How to Setup a Winning Trading Portfolio to Profit

By Dale Gillham and Janine Cox

In this week's Australian Stock Market Show, Dale will discuss how to setup a winning trading portfolio to profit consistently over the medium to long term. This will build on what we discussed in last week’s show with how to turn $20K into $1 million trading stocks, so you can work towards achieving your financial goals.

Obviously your goals will be influenced by many things including your age, your income, the size of your family and your current wealth.

Documenting your trading goals

Therefore, it’s important to document the goals and objectives of what you want to achieve, as this will not only provide the direction you need to take in order to achieve the financial outcomes you desire, it will also provide you with an indication of the risks you are willing to take with your investments.

So, some of the questions you need to ask yourself include:

- How long do I want to invest for?

- How much money do I require to achieve my goals?

- What returns do I expect to get?

- What level of risk will I will comfortable with?

- How much investment capital am I willing to risk for the opportunity to make higher returns?

- Do I require income or capital growth from my investments?

- Am I comfortable borrowing money to invest?

Once you have documented your goals, you then need to make a commitment to take action to acquire the knowledge and skill that will enable you to invest confidently and safely.

The answers you provide will also assist you in selecting a portfolio of stocks that is suitable for you.

Portfolio selection and risk

To assist you in the process, I will share with you four different types of portfolios based on the level of risk involved that I outline in my latest book award winning book Accelerate Your Wealth.

By no means are these the only portfolios you could construct, but they do provide an indication of the volatility associated with each investment.

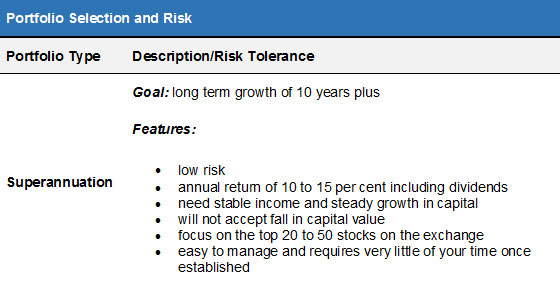

Superannuation Portfolio

First up is what I call the superannuation portfolio, which is suitable for those looking for a low risk portfolio that delivers stable income and a steady increase in capital over 10 years or more. Someone with this level of risk tolerance would not accept a fall in capital value.

Because you are seeking growth stocks that, over a period of time, reach higher prices and pay high dividends that enable you to achieve an annual return of 10 to 15 percent, it is recommended you construct your portfolio from the top 20 to 50 stocks on the exchange.

This type of portfolio is really easy to manage and requires very little of your time once it is established, which is why it is more suited to investors who have at least one hour a month to manage their portfolio.

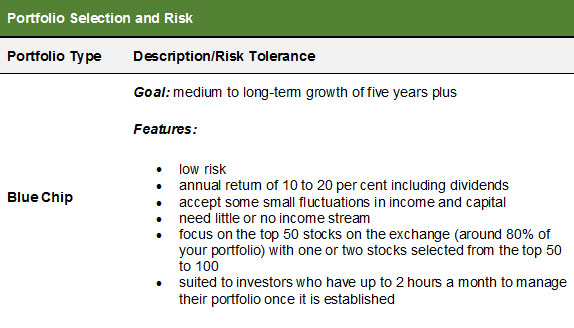

Blue Chip Portfolio

Next up is the blue chip portfolio, which is also suitable for those looking for a low risk portfolio but who prefer a higher annual return of between 10 and 20 per cent including dividends over the medium to long term of 5 years plus.

This type of portfolio is best suited to people with a low tolerance to risk who are willing to accept small fluctuations in come and capital growth, and require very little to no income stream from their investments to maintain their lifestyle.

A blue chip portfolio is weighted around 80 per cent to the top 50 stocks on the exchange, with one or two stocks selected from the top 50 to 100. This type of portfolio is more suited to investors who have up to 2 hours a month to manage their portfolio once it is established.

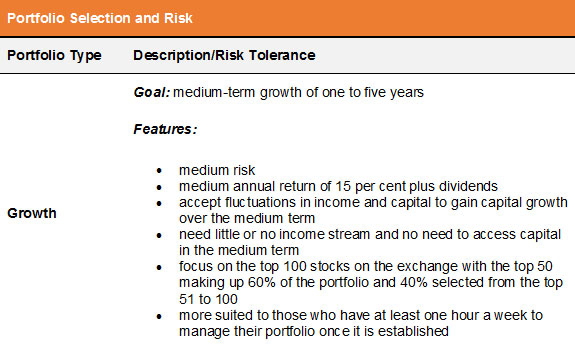

Growth Portfolio

Next is the growth portfolio, which is suitable for those who are more risk tolerant and willing to spend more time getting a higher annual return on their investments of 15 per cent plus dividends over the medium term.

This type of investor would accept fluctuations in both income and capital growth to gain more capital growth over the medium term and would need little or no income, and no need to access their capital in the medium term.

This type of portfolio would be constructed using a mixture of the top 100 stocks on the exchange with 60 per cent of the portfolio weighted to the top 50 and 40 per cent weighted to the top 51 to 100. This would give you stability from stocks in the top 50 combined with the growth potential of stocks in the top 51 to 100.

As you are seeking a higher return, this portfolio is more suited to investors who have at least one hour a week to manage their portfolio once it is established.

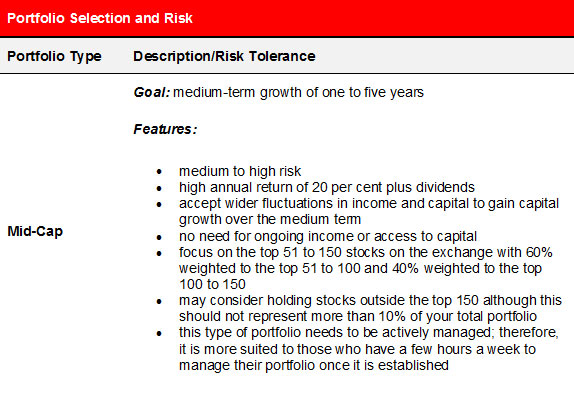

Mid-Cap Portfolio

Lastly, the mid-cap portfolio is more suited to investors who have a medium to high tolerance to risk, and are willing to accept wider fluctuations in income and capital to achieve annual returns of 20 per cent plus dividends. The investor also doesn’t need to draw income or access their capital to maintain their lifestyle.

Because this type of portfolio needs to be actively managed, it is more suited to those who have a few hours a week to allocate to managing the portfolio once it is established.

A mid-cap portfolio is generally constructed from the top 51 to 150 stocks on the exchange, therefore, you are taking on higher risks as these stocks are subject to more volatility. Your portfolio would be weighted 60 per cent to the top 51 to 100 and 40 per cent to the top 100 to 150.

You may also want to consider holding stocks outside the top 150 although I recommend you never hold more than 10 per cent of these stocks in your portfolio at any one time. Remember, the more you stray outside the top 100 stocks on the market, the more volatility you will experience.

Watch list of stocks to draw from

The good news is that once you have a list of stocks to draw from, you will find:

- You spend less time researching what stocks to buy as you will tend to ignore any stock that is not on your list, and

- You will also be more profitable because you will spend more time getting to know the stocks that are relevant to your portfolio, which will enable you to pick the best stocks more easily.

And, of course, as you have heard me say many times before it is also important to acquire the knowledge and skill that will enable you to invest safely and confidently by getting a quality education in trading so you can fast track your financial goals and retire financially independent.

To get started, I encourage you to purchase a copy of my latest award winning book, Accelerate Your Wealth, as it will give you the techniques and strategies that will enable you to take a low risk approach to profiting from the stock market.