Is the Dunning Kruger Effect Killing Your Profits?

By Dale Gillham

This may come as a surprise but did you know that there is a common theme among investors and traders that leads them to kill their portfolio returns. The good news is that once you become aware of this issue, you can take control and stop losing.

Learn why you maybe killing your portfolio returns and how to stop it

Like me, you have probably been at a dinner party listening to someone who acts like they know everything and drowning the thoughts and opinions of others out of the conversation. Yet as you listen to what is being said, it becomes increasingly obvious that they don’t even know half of what is actually coming out of their own mouth. Worse still, they are completely oblivious to their own ignorance on the topic in question.

I have spoken to more than my fair share of these self-proclaimed stock market experts telling me how the market works and how I should trade. Remember, these self-titled experts are calling me to enquire about how I can help them trade better, so I am sure you can understand the irony in this.

When I question them about how they trade, so I can determine how best to assist them, I find they get defensive. Even when I offer to explain how they could trade much better and highlight how their thinking about trading or the market is killing their portfolio returns, they dig in even harder and don’t listen.

This behaviour is actually referred to as cognitive bias, which I will share with you in more detail shortly so you can recognize if this applies to you and how you can change this behaviour to improve your profits.

Interestingly, 99 per cent of the time it is men who suffer from cognitive bias. Sadly, these individuals are walking towards the edge of a cliff blissfully unaware of the ever present danger that is right in front of them. But it doesn’t have to be that way.

Understanding the Dunning-Kruger effect

You can imagine my excitement when I recently came across a scientific study that was conducted in 1999 that perfectly explains the behaviour I have just described. The study is called the Dunning-Kruger Effect, which explains the effect of cognitive bias from a scientific perspective. In simple terms, cognitive bias is a systematic pattern of deviation from what is considered normal or a rationality in judgement.

In other words, people create their very own “subjective reality”, which is why those who possess this behaviour do not listen to logical arguments or ignore any evidence that proves their reality to be incorrect. As you can probably guess, after more than two decades of working with traders the results of this study confirmed what we already knew.

The Dunning–Kruger Effect explains a person’s inability to recognize their own lack of ability. And without this self-awareness, people cannot objectively evaluate their own competence or incompetence. This explains why many traders and investors feel like they are beating their head against a brick wall when they fail to achieve the profits they expected with their trading, as they are unable to recognize their own incompetence.

In the study, social psychologists David Dunning and Justin Kruger determined that the cognitive bias of false superiority results from an internal illusion in people with a low ability and from an external misperception in people with a high ability. I know this seems heavy but stay with me, you’ll be glad you did.

Put simply, people of low skill overestimate their level of knowledge and skill, and underestimate the knowledge and skill of the experts in the field. This explains why cognitive bias is predominantly oriented towards men, as the male ego often gets in the way of them actually listening and learning.

In short, the research indicates that people with this cognitive bias who have limited to no training are delusional about their own level of knowledge and skill. It also explains why many people who seek our help tell us that they love what we talk about in our weekly stock market show but they choose not to follow what we recommend or they do the exact opposite of what we are advising you should do.

Interestingly, the Dunning–Kruger Effect is not specific to the stock market, so if you possess this cognitive bias you may see it raise its ugly head in other areas of your life.

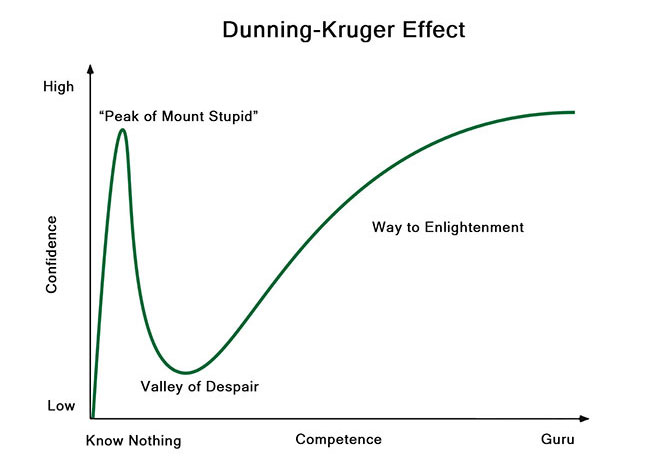

Figure 1, below, shows the results of the study. According to Wikipedia, the Dunning–Kruger effect is a cognitive bias in which people assess their cognitive ability as greater than it is. Cognition is the mental action or process of acquiring knowledge and understanding through thought, experience, and the senses.

Figure 1: The Dunning-Kruger effect (Source Wikipedia)

On the vertical scale is the level of confidence from low to high while the horizontal scale represents the level of competence from knowing nothing to being an expert in any given subject.

As you can see, the green line grows as people start to learn about a subject before it reaches the peak of “mount stupid”. This is where the old saying “a little bit of knowledge can be dangerous” applies. From a trading perspective, this is where we see so many people new to the market teeter as they have watched some YouTube videos, maybe read a book or two, and are sitting on top of “mount stupid” thinking they know what they are doing.

But these people are deluding themselves as to how skillful and knowledgeable they really are with their trading with many sitting on the edge of a cliff. As the research shows, all it takes is one stiff breeze to knock them off their precarious position, which as any experienced trader knows, occurs all the time for the uneducated trader with many falling into a valley of despair. Then they choose to stay there for years on end, playing a game of trial and error, inconsistency, frustration to the point where they finally give up altogether.

From experience, those that have cognitive bias are not willing to admit that they are doing poorly and tend to blame or justify their poor performance on the market or other factors. Unfortunately, many men fall into this trap, as their ego often stops them from taking responsibility or admitting fault.

If you have been trading for more than a year, yet you did not make 20 per cent plus from the market in 2019, then there is a high probability we are talking about you.

Fortunately, a small percentage do become aware of their cognitive bias and decide to become teachable, and subsequently move up the curve to the “way of enlightenment”. The question you have to ask yourself is do you want wait years wallowing in the valley of despair while continuing to lose money or do you want to fast track your journey so you can become a consistently, profitable trader?

Now let’s take a look at how you can recognize your cognitive bias and in the process start changing your behaviour and your future.

The four stages of learning

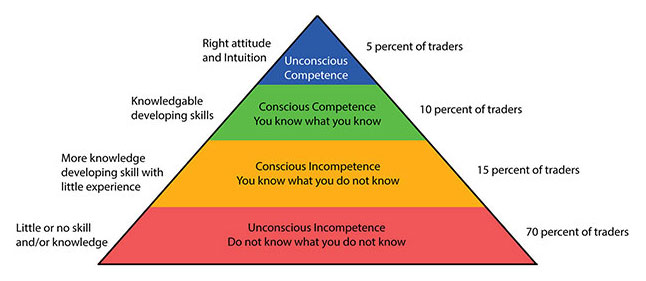

This is where the four stages of learning can support you to move from a path of unconscious incompetence to unconscious competence.

Think back when you learnt to drive a car. When you started out, you had very little knowledge about how to drive. That’s unconscious incompetence. But after many lessons and time gaining experience, you developed the right skills and knowledge to drive confidently. Now when you get in the car now and drive somewhere, you get to your destination without even thinking about it. That’s unconscious competence.

When it comes to trading and investing, the majority of those with a cognitive basis exist in the red section of Figure 2, below. They possess little to no skill or knowledge, or as we often say, they do not know what they do not know. This is where most people who call themselves traders exist.

Figure 2 – The Four Stages of Learning

If you exist in unconscious incompetence you are blissfully unaware of your own inadequacies and shortcomings that are holding you back from being a consistently, profitable trader. But the way to rise up through the pyramid to unconscious competence is to be in a perpetual state of openness and learning. In other words, you simply need to be teachable.

The great Zig Ziglar, who inspired me in my early days, said that “if you are not willing to learn then no one can help you, but if you are willing to learn then no one can stop you”. After mentoring and teaching people for over two decades, I certainly have to agree with him.

Most traders who come to us for help are in a state of unconscious incompetence or they have become self-aware and have moved up to conscious incompetence. This is where they have more knowledge but are still developing their trading skills and have very little experience trading the right way.

The major difference between those who exist in the red versus the orange section in Figure 2, above, is that those in the red section are more closed off and guarded, and always looking at what something will cost them. But what they fail to see is that without the right knowledge, it will definitely cost them more in terms of lost profit and lost opportunity than it would cost them to get a quality education in trading.

What astounds me is how those in the red section say that they know how to trade after reading some books or watching some YouTube videos. So, they limit their thinking about why they should pay for a course because they believe they can get everything they need for free. But in reality they are deluding themselves, otherwise why are they continuing to search for the “holy grail”. Because somewhere deep down they know what they are doing is not working, they are just not willing to admit it.

How to stop losing and start marking money

But the best way to stop losing and start making consistent profits in the market is to become self-aware and admit that what you are doing is not working and acknowledge that you don’t have all the answers and you need help. In simple terms, this means being open to learning.

Those in the orange area know they do not know enough and after trying to trade but being unsuccessful are now open to learning. This often occurs after the market has taught them some big lessons, which is why we say if you don’t pay for a proper education, someone with more knowledge will take your money.

Those in the green section of Figure 2, above, are teachable and are moving towards becoming that profitable trader they set out to become from the beginning of their journey, as they get to the point where they ‘know they know’ how to trade and realize that this is an awesome place to be. From there, it is simply the consistent application and practice of the techniques and strategies you have learnt that will move you to a level of unconscious competence.

Imagine having the skills to create a living from trading, to choose if you work or play. When you reach a level of unconscious competence (the blue section in Figure 2, above) you have the right attitude and your intuition leads you to trade very well. These are the people that make trading look easy. No doubt that’s where you want to be.

There is an old saying that when the student is ready the teacher arrives. When this occurs, it means you have recognized your limitations and become open to learning. When this happens, you will change your approach to the market and thinking for the better, which will change your results for the better.

So, if you are not getting the results you want, ask yourself why and then write down what are you going to do to change that.

Others who read this article also enjoyed reading:

You can also purchase my latest award winning book Accelerate Your Wealth, It's Your Money, Your Choice, which is packed with strategies to teach you how to confidently and profitably trade the stock market.