7 ASX Stocks You Must Own in the Q3 Pullback (Sept–Oct)

By Fil Tortevski, Janine Cox and Pedro Banales

Insights from Filip Tortevski Janine Cox and Pedro Banales

History shows September and October are the market’s worst performing months.

But not all stocks sink—some defend and even surge.

Below, we outline the seasonal context, the sector lens, and seven stocks our team highlight as potential winners during the dip.

Want to build skill and certainty? Explore our Trading courses.

Why September–October often pulls back

The All Ordinaries Index has rallied hard and is well overdue for a correction. History has shown that a surge over 25% with no meaningful selling is often the cap, resulting in a pullback shortly after. Since April, the market has run over 26% so it is sitting right in the range for a turnaround.

Seasonality and stretched runs often precede a pause or pullback into September and sometimes early October, before strength re-emerges toward November.

Key idea: Expect volatility, not necessarily a crash. Stock selection, timing and risk management matter most in this window.

Watch our weekly market breakdowns in our ASX video library.

The sector lens, and why stock selection wins

Financials and select consumer names often hold up, while miners can be the swing factor. Our approach is stock-specific seasonality supported by technical confirmation, not blanket sector bets.

If you want to systemise this approach, our Diploma of Share Trading and Investment shows you how trade with more certainty than over 95% of all traders by combining fundamentals, with price and pattern.

7 stocks to watch in the Q3 pullback

These stocks were discussed on the show with a focus on seasonal tendencies and current technical context.

Always wait for confirmation and manage risk.

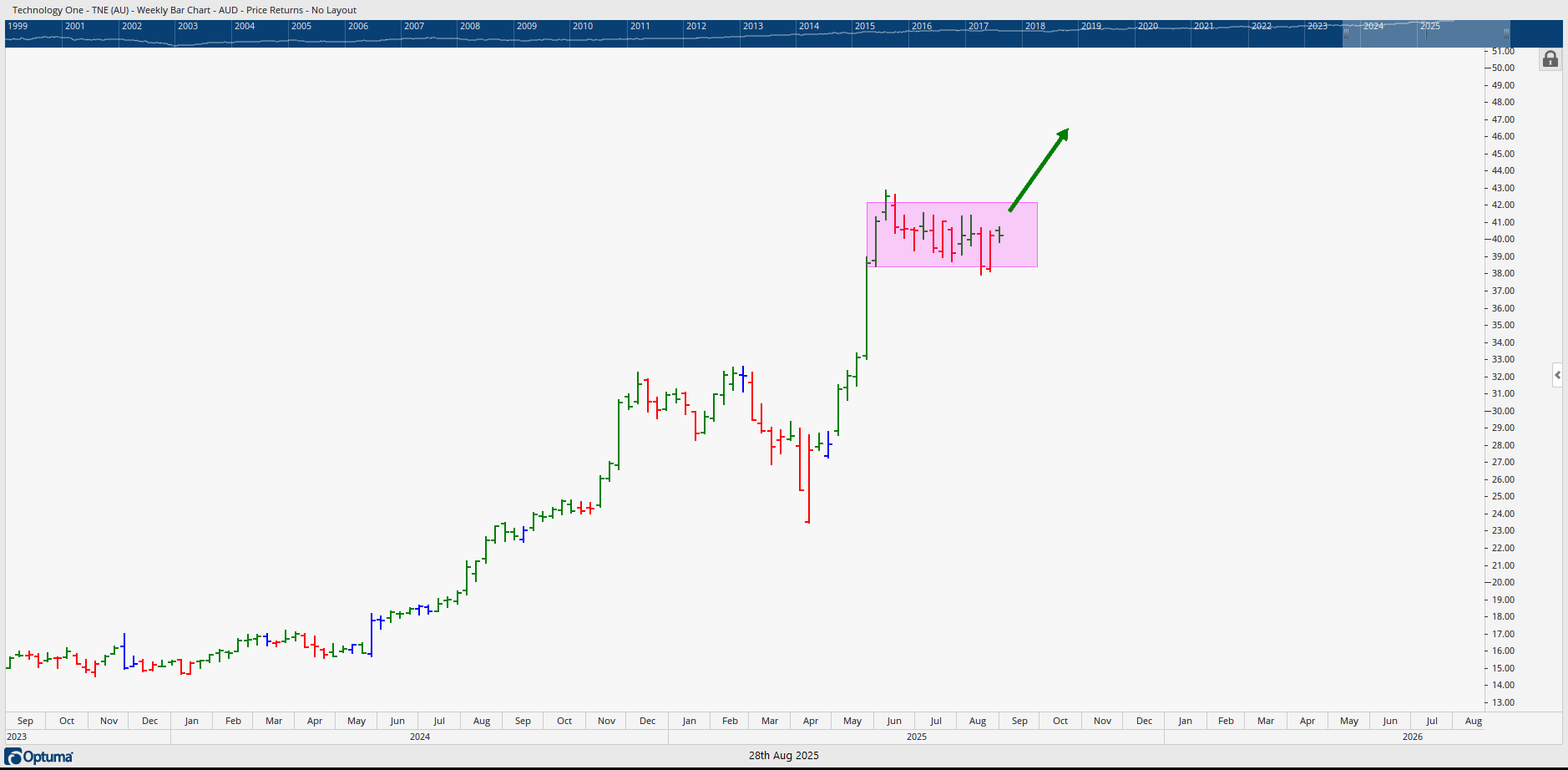

1. TechnologyOne (ASX: TNE)

Profile: Sideways consolidation on the weekly chart; a breakout from consolidation can kick off the next leg.

Setup: Sideways digestion on weekly; a breakout from consolidation can kick off the next leg.

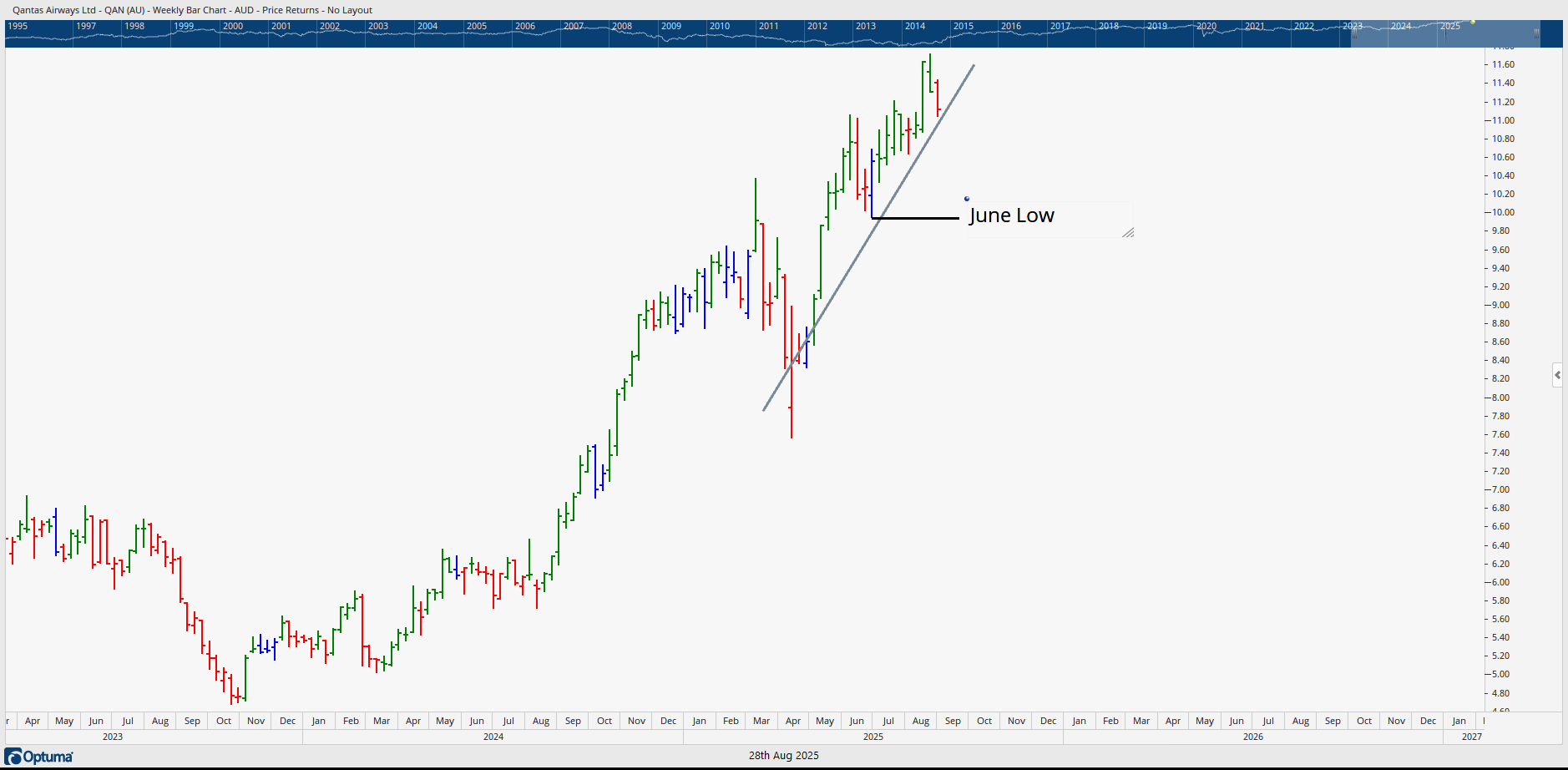

2. Qantas (ASX: QAN)

Profile: Transformed post‑COVID; making new highs with a well-defined rising trend.

Level: Recent June low is your line-in-the-sand; trendline support remains key.

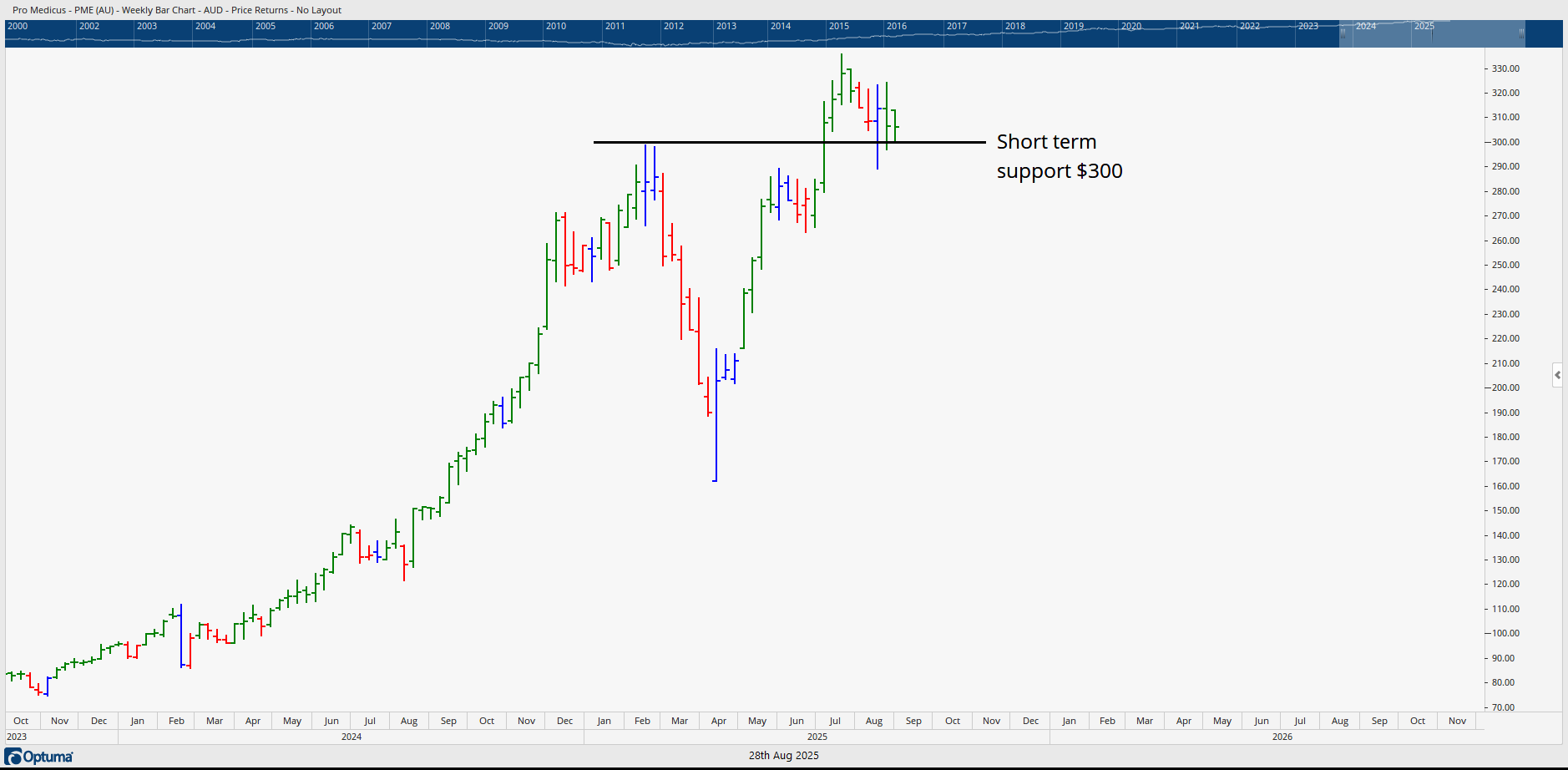

3. Pro Medicus (ASX: PME)

Profile: Seasonality often sees September as a springboard into strong runs.

Levels: Short-term support around $300. A break of the prior all-time hight (ATH) can open another momentum phase.

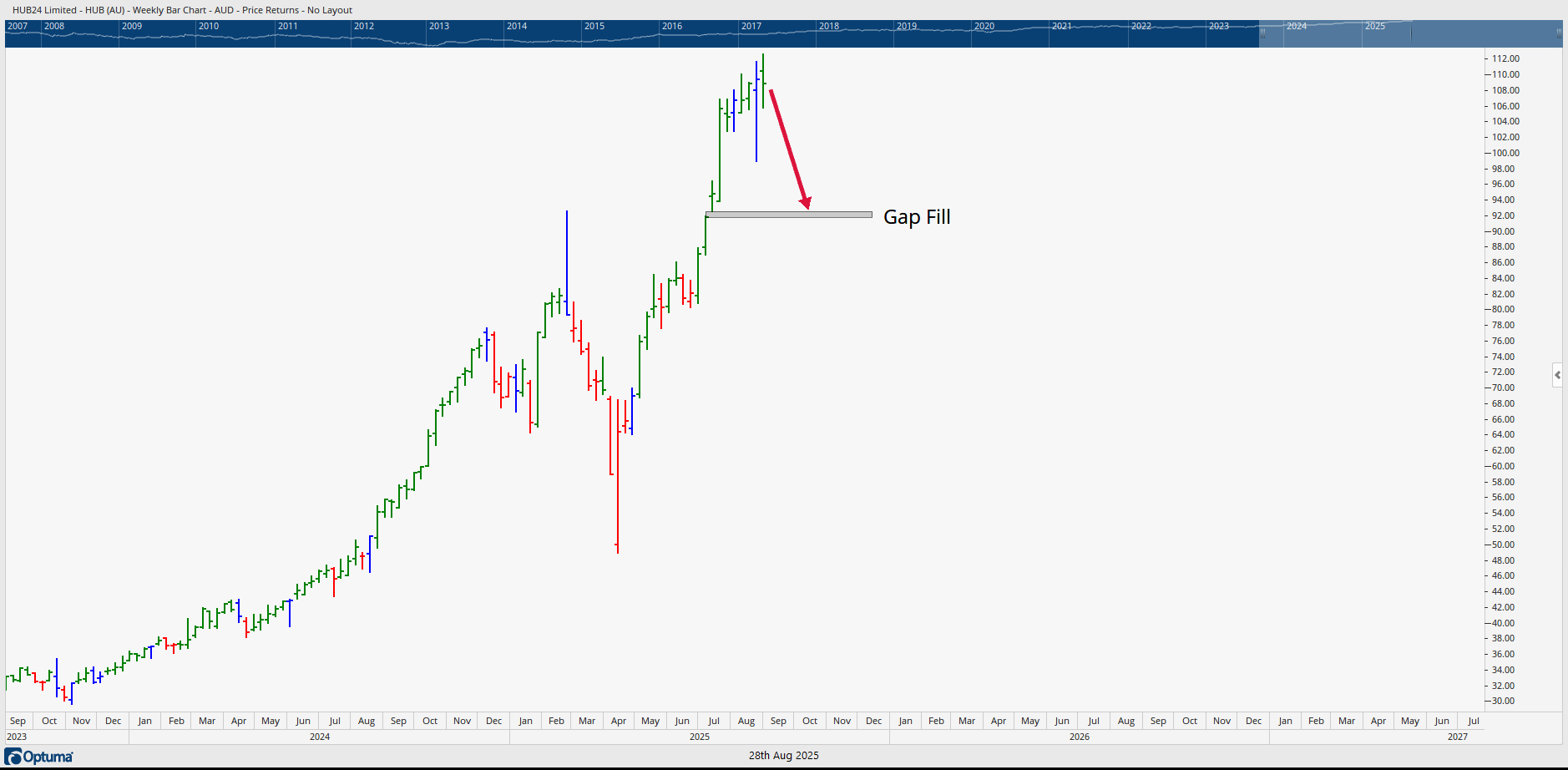

4. HUB24 (ASX: HUB)

Profile: Strong trend, but extended.

Plan: Prefer a pullback to fill the gap around $92 before considering a fresh entry.

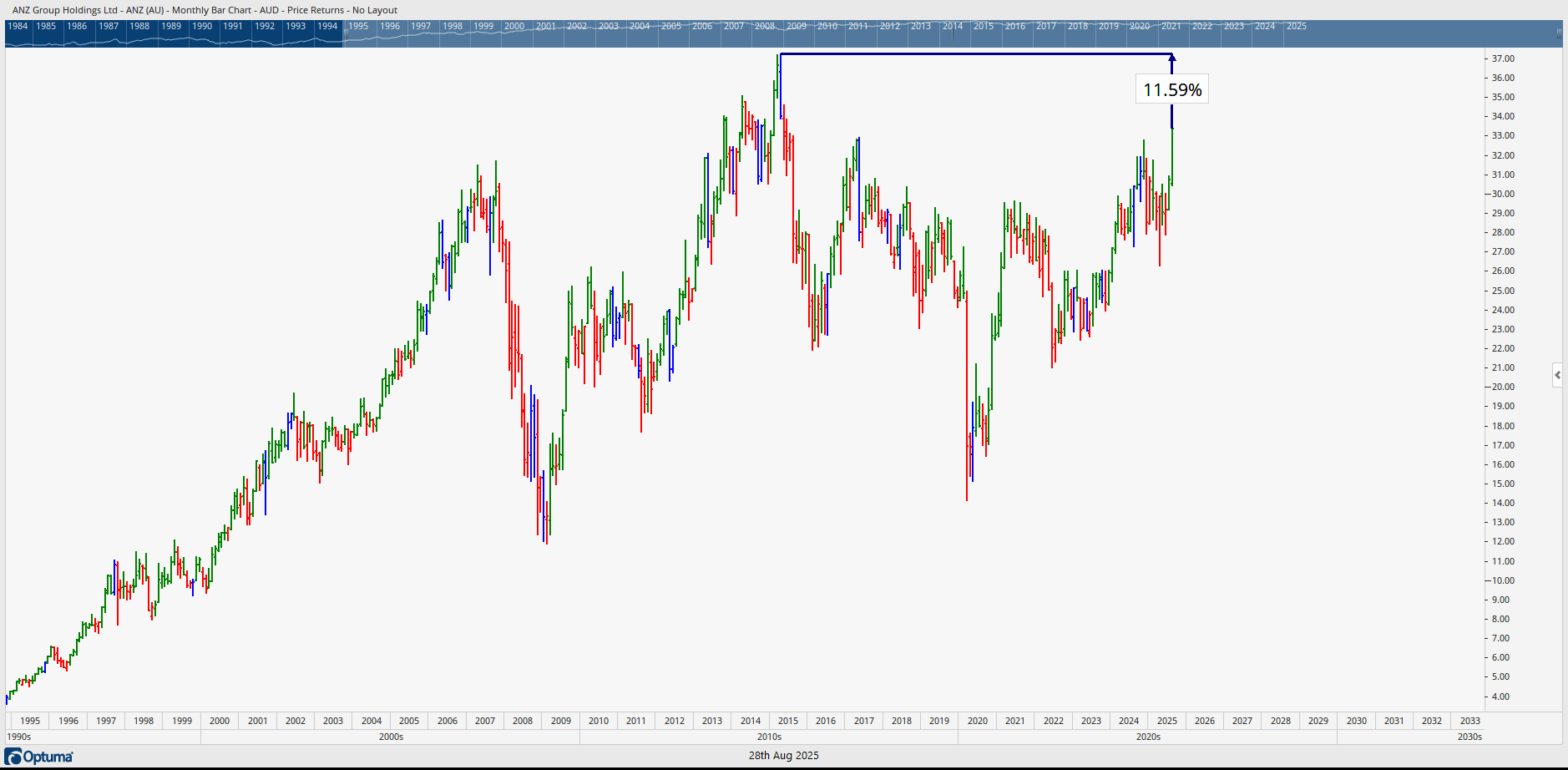

5. ANZ Group (ASX: ANZ)

Profile: More defensive among majors; still below its ATH, offering upside potential.

Map: ~11% to prior ATH; above that, a pathway toward $42+ opens up.

6. Xero (ASX: XRO)

Profile: September can be softer, but October seasonality is strong.

Level: Watch the $155 support and trend/momentum confluence; confirmation could set a run back toward its highs.

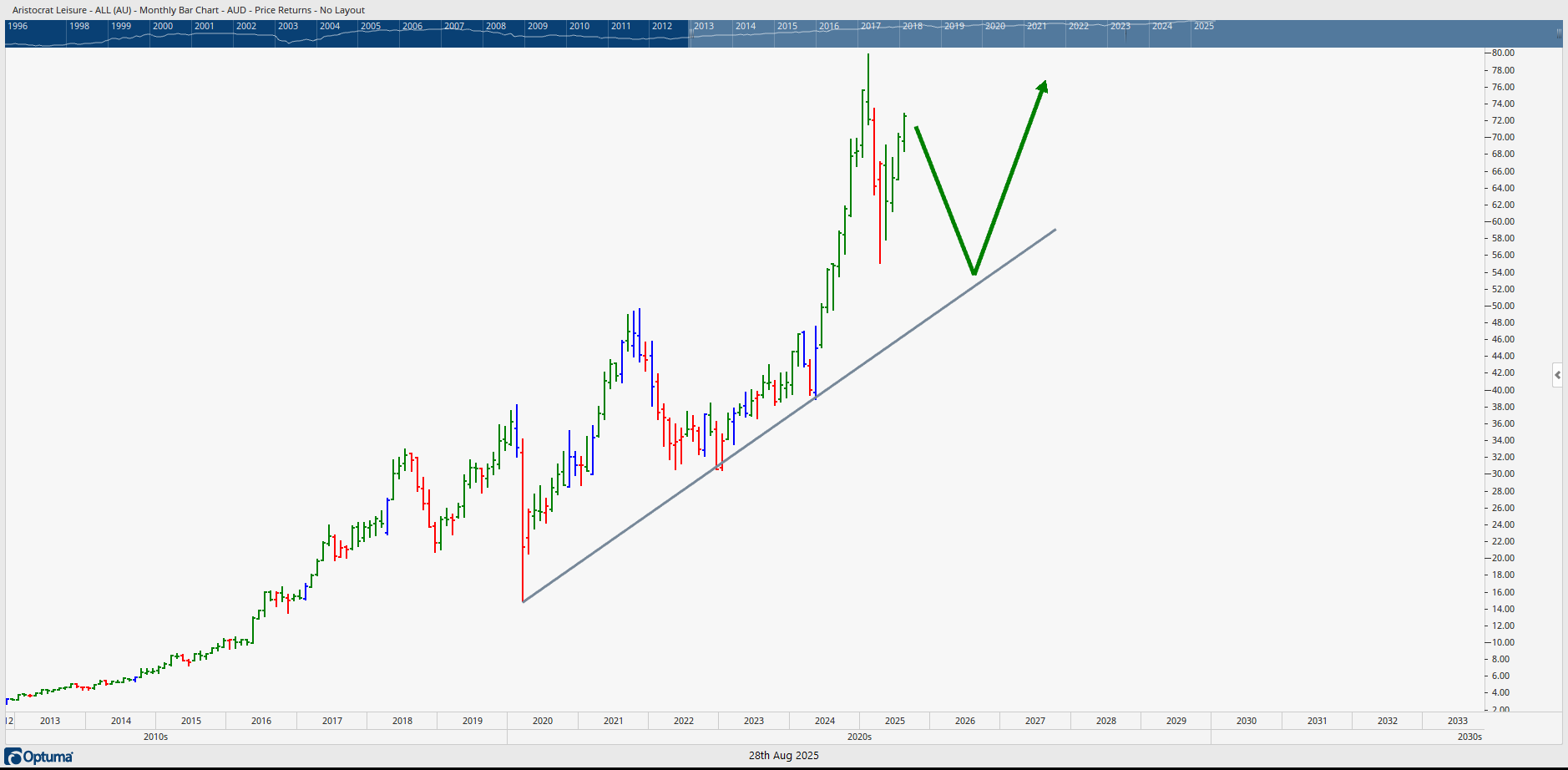

7. Aristocrat Leisure (ASX: ALL)

Profile: Near ATH with constructive structure; potential to join the “$100 club.”

Plan: Embrace healthy pullbacks; post‑retest breakouts can travel well.

To deepen your technical timing skills, including price, pattern and time, consider our advanced stock trading course.

Trending topic: new US de minimis rules and Aussie online retailers

Australia Post has paused parcels to the US amid tariff changes that lower duty‑free thresholds.

Larger players like Amazon can absorb costs better than small Aussie e‑commerce exporters, potentially reshaping competitive dynamics.

Portfolio takeaway: review holdings with US parcel exposure and adjust risk if needed.

A rules-based playbook for September and October

Let seasonality inform, not dictate: combine with price action and confirmation.

Define invalidation before entry: e.g., TNE breakout failure, XRO $155, QAN June low.

Scale with volatility: smaller size for higher beta names (PME, XRO).

Respect gaps and retests: HUB pullback into $92; ALL retests before continuation.

Journal and review: repeatable patterns and timing edges compound over time.

New here? Learn who we are and how we help traders succeed: About Wealth Within.

Important information

This content is provided for educational purposes only and is not personal financial advice. It does not take into account your objectives, financial situation or needs. Consider seeking advice from a licensed professional before acting on this information. Markets involve risk; past performance is not a reliable indicator of future performance.