Small Cap Stocks: Should You Invest?

By Dale Gillham

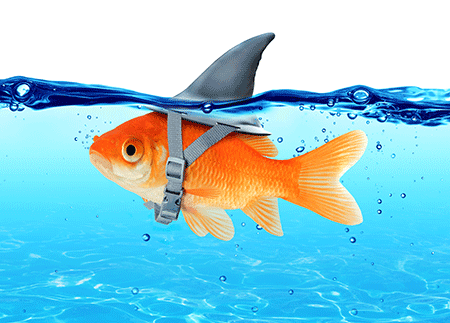

The dream of every trader or investor is to pick a company that transforms from relative obscurity to being the next Google. But let me give you an analogy right up front about the reality of investing in small-cap stocks.

Some traders manage to catch the elusive small fish that eventually becomes the next big fish. However, for the majority, the small fish they thought would be the catch of the century either get washed up onshore only to die a slow death, struggle in shallow waters for years going nowhere or simply get swallowed up by the bigger fish.

Many of the biggest stocks on the Australian market and, indeed, world markets did not start out as big fish. You only need to look back around 42 years to when Apple launched and just over 20 years for Google. Both companies are now heavyweights in the US share market.

Many companies on the ASX and the S&P500 started as small fish in a big pond and had you invested in one during their very early days, you may be a millionaire today. That said, picking these stocks can be high risk, as not all grow into big companies like Apple or Google.

Because small-cap stocks are, by their very nature, high risk, I place them firmly in the “speculation” bucket of your investment portfolio. Given this, investing all of your money in these stocks is not a sound retirement strategy or a substitute for a well-thought-out investment strategy.

So should you invest in small-cap stocks? Absolutely but let me share with you some solid rules throughout this article that will increase your chances of selecting the right stocks.

The key to protecting your capital when investing in small-cap stocks

Firstly, I have a simple rule that will help you if you take the time to think about it. When considering whether you should invest in small-cap stocks, it is important to remember that the higher the risk you are exposing yourself to the more research, knowledge and skill you require to manage this risk.

This rule applies not only to the different markets you are trading but also to the different classes of stocks, regardless of whether you are investing in large-cap stocks, mid-cap stocks or small-cap stocks and even penny dreadfuls.

Unfortunately, very few understand or even consider this rule before plunging head-first into buying small-cap stocks. Many invest in this segment of the market without any rules at all or a misguided perception that they have rules. Let me share an example with you.

I was talking to a trader recently who had read my latest book, Accelerate Your Wealth - It’s Your Money, Your Choice. He shared with me that he loved the book, as it opened his eyes to the simplicity of how you can make serious money in the share market, however, he had broken all the rules I advise you should follow and he admitted that he was the very definition of a gambler that I outline in the book.

Unfortunately, he had put all of his money into two small-cap stocks hoping to win big. And I mean everything by mortgaging his house and borrowing money from credit cards and a personal loan. While he validated his reasons for buying the stocks, they were not based on sound trading rules.

Currently, one of the positions is down $35,000 while the other is in a trading halt and has been for months. The good news is that after reading my book he now realises his mistakes and, more importantly, the true value of getting a good, solid education in trading before you trade.

Regrettably, this conversation is the same one I have had with thousands of individuals over the decades I have been helping traders, although in this instance this person was smart enough to realise he needed to change his ways to achieve what he set out to. Sadly, some never get it and so continue to invest in small-cap stocks using what I like to call the “buy and prey” method.

Trading small-cap stocks

For some reason, people tend to treat trading in small-cap stocks like they do when punting at the races. When trading the stock market, however, the stakes are generally much higher because over time the uneducated lose more than they win, and unfortunately some lose everything. Interestingly, many of the people I talk to who speculate in small-cap stocks tell me that they don’t have a very high tolerance to risk, yet this is exactly what they are exposing themselves to.

The rationale for buying small-cap stocks often stems from the perception that they are cheap given that many are priced at only a few cents. I have lost count of the number of people who have told me they invested in a small-cap stock because it was cheap. But as many come to realise, buying cheap doesn’t always mean a bargain.

Buying cheap doesn’t mean a bargain

People usually have a misunderstanding that because a stock is cheap they can buy more shares in comparison to a stock that is more expensive and somehow stand to make more profit. But the amount of shares you buy is irrelevant to your potential profit. Unfortunately, it is this one concept alone that causes the demise of more traders than anything else.

You cannot determine whether a stock is cheap based on the share price alone. Instead, you need to compare the real value of the company per share against the current share price. Let me explain.

If a company is valued at one million and has one million shares on issue, this means that each share is worth $1.00. But if the company is trading at $2.00 then the stock price is expensive, whereas if it is trading at $0.50, it would be considered cheap in comparison to its real value.

The attraction to buying small-cap stocks is based on the perception that they can move very fast in price and make you a lot of money quite quickly. While this can and does happen, it is not always the case.

Unfortunately, many traders mistakenly believe that a major benefit of investing in small-cap stocks is their ability to move very fast. But in reality, it is also one of the biggest risks, which makes small-cap stocks much more hit-and-miss. The statistics prove they are more miss than hit, which is why you need to have more knowledge and skill when trading these stocks than you would when trading a top 20 stock.

Understanding liquidity when investing in small-cap stocks

It is also important to understand the liquidity risks that exist when you trade small-cap stocks. The gentleman I referred to earlier who had bought the two stocks did so because he thought they had good liquidity but when I shared with him that this was not the case he was surprised.

That is why you need to understand that the volume of shares traded does not mean a stock is liquid. The amount of shares this person owned in just one stock would have taken him days, if not weeks to sell out of and if the price is falling as more shares are sold, his sale price will continue to decrease.

This is because, with an illiquid stock, there is far less trading that occurs, which means just because you can buy a small-cap stock does not mean you can sell it at a price you want, when you want, which is why I refer to them as a double-edged sword.

Seven Rules to consider before you invest in small-cap stocks

Small cap stocks do not suit everyone especially given that many do not pay a dividend and their past performance is no guarantee of future performance. Given this, small-cap stocks are more suitable for those in the growth stage of building their portfolio who have a higher tolerance to managing risk. However, this is only the case if you have a high level of knowledge and the skill to analyse a price chart, and you can handle the large swings in price that unfold with these stocks.

Before you buy a small-cap stock, I highly recommend you consider the following seven points so you stack the odds in your favour:

- Ensure the company has revenue coming in from sales and they are profitable.

- Ensure they do not have a high level of debt. While the market generally prefers larger companies to have debt around 30 per cent of equity or lower, for small-cap stocks it’s generally up to 50 per cent.

- Look at a monthly bar chart to ensure the share price is rising and to confirm it trends well.

- If there are around five years of historical data, back-test a suitable trading strategy and identify how much you are prepared to risk losing.

- Assess the price levels that are likely to provide support if the stock falls or resistance if the price rises.

- Review the weekly price chart to understand how volatile the stock is, or in other words, how it moves? Can you move in and out of the stock quickly without adversely affecting the stock price? Remember, the volatility of smaller stocks can be more than double that of a big blue-chip company. Some stocks will rise or fall by 15 to 30 per cent on average in a week. So while you can probably handle the stock rising, the real question you have to ask is can you handle the falls?

- Have a view of the upside potential and the downside risks. A trader who fails to consider the potential downside is more likely to lose in the long run.

I also recommend that your collective holding in these stocks should be no more than 10 per cent of your total portfolio.

Finally, trading can be very financially rewarding and I have seen it change many lives (just read our client reviews and success stories), however, the problem for those who are not educated is that you don’t know what you don’t know. As a consequence, many go through the school of hard knocks before they realise that something is wrong with their approach.

For this reason, you need to have some self-awareness around your trading and be honest with yourself. Consider whether you are ready to trade these highly volatile, high-risk stocks. If not, and you proceed down this path, I can tell you with 100 per cent certainty what will happen, if it hasn’t already.

Now let’s get into this week’s stocks. Watch the video to find out more.

Others who read this also enjoyed reading: