The Hottest ASX Dividend Stocks to Buy in 2026

By Dale Gillham, Janine Cox, Fil Tortevski and Pedro Banales

If you’re an investor looking to earn consistent income and strong growth in 2026, dividend stocks may be your best play. The team at Wealth Within, Australia’s leading accredited share trading educator, has unveiled its latest picks for the hottest ASX dividend stocks set to deliver strong yields and capital growth next year.

Understanding the 2026 Dividend Landscape

As we approach 2026, dividends are expected to remain a key income source for investors, but not all sectors will perform equally. While analysts anticipate rising yields, the focus is shifting to specific sectors showing robust earnings growth and recovery potential.

Here’s what’s standing out right now:

- Technology is poised for outperformance, boasting a forecast growth of over 22%, driven by strong cash flows from major players.

- Healthcare remains resilient, with stocks like Cochlear and ResMed holding firm despite recent sector volatility.

- Materials and industrials continue to gain momentum as companies like BHP, Rio Tinto, and Fortescue reach new highs.

These sectors represent a balance between stability and opportunity which are key principles for anyone learning how to invest for income and growth.

Top ASX Dividend Stocks to Watch in 2026

The Wealth Within analyst team, Dale Gillham, Janine Cox, Filip Tortevski and Pedro Banales have identified several ASX stocks combining yield, growth, and timing opportunities.

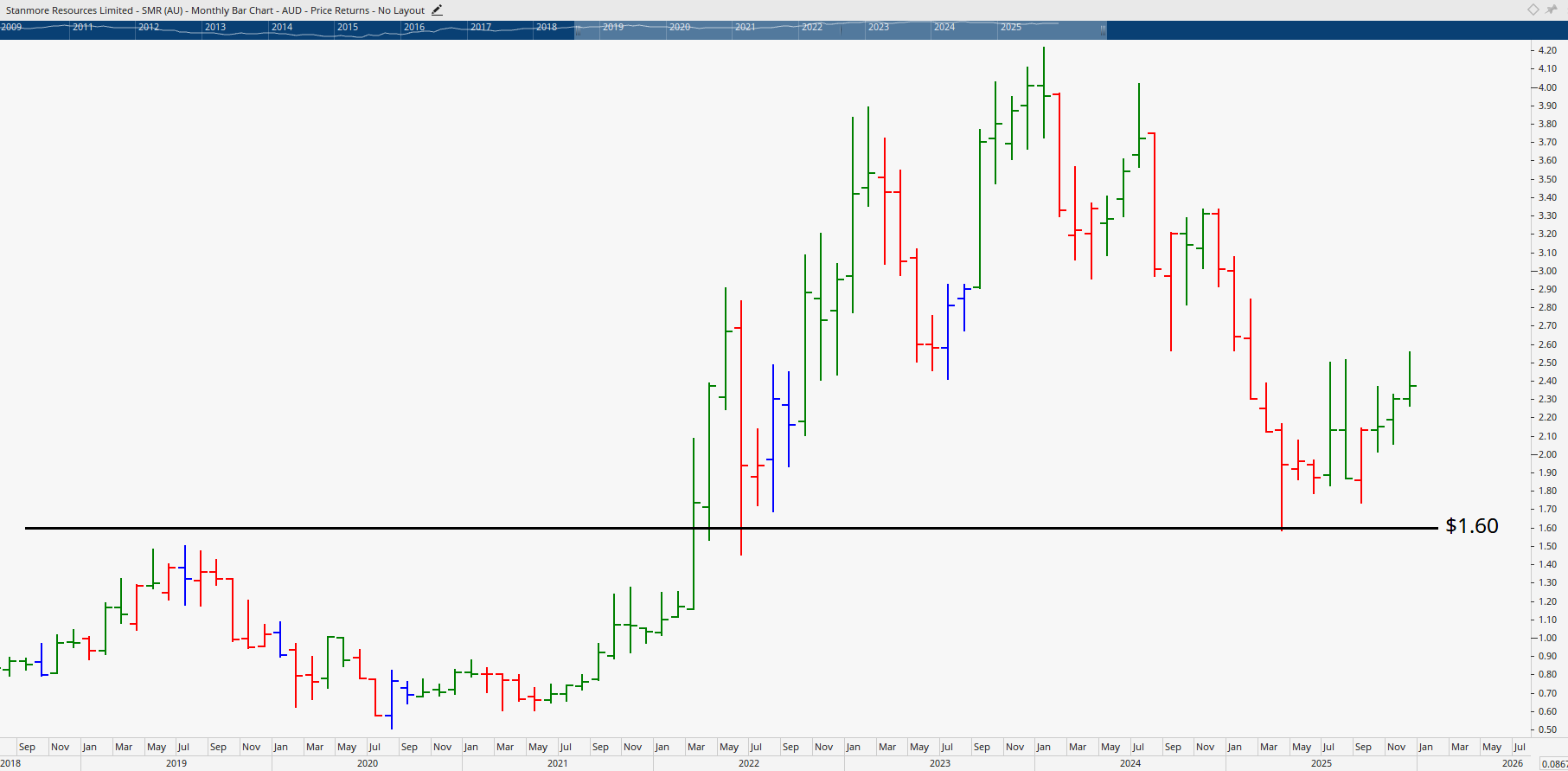

1. Stanmore Resources (ASX: SMR) – 23.2% Dividend Yield

Mining continues to shine, and Stanmore Resources stands out with an exceptional yield. Following strong support near $1.60, the stock has retested its base and appears positioned for a potential rebound.

However, analysts caution that a 23% yield is unlikely to remain sustainable over the long term. Traders must approach high-yielding stocks with discipline, keeping stop losses in place and focusing on timing rather than simply chasing big dividends.

Timing and price entry are central to wealth creation, concepts mastered through structured education such as Wealth Within’s Advanced stock trading course.

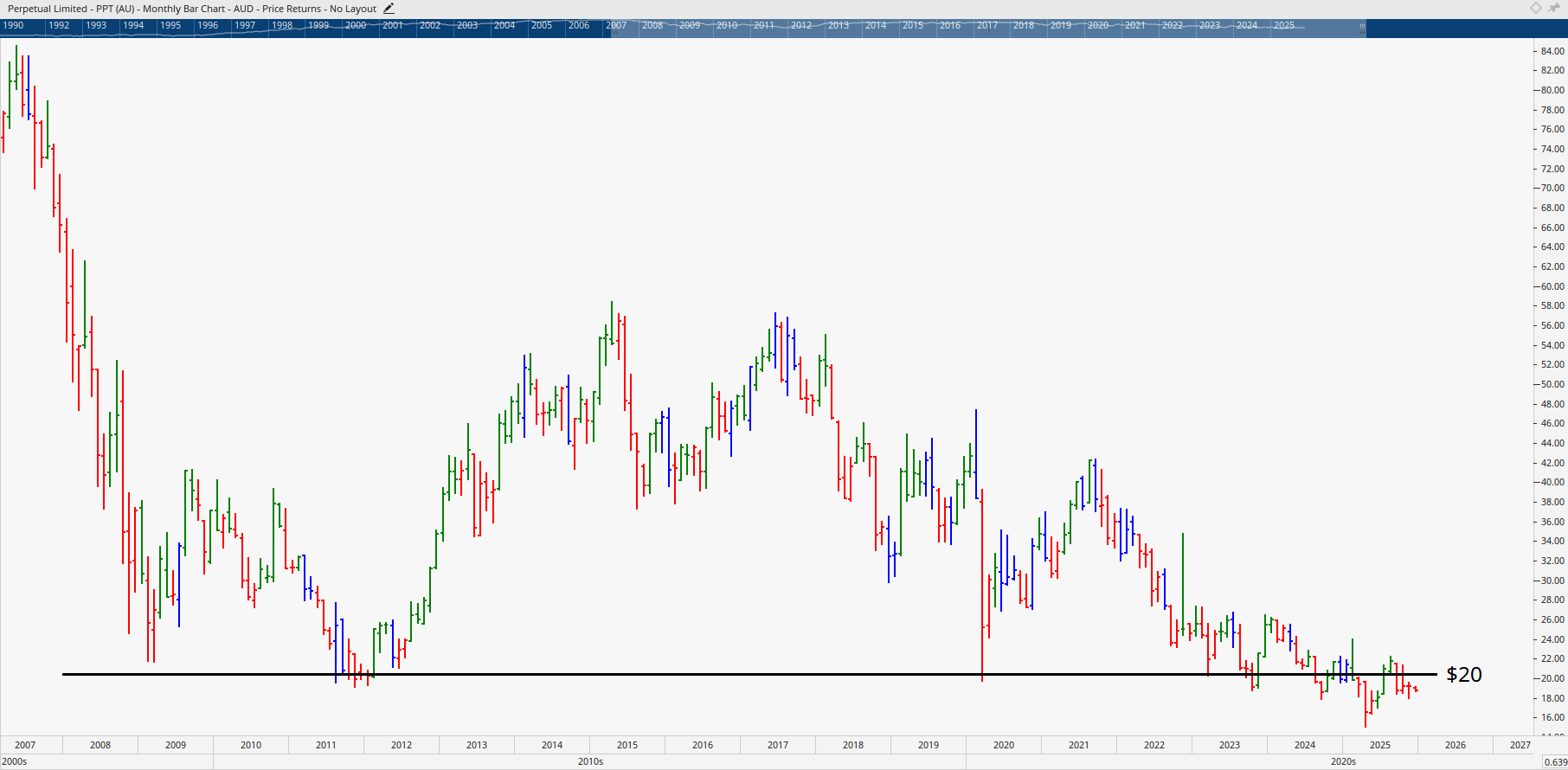

2. Perpetual Limited (ASX: PPT) – 9.4% Dividend Yield

In contrast, Perpetual Limited offers a more stable yield in the financial sector. With its share price consolidating around $20, this stock appeals to cautious investors seeking consistency rather than volatility.

“Perpetual’s long-term charts show strong basing patterns,” says senior analyst Filip Tortevski. “That kind of setup supports reliable income portfolios, particularly for super funds.”

This kind of analytical thinking, identifying risk and opportunity through chart patterns, is fundamental in structured Trading courses focused on market timing and trend trading.

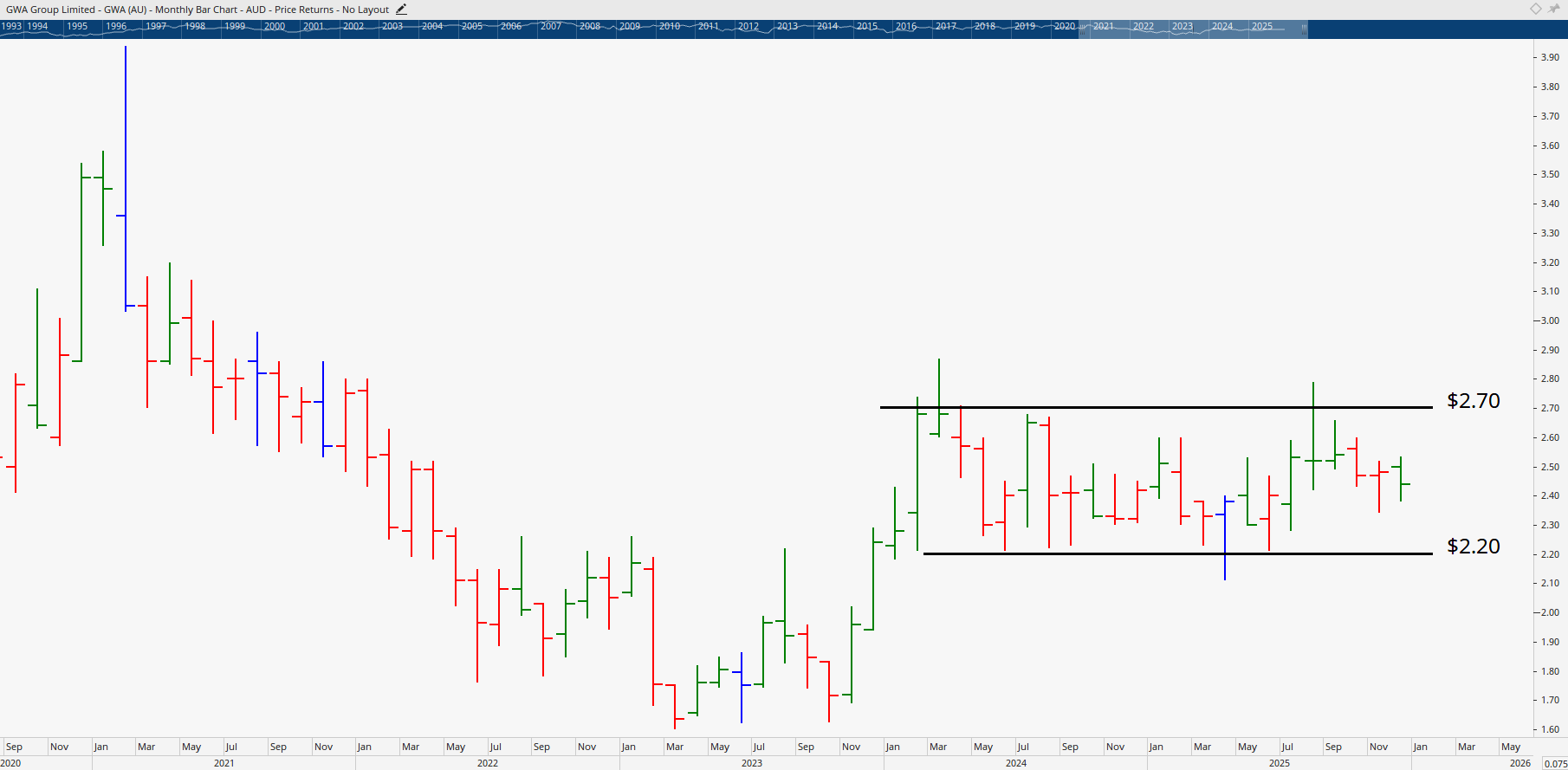

3. GWA Group (ASX: GWA) – 9.3% Dividend Yield

Operating in Australia’s construction space, GWA Group has been consolidating sideways, trading between $2.20 and $2.70 since early 2025. This range provides short-term opportunities for active traders who can manage entries and exits within well-defined support and resistance zones.

Wealth Within analysts emphasise GWA’s suitability as a trading stock, not a long-term investment, due to its inherent volatility. Applying the right strategy, one learned through structured Share trading education, is key to turning price swings into profits.

4. McMillan Shakespeare (ASX: MMS) – 8.8% Dividend Yield

This financial services group has shown impressive historical performance, reaching all-time highs in 2025. Analysts note that MMS offers an excellent blend of income and capital appreciation, provided prices stay above $15.

For long-term investors, MMS is an excellent example of a “simple but effective” setup which is the type of trade Wealth Within mentors teach during the Short Course in Share Trading.

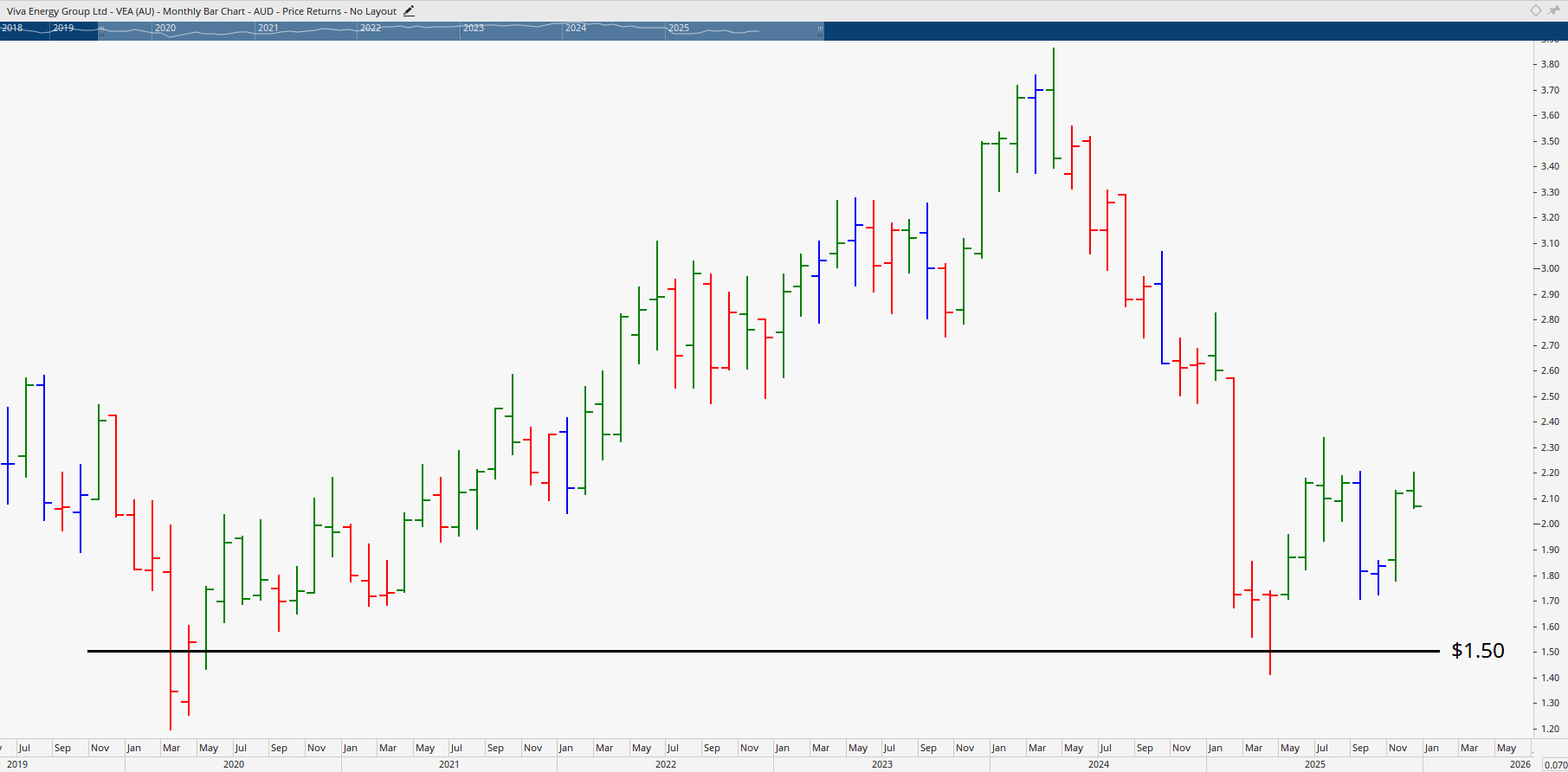

5. Viva Energy Group (ASX: VEA) – 8.0% Dividend Yield

As the parent company operating many of Australia’s Shell petrol stations, Viva Energy is a strong dividend-paying stock within the energy sector. The price has twice bounced off support around $1.50, suggesting a potential trend reversal.

The company’s industry position and stable price behaviour make it a technically appealing stock for medium- to long-term investors. A steady trading approach, rather than frequent speculation, improves outcomes for investors pursuing sustainable wealth.

6. Chorus Limited (ASX: CNU) – 8.0% Dividend Yield

Chorus recently broke to a new all-time high and is showing a healthy trend supported by balanced buying and selling pressure. Unlike more volatile picks, this stock provides a defensive option for yield-oriented portfolios.

As analyst Pedro Banales explains, “A strong, steady trend is often the best companion for consistent dividend returns.” This principle underpins the philosophy behind Wealth Within’s Diploma of Share Trading and Investment, which helps traders systemise decision-making.

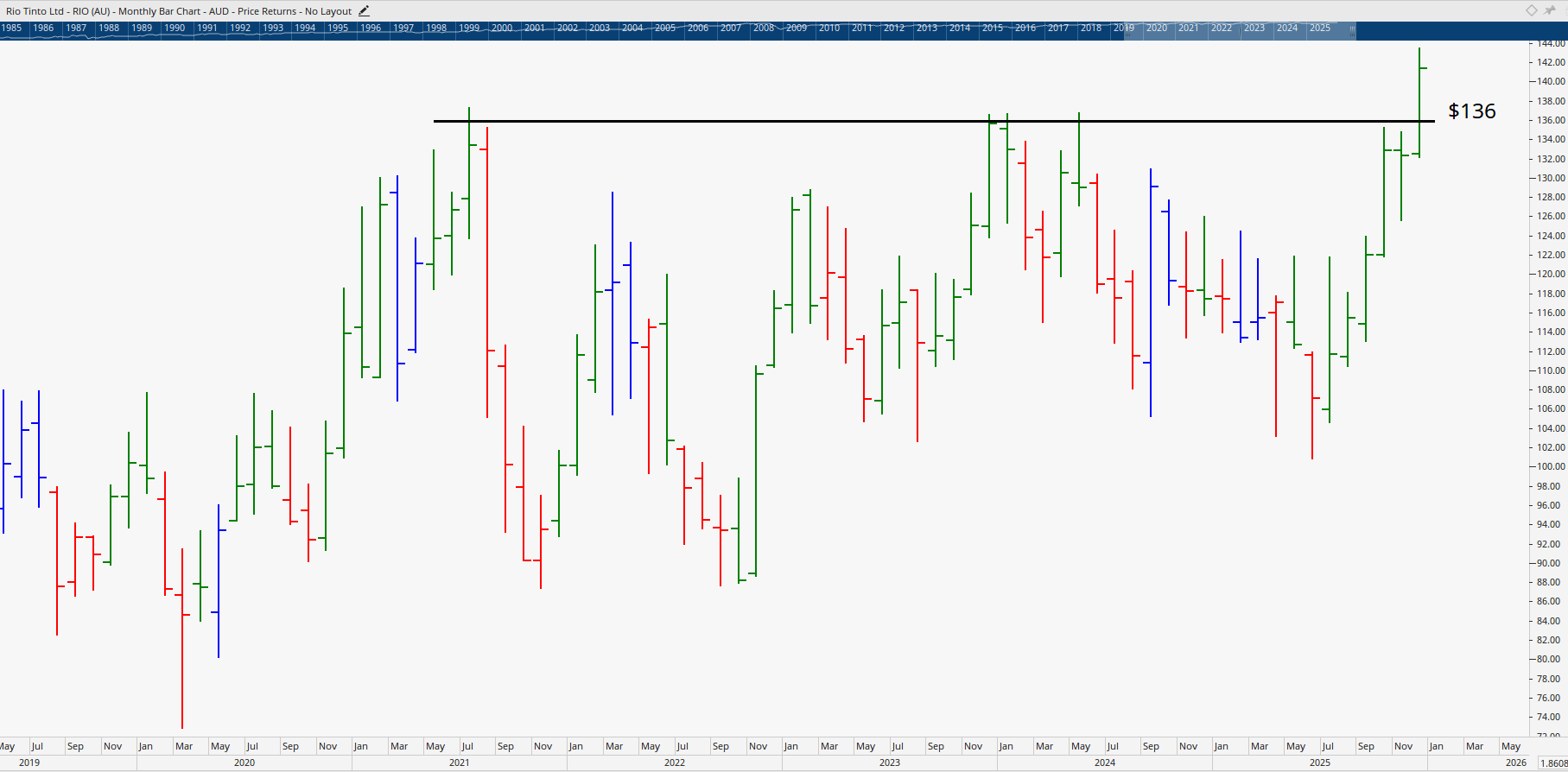

7. Rio Tinto (ASX: RIO) – 7.0% Dividend Yield

A reliable blue-chip pick, Rio Tinto has been consolidating since 2021 and recently confirmed a breakout around the $136 mark. With strong mining fundamentals and renewed bullish sentiment, Rio continues to serve as a foundation stock for dividend investors.

As one of Australia’s top 20 shares, Rio Tinto offers both stability and liquidity, two essential traits for investors focused on managing risk and compounding over the long term.

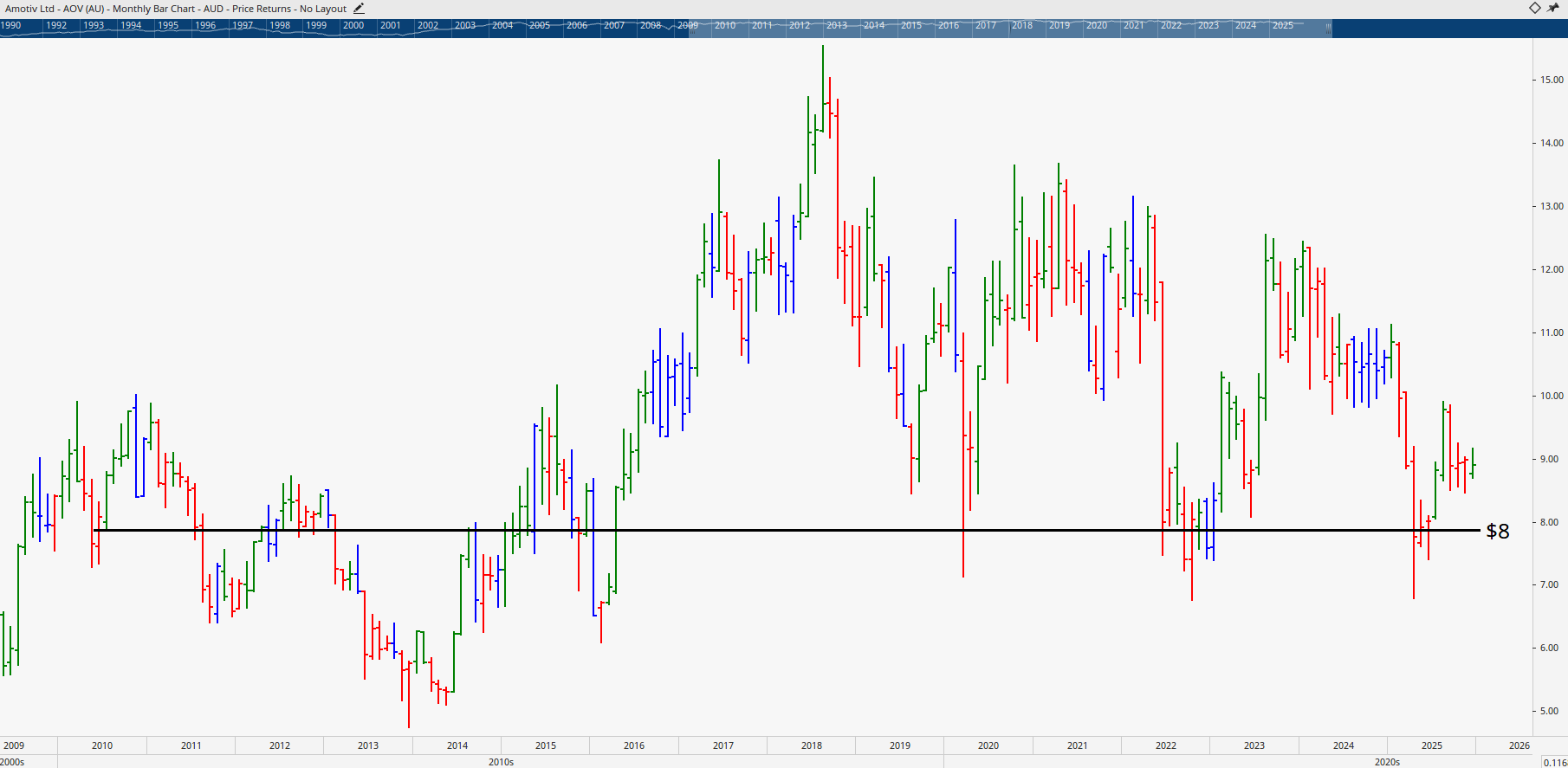

8. Amotiv Limited (ASX: AOV) – 6.5% Dividend Yield

Once overlooked, Amotiv Limited appears to be forming strong support around $8, which historically marked a major resistance zone between 2004 and 2015. With its current price now holding above that base, a potential breakout could create new opportunities for value investors in 2026.

Investor Insights for 2026: It’s All About Timing and Discipline

A consistent theme across the analysts’ discussion was that investors should not rely solely on the yield percentage. Instead, the timing of your entry and exit matters far more than chasing short-term payouts.

Dale Gillham, founder of Wealth Within, reminds investors,

“The best opportunities come to those who are prepared. Education, patience, and sound strategy are what separate successful traders from hopeful investors.”

For those new to the market, building these habits is best done by first understanding the Stock Market for Beginners through foundations in risk management, trading psychology, and proven technical strategies.

Learn to Trade Smarter in 2026

If you’d like to analyse stocks with the same precision as the experts, explore Wealth Within’s nationally recognised Trading courses. These programs teach you to learn to trade shares confidently, identify patterns, manage risk, and make profitable, informed decisions.

Watch our weekly Hot Stock Tips videos or the Australian Stock Market Show in our ASX video library to see real-world examples of these principles in action. You’ll also find discussions on topics like emerging sectors, market timing, and portfolio management.

Learn to Trade with Confidence

The hottest ASX dividend stocks for 2026 reflect a clear message:

Balance income with growth, manage risk, and focus on timing.

With careful stock selection, patient execution, and expert-guided education, you can turn 2026 into a year of smarter, more profitable investing with Wealth Within!