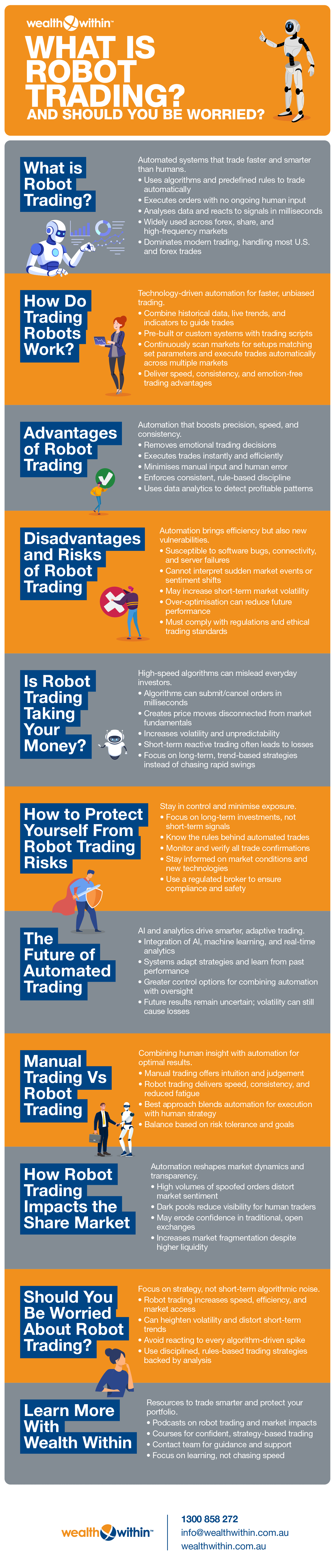

What is Robot Trading & Should You Be Worried?

By Dale Gillham

Could computer algorithms be affecting the share market and, therefore, your potential returns? We've been keeping a close eye on automated robot trading systems to see how they are influencing market volatility, share prices, and decision‑making for human traders.

With the ability to execute trades automatically at lightning speed, some trading robots can place 150 trades per millisecond so it’s no surprise the financial landscape is shifting rapidly.

In this article, we'll take a closer look at how robot trading, also known as algorithmic trading or automated trading works and what you can do to beat the power of automation. Read on to find out why you should be aware of what's happening in the market, so you can look after your money.

What is Robot Trading?

Robot trading (often called algorithmic trading, auto trading, or automated trading) is the use of computer algorithms and predefined rules to automatically execute trades in the financial markets. These systems are programmed to follow a particular trading strategy without the need for ongoing human intervention.

A trading robot, also known as a forex robot or expert advisor, operates through automated trading software that can place buy and sell orders on your behalf. These automated systems analyse market data, detect trading signals, and make decisions based on a set of rules, all within fractions of a second.

This technology is now common across multiple markets, including forex trading, share trading, and high‑frequency trading environments. While algorithms currently execute 75% of all U.S. stock trades, forex trading robots dominate the forex markets, executing trades faster than any human trader ever could.

How Do Trading Robots Work?

Trading robots work by using advanced technology and computer programs that combine historical market data, real‑time trends, and technical indicators to guide trading decisions.

Depending on the trading software or platform used, these robots can be either:

- Pre‑built automated trading systems: where traders select from a list of strategies, timeframes, and indicators.

- Custom‑built robots: developed using a scripting language such as MQL, allowing users to create their own tailored approach based on trading preferences, objectives, and styles.

Once configured, a robot trading system continuously analyses the market conditions, scanning for market opportunities that align with a trader’s parameters. When a setup meets its predefined rules, the system can automatically execute trades across multiple markets simultaneously, all without hesitation or emotional bias.

This ability to execute trades faster, capture market opportunities, and instantly adapt to changing market conditions gives automated trading a clear speed advantage over traditional manual trading.

Advantages of Robot Trading

When implemented carefully, automated trading systems offer several benefits that can enhance consistency and discipline.

1. Eliminates emotional bias

Unlike human traders, robots follow logic, not feelings. This helps avoid fear‑based selling or impulsive buying: two of the most common emotional pitfalls in manual trading.

2. Faster execution and confirmation

A robot trading system can execute trades faster and more efficiently than any person, reducing delays caused by indecision or slow reactions to market trends.

3. Reduces human error

By automating the manual execution process, trading robots minimise mistakes often caused by typing, order input, or timing errors.

4. Consistent discipline

Because these systems trade according to a predefined set of rules, they maintain consistent behaviour even when market volatility spikes.

5. Data‑Driven decisions

Powerful automated trading software can track and process vast amounts of market data, identifying patterns and trading signals across forex, shares, and other asset classes.

Disadvantages and Risks of Robot Trading

Of course, robot trading isn’t without its downsides. While it can provide efficiency, it also introduces new risks that traders must fully understand.

1. Technical failures

Even the best automated systems are only as reliable as their coding and internet connection. Software bugs, connectivity issues, or server outages can all result in unintended trades or losses.

2. Lack of human judgement

While robots can analyse data, they can’t interpret market sentiment or sudden shifts caused by events like company announcements or geopolitical news. Human traders often excel in assessing these nuances.

3. Increased market volatility

High‑frequency robots contribute to market volatility, especially when trading robots flood the market with high‑speed transactions that create short‑term price spikes or misleading momentum.

4. Over‑Optimisation

Many developers fine-tune their trading systems for historical data (backtesting), producing strong past performance but poor future results once market conditions change.

5. Regulatory and ethical concerns

Without oversight, automated activity can distort true market value. Traders should work with a regulated broker and be aware of Australian Financial Services Licence (AFSL) requirements before engaging in algorithmic or forex trading bots.

Is Robot Trading Taking Your Money?

In his article Share Wars: How the Robots are Robbing You, David Potts discusses how the influx of computer-generated trading has built a potentially dangerous environment for investors.

These computer algorithms can tap directly into exchange servers like the ASX, submitting or cancelling orders within milliseconds, a time frame no human could match.

This high‑speed trading environment can push market prices in directions disconnected from fundamental market trends. Everyday investors may interpret these artificial moves as real signals, only to be caught out when algorithms reverse course just as quickly.

As Wealth Within’s experts explain, this creates a “survival of the fastest” situation rather than a traditional market of value.

“Robot trading makes markets more volatile and unpredictable. It’s like a marathon race; someone sprints ahead for a bit, but eventually the pack catches up. The goal for everyday traders is to step back and focus on the bigger picture.”

Our advice is to avoid trading reactively or copying other traders who chase short‑term price fluctuations fuelled by trading bots. Instead, adopt a sustainable trading strategy focused on analysing market trends over weeks and months, not minutes.

How to Protect Yourself From the Risks of Robot Trading

While automated trading will continue expanding, that doesn’t mean you’re powerless. Here are steps every investor can take to maintain control and reduce exposure to mechanised trading activity:

- Invest for the Long Term: Avoid day trading or relying on short‑term trading signals. Focus on solid companies and quality shares that perform well despite daily fluctuations.

- Understand What You’re Using: If your broker or platform uses automated trading systems, ensure you know the set of rules guiding the trades automatically executed on your behalf.

- Monitor Your Orders: Always verify trade confirmations, especially with platforms that use auto‑execution models.

- Stay Updated: Keep learning about market conditions, new technologies, and the potential risks involved in robot trading.

- Work With a Regulated Broker: This ensures compliance with Australian Financial Services Licence standards, reducing exposure to unregulated markets or fraudulent software.

The Future of Automated Trading

As technology evolves, automated trading is becoming more sophisticated, integrating AI, machine learning, and real‑time analytics. These computer programs can adapt faster to changing market conditions, refine strategies based on performance data, and even learn from errors.

We can expect greater integration of advanced technology, smarter use of technical indicators, and enhanced control options for traders who want to blend automation with oversight.

Still, investors should remember that even with fully automated systems, future results are never guaranteed. Past performance doesn't assure profitability, and even the most advanced forex trading bots can produce unexpected outcomes during extreme volatility.

Manual Trading Vs Robot Trading

While manual trading allows for intuition, experience, and human judgement, automated trading systems offer speed, consistency, and reduced fatigue. The best traders combine both, using automation for scanning and order execution while relying on human insight for strategic decisions.

The key is to strike a balance that suits your risk tolerance, financial situation, and overall trading objectives.

How Robot Trading Impacts the Share Market

While automated trading software affects all asset classes, share trading and forex trading are most impacted. These platforms often experience large volumes of fake bids, also known as spoofing, that can distort market sentiment.

Some brokers have responded by moving transactions into “dark pools” which are private systems that limit transparency. Although auto trading advocates claim this increases liquidity, the result is often reduced visibility for human traders and more fragmented market data.

In the long term, this trend could erode confidence among traditional investors who rely on open exchanges to ensure fairness and transparency.

Should You Be Worried About Robot Trading?

Robot trading is here to stay and while it brings efficiency and broader access to global markets, it also poses new challenges for retail investors.

Automated trading systems can execute trades faster, identify short‑term market opportunities, and remove emotional biases, but they also heighten market volatility and change the way market trends behave.

At Wealth Within, we encourage traders to look beyond the noise. Rather than reacting to every algorithm‑driven spike, focus on developing a smart, rules‑based trading strategy backed by sound analysis and strong discipline.

Stay informed, stay patient, and trade with purpose.

Learn More With Wealth Within

If you’d like a deeper understanding of how trading robots and automated systems are shaping today’s financial markets, explore our related resources:

- Listen to the Robot Trading War: Part 1 and Robot Trading War: Part 2 podcasts from Wealth Within. Uncover how forex robots influence human traders and how to protect your portfolio.

- Trading courses - designed to help you start trading confidently and profitably with well‑researched strategies and proper risk management.

- Contact Our Team – call 1300 858 272 or visit our website to learn more about achieving your trading objectives under real‑world market conditions.

Take control of your future and learn to trade smarter not faster with Wealth Within, Australia’s trusted authority in share trading education.

Others who read this also enjoyed reading: