Buy Bargain ASX Real Estate Stocks Before the RBA Rate Cut

By Janine Cox and Fil Tortevski

As Australia counts down to a likely interest rate cut in November 2025, savvy investors are positioning themselves in sectors set to benefit from cheaper money. Rising valuations, high rental yields, and renewed optimism are lighting up the ASX real estate sector, but which stocks are still trading at a bargain?

In this article, senior analyst Janine Cox and host Filip Tortevski from Wealth Within reveal three standout ASX-listed real estate stocks set to shine before the rate cut hits, along with insights on timing, market psychology, and investor strategy.

Why the RBA Rate Cut Matters for Real Estate Stocks

Lower interest rates reduce borrowing costs for property developers, investors, and fund managers. This leads to:

- Higher valuations across commercial and residential property sectors

- Increased investor confidence and improved liquidity

- Stronger demand for companies with large property portfolios

As Janine Cox explained, “Regardless of whether the RBA acts in December or early next year, the sector already looks strong. A rate cut simply accelerates the opportunity.”

To learn how movements like this affect stock performance and how to trade them, consider enrolling in one of our Trading courses, the foundation of professional-level share trading education in Australia.

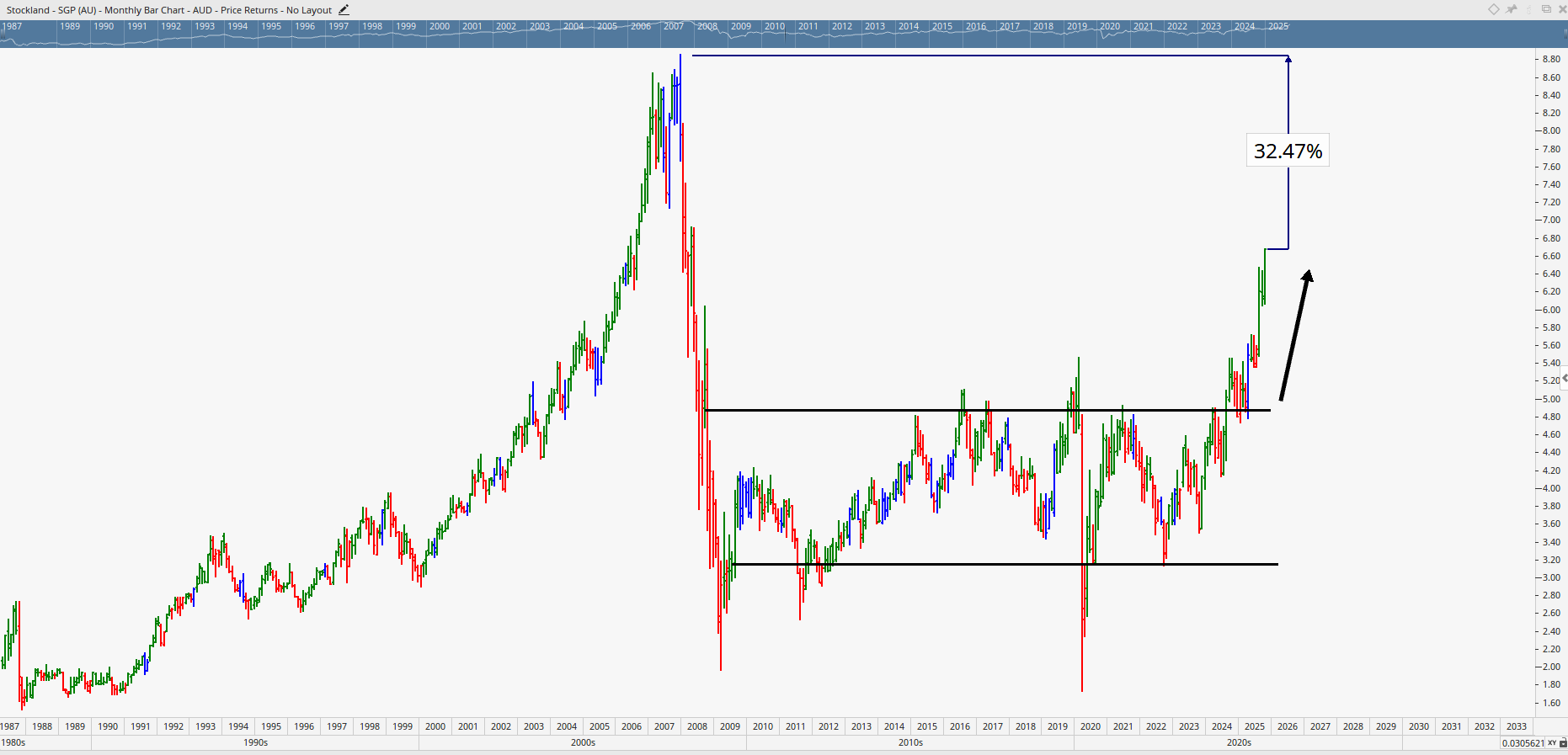

1. Stockland Group (ASX: SGP) - Reawakening After Years of Sideways Action

Stockland has quietly transitioned from a long sideways pattern into a clear upward trend and technical analysis now suggests significant momentum is building.

Key insights:

- Stockland could climb another 30–70% toward its all‑time high.

- The last strong rise in a similar pattern delivered a 70%+ gain.

- Even if the RBA delays a rate cut, Stockland’s trajectory remains intact.

Janine noted, “We’re seeing the stock re‑enter its expansion phase after years of range‑bound trading — that’s often the signal that precedes major upside.”

With steady dividends and solid property assets, Stockland also appeals to investors who value both income and growth potential.

If you’re ready to interpret market cycles and price action like a professional, the Short Course in Share Trading provides the tools you need to analyse setups just like this.

2. Goodman Group (ASX: GMG) — The Powerhouse of Industrial Innovation

Goodman Group continues to be a standout in real estate and logistics, building the backbone for Australia’s online economy. The company develops warehouse and data centre infrastructure both in high demand amid ongoing expansion in e‑commerce and cloud services.

Why it’s one to watch:

- RBA rate cuts will make funding cheaper for Goodman’s development pipeline.

- The stock remains structurally strong and could hit $50 long‑term.

- Short‑term pullbacks could provide ideal entry opportunities for traders.

“Goodman moves in steps, not surges,” said Cox. “Understanding how to trade these patterns allows investors to scale in and protect capital, an approach we teach comprehensively in our Diploma of Share Trading and Investment.”

This company’s resilience through multiple market cycles makes it a textbook example of disciplined growth and market confidence.

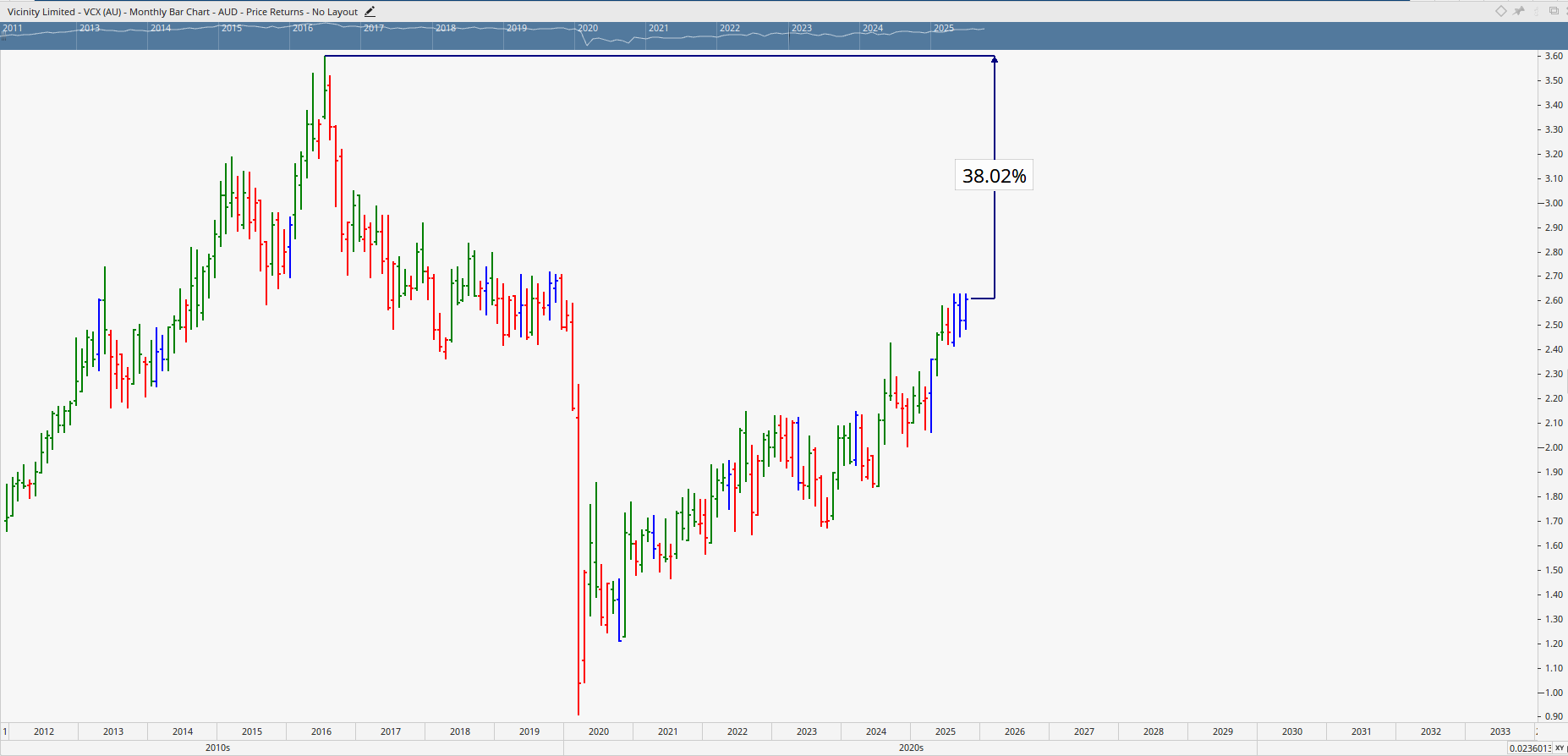

3. Vicinity Centres (ASX: VCX) — The Retail Recovery Play

While the big property groups dominate industrial and residential development, Vicinity Centres represents a rare opportunity in retail property.

Why VCX could surge next:

- As consumer confidence grows and retail foot traffic returns, shopping centres stand to benefit directly.

- A December rate cut would boost disposable income and retail sales, supporting upward momentum in rent yields.

- The stock is currently 38% below its all‑time high and offering strong recovery potential.

Janine explains, “VCX benefits not just from falling rates, but also from seasonal factors like consumer discretionary spending and events like Black Friday. Both trends feed directly into its bottom line.”

For investors eyeing post‑rate cut upside, VCX offers a balanced mix of capital growth and income yield.

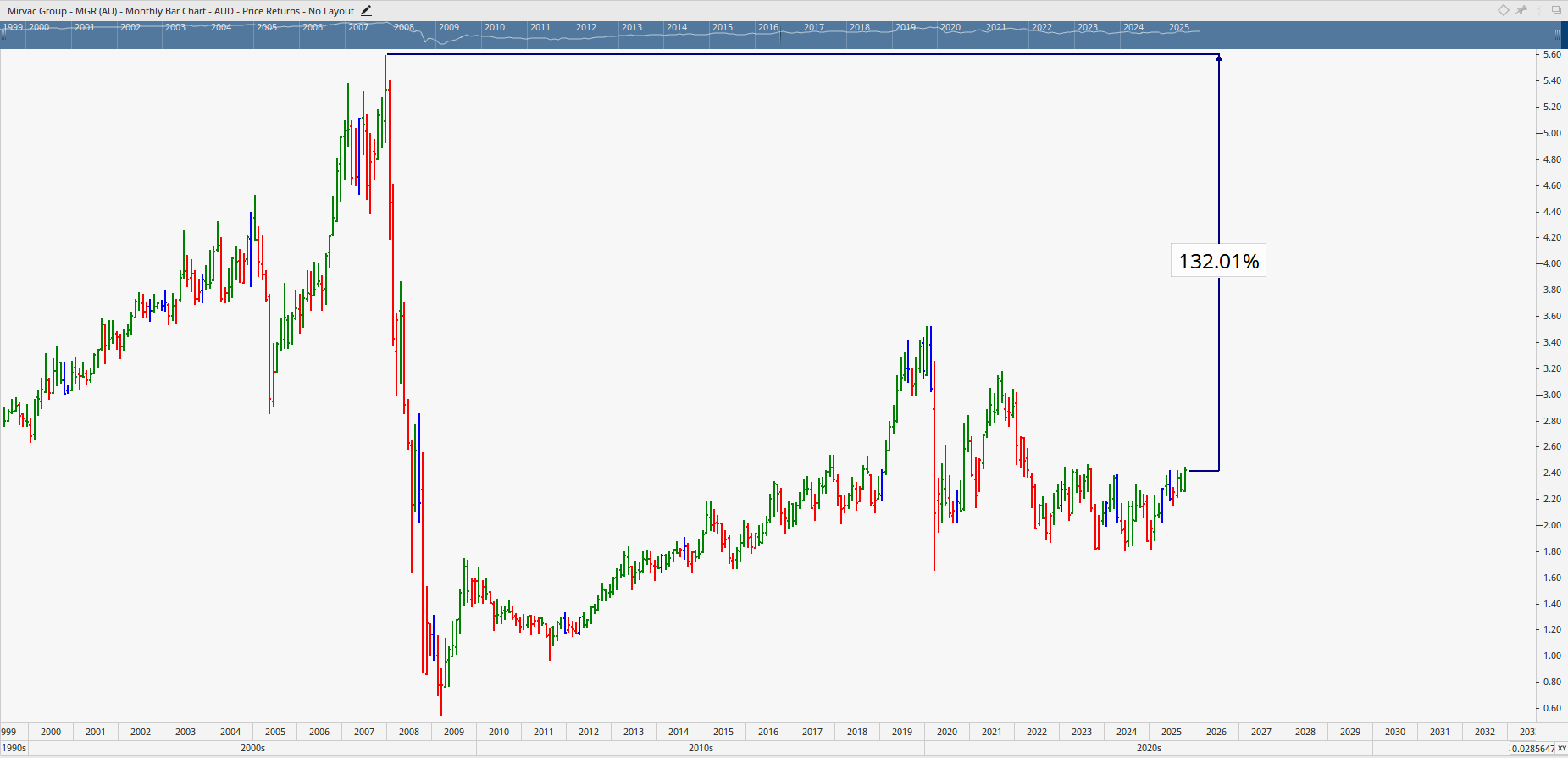

Bonus Pick: Mirvac Group (ASX: MGR) - The Quiet Contender

Mirvac (MGR) is another promising property stock yet to break out fully. It trades 132% below its all‑time high, suggesting substantial room for recovery.

While Mirvac may appear slow‑moving (“a plotter,” as Cox puts it), it’s often these steady setups that lead to powerful acceleration when conditions align.

Cox cautions, “Wait for confirmation. The breakout will come, and when it does, it could deliver a 50%+ return. The key is patience and having clear exit strategies.”

To learn how to develop and apply breakout and timing strategies like these, explore our Advanced stock trading course, where you’ll master timing, Elliot Wave, and portfolio construction.

Key Takeaway: Prepare Before the Market Moves

Historically, the biggest profits go to those who act before policy changes hit the market. The upcoming RBA rate cut could unlock major gains within the real estate sector but success will depend on knowledge, timing, and execution.

If you’d like to strengthen your skills and trade with confidence before the next market shift, Wealth Within’s nationally recognised Trading courses provide exactly that, from foundational learning to advanced strategy formulation.

Whether your goal is income generation, portfolio diversification, or building long‑term wealth, structured education is your edge.

Continue Learning and Stay Ahead

For more stock analysis, market forecasts, and insights straight from our experts, visit our Hot Stock Tips videos, ASX video library, where we cover what’s moving and what’s next across the ASX each week.

To learn more about who we are and why over 30,000 students have trusted our expertise for more than two decades, visit About Wealth Within.

Final Thought

The RBA’s upcoming rate cut could be the catalyst real estate investors have been waiting for. Stockland, Goodman, and Vicinity are poised to benefit most, while Mirvac offers huge long‑term value for those with patience.

By pairing these insights with proven trading education, you’ll position yourself to capture profits before the rest of the market catches on.

Important information

This content is provided for educational purposes only and is not personal financial advice. It does not take into account your objectives, financial situation or needs. Consider seeking advice from a licensed professional before acting on this information. Markets involve risk; past performance is not a reliable indicator of future performance.