Oil Stocks Just Turned Bullish: Get In Early on the Next Market Rally

By Janine Cox, Fil Tortevski and Pedro Banales

Could the next major market rally be driven not by renewables, but by traditional oil and gas? According to Wealth Within’s market analysts, that’s exactly what might be unfolding right now. Supply constraints, AI-driven power demand, and geopolitical risks are creating the perfect storm for another energy sector bull run, and savvy investors are already positioning for it.

If you’re ready to take advantage of emerging opportunities in the ASX energy sector, you’ll need solid technical and strategic skills. Wealth Within’s recognised Trading courses can help you learn to trade shares confidently while minimising risk in volatile market cycles.

Why Oil Stocks Could Surge Ahead of Renewables

In a recent episode of Wealth Within’s ASX video library, senior analysts discussed the rising gap between renewable energy supply and surging global electricity demand. While AI-driven data centres are rapidly expanding, renewables simply aren’t scaling fast enough, leaving oil and gas as the short-term solution to energy shortages.

“AI data centre growth is accelerating faster than grid forecasts,” said senior analyst Filip Tortevski. “We’re looking at a seven to ten-year window before renewable production catches up, creating a structural demand gap in fossil fuels.”

This mismatch could fuel a powerful rally in energy stocks as investors realise the short-term necessity of oil to balance the world’s energy grid.

The Oil Stocks Turning Bullish

Woodside Energy (ASX: WDS)

Woodside remains one of Australia’s premium energy plays and is starting to show signs of a base-building reversal.

“We’ve seen a key support level at $20 hold strong multiple times since 2020,” said Tortevski. “For the first time since the COVID correction, sellers couldn’t push the price below that range, suggesting a bullish turn may be underway.”

If momentum follows through, short- to medium-term traders could target a move toward $36. The stock’s ability to hold above $20 is critical confirmation of strength building for a new cycle.

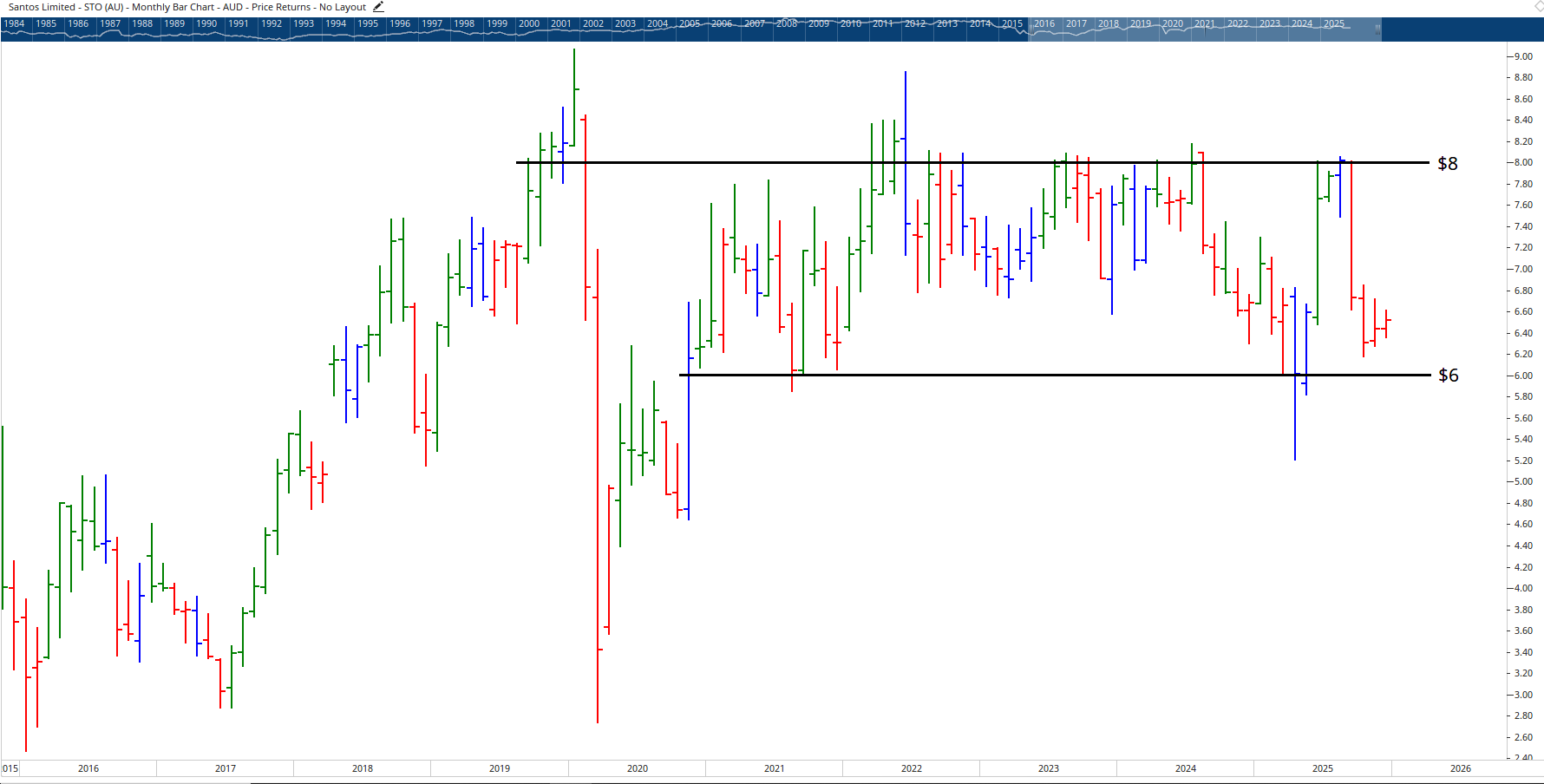

Santos Limited (ASX: STO)

Following a failed acquisition bid, Santos has found solid value around the $6 level. Analysts observed that the company has traded between $6 and $8 since 2017, a wide but consistent range that may be primed for another breakout.

“With its strong fundamentals and history of takeover interest around $8, I see a clear upside opportunity,” said analyst Pedro Banales, highlighting the potential for renewed buyer activity if momentum continues to improve.

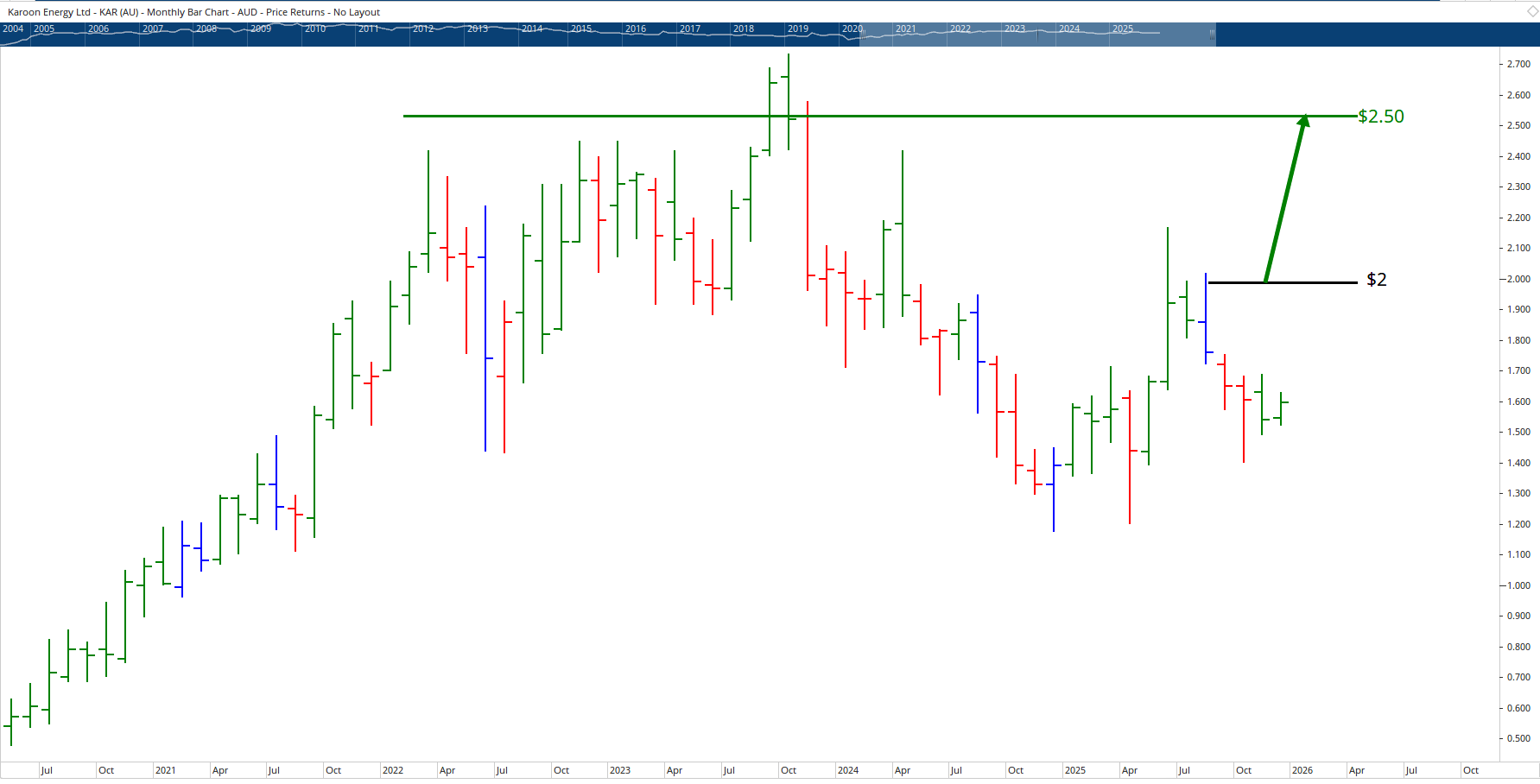

Karoon Energy (ASX: KAR)

Karoon Energy’s chart has started to show clear structural strength after years of decline. Buyers have continued to absorb supply since October 2023, outlining the early stages of a bullish cycle.

If prices move past $1.80 and push toward $2.00, analysts expect the stock to challenge previous highs of $2.50. However, as Fil noted, these setups reward traders with patience and consistent education, not emotion-driven entries.

“If you don’t know how to structure your trades, you’ll get caught chasing moves too late,” warned Tortevski. “That’s why getting proper Share trading education makes all the difference.”

Smaller-Cap Oil Stocks Showing Promise

For traders with more experience and time to monitor the market, several small energy explorers are signalling potential breakouts, but these come with higher risk and volatility.

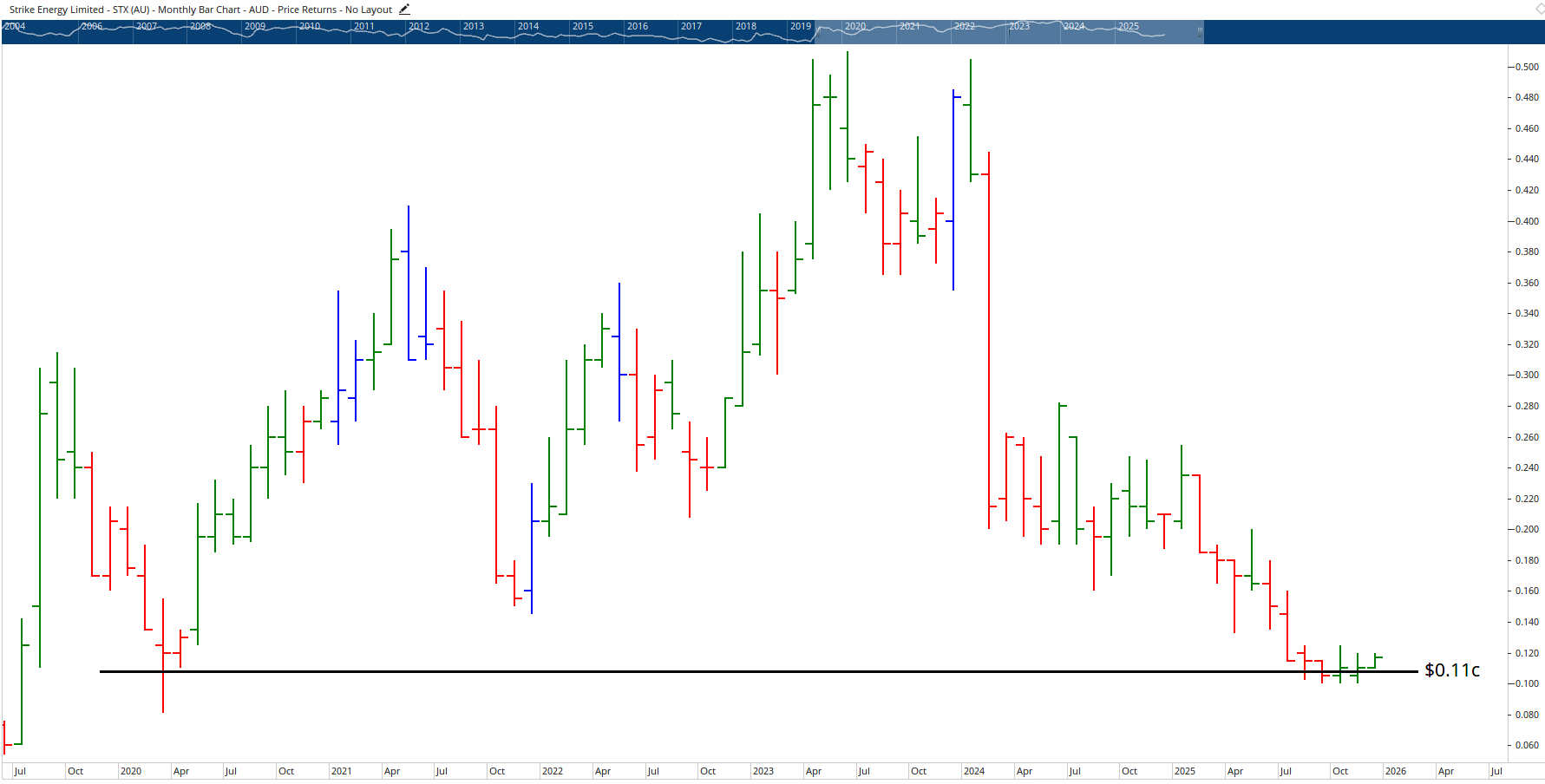

Strike Energy (ASX: STX)

Trading at around 11 cents, Strike Energy is not for novices. The stock has delivered triple-digit returns during its previous upswings but requires vigilant monitoring.

“These types of stocks demand time and precision,” Pedro explained. "If you’re going to trade them, you must know how to handle volatility, use stop-loss rules, and assess price structure across weekly and monthly charts.”

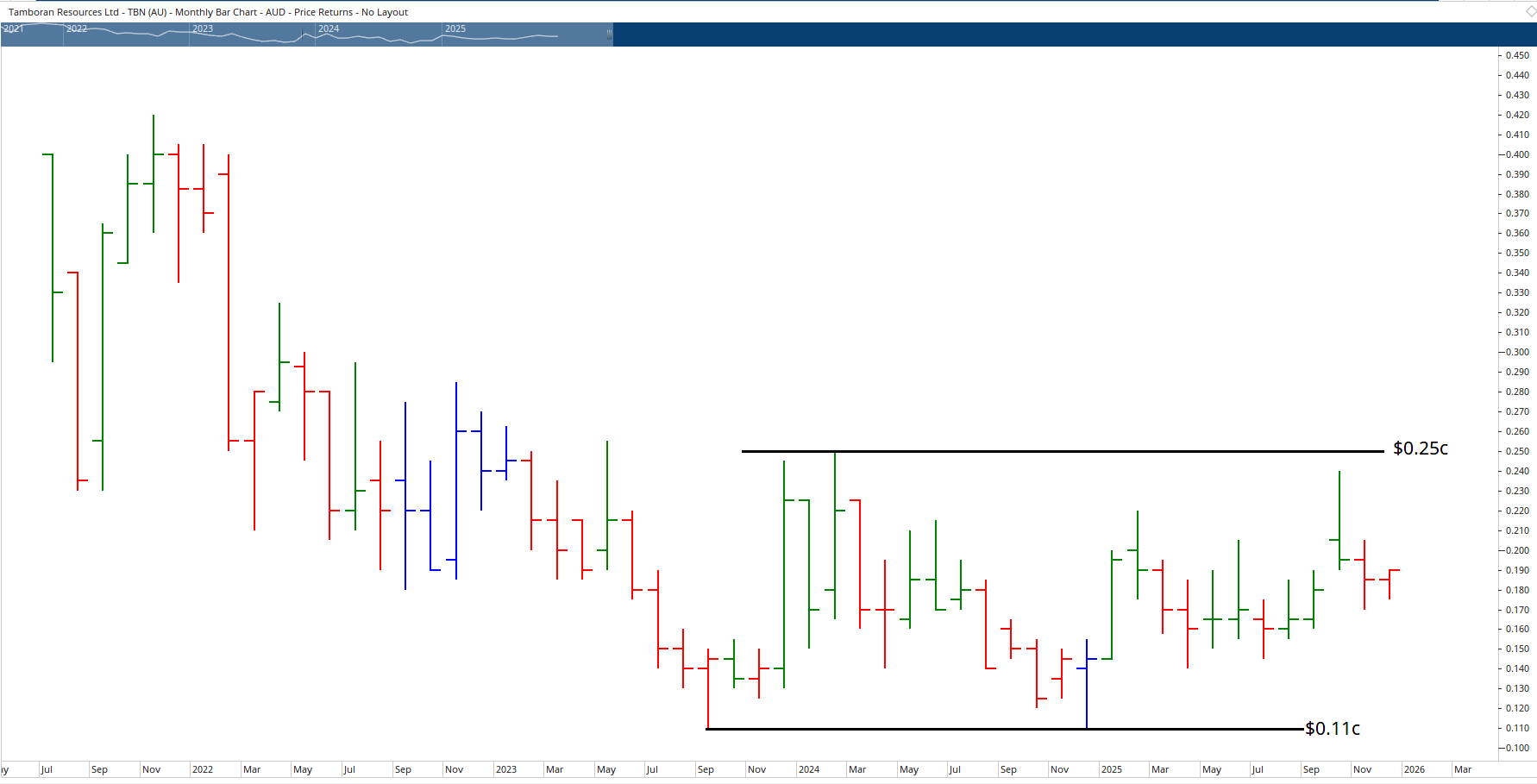

Tamboran Resources (ASX: TBN)

Tamboran has shown encouraging technical behaviour after retesting its all-time low at 11 cents and rebounding. The analysts suggested that a move above 25 cents would add conviction, potentially driving it back toward its 2021 highs.

“As the stock price increases, liquidity improves,” said Pedro. “Once it stabilises above 25 cents, there could be broader institutional interest.”

Horizon Oil (ASX: HZN)

Horizon is tracking strongly after reclaiming the key 17-cent resistance level that has weighed on it for years. Analysts see a potential short-term run toward 30 cents, supported by improving technical structure and trend momentum.

Essential Education Before Trading Energy Stocks

Wealth Within’s analysts were quick to emphasise that education is vital before diving into volatile sectors like energy or small caps.

“If your foundation’s weak, you’ll focus on the wrong factors — usually price alone,” said Janine Cox. “But trading successfully is about process, precision, and practice.”

Through the nationally accredited Diploma of Share Trading and Investment and the flexible Short Course in Share Trading, Wealth Within teaches traders the strategic and psychological tools to take advantage of opportunities like these without taking unnecessary risks.

The Bigger Picture: Currency Moves and Market Psychology

Beyond oil, the team discussed global macro changes such as Japan’s long-anticipated shift in interest rate policy, which could reshape major currencies like the Yen (JPY). These moves emphasise how interconnected global finance is, and why adaptable traders often succeed across multiple asset classes.

Experienced students studying Wealth Within’s Advanced stock trading course learn how to apply time analysis, Elliott Wave techniques, and multi-market correlations to harness opportunities that stem from macro events like these.

Key Takeaways from the Oil Market Discussion

- AI power demand is driving fossil fuel consumption faster than renewables can match.

- Oil and gas stocks remain under-owned relative to growth sectors, despite rising demand.

- Woodside and Santos lead the ASX majors with bullish setups above key technical levels.

- Education and timing are the trader’s real advantage, not speculation.

- Volatility creates opportunity, but only if you’re prepared with the right trading skills.

Learn to Trade with Confidence

If you’re ready to take control of your financial future and want to master the art of strategic trading, start your journey with Wealth Within.

Whether you’re a beginner exploring the Stock market for beginners or an active trader looking to refine your expertise, you’ll gain world-class support and proven methodologies to build long-term success.

To find out more about our trusted Trading courses or learn more About Wealth Within, visit our website and explore how thousands of Australians have already built profitable, sustainable trading careers.