Property vs Shares: The Definitive Guide

By Dale Gillham

The age-old debate of property versus shares continues to spark dialogue among investors looking for the best opportunities to grow their long-term wealth. Both investment options come with their own unique set of advantages and challenges, as they represent different asset classes. Understanding how these asset classes behave over time is crucial, making it essential for investors to weigh up the risks and rewards based on their financial goals, risk tolerance, and investment time horizon.

In this definitive guide, we delve into the key differences between property and shares and discuss which asset may be the better option based on your personal financial circumstances. We also discuss why we get conflicting answers on the debate around property versus shares, and I share why it's important to consider investing in both assets to accumulate wealth.

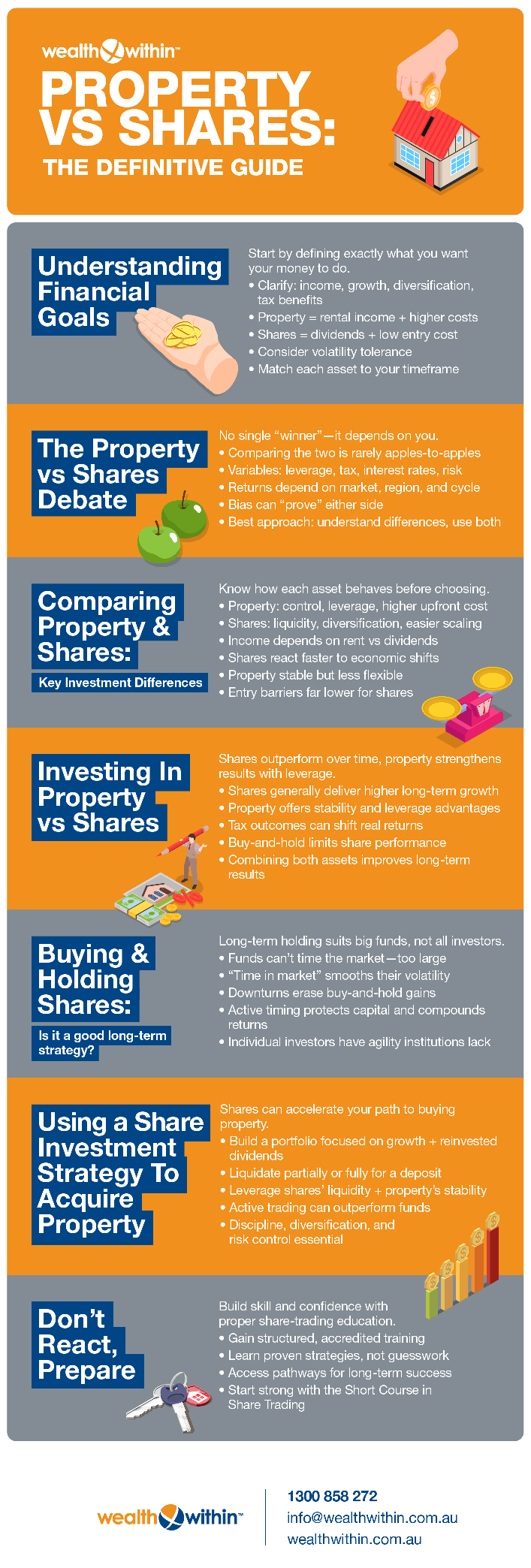

Understanding financial goals

When it comes to choosing between investing in property or shares, the first and most important step is to clarify your financial goals. Are you aiming for long-term capital growth, a steady stream of passive income, or perhaps a combination of both?

Maybe you’re interested in building a diversified portfolio to spread risk, or you’re looking for tax benefits such as negative gearing on an investment property or franking credits from dividend income. Defining your objectives will help you determine which investment options best suit your needs.

For those seeking regular income, an investment property can provide rental income, but it’s important to factor in the ongoing responsibilities and costs of property ownership. Expenses such as maintenance, land tax, and the potential impact of capital gains tax when selling property can affect your net rental income and overall returns.

Additionally, property prices and rental yields can vary widely across the Australian property market, with residential property in major cities often commanding higher prices but lower yields compared to regional areas. Understanding the dynamics of the local property market is crucial before making a purchase.

On the other hand, investing in shares can offer dividend income and the potential for long-term capital growth. The stock market allows you to build a well-diversified portfolio with relatively low entry costs, and you can contribute additional funds over time to grow your investment.

However, share prices can be subject to market volatility, and the value of your investment may fluctuate in response to broader economic conditions and market sentiment. A diversified portfolio of shares can help manage these risks and provide more stable returns over the long term.

The property versus shares debate

Depending on who you listen to, you will often find that one investment is favoured over the other. Indeed, the persistent debate comparing the returns on shares with the returns on property tends to vary depending on market conditions and the writer's bias.

As a share trader and an accredited educator in share trading, I could write this article in favour of shares. However, I am also a property investor, and I believe that any intelligent investor needs to be in both markets.

The truth of the matter is that it is very hard to compare these two markets simply because we are not comparing apples with apples. There are many different variables to consider when investing in either market; for example, leveraging, taxation, interest rates, risk and holding costs, to name a few.

Then we need to consider what aspects of these markets we compare to provide a fair and unbiased analysis. Do we compare the All Ordinaries Index with the Melbourne property market, the Victorian property market or the Australian property market? And should we compare capital growth or capital growth and income?

The combinations are endless, and, as evidenced by many other articles on this topic, it is possible to deliver any outcome depending on your bias and make it appear as if we have settled the dispute once and for all.

That said, we can compare the key differences in regard to the investment opportunities they present, as well as the risks. The debate often centers on which is the better investment, but this ultimately depends on individual circumstances, asset classes, and prevailing market conditions.

Comparing property and shares: Key investment differences

Some claim that you would be better off investing in property rather than shares, as this asset is more tangible and potentially represents less risk. However, what I want to propose is that you can benefit tenfold by investing directly in shares as well as property.

While property investments typically require a larger initial capital outlay compared to shares, they offer investors greater control and leverage over their money. Shares, on the other hand, provide easier access to diversification, liquidity, and potentially higher returns over time.

Property and shares are two major asset classes, and understanding their roles in an investment portfolio is key to making informed decisions. Both investment options have their own set of risks and rewards, which depend on various factors, such as market conditions, personal financial goals, and your tolerance to risk.

So, let's investigate the key investment differences.

1. Capital growth potential

For most people, investing in property is a long-term buy-and-hold strategy where “time in the market” yields good capital growth potential, as prices tend to increase steadily over time. When you buy a property, it will remain relatively unchanged as an investment for decades, except for general maintenance.

Shares, on the other hand, should never be treated as a long-term investment; rather, they are a short to medium-term investment vehicle where “timing the market” is far more important than time in the market. When it comes to shares, timing the market is everything simply because it is about buying low and selling high. As a consequence, shares can provide higher returns than property, which I show you later in this article.

2. Market volatility

Property investments also tend to exhibit lower volatility compared to shares, making them more attractive to risk-averse investors. However, shares can provide higher returns in shorter timeframes, which is appealing to those who have the knowledge and skill to consistently profit from the stock market.

3. Income generation

Property investments can generate consistent rental income, while shares can produce dividend income. However, property investors must also account for management fees, which can impact net rental yields. There is conjecture on which option provides a more reliable income stream, as rental income depends on tenant demand and market conditions, while dividends are subject to company performance and payout policies.

That said, investing in stocks in the top 50 on the ASX can generate a solid dividend income.

4. Diversification

Property investments can offer diversification opportunities, although they may require more effort and capital compared to shares. Shares also offer the advantage of diversification, allowing investors to spread their risk across a variety of companies and sectors, which is much easier to achieve, as it requires a smaller capital outlay.

5. Liquidity

Liquidity refers to the ease with which an asset can be bought or sold in the market without significantly affecting its price. Shares tend to be more liquid than property investments, meaning they can be bought and sold more quickly, which can be crucial during periods of market volatility.

6. Higher returns

Property investment can offer various forms of return, depending on the type of property, investment strategy, and market conditions. Property returns are cyclical and can fluctuate with supply, demand, and broader economic conditions, impacting both rental income and capital appreciation. However, over the longer term, shares are likely to provide higher returns, although this will depend on various factors, such as the performance of individual stocks and the broader market trends.

7. Leverage and debt

Property investments often involve the use of leverage through mortgages with many investors borrowing money to buy property, which can amplify returns but it will also increase risks. Property typically allows for higher leverage than shares, and you cannot achieve the same leverage with shares as with property. Unfortunately, the debt on property investments can lead to significant financial stress during market downturns or when interest rates rise.

In contrast, shares typically involve less leverage, which reduces the risks associated with debt. However, investors can use a margin loan to borrow money to invest in shares, but this comes with the risk of margin calls if share prices fall, requiring investors to either add more funds or sell their shares to maintain their position. That said, leveraging can cause significant financial stress during market downturns if you don’t know how and when to exit your positions to preserve your capital.

8. Management and control

The appeal of property investments is due to the direct control investors have over these assets. In contrast, share investors have limited control over company management and decisions, which can impact their investment performance. However, investors do have control over when they enter and exit a stock to ensure they are compounding their returns.

9. Barriers to entry

Property investments usually require a more significant capital outlay, and they have ongoing expenses compared to share investments, which have lower entry costs. When you buy property, you need substantial capital not only for the purchase price but also for major upfront costs like stamp duty.

Additionally, ongoing mortgage repayments are a key consideration, as they can impact your cash flow and the overall profitability of your investment. While this accessibility makes shares more appealing, in my opinion, both investments are essential for accumulating wealth, as each assists you in investing in the other, given that when you invest in shares using my four golden rules, it provides the cash flow to invest in property, and property provides you with leveraging opportunities to trade shares.

Both property and shares carry their own set of risks and rewards, which can vary depending on factors such as market conditions, interest rates, economic trends, and geopolitical events. Your own financial goals and tolerance to risk will also play a significant role in determining the most suitable investment option for you.

By understanding the key differences between these two investment options and evaluating your personal financial goals, you can make informed decisions that best align with your financial objectives.

Now, let's investigate the return on property versus shares.

Investing in property vs shares

According to Vanguard, the 30-year return on Australian shares as at 30 June 2025 (excluding acquisition costs and taxes, and with all income reinvested) was 9.3 per cent. In comparison, the 30-year average annual growth rate for housing values in Australia was 6.4 per cent. Even if we consider the 10- and 20-year returns on Australian shares as at 30 June 2025, at 9.1 and 8 per cent respectively, it is evident that shares significantly outperform property over the long term.

Having now read this, some would argue that it supports the perennial debate over whether it is better to invest in shares. However, neither scenario accounts for leveraging (or gearing), which is usually associated with property investments.

In an after-tax scenario (depending on your marginal tax rate), the return on property could equal or surpass the return on shares, which is why I argue that it is better to consider investing in both asset classes. This provides an opportunity to leverage the growth potential and liquidity of shares to acquire property by regularly investing in a diversified share portfolio.

The above scenarios also assume a buy-and-hold strategy when investing in the stock market. But what if you could double your returns in the stock market and compound your returns substantially? When comparing investments, it is crucial to consider the tax implications, including capital gains tax, and seek professional advice to optimise your financial strategy.

Buying and holding shares: Is it a good long-term strategy?

The reason why most of us hear the words “buy and hold” or it is time in the share market that yields returns is because the institutional funds cannot time the market, they are just too big to manoeuvre with any speed.

Anyone who has dealt with a financial adviser about investing in the stock market would be familiar with the adage that you need to hold onto a portfolio for 10 years or more to yield an adequate return. It is also important to consult a financial advisor for personalised financial planning and investment decisions, as they can help tailor strategies to your individual goals and circumstances.

In essence, this allows the investor to experience a rising market 30 to 50 per cent of the time to compensate for the years that the market is moving sideways or down. If you don’t believe me, just look at the returns on institutional funds over the past 10 years - at least 80 per cent have underperformed.

Therefore, to accept that time in the market is more important than timing the market is probably the greatest downfall of anyone wanting to beat the market average.

The reality is that using a “buy and hold” strategy will see gains during bullish periods in the stock market decimated when the bears take control in a bearish market, as we saw occur during the Global Financial Crisis (GFC) and other previous major market declines. In contrast, with a little bit of knowledge, a more active approach will allow you to participate during the bullish run and sit on the sidelines when the market trades sideways or down.

Using a share investment strategy to acquire property

Remember, it is possible to leverage the growth potential and liquidity of shares to acquire property by regularly investing in a diversified share portfolio. By focusing on capital appreciation and reinvesting your dividends, you can grow your wealth.

Many investors use this strategy to diversify their wealth across different assets. As the value of the share portfolio increases, it can be partially or fully liquidated to provide the necessary capital for a deposit to purchase a property.

This approach ensures you benefit from the advantages of both shares and property by combining the potential for higher returns and the liquidity of shares with the stability, leverage, and tangible nature of property investments. Let me share how this is achievable.

Actively managing a share portfolio

As many who actively trade the share market know, timing the market is everything, as it alleviates the problems associated with having your capital tied up for years in unproductive investments that are present with a buy-and-hold strategy.

Unlike fund managers, who must invest your capital when they receive it irrespective of whether the market is rising or falling, you have the flexibility to diversify the timing of your entry and exit to ensure you only invest when the market is rising.

And the good news is you can do this using a low-risk, methodical approach that ensures you maximise your profits while minimising your risk.

In my latest award-winning book, Accelerate Your Wealth – It’s Your Money, Your Choice, I demonstrate how you can achieve returns that not only outperform the institutional funds by a significant margin but also rival or outperform the returns you achieve from investing in property. And you can do this in as little as a few hours a month once you establish your portfolio.

In my book, I actively traded a portfolio of the top 20 stocks on the ASX over 10 years from 2 January 2007 to take into account the effect of the GFC and the market volatility that followed. The gain achieved from capital growth and dividends during the period to 31 December 2016 was 225.82 per cent or an average annual return of 22.58 per cent, which you would have to say is pretty impressive. This equates to an annual compounded rate of return of 12.54 per cent. Obviously, the real return will be lower after factoring in capital gains tax and inflation.

But that aside, what I demonstrate is that individuals can achieve very rewarding returns without taking high risks or speculating. It may surprise you to learn that I achieved this outcome using a ruler and pencil to apply trend lines in combination with a stop loss to protect capital. In comparison, the return on managed funds, as published by Canstar Research, over the same ten-year period represented only 4.67 per cent.

So, not only can you achieve very profitable returns, but you also have the potential to outperform the institutional funds using some simple do-it-yourself stock market investment strategies. What this demonstrates is that it is possible to leverage the growth potential offered by shares to raise the initial capital required to purchase a property. The benefit of investing in both shares and property is that you can compound your returns substantially.

Remember, however, it's essential to monitor market conditions, maintain a well-diversified portfolio, and assess your tolerance to risk to ensure the success of this strategy.

Don’t React, Prepare

Take charge of your financial future with real, structured education through Wealth Within, Australia’s only government-accredited share trading educator. Learn more About Wealth Within and explore the pathways that have helped thousands of Australians trade confidently and achieve lasting success.

Ready to stop guessing and start trading with skill? Join Australia’s most trusted trading educator and take the first step with the Short Course in Share Trading.

Others who read this article also enjoyed reading: