How to Profit From a 20% Market Crash: Strategies and ASX Stocks to Buy Now

By Dale Gillham, Janine Cox and Fil Tortevski

When the market falls sharply, most investors panic but experienced traders know that downturns often create the biggest opportunities.

In a recent discussion on our ASX video library, Wealth Within analysts explored how to manage risk, spot early recovery signals, and take advantage of strong, stable stocks during volatile times.

Whether you’re a seasoned trader or a beginner keen to build confidence, learning how to approach downturns is essential. Let’s explore what to do when the market drops, how to recognise early signs of opportunity, and which ASX stocks currently show resilience.

Should You Panic or Prepare When the Market Drops?

As the All Ordinaries Index recently dipped over 5%, questions about a possible 20% correction began circulating. However, Wealth Within analysts explained that not every fall is a crash and short-term corrections are healthy.

- Minor pullbacks of 8–12% are typical in healthy bull markets.

- Corrections allow overvalued sectors to rebalance and create buying opportunities.

- Understanding whether a pullback or a true crash is occurring is vital before reacting emotionally.

As senior analyst Janine Cox noted, “Never panic. Preparing for a pullback and recognising where opportunities will emerge is far more profitable than reacting to media fear.”

This mindset reflects what we teach in our accredited Trading courses, how to apply strategy and avoid emotional trading decisions.

Learning From Past Market Crashes

By analysing data from previous collapses, such as the 1987, 2007, and 2020 sell-offs, Wealth Within experts identified one recurring truth:

Crashes are born on optimism and end on pessimism.

Studying market history helps traders identify cycles, trends, and turning points. As Dale Gillham explained, “Recognising the pullback phase early positions you to profit when confidence returns.”

This is why knowledge and timing are critical, skills you can master through our Diploma of Share Trading and Investment, which equips traders to recognise cycles before the crowd reacts.

When to Buy: Recognising Confirmation Signals

A key strategy shared in the discussion was to wait for confirmation before entering trades, especially during volatile periods.

Rather than trying to "catch the falling knife," competent traders rely on proven confirmation tools to ensure they’re entering in the safer part of a new trend.

As Filip Tortevski put it,

“Giving up a little from the bottom is far better than buying too early and getting caught in more falls. Wait for strength, not speculation.”

This disciplined mindset, waiting for setups rather than reacting impulsively, separates professionals from amateurs. The principles are deeply ingrained in our Short Course in Share Trading, designed to teach practical entry and exit strategies that protect capital while maximising returns.

4 ASX Stocks With Potential Upside After a Sell-Off

After reviewing market data for 2025, the Wealth Within team identified four ASX-listed stocks with strong technical and fundamental qualities. Each of these companies shows resilience, long-term profitability, and favourable setups for traders watching for recovery opportunities.

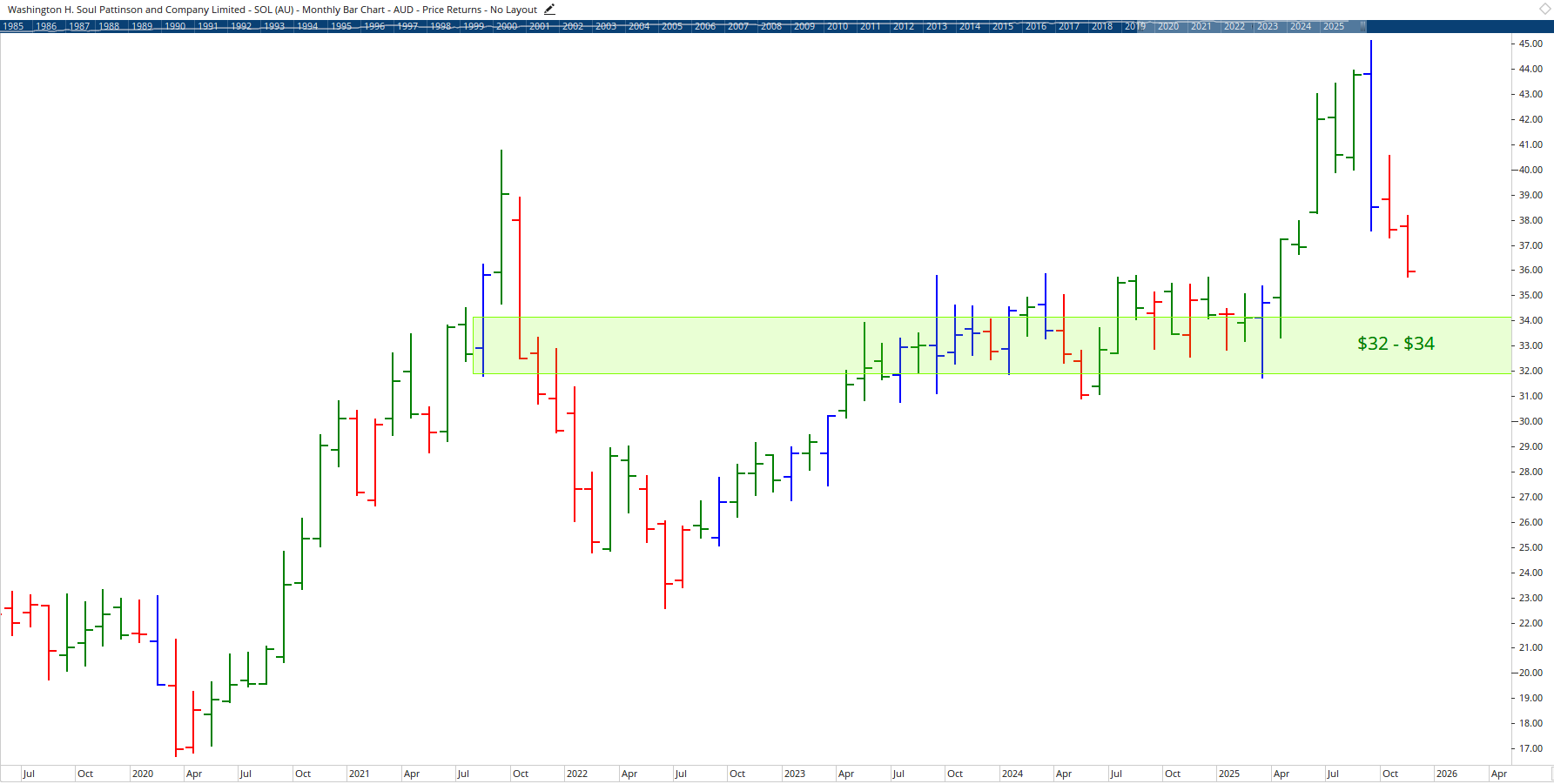

1. Washington H. Soul Pattinson (ASX: SOL) – The Steady Compounder

Often dubbed “Australia’s Berkshire Hathaway,” Soul Pattinson has a reputation for capital discipline and consistent dividends.

Analysts noted that its ability to recover after pullbacks presents steady, low-risk opportunity.

Previously showing support around the $32–$34 range, the stock could re-emerge for medium-term growth once confirmation signals appear.

With dividends stretching back to 1990 and solid management, it remains a long-term anchor for portfolio balance in volatile times.

2. Whitehaven Coal (ASX: WHC) – Rebounding From Strong Support Levels

While energy markets have seen mixed sentiment, Whitehaven Coal remains technically solid.

After falling sharply in early 2025, the stock has shown signs of building a base near $6, a level analysts view as key support.

Maintaining that base could signal a new rally toward resistance, with a potential upside of over 50% if momentum continues. Janine Cox notes that with the right trading rules, “Whitehaven Coal provides a perfect exercise in applying structured strategies during recovery conditions.”

This is exactly the type of setup explored in our Advanced stock trading course, where students learn to develop confirmation-based trading systems.

3. Worley (ASX: WOR) – An Energy and Materials Play

Engineering and project management firm Worley often moves in line with materials and oil prices. It’s coming off a long-term consolidation range between $11 and $19, with early signs of returning strength.

With global infrastructure and energy projects ramping up, this could be a mid-term trend opportunity for those who prefer capital-intensive industrial stocks.

Analysts emphasise that timing entries carefully during phases of expansion is critical, something that can be learned through proper Share trading education.

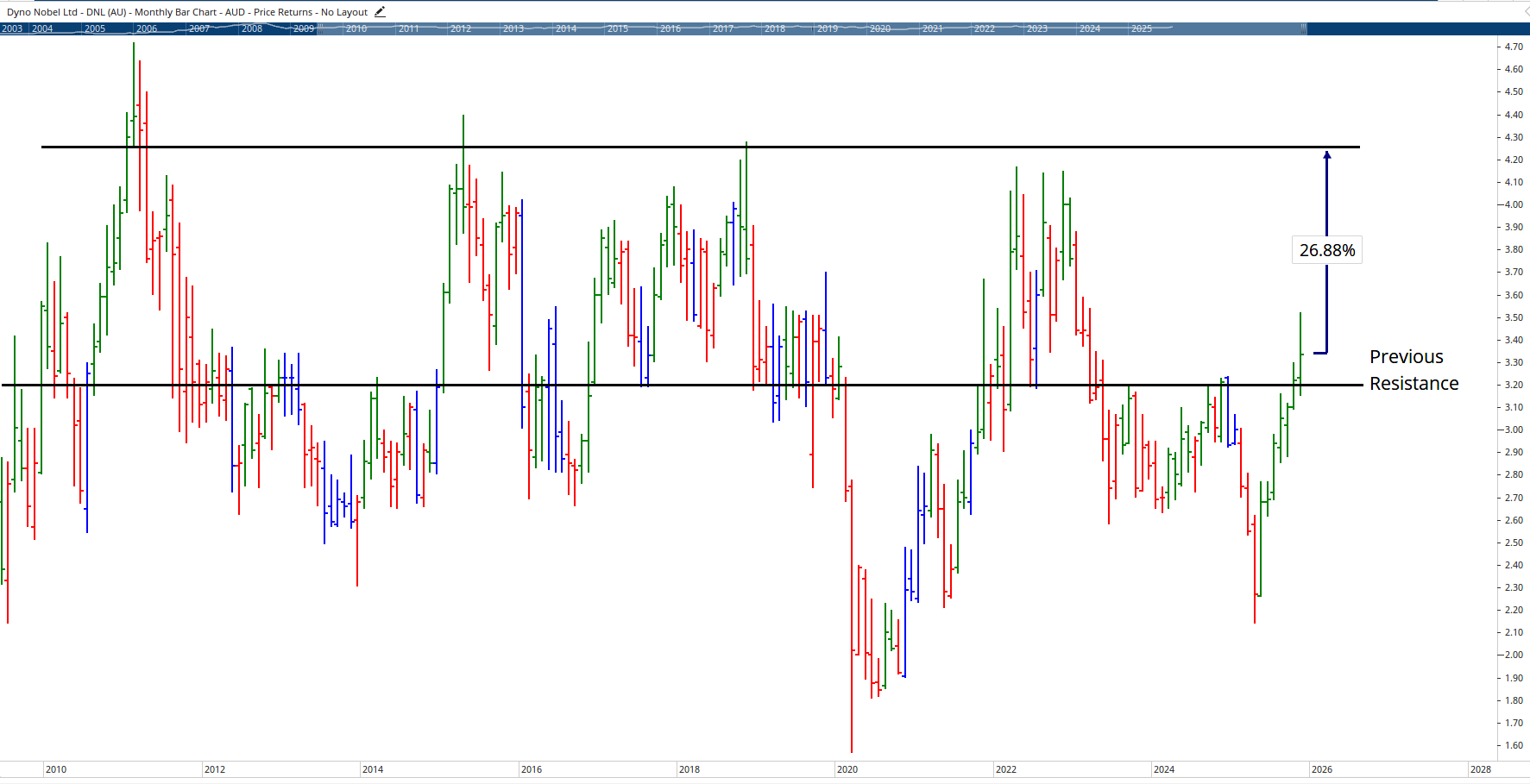

4. Dyno Nobel (ASX: DNL) – Quietly Building Momentum

Explosives and chemicals supplier Dyno Nobel has been trending positively since early 2025 and recently surpassed long-term resistance levels.

With additional upside of around 20% before the next resistance zone, this stock illustrates the power of strategic patience in post-correction conditions.

Analysts note that while investors may have missed the initial breakout, those who wait for a measured pullback could find a lower-risk entry during consolidation.

Investor Psychology: Why Most Get It Wrong

When markets fall, fear and cortisol spike, leading to emotional decision-making.

Wealth Within’s Talking Wealth Podcast recently explored the neuroscience of trading decisions, explaining how identifying fear-based thinking can dramatically improve results.

“If you let headlines decide your trades, you’ll always be behind,” Dale Gillham remarked.

“Train your brain for strategy, not stress.”

This connection between psychology and performance is a cornerstone of our learning philosophy at Wealth Within. Developing trader confidence takes more than reading price charts, it requires proper guidance and structured education.

Using Education to Turn Downturns into Profitable Opportunities

A market correction can feel intimidating, but for those with the right preparation, it becomes an ideal learning and profit opportunity.

Through our nationally accredited Diploma of Share Trading and Investment, you can learn:

- How to identify sustainable price trends.

- Techniques for managing capital during volatile markets.

- How to profit safely through both bull and bear cycles.

- The psychology framework to remain calm under pressure.

If you prefer shorter, flexible training, our Short Course in Share Trading provides practical foundations to start managing trades confidently and protect your wealth.

To learn more about our expert team, visit About Wealth Within.

Final Thoughts: Turning Volatility Into Opportunity

A 20% market correction doesn’t have to be a financial disaster, it can be a turning point for smart investors.

As Wealth Within’s experts explained, the key lies in discipline, confirmation, and strategy; not panic.

By recognising structure in chaos, you can align your trades with market momentum rather than against it.

For traders ready to deepen their knowledge, explore our Trading courses and build the confidence to profit in any market condition.