ASX Index to Hit 10,000: Buy These Blue-Chip Stocks ASAP

By Janine Cox and Fil Tortevski

The ASX is charging towards the 10,000 mark, and investors everywhere are asking the same question, have they already missed the boat? While markets at record highs can often intimidate buyers, there’s still value hiding in plain sight.

According to the analysts at Wealth Within, there are blue-chip stocks still offering strong earnings growth, robust dividends, and major upside potential especially with the Reserve Bank of Australia expected to cut rates before the end of the year.

Will the ASX Break 10,000 and When?

Senior analyst Janine Cox believes the move to 10,000 is not a matter of if, but when. “There’s a high probability that the ASX will break 10,000 before the end of 2025 or in the first quarter of 2026,” she said.

The optimism stems from strength across financials and technology in the U.S., with capital rotating into similar sectors in Australia. “We’ve seen financials and tech performing well, and now the momentum is clearly building locally.”

As the ASX enters this next phase of expansion, investors should focus on stable, high-quality blue-chip stocks rather than risking capital chasing small-cap volatility.

Why Blue-Chip Stocks Still Matter

While small-cap speculation may capture attention, blue-chip stocks remain the foundation of long-term wealth creation as they offer liquidity, dividends, and consistent growth.

Cox emphasises that successful traders treat blue chips not only as long-term investments but also as short- to medium-term trading opportunities,

“The big stocks like BHP, Rio, and Transurban respond beautifully to technical analysis tools like trendlines, something we teach extensively in our Trading courses. When you know how to read the chart structure, you can trade them for growth as effectively as any smaller stock.”

With many of these stocks setting up for strong breakouts, now is the time to know when to buy, when to sell, and how to manage risk. The nationally accredited Diploma of Share Trading and Investment equips traders with these exact skills.

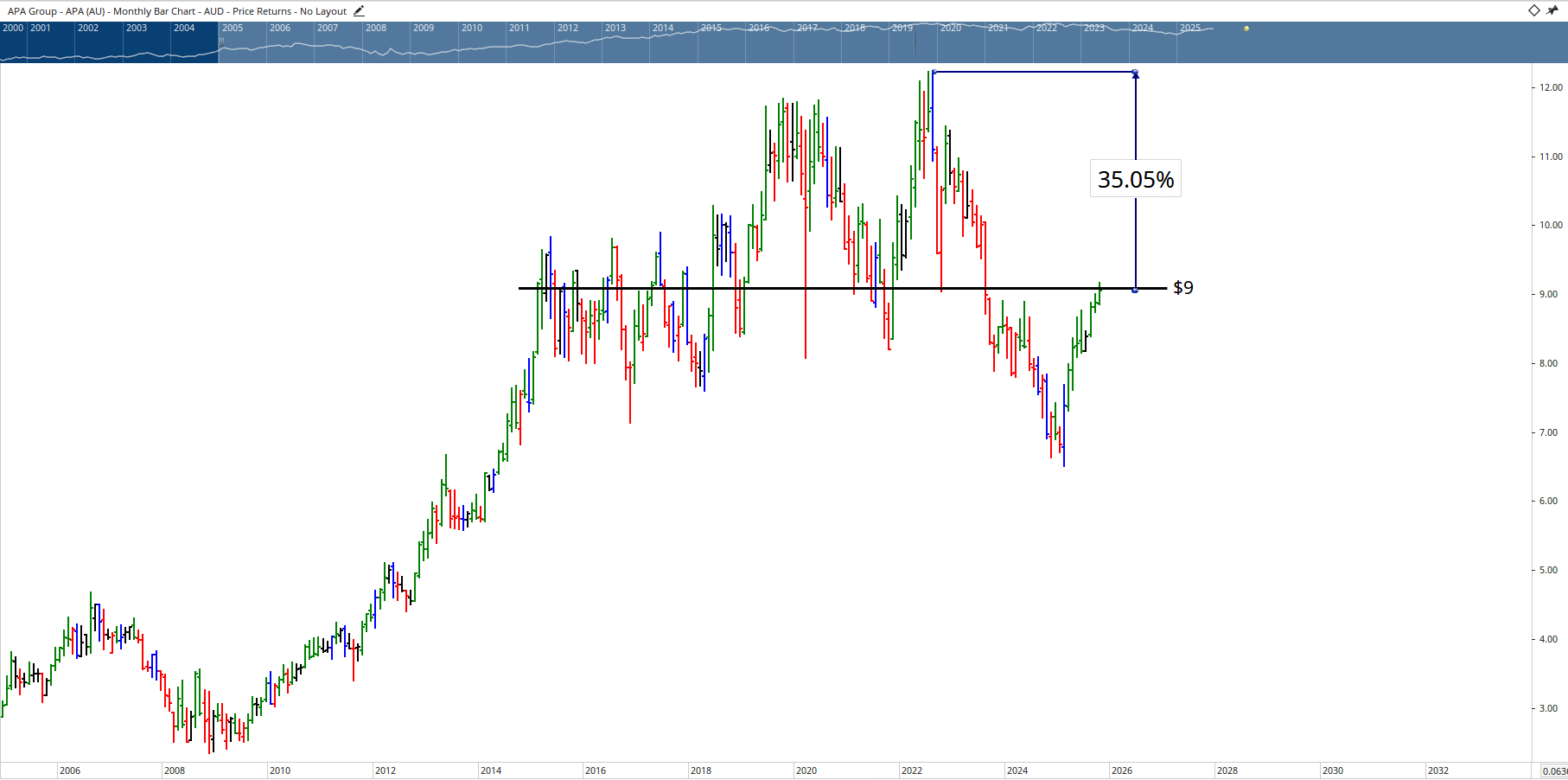

APA Group (ASX: APA) - Standing Out in the Utilities Sector

The APA Group continues to impress, rising steadily toward major resistance around the $9 level. Despite strong gains, analysts say there’s more upside to come, with about 35% potential to the all-time high.

What makes APA appealing is its consistent price rhythm with periods of consolidation followed by healthy rallies. When properly timed, this pattern provides ideal entry opportunities for both growth investors and income-focused SMSF portfolios.

As Janine noted, “The stock has a long, repeatable pattern of pullbacks and surges, the kind smart traders thrive on.”

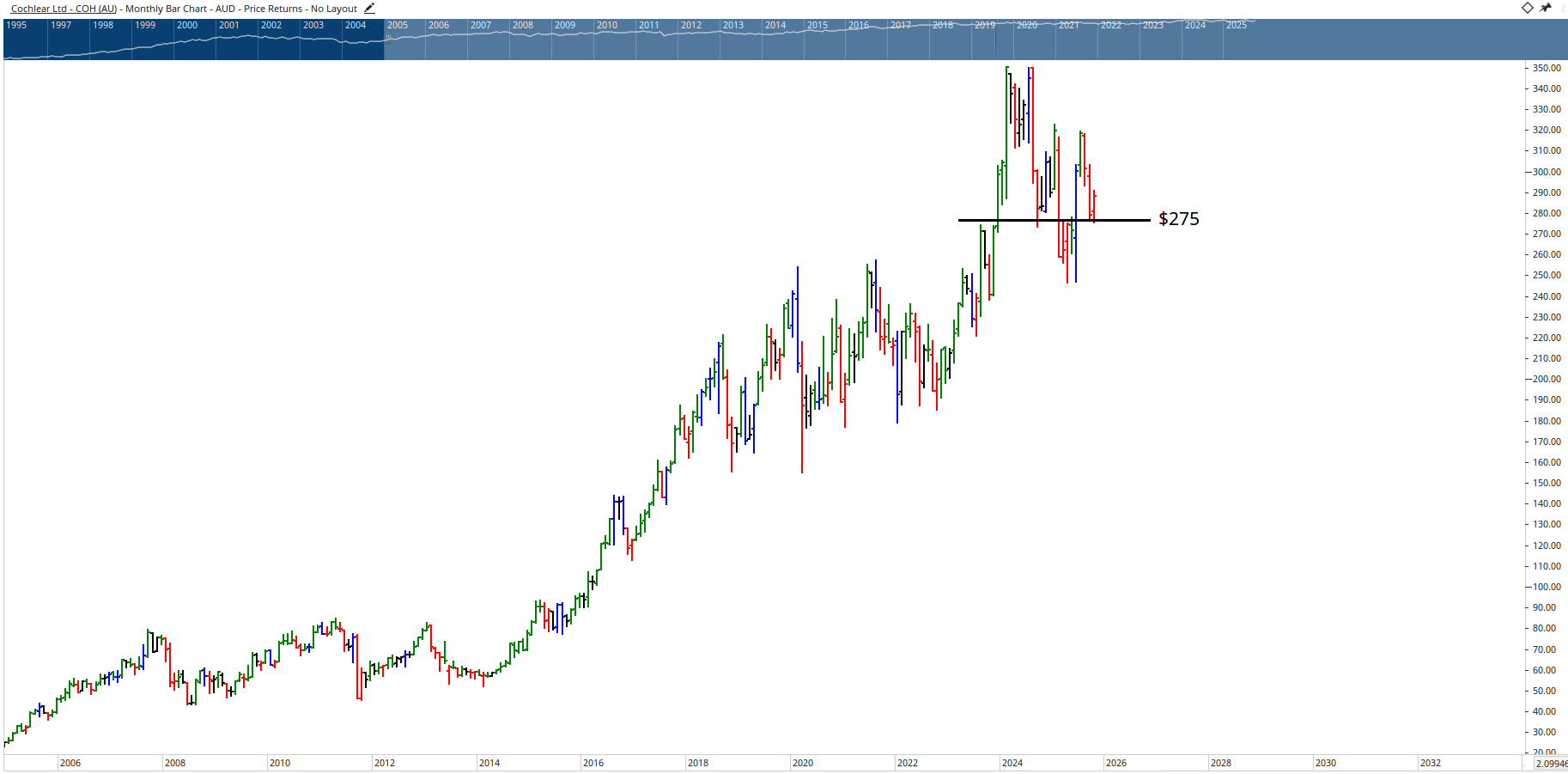

Cochlear (ASX: COH) - The Quiet Performer in Healthcare

While healthcare has fallen out of favour recently, Cochlear remains a resilient player, maintaining clear uptrend structures and finding steady support around the $275 mark.

Its consistency compared to peers like CSL and Sonic Healthcare is striking. “Cochlear’s ability to hold trend while its sector falls demonstrates why it deserves a spot on investors’ watchlists,” says Cox.

That said, she cautions, “It’s not just about buying the dip. You must know when the market is saying go, stop, or wait, a core principle we teach in our Short Course in Share Trading.”

South32 (ASX: S32) - Consolidating Before Its Breakout

South32 has spent the better part of a year consolidating after a long downtrend. The setup now indicates potential accumulation, especially as price begins to climb on rising volume.

A breakout above $3.25 could open the path to $3.80–$4.00, suggesting meaningful upside. However, timing is key.

Head of Premium Sales and Wealth Within graduate Zoran Kresovic notes, “This is one to watch, not rush. Wait for confirmation of a breakout before entering, as false reversals can catch investors off guard.”

For superannuation investors seeking diversification, South32 also offers defensive exposure to materials, making it a pragmatic inclusion for moderate-risk portfolios.

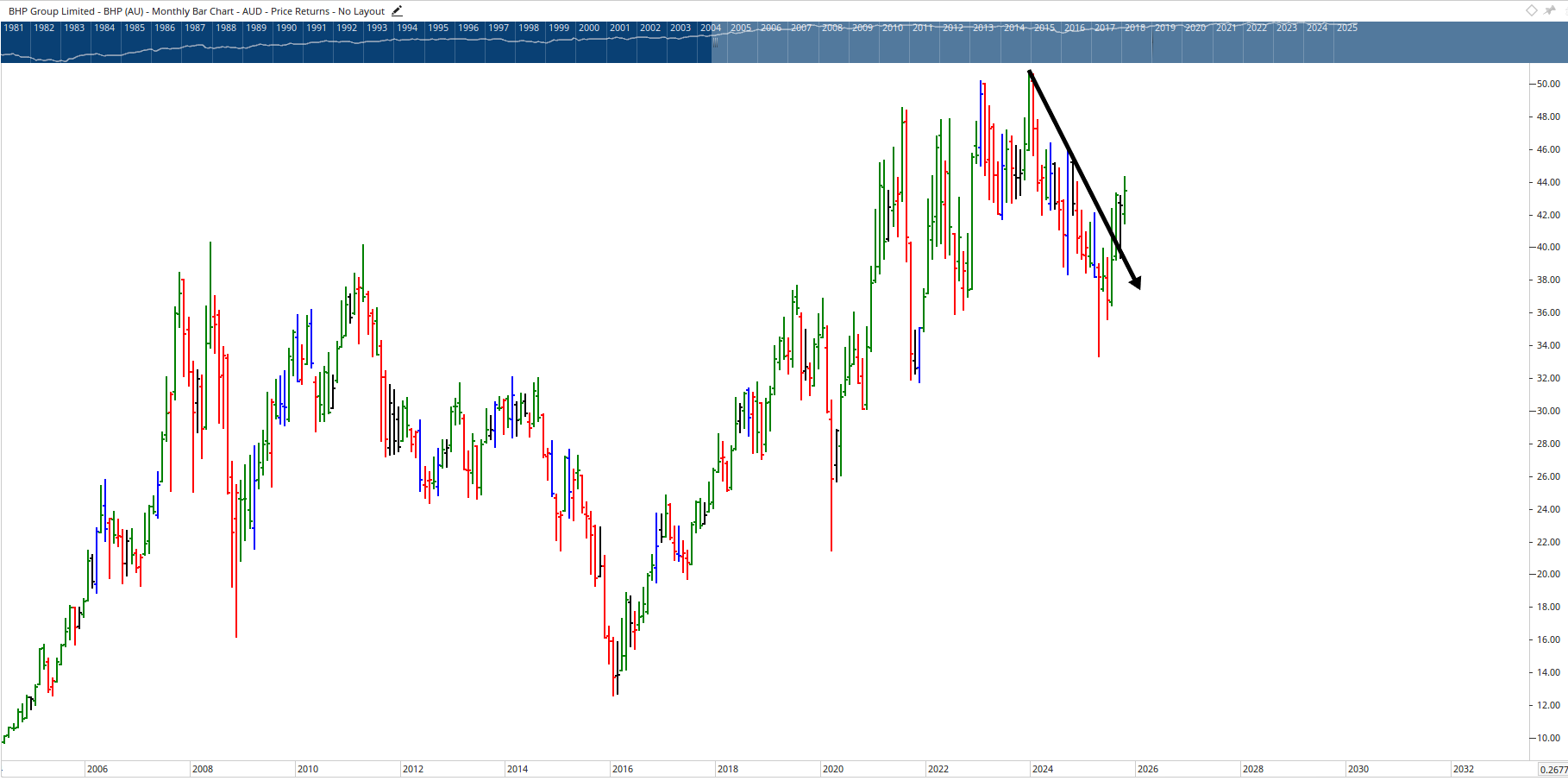

BHP (ASX: BHP) - Setting the Stage for the Next Uptrend

BHP is once again leading the charge for Australian miners. Having broken its long-term downtrend from the 2023 highs, the stock has re-entered an upward stride, supported by consistent volume and bullish price action.

“This could mark the early stages of a new sustainable trend,” says Kresovic. “The structure is clean, bullish, and supported by fundamentals.”

If you want to learn how to identify breakouts and momentum trades in top 20 stocks like BHP, the Advanced stock trading course teaches traders how to combine timing tools like Elliott Wave and time analysis for high-probability setups.

Macquarie Group (ASX: MQG) - The Silent Financial Star

While the big four banks have been in the spotlight, Macquarie has steadily delivered. Its broad international exposure and diversified income streams provide both resilience and opportunity.

After a strong rebound from its early 2025 correction, the stock appears positioned for a climb toward $242, representing a modest but reliable upside.

Revic notes, “Macquarie has navigated volatility extremely well, which is a hallmark of strength when compounding wealth for the long term.”

Rio Tinto (ASX: RIO) - Eyeing a Major Breakout

Rio Tinto looks ready for its next leg up, provided it can clear strong resistance near past highs around $130–$136. Once that barrier breaks, price targets toward $150+ come into view, potentially marking a fresh multi‑year bull run.

Janine adds, “The pattern looks eerily similar to pre‑GFC breakouts where accumulation led to steep rises. It’s not about predicting an identical move, but the risk‑reward setup is undeniably attractive.”

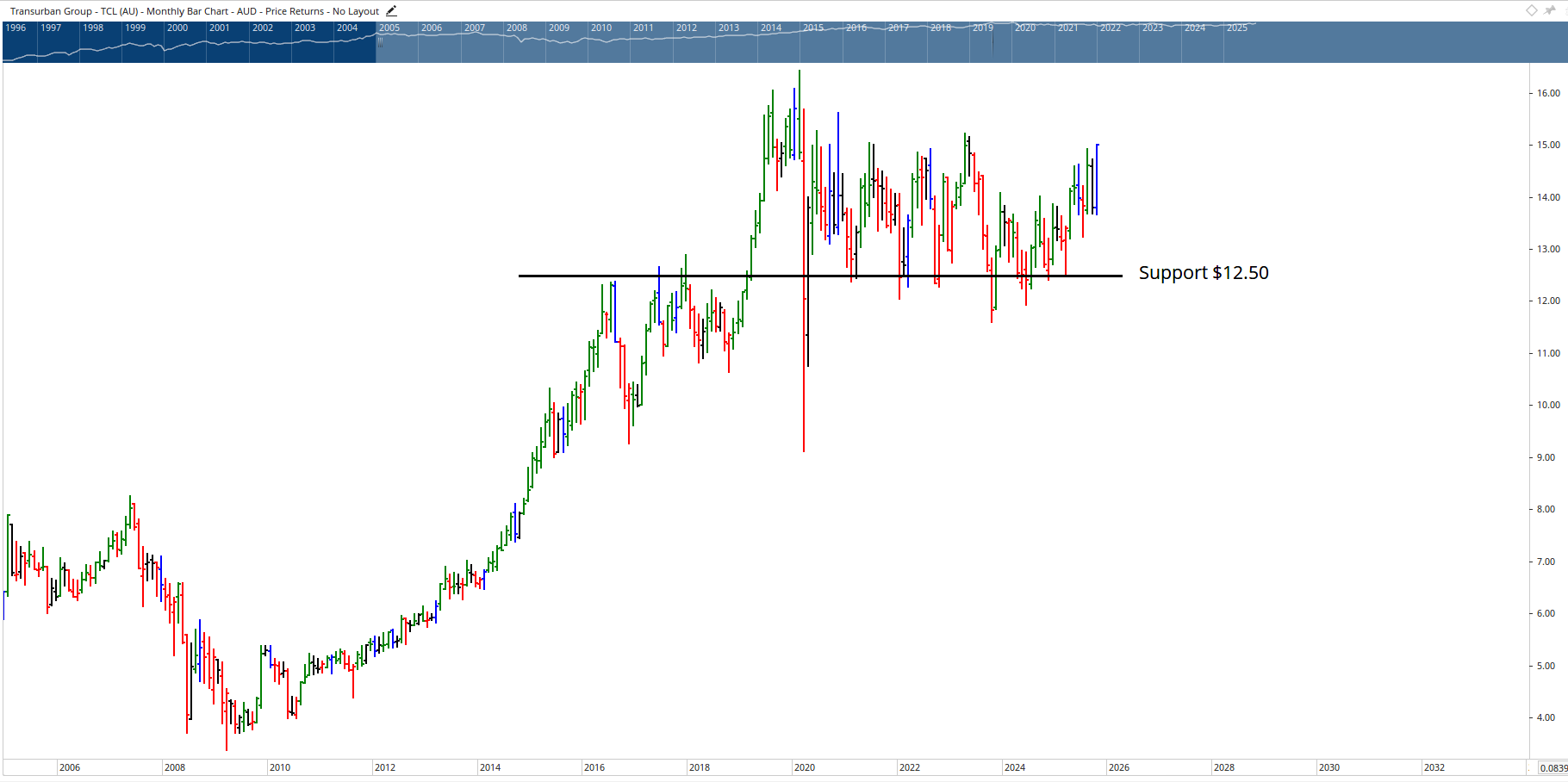

Transurban (ASX: TCL) - A Consistent Market Leader

Transurban continues to deliver stable growth, with price action mirroring a well‑defined uptrend since 2023. With minimal downside volatility and strong support around $12.50, it’s a preferred choice for investors seeking long-term capital growth and reliable dividends.

“This is textbook top‑20 stock behaviour, high-quality structure and sustained growth,” says Kresovic.

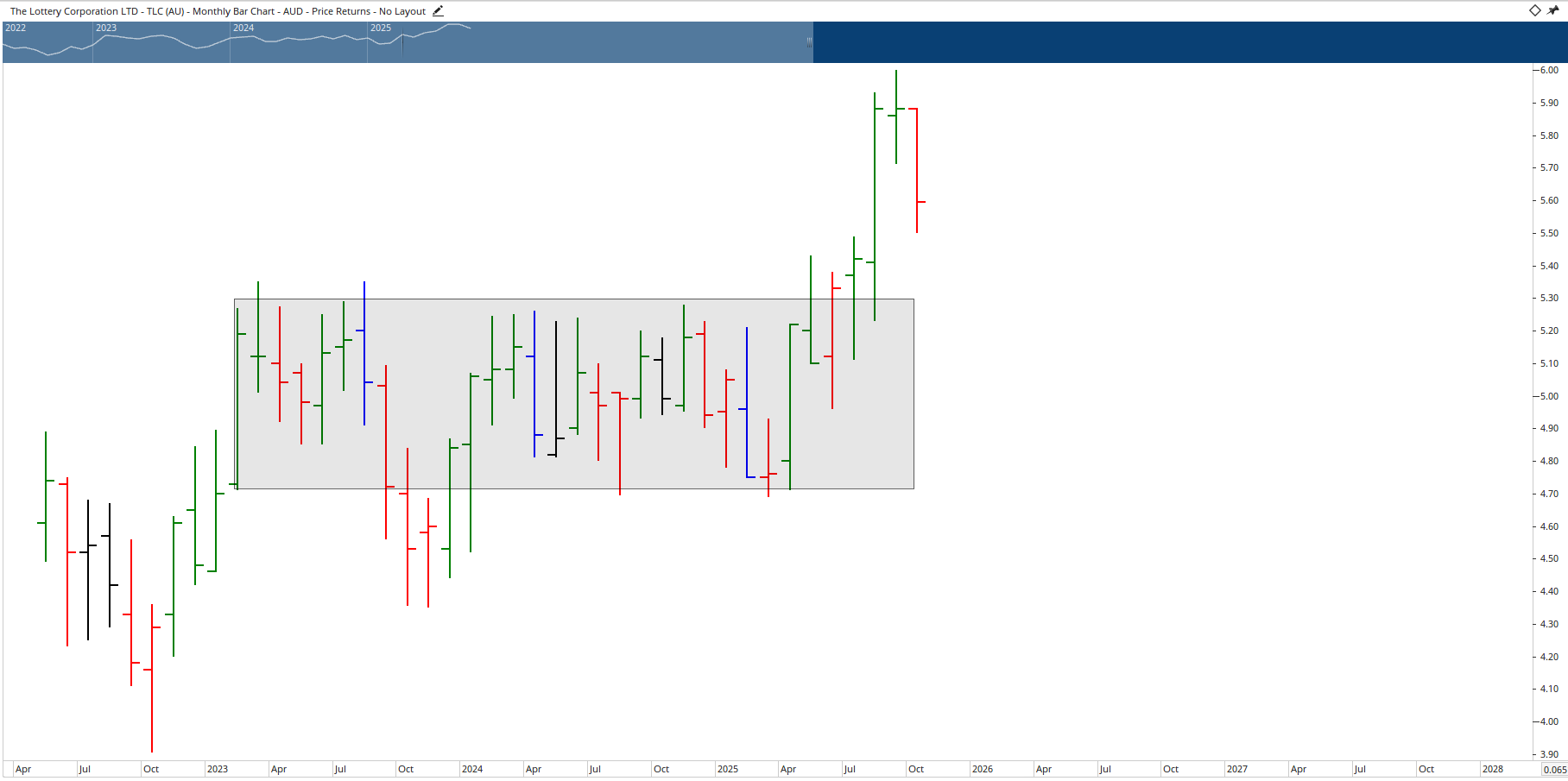

The Lottery Corporation (ASX: TLC) Breaking Out and Running

Having recently broken out of a long consolidation phase, The Lottery Corporation has surged beyond $6 after earlier coverage on the Wealth Within show when it sat around $5.20.

This validates the technical perspective that price action often leads to fundamentals. “Many focused solely on intrinsic valuations, but charts were already signalling momentum,” said Tortevski.

Xero (ASX:XRO) -The Weak Link Among Tech Leaders

Not all blue chips are in strong momentum. Xero has shown weakness, slipping below key support levels with fading volume. Analysts expect more downside before a base forms.

“This is the kind of stock where patience is key,” Cox explained. “Wait for the structure to confirm a bottom, otherwise you’re just catching falling knives.”

Final Word - Prepare and Educate While the Market Rises

With the ASX approaching 10,000, investors should balance optimism with preparedness. Markets don’t rise forever and understanding how to protect, preserve, and grow capital will define who thrives in the next phase.

If you want to gain confidence during market highs and navigate corrections with precision, explore Wealth Within’s award-winning share trading education today.

To watch ongoing analysis and real-time insights from Janine Cox, Filip Tortevski, and the team, visit our Hot Stock Tips videos, ASX video library.

For over 23 years, About Wealth Within has empowered Australians to take control of their financial future through education, discipline, and strategy because knowledge, not luck, builds wealth.

Important information

This content is provided for educational purposes only and is not personal financial advice. It does not take into account your objectives, financial situation or needs. Consider seeking advice from a licensed professional before acting on this information. Markets involve risk; past performance is not a reliable indicator of future performance.