Biggest ASX Growth Stocks to Buy in Q4 2025

By Janine Cox and Fil Tortevski

As we enter the final quarter of 2025, the Australian share market is once again alive with opportunities. Historically, Q4 is when strong market trends and standout growth stories emerge, which is setting the tone for the year ahead.

This month, our senior Wealth Within analysts, featured on Bloomberg, Sky News, and CNBC, break down the stocks and sectors showing the strongest momentum as the market prepares for potential new highs.

Quarter Four Market Themes: Small Caps Lead the Way

Growth is shifting in interesting ways this quarter. While traditional sectors like technology and materials continue their steady climb, the small-cap sector has quietly gained momentum.

According to Wealth Within’s analysts, the small-cap end of the ASX is currently outperforming large-cap peers, a strong signal of growing investor confidence and risk appetite. This pattern often unfolds toward the later stages of a market growth cycle, where capital rotation into smaller, faster-moving stocks accelerates.

To understand these pivotal market rotations and make informed decisions, traders can benefit from foundational Trading courses designed to help them learn to trade shares confidently during changing conditions.

Momentum vs Earnings: Where Should You Focus?

As fund managers debate valuations across key sectors, one thing’s clear: momentum is prevailing. Despite some areas showing stretched earnings numbers, bullish sentiment remains visible across most indices, suggesting that buyers are controlling the direction.

With historical cycles showing that November and December often deliver positive returns, this final quarter could be the strongest part of the year for equity investors.

Top ASX Growth Stocks Showing Potential in Q4

Our analysts have focused on stocks demonstrating strong technical formations, rising volume, and institutional support, hallmarks of sustainable growth.

Here are some names to watch:

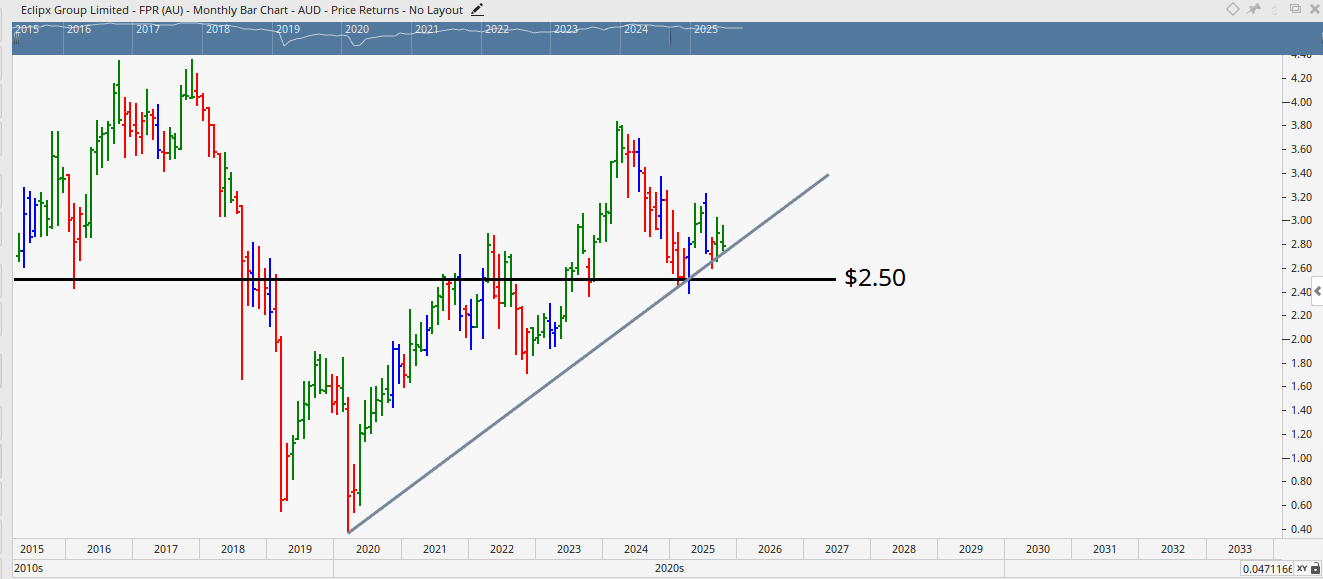

Eclipx Group (ASX: FPR)

- Sector: Financial and fleet management

- Setup: The stock is building clear bullish momentum and recently tested key support levels around $2.50

- Why it’s interesting: The share price is tracking above its long-term trend line, and institutional buying volumes have surged to the strongest levels since 2020 - a clear sign of accumulation.

This setup highlights why quality entry and exit rules, such as those taught in the Short Course in Share Trading, are essential when capitalising on trending stocks.

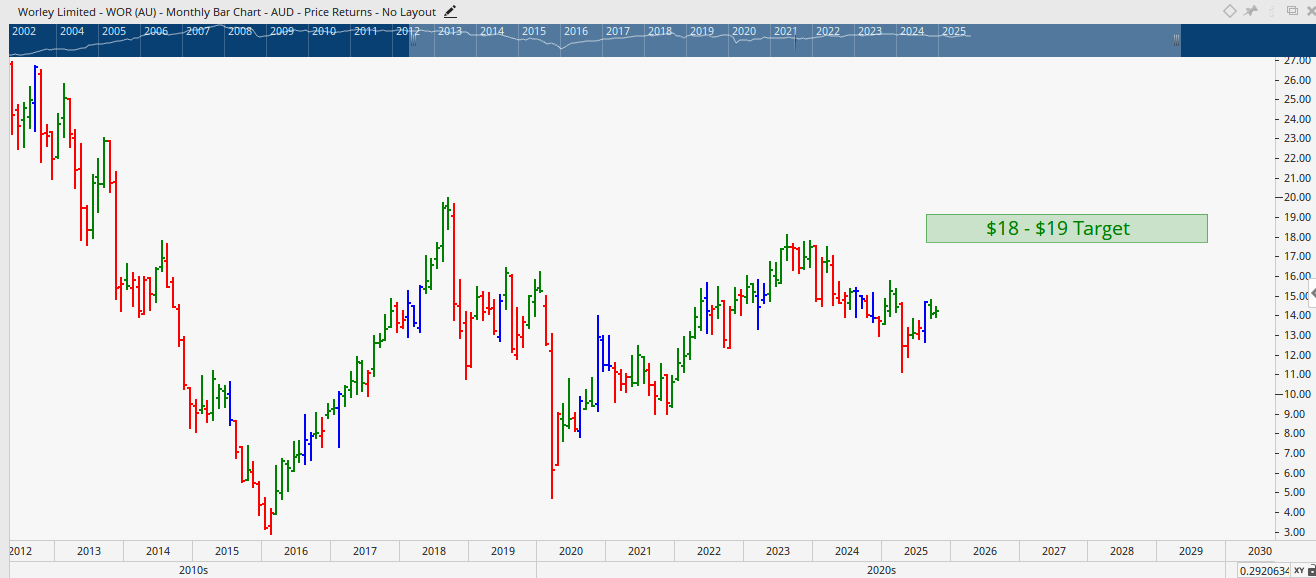

Worley Limited (ASX: WOR)

Although reclassified from pure energy into diversified resources, Worley continues to look technically strong.

- Setup: Support retested after a healthy correction, with potential upside to $18–$19.

- Why it matters: The gradual recovery in energy-related sectors has provided favourable conditions for patient, technically disciplined investors.

Dicker Data (ASX: DDR)

DDR, one of Australia’s key players in IT hardware and software distribution, is showing constructive price action post‑earnings.

- Technical highlights: Consistent buying support around $8, combined with expanded trading volume since August, signals a likely breakout to $13 if the trend continues.

- Sector tie-in: The ongoing AI and data‑centre boom continues to fuel demand across supply chain technology, aligning this stock with high‑growth trends.

Amplitude Energy (ASX: AEL)** – Emerging Opportunity

With prices below $1.00, AEL is building early-stage consolidation that could appeal to traders with a high-risk tolerance. Lower-capital trades on smaller positions can be structured safely using principles from the Diploma of Share Trading and Investment.

AI and Data Centres - The Next Growth Engine

Big technology themes continue to dominate global and local markets. Following global announcements by OpenAI and AMD, there’s renewed optimism across AI infrastructure and data‑centre stocks.

In Australia, companies such as NextDC (ASX: NXT) are now in focus for their ability to provide the backbone of this transformation. While valuations are high, strong underlying demand and rapid adoption continue to fuel investor interest.

For traders comfortable with technical analysis, timing entries around these cyclical surges can be learned through our Advanced stock trading course, where students master tools like time analysis and Elliott Wave trading.

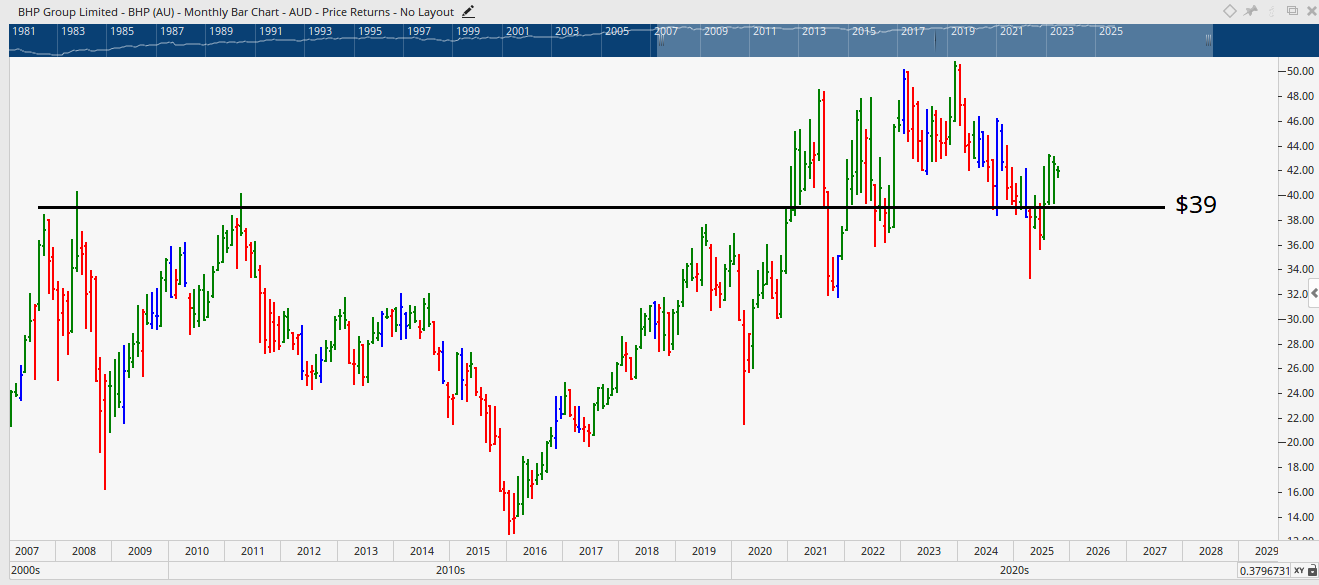

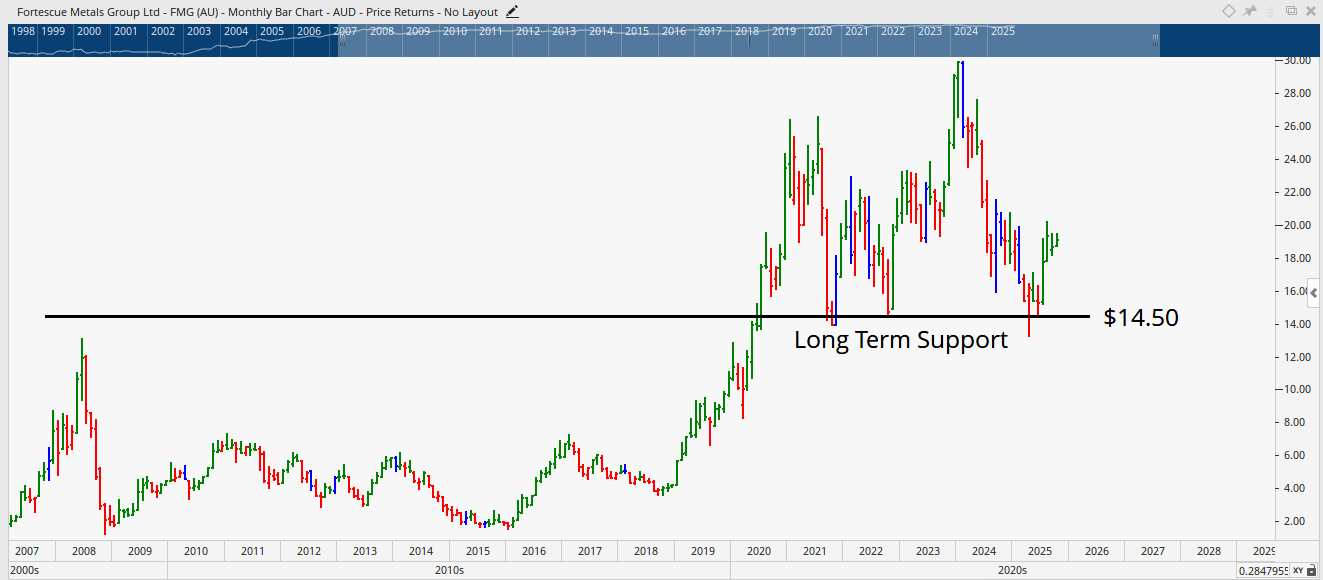

Materials Sector Reawakens — BHP, Rio, and FMG

The materials sector’s quiet revival is one of the more intriguing stories of 2025. Iron ore giants BHP, Rio Tinto, and Fortescue (FMG) have stabilised after multi‑year consolidations, showing signs of momentum just as global demand for resources begins to recover.

- BHP (ASX: BHP): Breaking through key resistance around $39 - a strong medium‑term bullish signal.

- Rio Tinto (ASX: RIO): Recently announced a $733 million development plan in Western Australia’s Pilbara, reinvigorating institutional confidence amid a rebound in lithium exposure.

- FMG (ASX: FMG): Holding above long‑term support at $14.50 and forming a bullish continuation pattern, signalling potential for sustained upside through Q4.

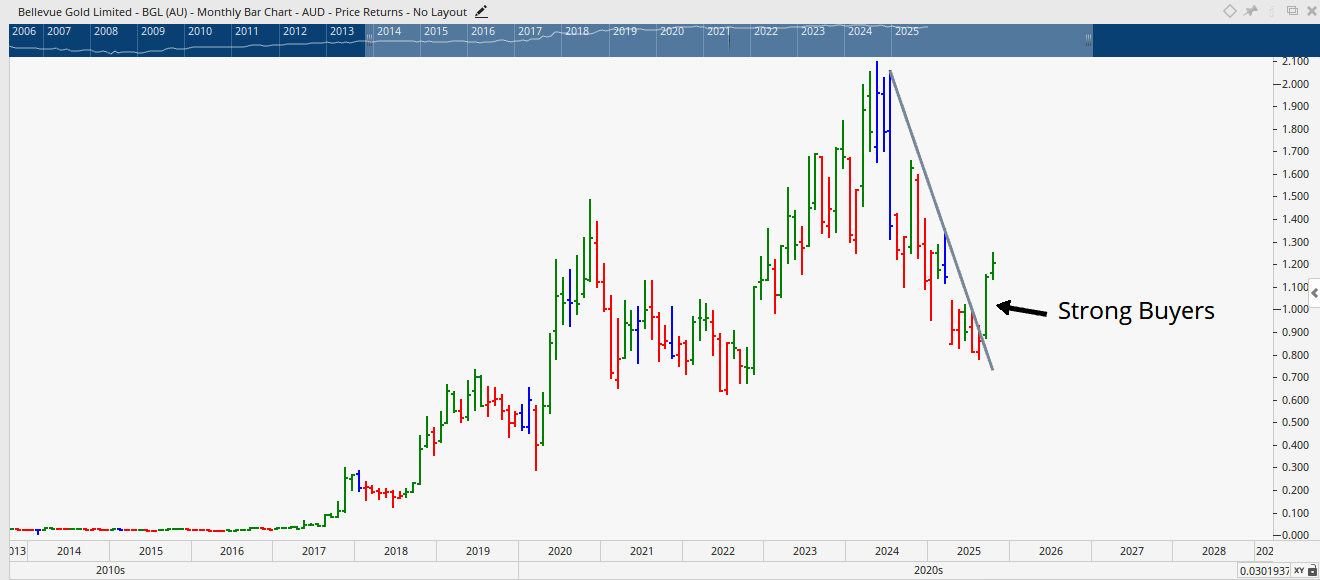

Gold Stocks Glitter Again

With gold prices nearing record highs around US$4,000/oz, smaller ASX‑listed miners like Bellevue Gold (ASX: BGL) are starting to attract investor attention. Typically, these smaller players move later in the commodity cycle and are often delivering stronger percentage gains once momentum takes hold.

A strategic mix of large‑cap resource exposure and selective smaller names, guided by robust Share trading education, can help investors capture both the stability of big players and the explosive growth potential from the small caps.

Trading With Structure and Strategy

As the market heads into the most seasonally active quarter of the year, many traders find themselves overwhelmed by opportunity. The real edge isn’t in finding the next “hot stock”, it’s in mastering timing, portfolio structure, and disciplined risk management.

That process starts with education. Whether it’s our foundational Diploma of Share Trading and Investment or the Advanced stock trading course, Wealth Within provides the same proven, government-accredited training used by professional portfolio managers across Australia.

Get Professional Insight Into the ASX

If you’d like to see expert analysis of these and other stocks each week, explore our Hot Stock Tips videos, ASX video library for real‑time chart breakdowns, guidance, and investor education.

For over two decades, About Wealth Within has empowered Australians to take control of their financial futures through high‑quality education and transparent, research‑based learning.

Take Advantage of Q4 Opportunities

The final quarter of every year tends to reward those who prepare, not those who chase. By combining insight, timing, and knowledge, you can position yourself ahead of market trends rather than behind them.

Start sharpening your competitive edge today by enrolling in one of Wealth Within’s Trading courses and make your next investment decision your smartest one yet.

Important information

This content is provided for educational purposes only and is not personal financial advice. It does not take into account your objectives, financial situation or needs. Consider seeking advice from a licensed professional before acting on this information. Markets involve risk; past performance is not a reliable indicator of future performance.