How to Be Financially Independent and Retire Early

By Dale Gillham and Janine Cox

The most common questions people ask when it comes to thinking about retirement is how much money do I need to save for retirement or how much money do you need to retire comfortably?

While these are all great questions, the real question we should be asking is how can we become financially independent and retire early with $1 million dollars. Let’s face it, most of us don’t want to be working until we are aged 70 unless we actually love what we do.

So what follows are some simple but powerful tips that will show you how by saving a percentage of your hard earned money and investing it in the stock market, you will be able to compound your investment returns to build wealth.Obviously, the earlier you start the better off you will be.

The examples I am about to share with you are all relative – given that each of you will have a different earning capacity and various financial commitments.That said, for those who do earn an annual income, even after quantifying and accounting for your expenses, I have never met anyone who could not save at least 10 per cent of their household income. In fact, most people find they can save 20 to 30 per cent and still maintain a good lifestyle.

So let’s consider how you can set up a savings strategy and invest in the stock market to accumulate wealth so you can become financially independent and retire early.

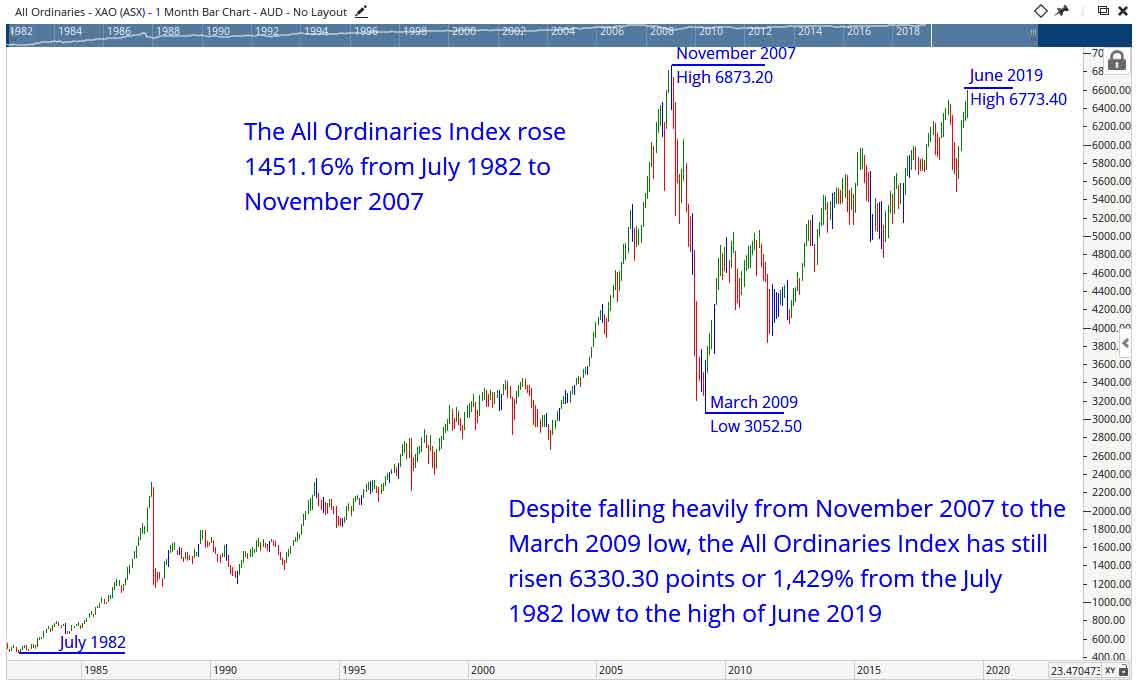

The All Ordinaries Index from July 1982 to July 2019

For someone on a low income who is only able to save around $2,000 a year, it would take approximately 41 years to accumulate $1 million dollars based on a 10 per cent compounded growth rate.Now I can hear some of you saying 10 per cent – isn’t that unrealistic.

Well, not really. And that’s because if you just bought and held the top 10 shares over any 10 year period on the Australian market, your return would be around 10 per cent including dividends. As you can see on the All Ordinaries Chart, below, it rose 1,429 per cent from July 1982 to June 2019. This equates to an annual rate of return of around 38.62 or a compounded rate of return of around 10 per cent.

Investing in the stock market so you can be financially independent and retire early

So let’s look at the effect of investing $2,000 a year with a compounded investment return of 10 per cent. As you can see, it took 41 years to accumulate $1,073,284.

| Investing $2,000 P.A. | |

|---|---|

| Total Amount Invested | $82,000 |

| Years to Reach $1M | 41 |

| Investment Value | $1,073,274 |

| Investment Return | 10% |

If we double the investment to $4,000 a year with a compounded return of 10 per cent, you can see it would take you 34 years to accumulate over a $1 million dollars.

| Investing $4,000 P.A. | |

|---|---|

| Total Amount Invested | $136,000 |

| Years to Reach $1M | 34 |

| Investment Value | $1,080,097 |

| Investment Return | 10% |

While I appreciate that someone investing $2,000 or even $4,000 is not going to be able to purchase all of the top 10 stocks when they initially start out because of the effect of transaction costs on their portfolio returns, which I outline in my latest book, as you accumulate more savings, you will be able to build up your portfolio until you are able to hold at least 5 stocks.

Now let’s consider, how long it would take if you invested $10,000 per annum with a compounded return of 10 per cent.

| Investing $10,000 P.A. | |

|---|---|

| Total Amount Invested | $250,000 |

| Years to Reach $1M | 25 |

| Investment Value | $1,081,818 |

| Investment Return | 10% |

As you can see, the compounding effect is quite significant reducing the time it takes to accumulate $1 million dollars by around 9 years.

Taking a more active approach to managing your investments

Now let’s consider, what the outcome would be if you took a more active approach to managing your portfolio, as opposed to a buy and hold strategy.

For those of you who have read my latest award winning book, Accelerate Your Wealth, you will know I traded an active portfolio over 10 years from January 2007 using the top 20 stocks on the Australian market, which took into account the effect of the GFC and the market volatility that followed this period.

Over the 10 years ending December 2016, the gain achieved from capital growth and dividends amounted to 225.82 per cent or an average annual return of 22.58 per cent. This equates to an annual compounded return of 12.54 per cent.

So now let’s look at what effect this would have on generating income for your retirement.

| Making $1 Million Trading the Stock Market | |||

|---|---|---|---|

| Amount Invested P.A. | $2,000 | $4,000 | $10,000 |

| Total Amount Invested | $70,000 | $116,000 | $220,000 |

| Years to Reach $1M | 35 | 29 | 22 |

| Investment Value | $1,103,504 | $1,068,104 | $1,117,406 |

| Investment Return | 12.54% | 12.54% | 12.54% |

As you can see, because of the compounding effect on your investments and the higher investment return, you have once again reduced the time it would take to accumulate $1 million dollars.

While the actual investment return would be slightly lower when making additional contributions overtime, what you can see is that by actively managing your portfolio and allowing your investments to compound, the better off you will be and the quicker you will be able to achieve your goal of being financially independent so you can retire early.