Silver, Gold & Platinum Exploding on the ASX: Are You Positioned to Profit?

By Dale Gillham, Janine Cox and Fil Tortevski

Precious metals are making news. Silver, gold, and platinum are all exploding on the ASX, hitting multi‑year highs and drawing attention from traders and long‑term investors alike. But the real question is: are you positioned to profit, or are you at risk of missing out entirely?

With decades of combined experience, the team at Wealth Within has seen these cycles before. Let’s explore why the rally is happening, what it means for investors, and how you can build a plan to navigate this space.

Why is Silver surging to 14‑Year highs?

Silver recently hit a 14‑year high, a milestone driven by two competing factors:

- Industrial demand, particularly from solar technology, electric vehicles, and even expanding data centres.

- Safe‑haven demand, as investors hedge against global uncertainty.

Silver has long trailed gold, but its unique blend of industrial utility and defensive appeal makes it a critical metal in changing markets.

Gold: Still the ultimate safe haven?

Gold continues to assert itself as a store of value in uncertain times. While industrial stories capture attention, gold’s primary appeal remains its safe‑haven status. Historical cycles show that despite corrections, like during the GFC, gold holds purchasing power far more reliably than fiat currencies.

Some analysts now expect gold to trade towards $3,700 per ounce, fuelled by bullish technical setups and sustained investor demand.

Platinum: The volatile profit machine

Platinum doesn’t get the same attention as gold or silver, but traders with experience know its reputation: high risk, high reward.

- Platinum rallies tend to be sharp and volatile.

- Recent moves suggest potential upside towards $2,000 and beyond.

- For those who prefer trading momentum cycles, platinum offers opportunity, but it’s not a buy‑and‑hold asset.

How traders can approach precious metals

When metals move like they are now, investors face three key choices:

- Buy physical bullion (through options like the Perth Mint or exchanges).

- Trade futures or CFDs for direct exposure.

- Invest in ASX mining stocks; from established producers to more speculative explorers.

Each approach has trade‑offs. Physical assets require storage, futures carry leverage risks, and stocks bring liquidity and company‑specific factors into play. A disciplined plan is essential to minimise risk.

ASX stocks in focus

During this rally, several ASX stocks have stood out:

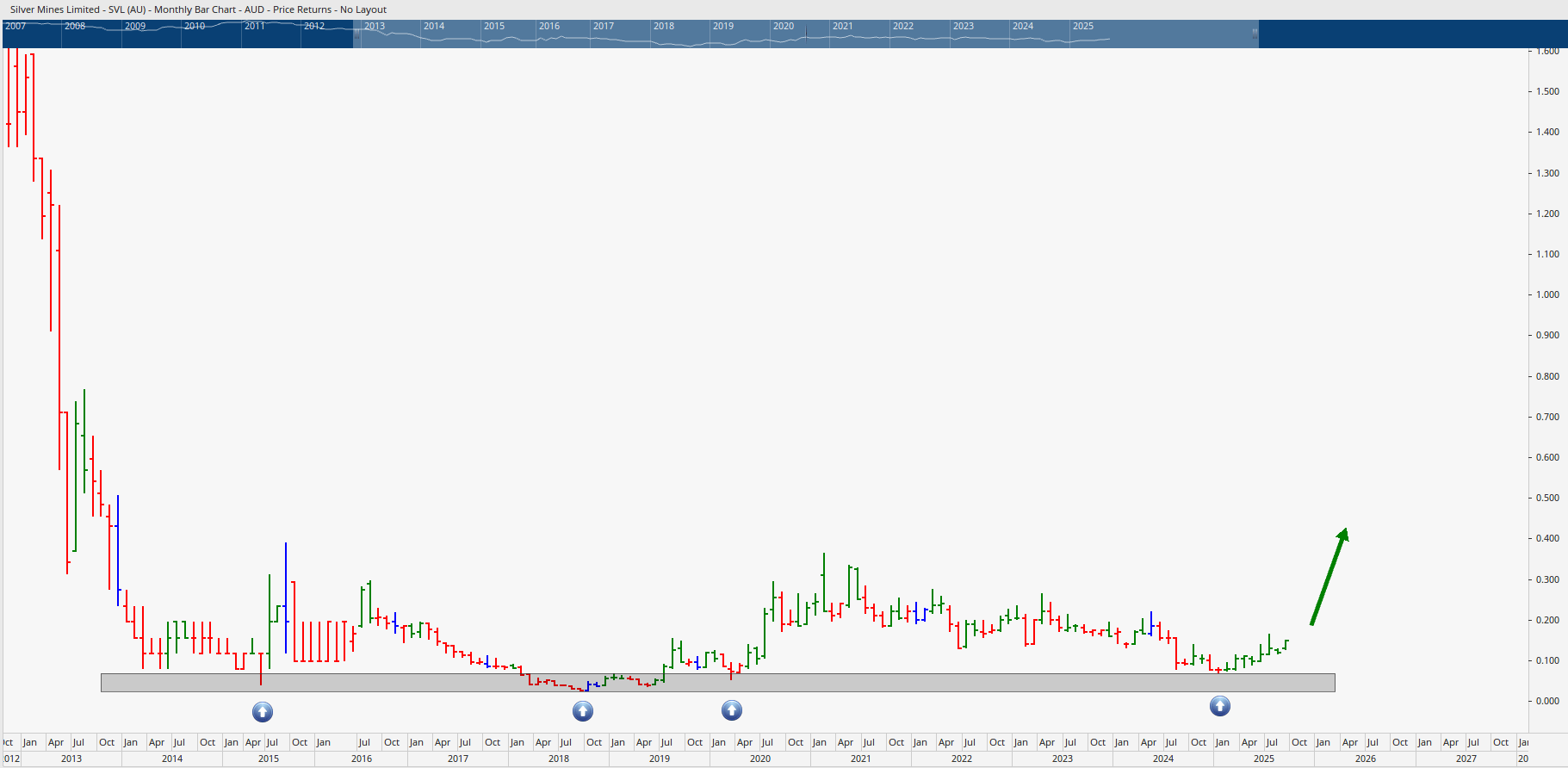

- Silver Mines (ASX: SVL) – one of the purest silver plays on the Australian market, showing signs of breaking out from long‑term lows.

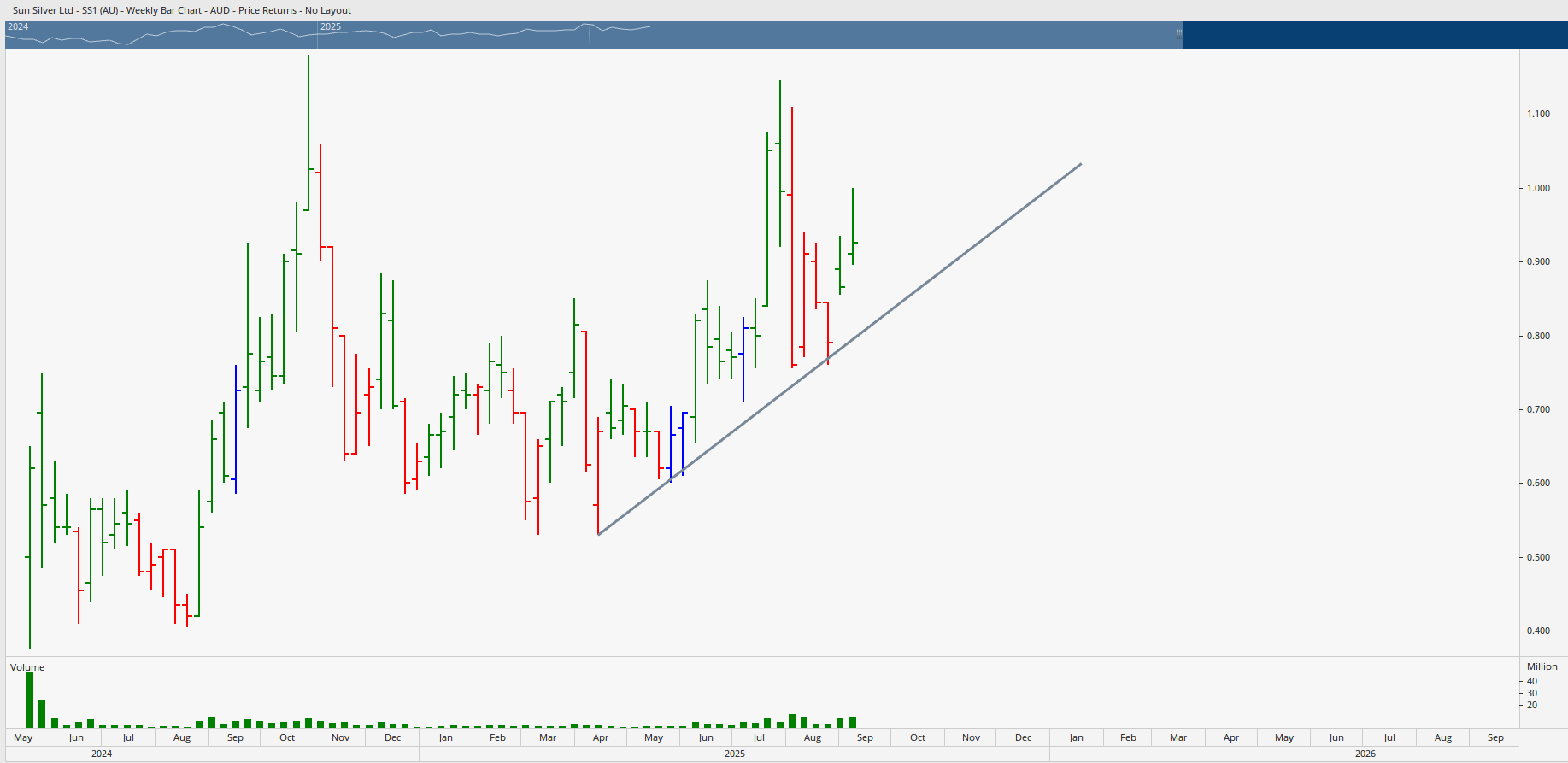

- Sun Silver Limited (ASX: SS1) – a recent IPO gaining traction alongside the silver spot price.

- Other small-cap miners in platinum and gold are also lining up for strong runs, though liquidity and volatility make them higher risk.

Remember: portfolio construction matters. Avoid chasing “shiny objects” without considering diversification and risk management.

FOMO vs. strategy

One of the dangers in hot markets like this is FOMO (fear of missing out). Many investors jump in late when prices are euphoric, only to see sharp pullbacks. The key is to:

- Trade with a plan for entry and exit.

- Understand that corrections are normal in commodity cycles.

- Balance the allure of fast gains with the discipline of long‑term wealth building.

How Wealth Within helps you trade with confidence

At Wealth Within, we believe education is the foundation of confident, profitable investing. Whether you’re new to the markets or ready to refine advanced techniques, our Trading courses are designed to give you the skills to succeed.

- Beginners can learn to trade shares safely with structured strategies.

- Our government‑accredited Diploma of Share Trading and Investment teaches a proven five‑step approach to managing risk, timing entries, and maximising profits.

- Experienced traders can sharpen their edge with our Advanced stock trading course, covering time analysis, Elliott Wave theory, and portfolio construction.

- To see market commentary in action, our Hot Stock Tips videos, ASX video library delivers weekly insights on the latest opportunities.

- To understand why thousands of Australians trust us, read more About Wealth Within.

Final thoughts: position yourself before the next breakout

When Silver, gold, and platinum align in powerful rallies, its time to get excited and that’s exactly what’s happening on the ASX right now. Whether this move continues or corrects, opportunity is everywhere for traders with the right knowledge and plan.

If you want to take control of your financial future, now is the time to prepare. Build your confidence, refine your strategy, and ensure you’re ready before the next breakout.