Short Selling Stocks to Increase Profits

By Janine Cox

Short selling is definitely a strategy you can utilise to make a lot of money to boost your bank balance. But it is also very easy to empty your bank account if you attempt short selling without the right knowledge and experience.

So how can you short sell stocks to increase your profits and, in turn, achieve your financial goals much sooner? And what do you need to be aware of to avoid the costly mistakes?

What is short selling?

Commonly referred to as shorting, short selling is a technique that can be used to generate profits from a fall in the value of a stock, market, currency or commodity. So unlike trading long, where the aim is to profit from the share price rising, when trading short your aim is to profit from the stock price falling.

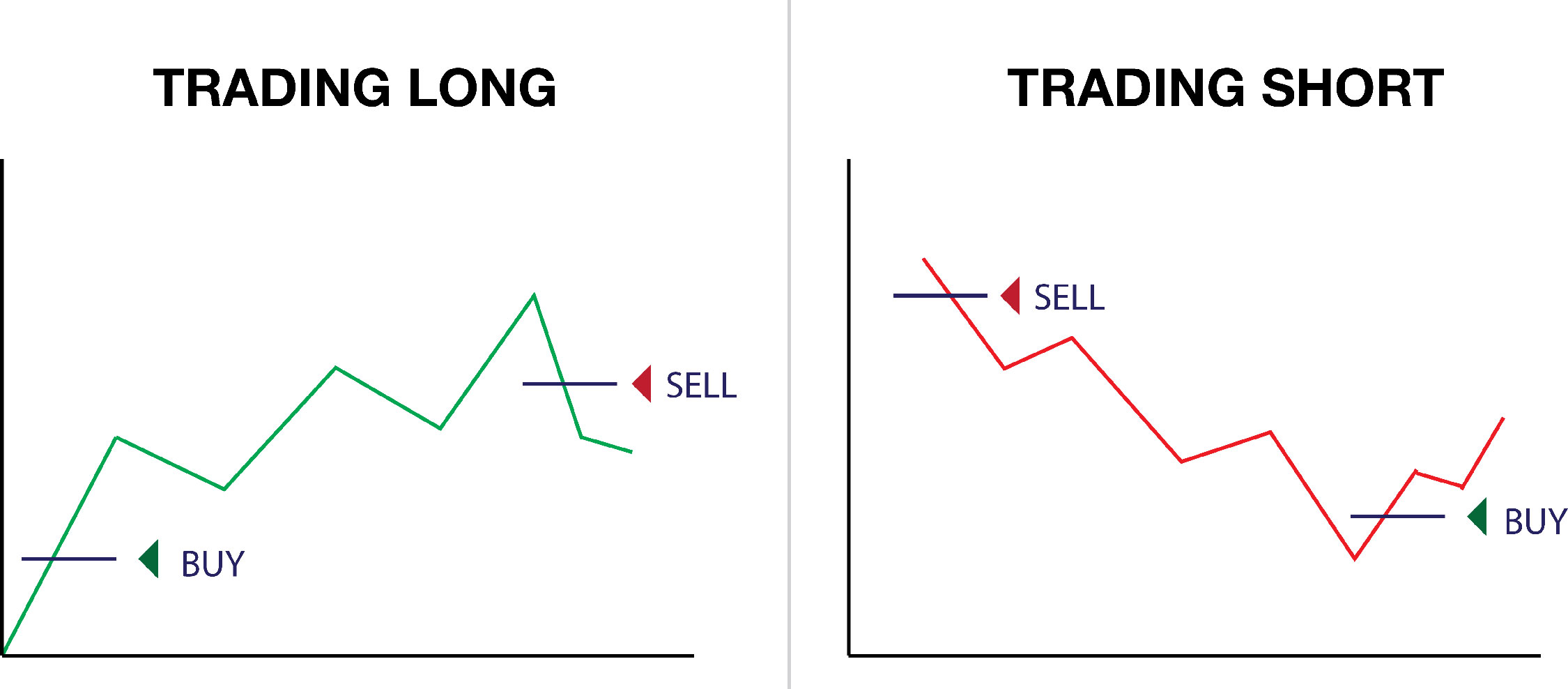

When trading long, the intention is buy low and sell high, whereas when you trade short you want to sell high and buy low as shown in Figure 1, below. Some people struggle with this concept because it can seem absurd to sell shares you don’t own.

Figure 1

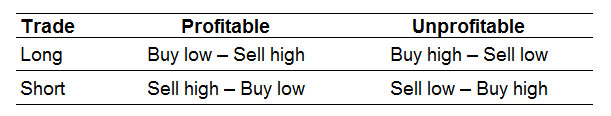

If you take a long position, you are anticipating a rise in the value of the share price and you would experience a loss if the price falls. On the other hand, if you short a stock, you are anticipating a fall in the value of the share price but if it actually rises, you would experience a loss, as shown in Figure 2, below.

Figure 2

Now let’s take a look at some examples of how short selling works.

How do you sell something you don’t own?

The action of selling something you don’t own is facilitated through the use of margin or trading using leverage, which requires you to put up collateral to purchase the asset from a broker.

Let’s say you decide you want to trade short, you would put up an initial margin to open the contract based on the associated risk of the position, which is determined by the broker.

For example, if you wanted to short sell AMP by purchasing 10,000 shares at a price of $2.11 with a margin of 10 per cent, you would be required to put up an initial margin of $2,110.

(10,000 * $2.11) = $21,100 (the total value of the position) x 10% = $2,110 (initial margin).

Now let’s consider what happens when you short sell a position.

When you open a position, you will be required to put up the initial margin as security, as well as meet your daily obligations following the revaluation of the position each day. If the position rises you will be required to pay additional margin into your account but if it falls, you will receive a margin equal to the positive movement in the value of the position.

That said, because your potential losses are not limited by the collateral you provide, the broker will require you to put up additional collateral to cover your margin obligations.

Unlike other derivatives, cash flows, such as interest and dividends, are paid while the position is open, allowing price to track the underlying instrument rather than trade at a discount or premium, as is the case with options, for example.

Therefore, when you open a short position, you will receive interest each day and pay any dividends on the ex-dividend date.

Let’s look at another short selling example

Let’s say you decide to short CBA because it has been in a downtrend and you believe it will continue to fall away. You decide to purchase 1,500 shares at an entry price of $80.86, which equates to a position size of $121,290 but as you are trading on margin, you are only required to put up 5 per cent as margin or the equivalent of $6,064.50.

You discover you were right in your analysis and the stock continues to fall, and you decide to exit the position at $77.01. Now let’s assume that you have paid approximately $100 in brokerage to hold the position, then your net profit equates to approximately $5,765 ($80.86 - $77.01 = $3.85 x 1,500 = $5,775 - $100 = $5,765) , which is a return of around 95 per cent. While this is exciting, let’s consider what would happen if the stock traded in the opposite direction.

Remember, short selling involves using leverage, therefore, your losses can be amplified. If CBA had risen instead of continuing to fall away, then you would be in an unprofitable trade because you would have been required to pay the $5,765 in collateral to the broker.

It is for this reason why it is so important that you understand how to trade the underlying stock and to ensure you are profitable in trading this instrument before you introduce leveraged trading or trading on margin as part of your trading strategy.

Why would you consider short selling?

There are two reasons you would consider short selling: the first is to profit from an asset that is falling, as we just discussed, and the second is to hedge your portfolio or position when the market is weak or the shares you hold are falling, and you want to protect your capital or profits. In this scenario, the aim is to continue to hold your shares as price falls to create a neutral position between the shares and the hedged position.

In other words, hedging involves offsetting the value of the shares you hold in your portfolio with the rising value of the hedged position. While this strategy is not guaranteed, as mistakes can be made, you need to know the right time to unwind the hedge, as it can be used to protect the downside. If you do decide to apply this strategy, it is important as a trader that you have experience and an in depth knowledge of technical analysis. It is also important to structure your portfolio so that no more than 10 per cent of your total capital is exposed to highly leveraged trades. Therefore, I encourage you to read my four golden rules to investing in shares.

What do you do if you hold the physical stock and it is being sold short?

First and foremost, the important thing is not to panic. While it is not uncommon to hear about a stock being heavily shorted in the media, this doesn’t always mean that the stock price is going to plummet.

Remember, it’s important to be rational when trading the stock market, therefore, irrespective of what is reported, you must always trade on what you know rather than what might unfold. Given this, it’s wise to apply your trading rules, rather than speculate if you want to be successful in the long run.

It is critical as a trader that you are always aware of the potential downside risks of any position you take, and if a stock you own has an increase in the number of short sellers, this could indicate that any fall may occur at a faster rate than normal. That said, it does not mean you need to change your stop loss or other rules.

If a stock you own is sold off heavily because it is being shorted, that may trigger your trading rules to exit. That said, short sellers are usually short term in their thinking, therefore, a stock that is heavily shorted can stop falling in a very short period of time. As most of the market trades long, any stock that is shorted can run out of sellers quite quickly, and start to rise as buyers come back in to grab a bargain.

When the fall in price stops, short sellers get nervous and cover their positions by closing the short trade, which means they buy the stock causing price to rise even faster. In turn, this causes even more short sellers to cover their positions. Therefore, it is incumbent upon you to understand what is happening when a stock is heavily shorted, so you know how to handle yourself and your psychology.

Should you short sell?

While short selling can be a great strategy to generate profits from the market or to hedge long positions against any potential downside risk, what most people don’t really appreciate is that prices generally fall faster than they rise. When trading short, being intelligent or having a quick wit is not enough to make you successful. It is imperative that you have the right knowledge and experience given that shorting a stock or market will cost you dearly if you get it wrong.

I strongly recommend that you prove to yourself that you can trade stocks long over a two to three year period before using margin to trade short. That’s because short selling is not for everyone, as you do need to have a different mindset, which can be the difference between success and failure when applying short selling strategies.

While anyone can place a trade to buy or sell, this does not make you a trader or indicate you will be profitable. All profitable traders are consistent in their application of their rules and they understand the right course of action to take in any market condition.

If you do want to use leverage in your trading, then there are many factors you must be aware of including the timing of the trade, proven rules for entry and exit, money management, risk and the list goes on. You also need to understand how the margin interest is applied and what happens to price when a company goes ex-dividend, and the impact that quarterly company reporting can have on your trade. This is because when a company reports it can increase volatility on the underlying asset and the probability of this impacting any leveraged trades you hold increases significantly.

Learn to manage your risk like a professional and you will succeed

If you truly want to be successful trading long or short, it pays to be realistic about the preparation and planning you need, and the knowledge you require. Shorting a stock or the market can be a very powerful strategy when applied properly and having the right knowledge and trading education will ensure your success.

If you are not properly prepared for any market condition because you have chosen to take short cuts in your education, you are setting yourself up for failure, and in doing so, you will be repeating the mistakes that the masses make. While you may believe you can work it out for yourself and somehow it will all be roses, I have seen many intelligent people with lots of qualifications make plenty of poor decisions in the market because of over confidence or ignorance.

It is wise to remember, the greater the rewards you seek from the market, the higher the risk you are taking. So it goes hand in hand: the higher the risk, the higher the level of knowledge and experience you need to succeed. We all have an ego and while some of us recognise when it is not serving us, others are oblivious to the role their ego plays in their decision making. If you are not consistently profitable, then you might like to have an honest think about what it is that is causing you to be inconsistent.

Remember, gaining the right knowledge by undertaking structured education ensures you develop the processes and strategies to be consistently profitable long term. Get that right and your leveraged trades will generate quick returns in the order of 50 per cent plus, as the example above demonstrated. Profiting regardless of whether the market is rising or falling is not hard if you have the right formula. As Warren Buffet once said, “The best investment you can make is an investment in yourself…the more you learn, the more you’ll earn”.

If you can appreciate the importance of this point, no matter how long you have been trading, you will dramatically increase your wealth and the opportunity to achieve your financial goals much sooner. Ignore this and your journey will be longer, harder, costlier and more stressful than it needs to be.

Others who read this article also enjoyed reading: