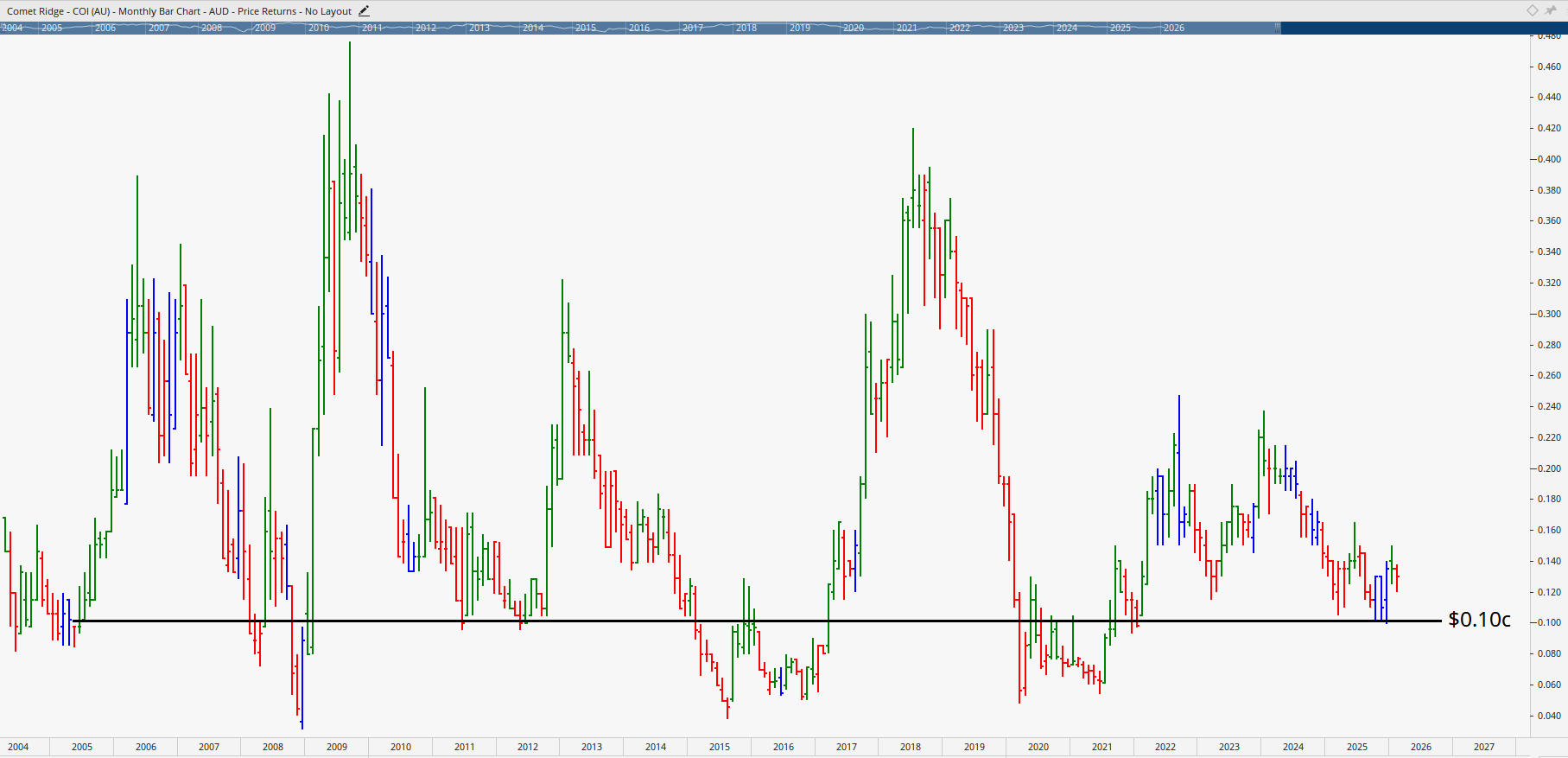

1. Comet Ridge (ASX: COI)

Comet Ridge focuses on natural gas exploration and production around Gladstone. The chart shows a consolidation pattern reminiscent of setups in 2016 and 2021, which were historically followed by strong price moves. Janine noted that while illiquid, “it may be forming a base for a potential breakout around the 10–11 cent level,” making it one to keep an eye on for active traders.

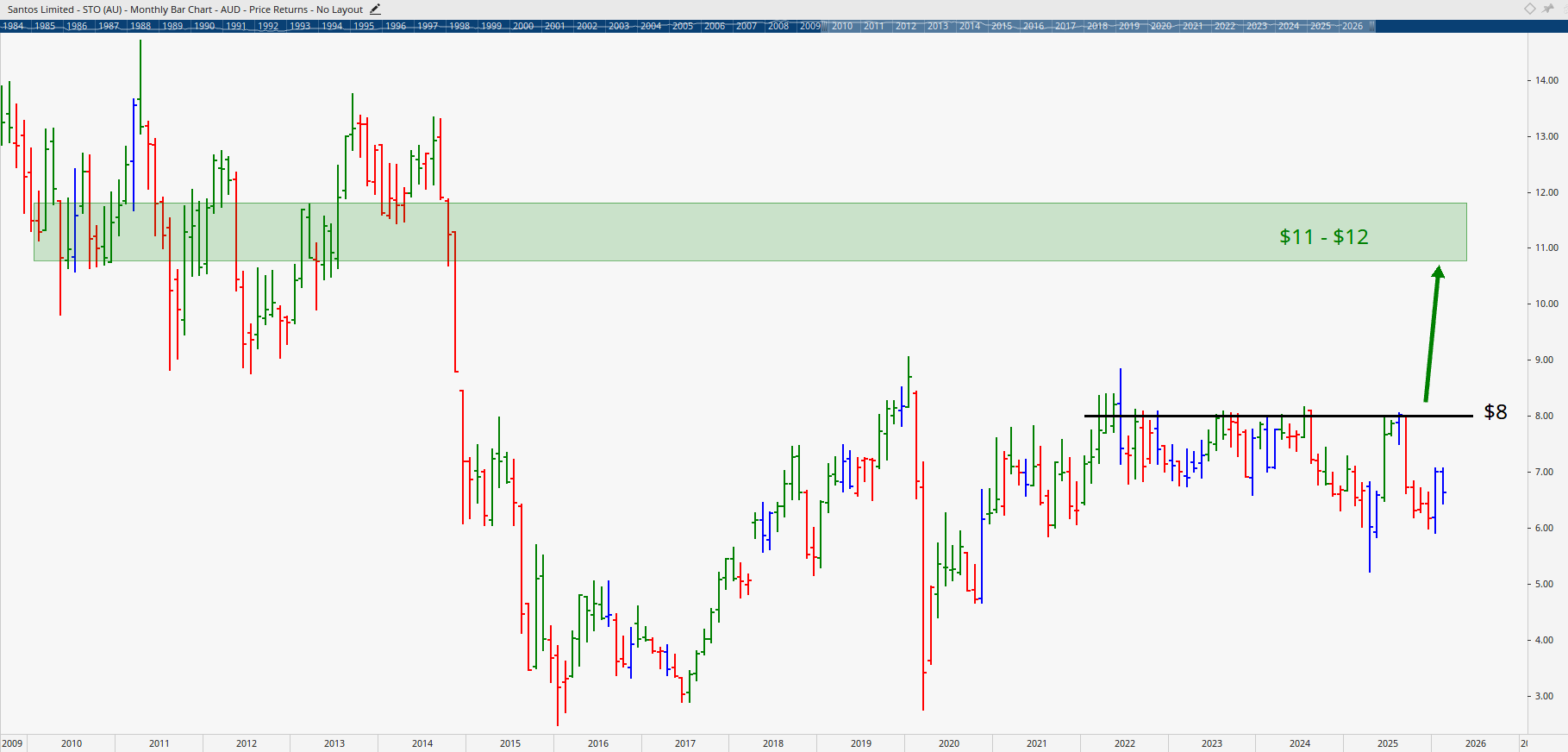

2. Santos (ASX: STO)

Santos remains a cornerstone of the Australian energy sector. Despite a failed takeover attempt in 2025, the fundamentals are solid, with strong cash generation and a historically stable dividend. Kresovic believes that resistance at $8.00 is critical, suggesting any breakout above this level could signal a new rally toward $11–12.

For long-term investors interested in learning how to analyse such setups, Wealth Within’s Diploma of Share Trading and Investment teaches how to combine technical and fundamental analysis to make confident market entries.

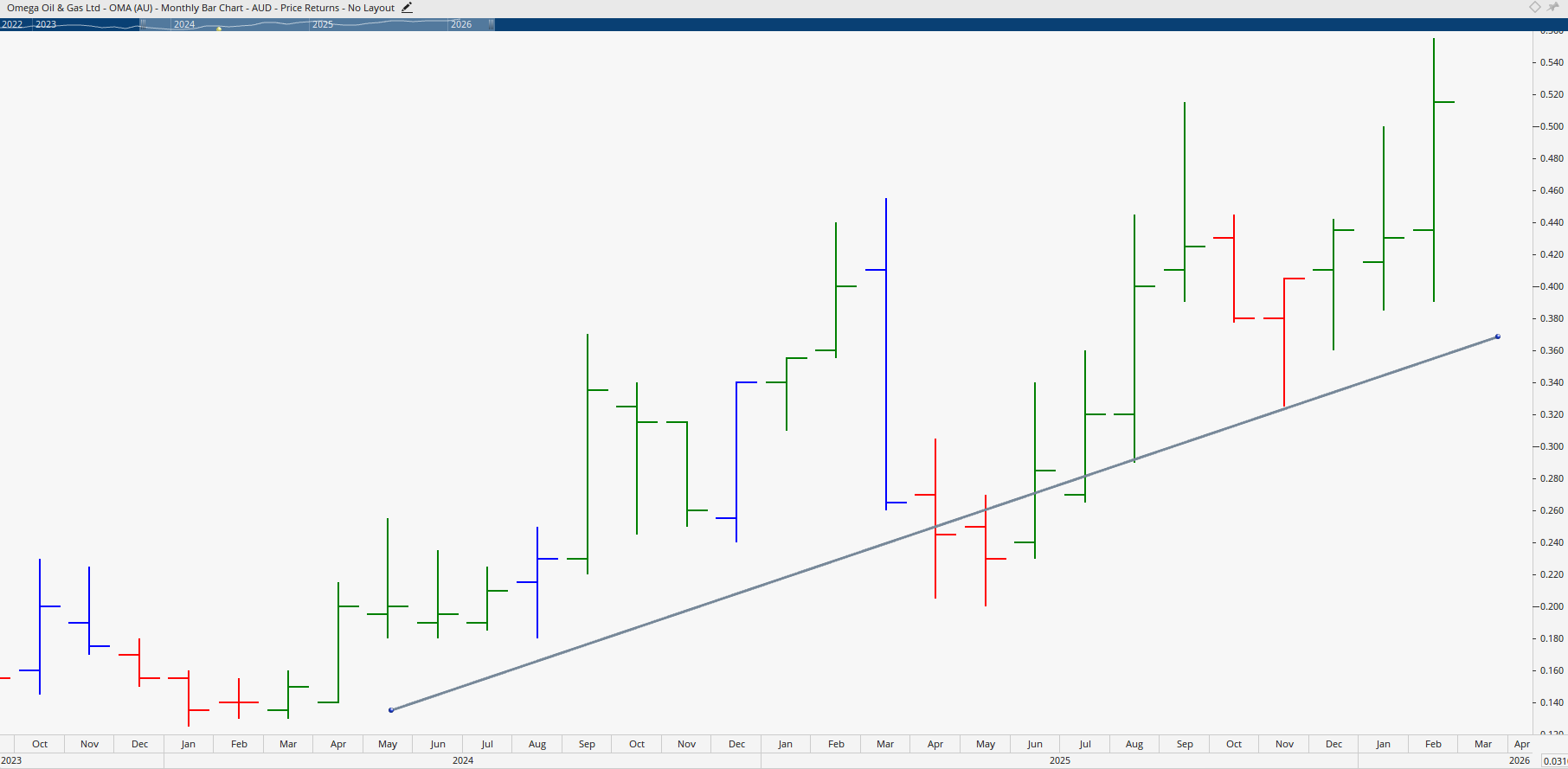

3. Omega Oil and Gas (ASX: OMA)

A speculative but high-volatility play, Omega Oil is known for frequent 40–50% price swings. Janine highlighted its ability to form short-term breakouts but warned that such stocks require active trading discipline. “These setups look great on the way up but can reverse just as quickly,” she said.

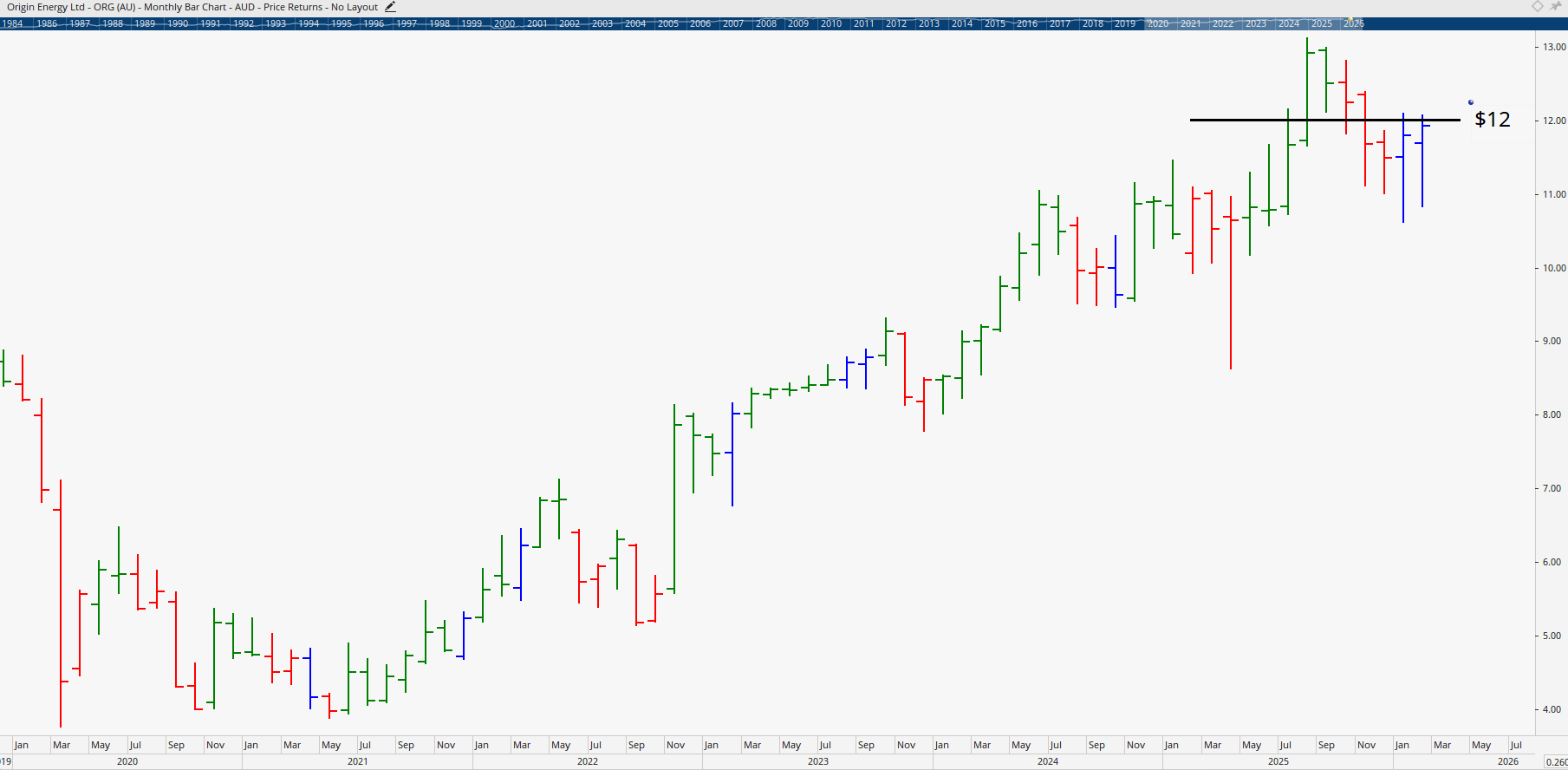

4. Origin Energy (ASX: ORG)

A favourite among analysts, Origin has demonstrated a long-term uptrend since 2021. Kresovic described it as a “top 50” stock that bridges both growth and income portfolios, supported by strong volume and steady momentum. He suggested that breaking above $12 could open the door to further strength up to $13 or higher.

For intermediate and advanced traders seeking to refine their portfolio management, the Advanced stock trading course expands on timing, portfolio construction, and trade management.

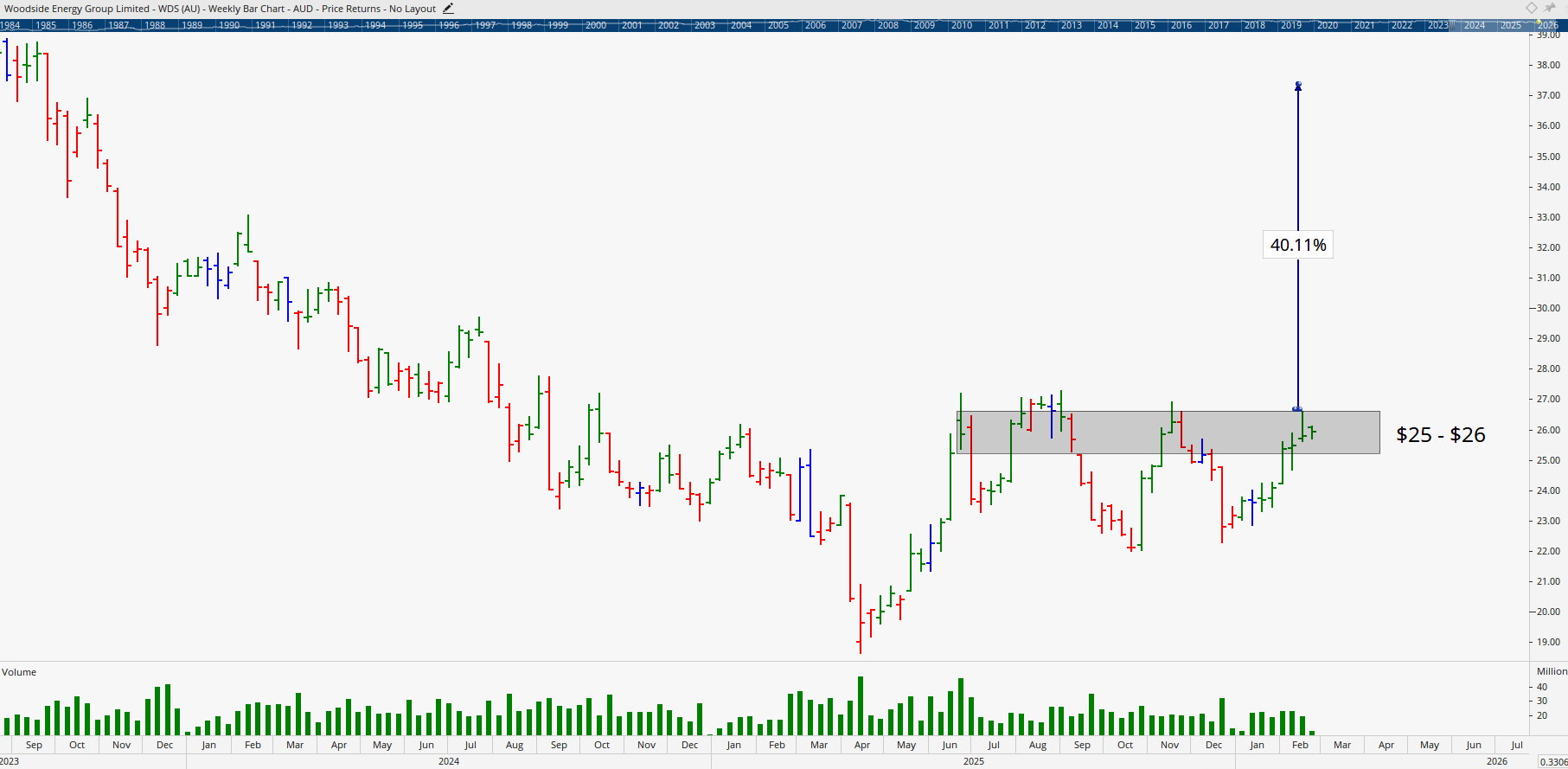

5. Woodside Energy (ASX: WDS)

Australia’s largest LNG exporter has been consolidating in recent months, but both analysts see this as a pause before potential upside. Janine estimated a 40% move higher if Woodside breaks through major resistance levels, while Kresovic highlighted the importance of watching the $25–$26 range for confirmation. “Patience is key. Traders often get bored before the real move begins,” Janine added.

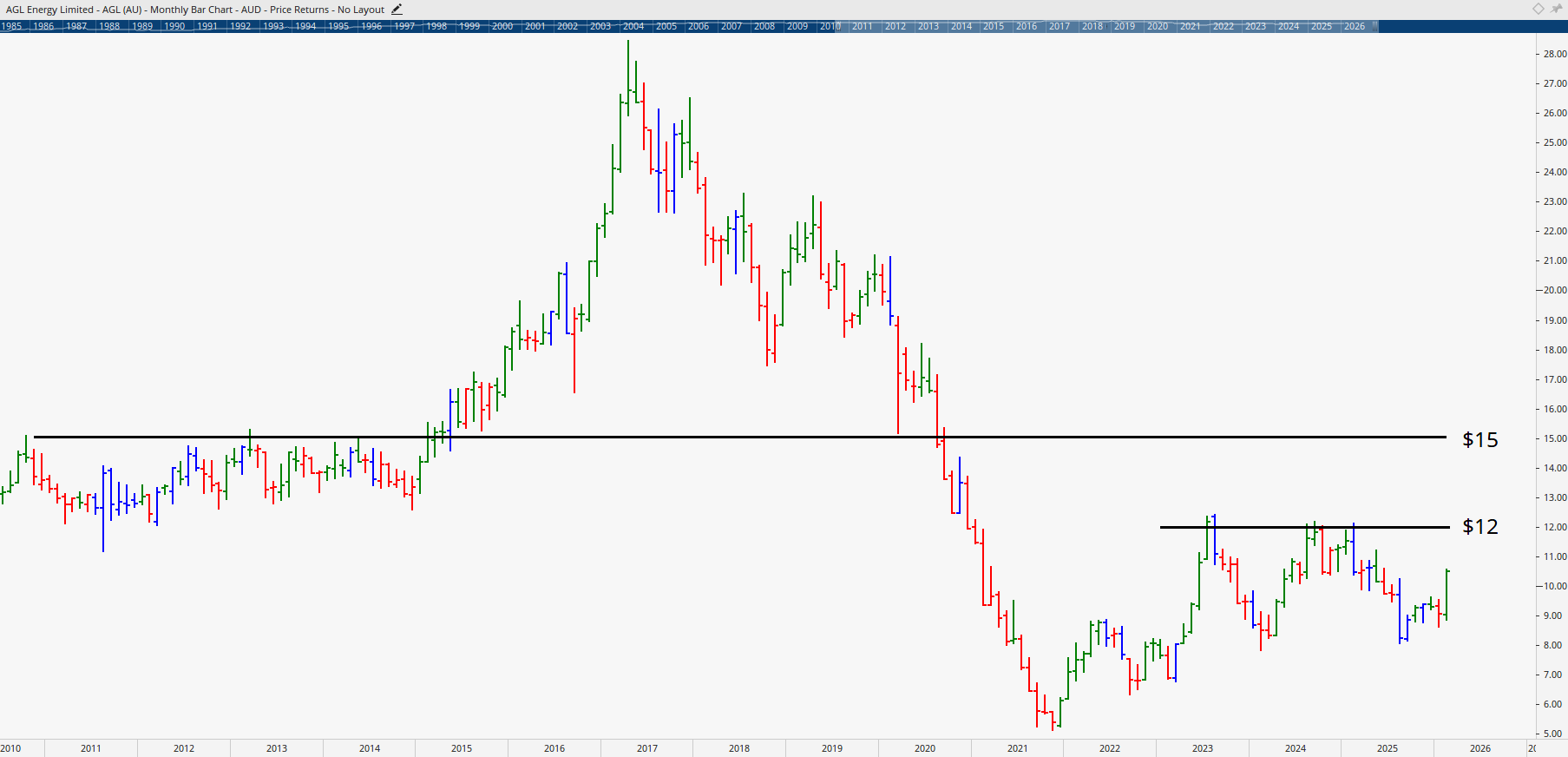

6. AGL Energy (ASX: AGL)

After months of sideways trading, AGL broke higher on strong earnings and volume. Zoran projected an initial resistance near $12, followed by a potential test toward $15 if bullish momentum holds. However, both he and Janine cautioned against chasing post-earnings spikes, instead recommending waiting for consolidation before entry.

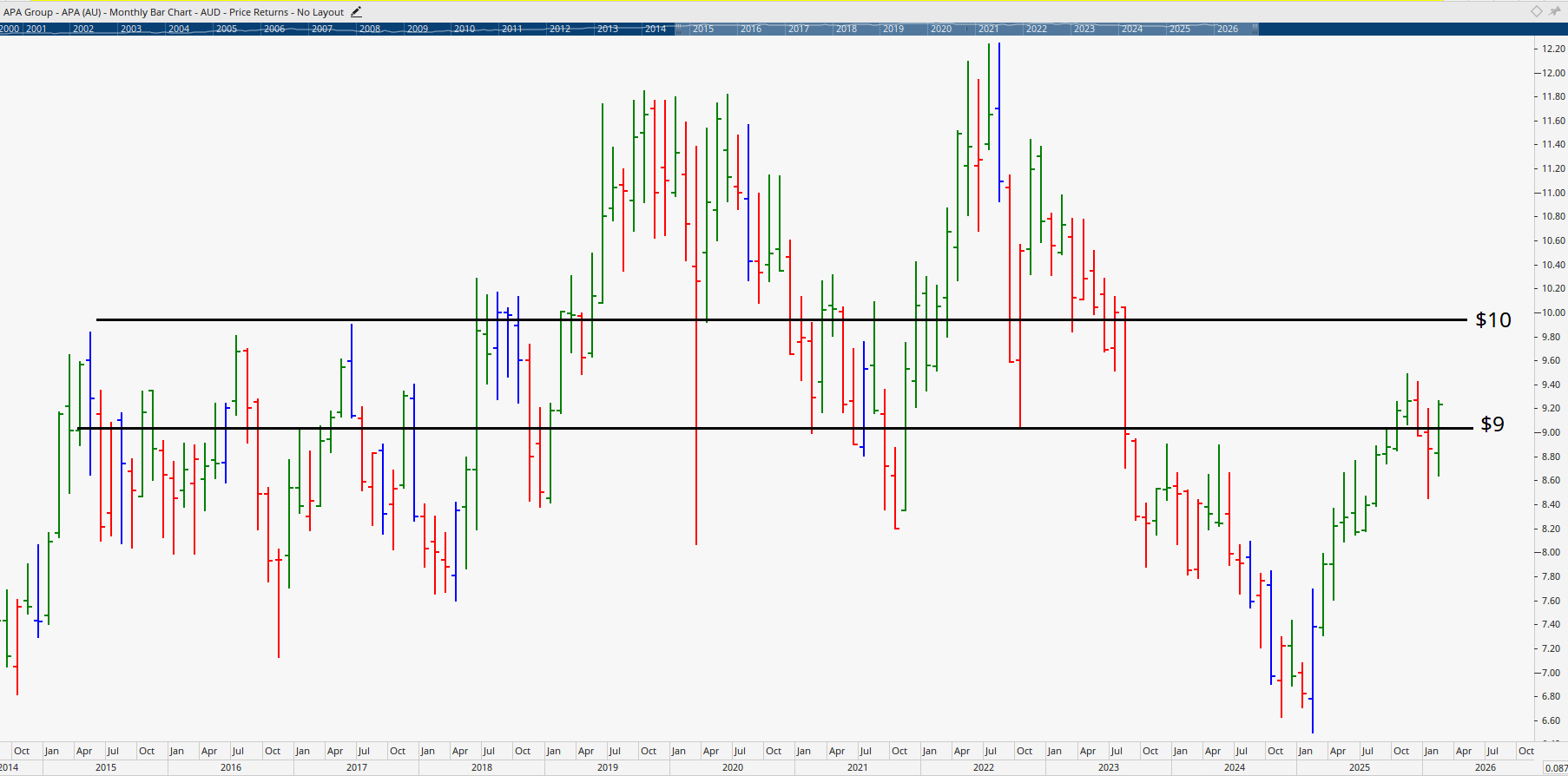

7. APA Group (ASX: APA)

APA, a diversified energy infrastructure company, has recovered strongly since early 2025. The analysts identified a recent pullback as potentially healthy, with support near $9–10 and the possibility of a next leg higher past $10 if momentum resumes. Janine classified APA as a “quiet achiever” for long-term portfolios.

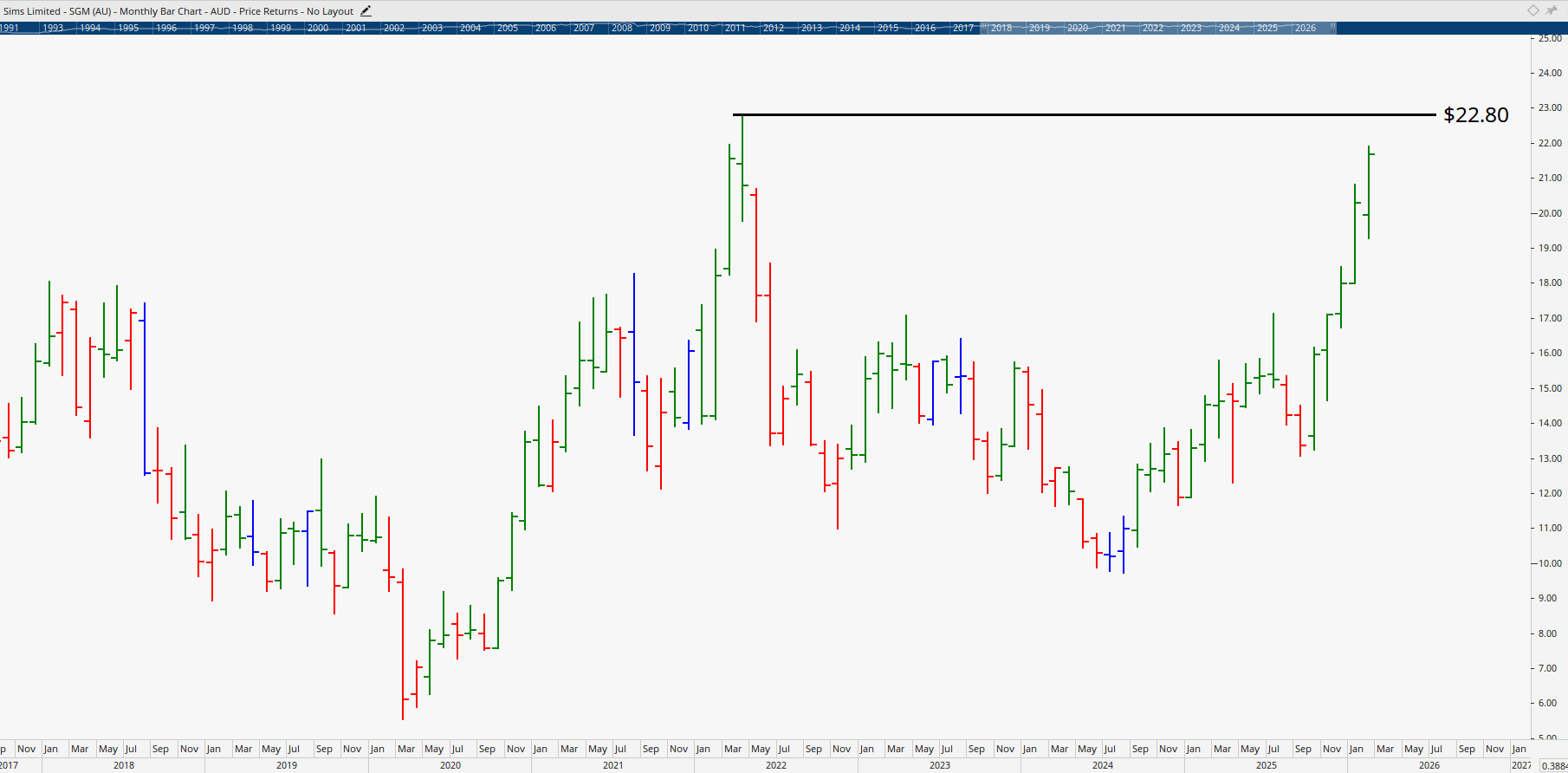

8. Sims Metal (ASX: SGM)

Closing the show, the team spotlighted Sims Metal as the “Hot Stock Tip” of the week. The company reported a 66% lift in EBIT and 71% jump in profits, driven by booming recycling operations in its tech division. Zoran highlighted that breaking above $22.80 could set the stage for a rally toward $30, supported by strong institutional buying.

The Bigger Picture: Price Knowledge and Trading Psychology

A recurring theme throughout the episode was mastering the ability to read charts in their purest form, without overreliance on indicators. “Price action tells you everything you need to know about sentiment,” Filip explained. The panel stressed that understanding core principles such as volume, support, resistance, and confirmation can prevent costly emotional trading mistakes.

If you’re new to the markets, Wealth Within’s beginner-friendly Stock Market for Beginners resource offers a step-by-step roadmap to get started safely and confidently.

Key Takeaways

The global energy market is quietly shifting its focus from oil to gas, and Australia, with its reserves and expertise, is uniquely positioned to benefit. The analysts’ outlook was clear: while risks remain, well-informed traders can capture significant growth opportunities with the right education and timing strategies.

To watch expert analysis and chart breakdowns like these each week, subscribe to Wealth Within’s Hot Stock Tips videos and ASX video library, where Australia’s top trading educators share actionable insights on emerging market trends.

Finally, if you want to understand how professional traders identify these moves before they happen, visit About Wealth Within to learn how Australia’s leading accredited trading educator can help you master the market.