Will Trump’s Europe Tariffs Crash the ASX? Here’s How You Could Profit

By Janine Cox, Fil Tortevski and Pedro Banales

What happens when global politics meets market psychology?

Trump’s renewed threat of European tariffs has sparked a wave of speculation across global markets and Australian investors are watching closely.

In the latest update from the team at Wealth Within, our analysts unpack whether these tariffs could actually disrupt the ASX, or instead offer some compelling buying opportunities.

The Global Context: Will This Tariff Talk Hit Markets Hard?

For many investors, the phrase “Trump tariffs” dredges up memories of previous market pullbacks. Last year’s similar move saw indexes shed nearly 20%. But this time, the focus is narrower as it is aimed at Europe, not a global trade war.

According to Wealth Within’s senior analysts, a long, drawn-out sell-off seems unlikely. While volatility is expected, the market remains structurally strong, bolstered by Australia’s continued commodities boom.

The real question for traders isn’t whether the ASX will crash; it’s where the next opportunities lie.

Which Sectors Could Benefit?

Our analysts suggest keeping a close eye on:

- Defensive stocks as investors seek safety;

- Energy, with tariff disruptions likely to shake up global supply chains;

- Healthcare, poised to capture demand redirected from European exporters, and

- Technology, which could rebound strongly after recent corrections.

Australia’s healthcare industry, in particular, could experience tailwinds as European producers face new export headwinds into the United States.

Is This a Buying Opportunity or a Warning Sign?

Savvy investors know that corrections are part of the market rhythm. Historically, the ASX sees two healthy pullbacks a year and seasoned traders often use them to reload.

As Wealth Within’s experts emphasised, markets move in cycles. Understanding these cycles is how professionals profit when others panic.

If you’re new to the stock market, our Stock Market for Beginners guide is a great place to start learning how cycles, risk, and timing play together.

Our Analysts’ Stock Spotlight

Using our technical and fundamental analysis frameworks, the latest Australian Stock Market Show highlighted several stocks that could benefit from the current situation.

Here’s a glimpse from the session:

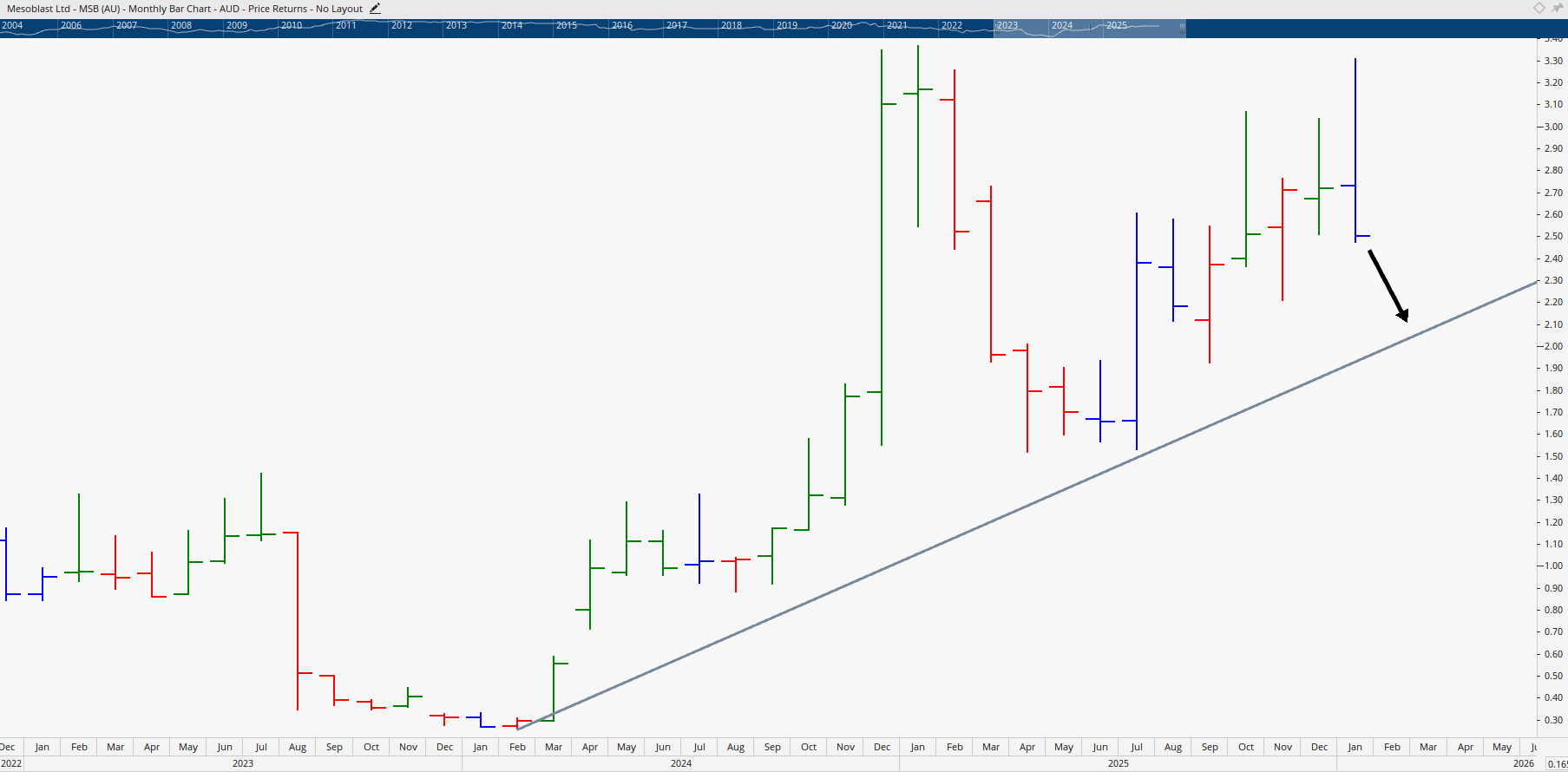

- Mesoblast (MSB) – Pulling back to key levels with upside potential if healthcare sentiment strengthens.

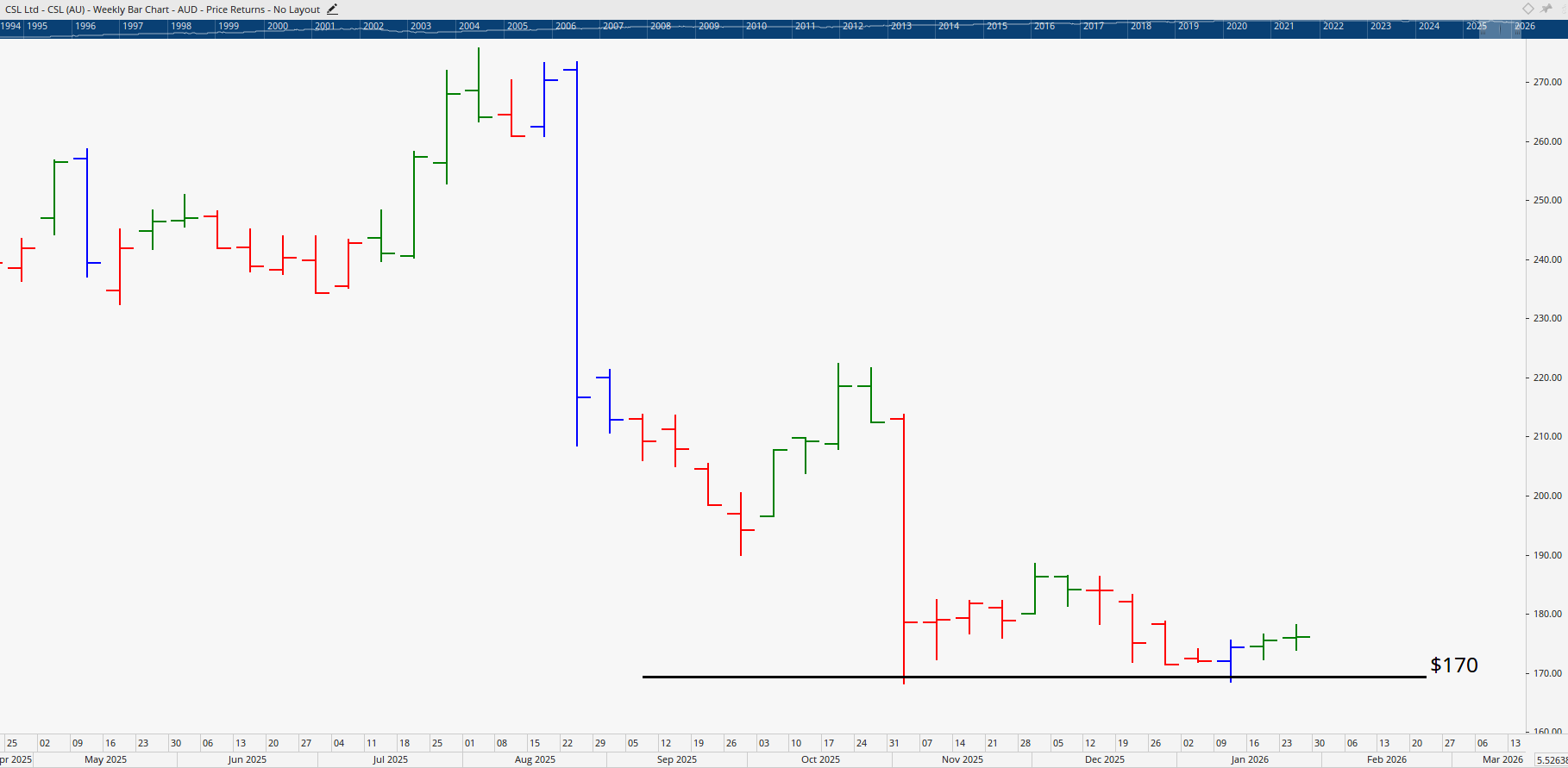

- CSL Limited (CSL) – Testing support near $170; one to watch for rebound confirmation.

- A2 Milk (A2M) – Short-term volatility following Chinese economic updates; traders may find medium-term upside once the dust settles.

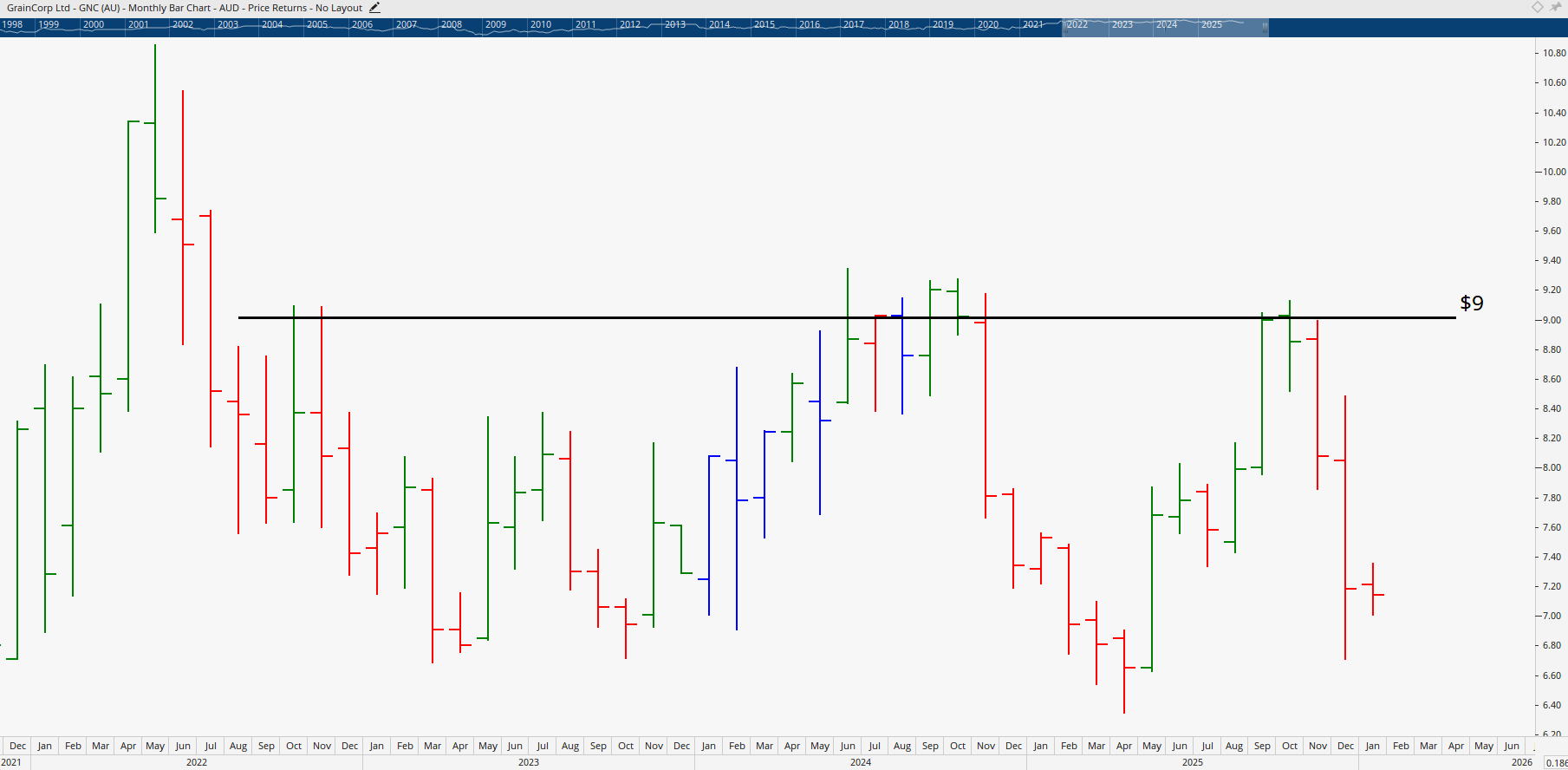

- GrainCorp (GNC) – Watching for strength above $9 could signal a continuation of its longer-term uptrend.

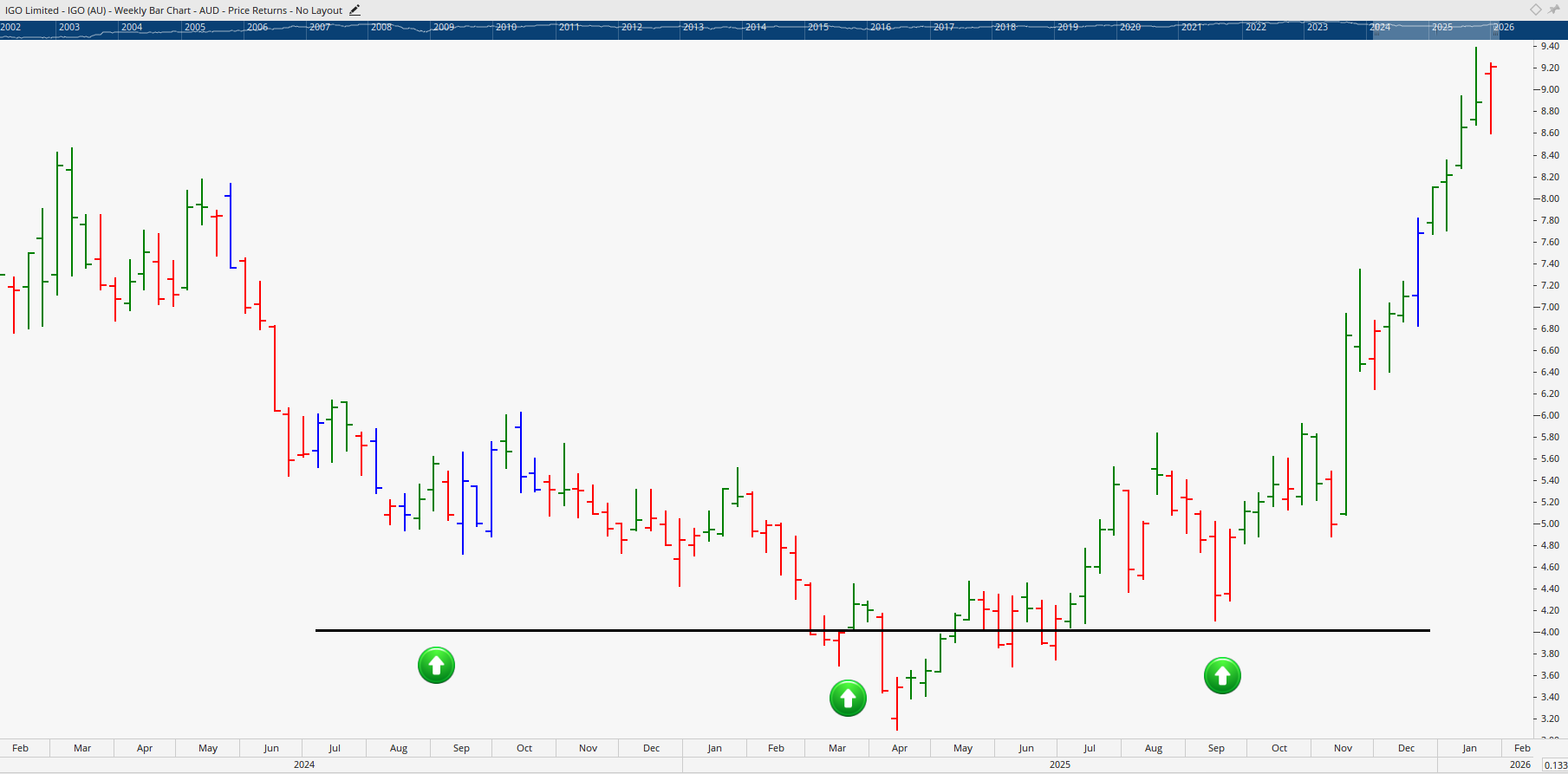

- IGO Limited (IGO) – Strong rebound from lows, benefiting from renewed momentum in commodities.

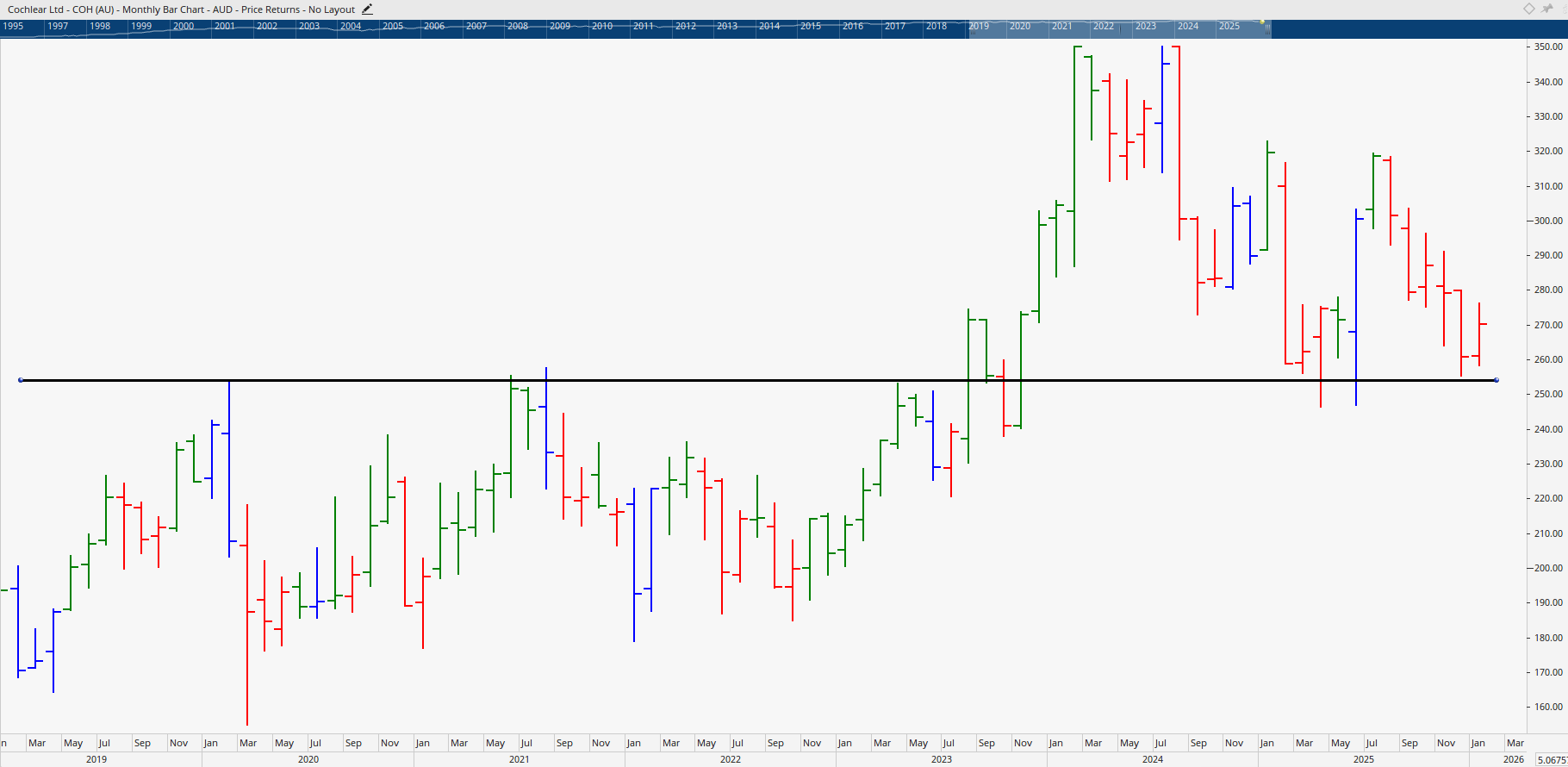

- Cochlear (COH) – Approaching long-term support zones that could set up a recovery rally.

For live analysis, subscribe to our Hot Stock Tips videos and our ASX video library on YouTube, which feature professional-level breakdowns of ASX and global trends each week.

Macro Outlook: ASX Still Bullish Despite Tariff Volatility

Despite short-term jitters, Wealth Within forecasts that the ASX could still reach record highs of around 11,000 points in 2026. While Trump’s trade rhetoric introduces uncertainty, it does not reshape the broader economic cycle.

Commodity strength and Australia's growth in sectors like energy, technology and healthcare remain promising.

Corrections of around 8% to 10%, if they occur, are likely to be temporary. This creates strategic entry points for informed investors.

Key Learnings for Traders and Investors

The discussion offered timeless takeaways for anyone serious about trading:

- Don’t chase media headlines — focus on timing and technical confirmation.

- Always assess risk vs reward before taking a position.

- Build your trading decisions around proven strategies, not speculation.

- Understand price, pattern, and time — the three pillars of market mastery.

If you want to elevate your understanding of these techniques, explore our structured Trading Courses. They’re designed to help investors trade with confidence and consistency, not emotion.

Learn to Trade Like a Professional

Whether you’re starting your investment journey or ready to refine your strategies, Wealth Within offers tailored education for all experience levels:

- Short Course in Share Trading — perfect for building strong, profitable foundations.

- Diploma of Share Trading and Investment — Australia’s only government-accredited trading qualification.

- Advanced Stock Trading Course — for mastering techniques like Elliott Wave and time analysis.

Each pathway is designed and taught by professionals with decades of market experience, so you can learn to make smarter, independent decisions in any market condition.

Final Thoughts: Tariffs May Rattle, But Not Ruin

Tariffs come and go. Skill stays.

Markets will always react to politics, but professional traders understand that volatility is an opportunity in disguise.

By combining education, data-driven analysis, and strategy, you can trade with clarity rather than emotion.

Ready to take control of your portfolio? Learn more About Wealth Within and how our education empowers everyday investors to trade as confidently as professionals.