How to Turn $20K into $1 Million Trading Stocks

By Dale Gillham and Janine Cox

In this week’s Australian Stock Market Show, we show you how to turn $20K into $1 million dollars by simply trading stocks in the share market. This week's topic is going to build on last week’s discussion where we showed you how to become financially independent and retire early with $1 million dollars trading a medium to long term portfolio.

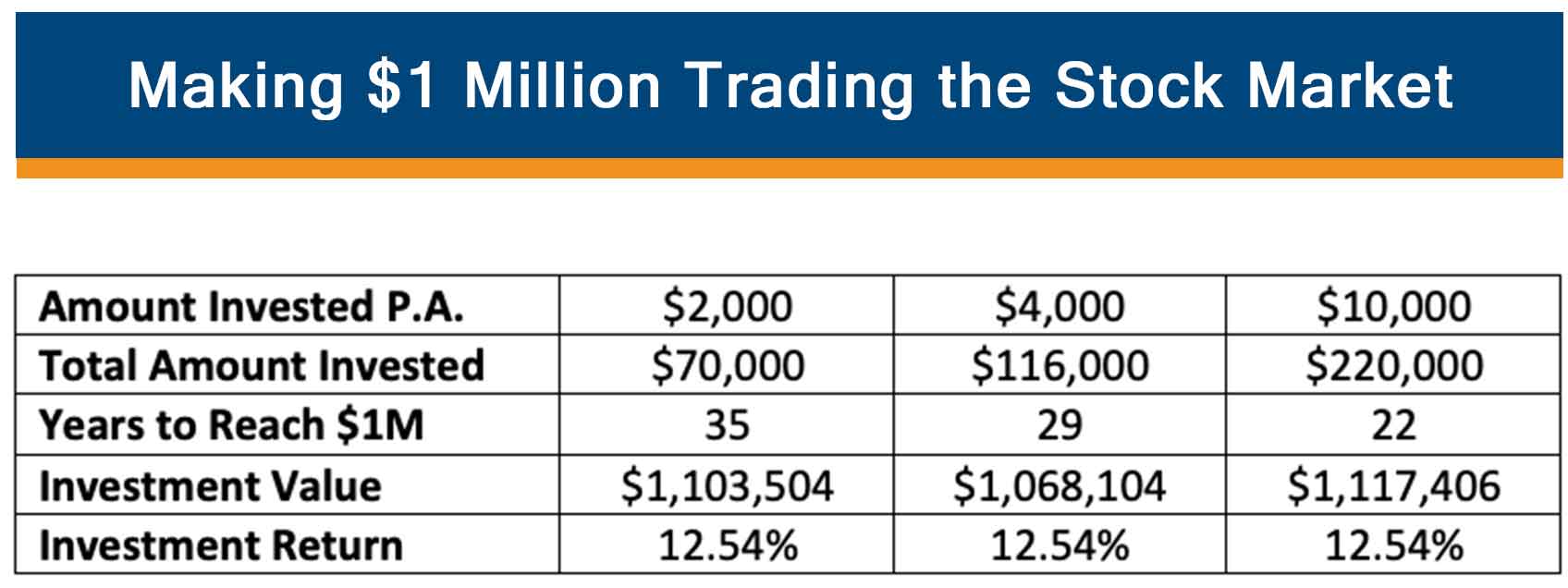

If you remember, we showed you how by investing a lump sum per annum and compounding your growth in the stock market using an active portfolio management strategy, as opposed to a buy and hold strategy, returning an annual compounded return of 12.54 per cent, you could accumulate $1 million dollars for your retirement.

So this week, I am going to build on this strategy and show you how you can reduce the time it takes to accumulate $1 million dollars using the portfolio management strategies that I introduced to you around 6 weeks ago, when we discussed how to set up a trading portfolio to generate $50K in income per annum.

So let’s briefly recap on one of the portfolio management strategies that I use or what I like to call my golden rules to success in the stock market.

Portfolio management strategies

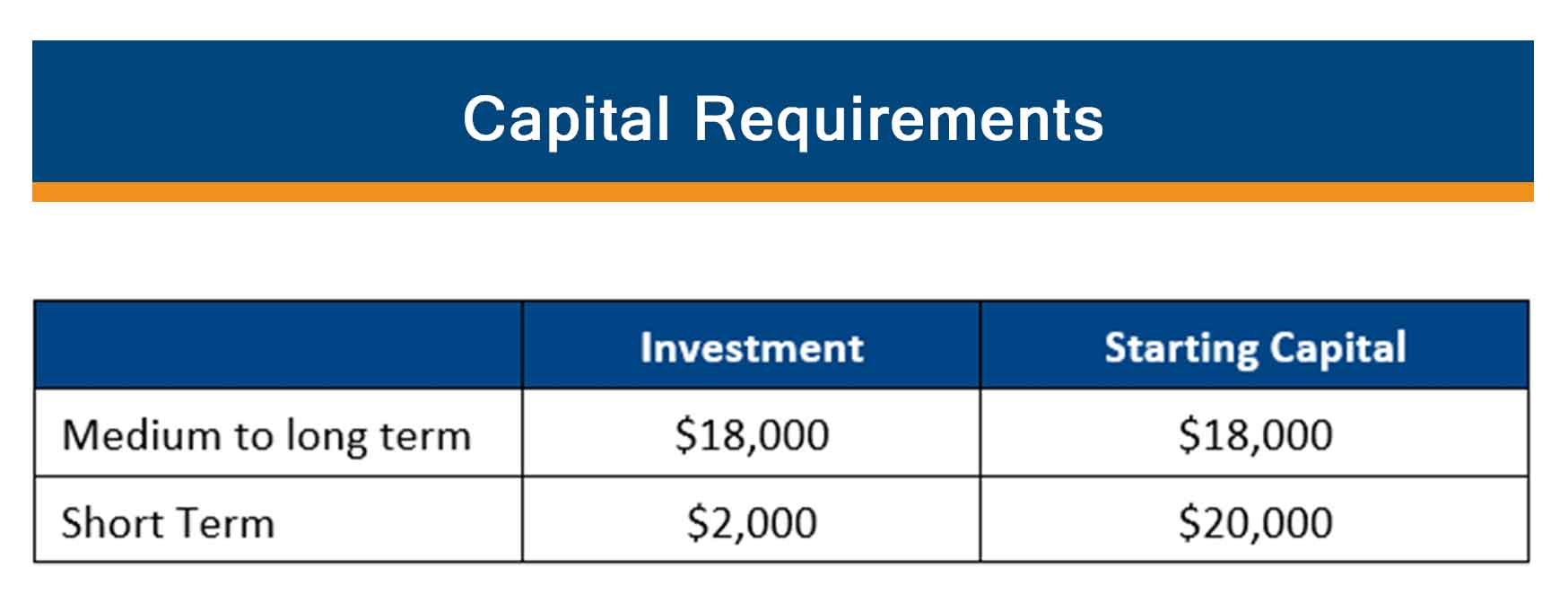

To ensure you minimize your risk when managing a portfolio, I encourage all traders to only invest 10 per cent of their available capital in trading short-term highly leveraged markets and allocate the remaining 90 per cent to trading a medium to long term portfolio.

This is a very solid management rule that allows you to take a low risk approach with your money while still achieving good returns on your capital. The goal with this rule is to have the 10 per cent allocated to trading short-term highly leveraged markets achieve equal or better returns when compared to the other 90 per cent.

Remember, however, as you have heard me stress many times before, particularly if you have read my latest award winning book Accelerate Your Wealth, you would need to ensure you are consistently profitable trading the stock market over the medium to long term before you consider this approach. In fact, without the right education it will cost you a lot of lost capital and opportunity if you get it wrong.

When trading your short term portfolio, you also need to ensure that you hold no more than four leveraged positions at any one time to minimize your risk. That way, you have the remaining cash accessible in the event of margin call if the leveraged assets losses value.

Another one of my rules, if you are going to start trading short-term highly leveraged markets is to have, as a minimum, $20,000 in capital in your portfolio so that the size of each position traded, in either the short or medium to long term portfolio, is not adversely effected by transaction costs.

So let’s consider how this strategy works.

Setting up your portfolio

With the $20,000 in capital, you would have $18,000 allocated to your medium to long term portfolio and the remaining $2,000 allocated to short term trading. Leveraging or trading on margin of 10 to 1, for example, you would have $20,000 in your short-term trading account.

Let me say that while it is not inconceivable to turn $20,000 into $1 million dollars using the strategy, if you want to fast track this goal, you will still need to implement a savings strategy as we did last week.

Therefore, we are going to assume you can invest an additional $10,000 per annum commencing at the end of the first year of trading your portfolio and we are also going to assume you have the knowledge to achieve the same returns on your medium to long term portfolio, as you do when trading your short term portfolio.

So as you can see, the starting capital in your medium to long term portfolio is $18,000, while the starting capital in your short term trading account is $20,000 trading on a margin of 10 to 1.

How to turn $20K into $1 million dollars

We are also going to revalue the starting position of each portfolio at the beginning of each year so that that total capital at risk in your short term trading account never exceeds more than 10 per cent of your total capital.

In reality, you would actually do this each time the capital in your short term portfolio exceeds 10 per cent of your total capital but for the purposes of this exercise, we are going to keep things simple.

Now let’s consider the outcome if you achieved a compounded annual return of 12.54 per cent on each portfolio.

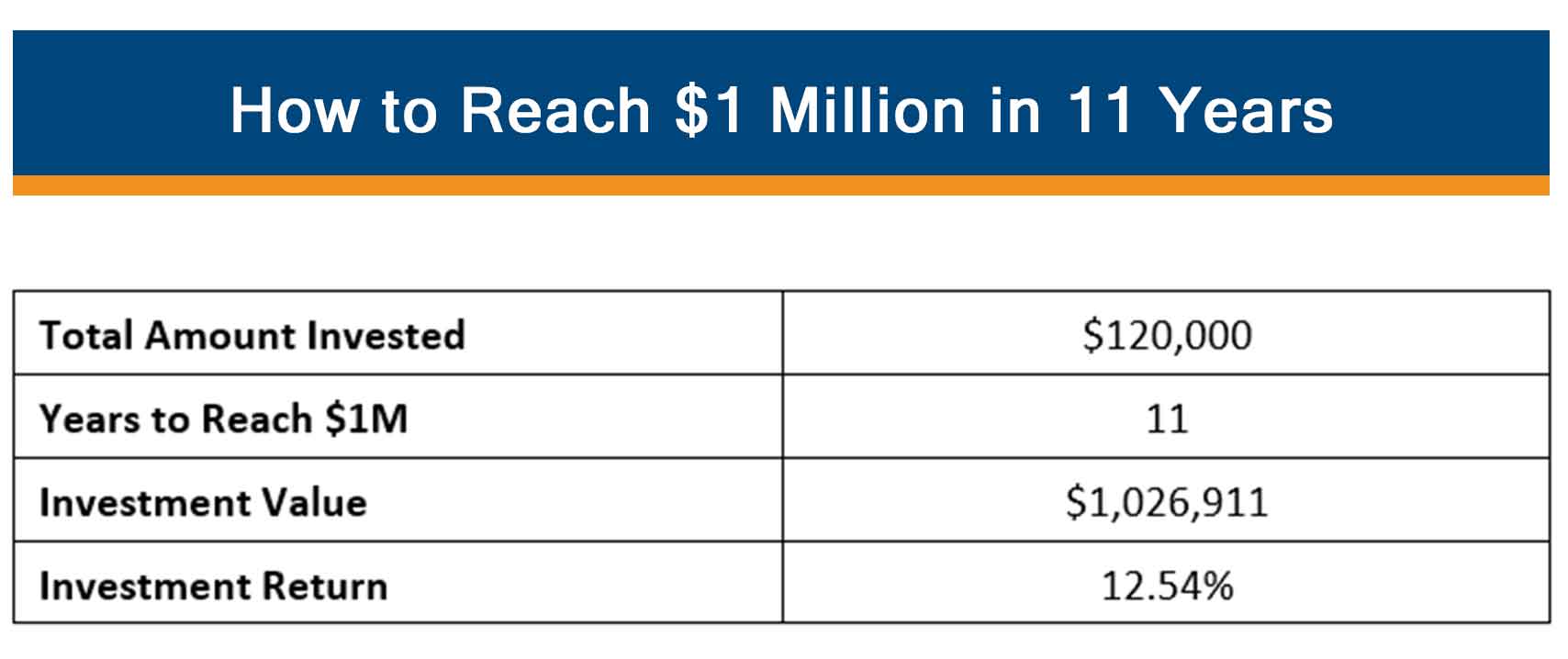

By starting with an initial capital of $20,000 and investing $10,000 per annum at the beginning of each successive year, you can see it takes 11 years or half the time and almost half the capital it took trading the medium to long term portfolio to reach $1 million dollars.

This is because you have double the amount of capital working for you with the additional short-term trading account.

But what if you were unable to achieve the same compounded return on your short term trading account as you did on your medium to long term portfolio. Obviously, the time it takes you to reach your goal of $1 million dollars will be longer but as you can see, it is still substantially less than trading a medium to long term portfolio alone.

It will take you just over 14 years to achieve your goal assuming you only achieve a compounded annual return of 8 per cent on your short term trading account, while still achieving an annual compounded return of 12.54 per cent on your medium to long term portfolio.

The actual investment value on the screen is the capital value at the end of 14 years but that aside, as you can see, the goal of reaching $1 million dollars was achieved 8 years earlier than if you had only traded a medium to long portfolio.

And of course, if you have less than $10,000 per annum to invest each year, your goal of reaching $1 million dollars will take longer but it is still very achievable.

But once again, I must stress if you venture down this path and begin trading highly leveraged markets before you have proven to yourself you can consistently make money trading over the medium to long term, you will not only putting at risk your capital but also your psychology, which will have an even greater impact on your ability to be consistent in trading your medium to long term portfolio.

So I implore you to get educated with our trading courses because the benefits will pay off tenfold.