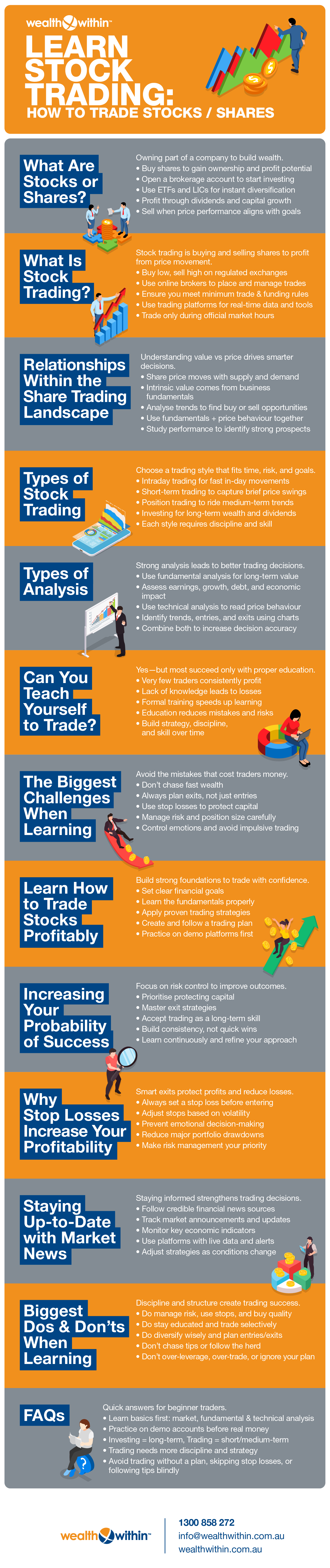

Learn Stock Trading: How to Trade Stocks / Shares

By Dale Gillham

Learning how to trade stocks is one of the best ways to grow your personal wealth, provided you do it the right way and understand the stock market inside and out.

As the saying goes: investing without knowledge is gambling. Only after you learn stock trading and understand how the stock exchange works do you truly grasp this truth.

Over more than three decades studying the market, I’ve learned that gaining the right knowledge and knowing how to apply it are what separate the average market participant from the successful trader.

Below, I’ll share powerful insights from my experience as a professional trader, fund manager, and trading educator to help you develop the right foundation so you can buy and sell shares confidently and achieve long‑term success.

What are Stocks or Shares?

Stocks, also called shares, represent ownership equity in a company. When you buy stocks, you become a shareholder and have the right to participate in profits through dividends or capital gains as the share price increases.

New traders need to open a brokerage account to buy shares, and choosing the right brokerage account is an important first step.

You can also invest through exchange traded funds (ETFs), listed investment companies (LICs), or listed real estate and infrastructure funds, which provide diversification across multiple assets on the stock exchange.

When you trade stocks, you own a portion of the business and can sell stocks later for profit, depending on how the share price performs. Share investing is the process of buying shares to participate in a company’s growth and profits.

What is Stock Trading?

Stock trading is the act of buying and selling stocks on a regulated stock exchange such as the Australian Securities Exchange (ASX). The goal is straightforward: purchase shares when prices are low and sell them when prices rise.

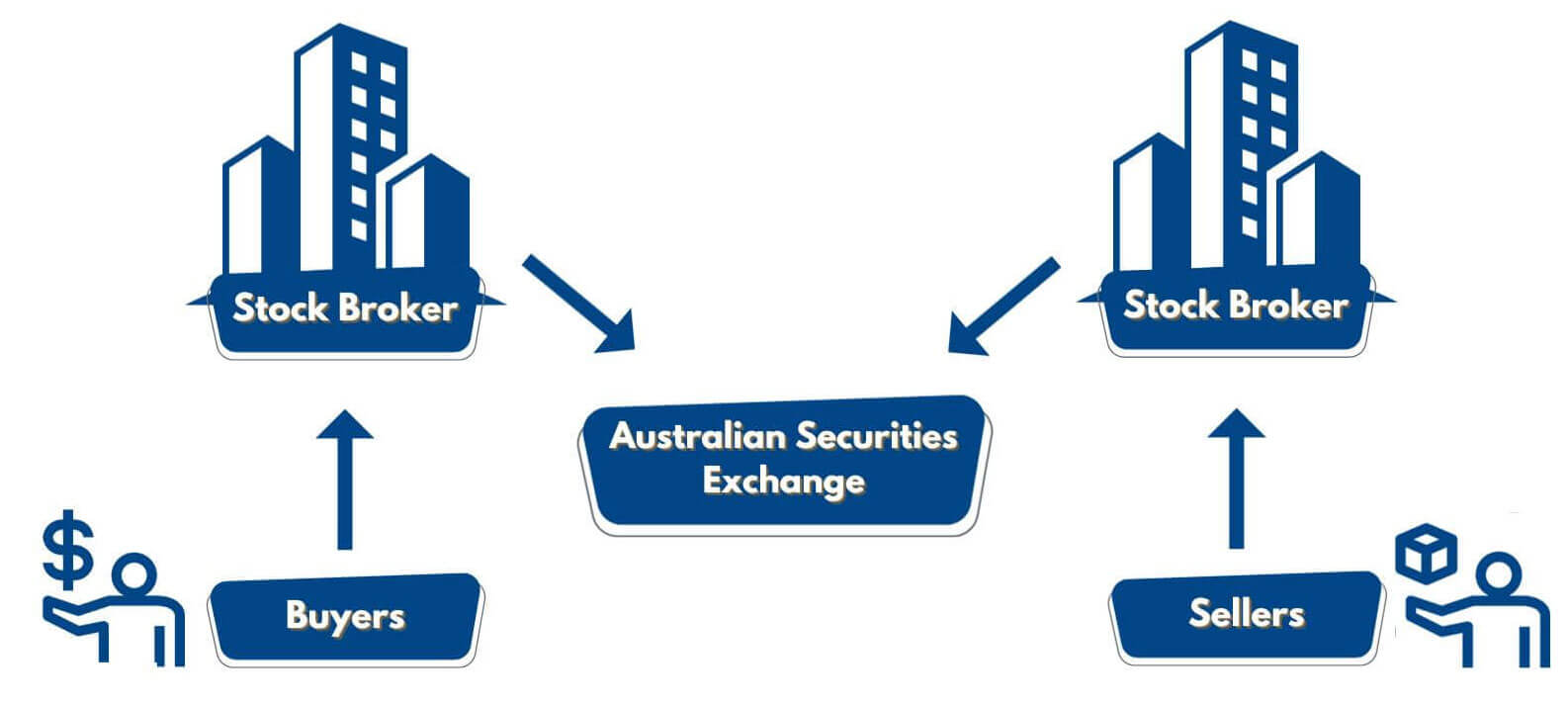

Each trade involves several participants:

- Buyers seeking to acquire shares

- Sellers exiting or reducing positions

- Online brokers who facilitate transactions while charging a brokerage fee

- The ASX, which handles trade settlement and clearing

Most brokers require a minimum investment or trade size to open a position. After funding your brokerage account, you will execute your first trade, so it's important to be aware of minimum investment amounts and any platform requirements before placing that initial transaction.

A trading platform enables investors to manage trades seamlessly online, offering live data, technical analysis tools, and real‑time stock price updates. Trades are executed during a trading day, which is the period when the stock exchange is open.

The various participants in the stock market

Relationships within the share trading landscape

A stock’s price and value aren’t the same. While accounting data defines intrinsic value, stock prices fluctuate based on supply and demand within the stock market.

Understanding share value helps investors assess a company's financial health and long-term prospects, as share price trends often reflect underlying business performance and growth potential.

Traders study these dynamics to determine if demand will push prices up (a buy opportunity) or down (a sell signal). Understanding this behaviour is crucial for making sound investment decisions.

Traders identify potential investments by analysing both price trends and company fundamentals to evaluate which stocks may offer promising opportunities.

If you’re just starting out, you may want to read Investing in Shares and Stocks for Beginners to build your foundational knowledge before you trade stocks actively.

Types of Stock Trading

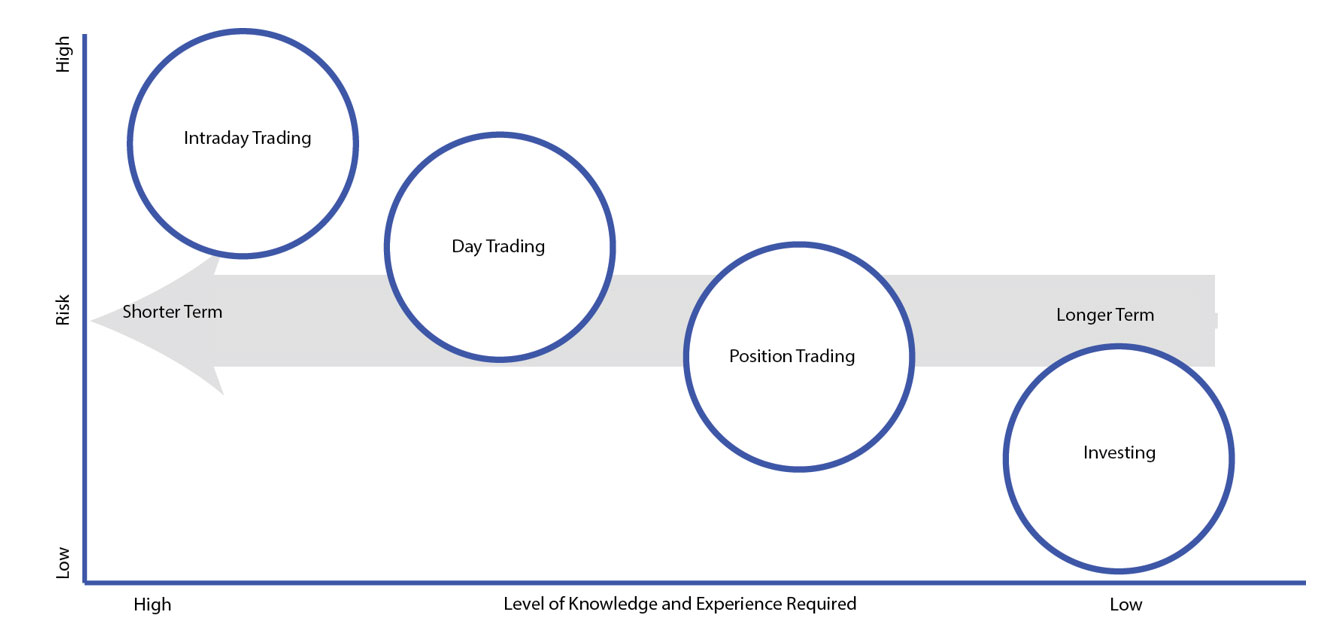

Your trading style depends on factors such as your financial goals, experience level, and preferred time commitment. The most common styles include:

Short selling is another trading strategy that allows traders to profit from falling share prices, but it carries higher risk than traditional long positions.

Intraday Trading

Short‑term day trading, where positions open and close within the same day. It’s fast‑paced and requires precise timing, strong technical analysis, and a solid risk management plan.

Day Trading

Also known as swing or short‑term trading. These trades may last several days and aim to capture share price fluctuations. Successful day traders focus on identifying moving averages and short‑term trend reversals.

Position Trading

A medium‑term approach focused on capturing broader market trends. Position traders look for buy‑low, sell‑high opportunities over weeks or months, often combining fundamental and technical analysis.

Investing

A long‑term strategy that emphasises fundamental value. Investors hold quality stocks or ETFs for years, aiming for consistent capital appreciation and dividends while minimising exposure to higher risk.

Each approach requires different levels of knowledge, capital, and emotional discipline.

The different types of stock trading

Types of Analysis

Whether you’re trading or investing, your buy and sell decisions depend on your analytical framework.

Technical and fundamental analysis are not only crucial for stock trading, but are also essential in forex trading. Many educational resources provide comprehensive coverage of both stock and forex markets, helping traders understand and apply these analysis techniques.

Learning to analyse stocks, forex, and other assets is a skill that improves with practice and educational resources are valuable tools for building your analysis skills.

Fundamental Analysis

Used primarily for long‑term investing, fundamental analysis assesses a company’s financial health via metrics like Earnings Per Share (EPS), Price‑Earnings (P/E) ratio, and revenue growth. Traders also monitor interest rates, debt levels, and external economic indicators.

Technical Analysis

This data‑driven analysis examines historical share price movements to spot repeating patterns using charts and indicators. Moving averages, trendlines, and candlestick analysis help traders identify entry and exit signals.

Combining both methods strengthens your ability to make informed investment decisions.

Can You Teach Yourself to Trade Stocks?

Yes, but learning to trade stocks successfully requires time, strategy, and discipline.

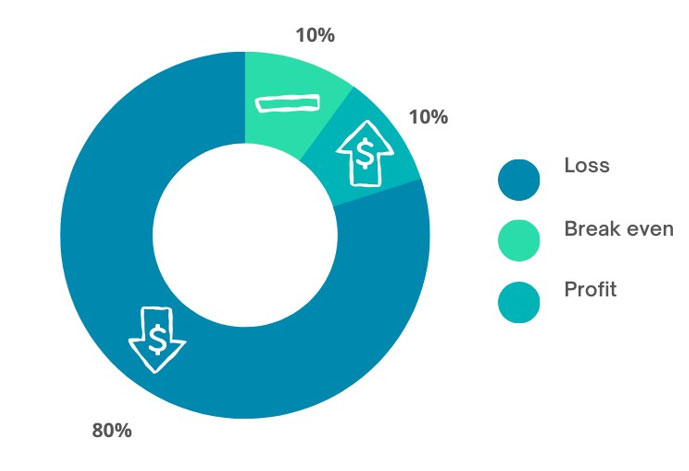

Only about 10% of traders consistently make profits in the stock market. That means most either lose money or just break even because they lack education or effective risk management practices.

The likelihood of stock market success

While self‑teaching is possible, formal education through trusted programs will significantly speed up your progress, help minimise mistakes, and ensure you develop both knowledge and trading skills. Leveraging educational resources such as courses, books, and online materials is essential to accelerate your learning and make informed trading decisions.

The Biggest Challenges When Learning to Trade Shares

The path to becoming a successful trader is filled with obstacles. Here are common pitfalls to avoid:

1. The Get‑Rich‑Quick Mentality

Trading isn’t instant wealth creation. Successful traders invest time and effort into education, practice, and discipline. You’ll either invest in quality education upfront or pay the price through losses later.

2. Not Knowing When to Sell Stocks

Many traders spend too much time finding winning stocks and not enough planning when to sell their stocks.

3. Failing to Set Stop Losses

Stop losses are essential for controlling risk. Setting appropriate exit levels protects capital and prevents emotional decision‑making.

4. Poor Risk Management

Risk should align with overall goals. Over‑ or under‑diversification, incorrect position sizing, and inappropriate trading tools can all erode returns. Effective risk management should also adapt to changing economic conditions, as fluctuations in the broader economic environment can significantly impact trading performance.

5. Trading on Emotion

Fear and greed cause market participants to abandon plans and chase short‑term stock price movements. A solid trading strategy and emotional control prevent over‑trading.

6. Overuse of Daily Charts

Daily charts can amplify short‑term noise. Use weekly or monthly data to identify broader market trends and avoid excessive trading that increases brokerage fees. Many day-traders find that over-trading results not just in higher fees but takes a greater amount of your valuable time only to result in poor returns.

7. Excessive Leverage

Leveraged markets (such as Forex, options and other leveraged instruments) involve higher risk. Don’t trade with borrowed capital until you can consistently profit from individual stocks. Traders should never consider leverage trading until they’ve proven to themselves that they can be consistently profitable trading individual stocks.

8. Trading on Hot Tips

Never base decisions on unverified tips. Always analyse fundamentals and technical setups before risking capital.

9. Ignoring the Long‑Term Perspective

Creating real wealth, replacing your income and indeed becoming a full-time trader so you can trade for a living is a long game and not something you just do for a few weeks or months.

It’s easy for novice traders to focus on short-term gains and forget the importance of taking a longer-term approach to being successful. As they say, Rome was not built in a day so being successful is not about finding the next stock that will rise 100 per cent or more, it is about gaining consistency.

Learn How to Trade Stocks Profitably

Once you understand potential pitfalls, focus on the methods that lead to consistent profits. Learning to trade is a crucial step in your overall investment journey, helping you build the skills and confidence needed to make informed decisions as you progress.

1. Set Clear Goals

Define why you want to learn stock trading, whether it be income generation, wealth building, or financial freedom. Clear investment objectives keep you motivated and focused on long‑term outcomes.

2. Educate Yourself

When starting out, it’s important to learn the fundamentals of investing in shares for beginners.

It’s also worthwhile taking a crash course on how to buy ASX shares to learn the basics including the terminology of different order types and how the stock market works.

Then, if you want to learn how to achieve consistently profitable results, it's a really good idea to complete a comprehensive trading course that will teach you how to apply both fundamental and technical analysis so you gain the confidence to navigate changing market conditions.

3. Apply Profitable Stock Trading Strategies

Avoid relying solely on lagging indicators such as moving averages or RSI. Instead, learn to identify leading indicators that confirm price direction early. Understanding price charts, market trends, and volume movements enhances accuracy when you buy and sell.

Using leading indicators means I am better placed to ‘time the market', which ultimately results in more consistent profits. While it requires a little more work to learn how to apply these techniques effectively, the effort is well worth it.

4. Develop a Trading Plan

Your plan should define:

- Entry and exit strategies

- Position sizing and risk management rules

- Emotional discipline procedures

A clear trading plan reduces impulsive choices and helps maintain consistency across trades.

5. Use a Demo Trading Platform

Practice using mock trading accounts before committing real money. Trading platforms offered by major online brokers allow paper trading to test strategies and build confidence without risk.

6. Learn to Manage Your Risk

Effective risk management determines how much capital you risk per trade. Use stop losses, avoid overexposure, and keep portfolio positions balanced to maximise performance and safety.

7. Start Small

Begin with small trades to test your system. Factor in brokerage fees which impact real returns, especially on smaller positions.

8. Analyse Your Trades

Maintain a detailed trade journal recording entries, exits, and results. Regular analysis helps refine your strategy and improve future decisions.

9. Develop the Traits of Successful Traders

Successful traders display discipline, patience, and adaptability. They understand market cycles, stay focused on sustainable growth, and commit to continuous learning.

Increasing Your Probability of Success When Learning to Trade

Now that you understand the skills and knowledge required to trade stocks profitably, let's look at how you can increase your likelihood of success when learning to trade.

Possibly the greatest word of wisdom I can offer is to learn where to exit. I mentioned earlier that trading is about minimising risk, not maximising profits—having solid exit strategies in place is the easiest way to ensure you let your profits run and cut your losses short.

Why Stop Losses Increase Your Profitability

Always set a stop loss before entering any trade. For example, a blue‑chip stock might have a stop loss around 15% below the entry price. Proper stop losses protect your portfolio and form a cornerstone of effective risk management.

There are various stop losses you can use depending on what you are trading, and you may adopt a different stop loss for different types of shares and trading styles, but as a rule of thumb, I always set my stop loss 15 per cent below my purchase price when trading blue chip shares (although this will vary depending on the volatility of the stock).

Staying Up-to-Date with Market News

In the fast-moving world of financial markets, staying informed is key to making smart investment decisions. Market news can have a direct impact on stock prices, trading volumes, and overall market sentiment. By keeping up with the latest developments, you can anticipate shifts in the market and adjust your strategy accordingly.

Leverage a variety of sources to stay current: follow reputable financial news websites, subscribe to updates from the stock exchange, and use trading platforms that offer real-time news feeds. Many online brokers also provide research tools and market alerts tailored to your portfolio.

Pay close attention to economic indicators such as interest rates, inflation, and employment data, as these factors often influence the direction of the stock market. By integrating market news into your decision-making process, you’ll be better equipped to identify opportunities, manage risks, and stay ahead in your trading journey.

Biggest Dos and Don'ts When Learning to Trade Shares

Learning how to trade stocks in the share market doesn’t have to be overwhelming. With the right education, structure, and discipline, anyone can develop the skills and confidence to succeed in the stock market.

Do:

- Always use stop losses and manage risk

- Buy only quality stocks or ETFs

- Trade thoughtfully and selectively

- Diversify but maintain focus

- Keep investing in your education

- When placing limit orders, set a maximum price (the highest price you are willing to pay when buying shares) and a minimum price (the lowest price you are willing to accept when selling shares). This helps control the execution price of your trades and manage risk.

- Consider investing in foreign company shares via CHESS Depositary Interests (CDIs) to receive the same benefits as regular shareholders, such as dividends and participation rights

- Understand how traders buy stocks to capitalise on short-term price movements, which differs from long-term investing strategies

After selling shares or other investments, transfer your trading profits to your bank account to keep your funds secure and maintain liquidity.

Don’t:

- Follow the herd or chase hot tips

- Dollar-cost average

- Buy penny stocks purely because they’re cheap

- Overuse leverage or trade impulsively

- Ignore your trading plan

To deepen your knowledge, explore my award‑winning book Accelerate Your Wealth: It’s Your Money, Your Choice, which reveals proven investing and trading strategies that help build lasting financial freedom.

Whether you’re learning the basics or looking to enhance your mastery, Wealth Within offers nationally recognised pathways to success. from the beginner-level Short Course in Share Trading to the advanced analytic rigor of the Diploma of Share Trading and Investment.

To explore more market insights and weekly stock analysis, tune into Wealth Within’s Hot Stock Tips videos, ASX video library, where you can watch the team dissect real-time opportunities across the ASX.

To learn more about Australia’s most respected share trading educator, visit our About Wealth Within page. Discover how you can develop long-term profitability and confidence in every market condition.

FAQs

How can beginners learn how to trade effectively?

Beginners can learn stock trading effectively by starting with the basics of how the stock market and stock exchange work. Begin by studying fundamental analysis and technical analysis to understand how to evaluate a company’s share price and market trends.

It’s also wise to practise trading using a demo trading platform through trusted online brokers before investing real money. Taking a structured trading course can help you master important skills such as risk management, position sizing, and how to buy and sell stocks strategically for long‑term success.

What is the difference between investing and trading stocks?

The main difference between investing and stock trading comes down to timeframes and strategy.

Investing is generally considered a long‑term approach focused on buying and holding quality shares, exchange traded funds (ETFs) or blue‑chip stocks for many years, benefiting from growth and dividends.

Trading stocks, on the other hand, involves buying and selling shares more frequently to profit from long, medium and short‑term stock price movements. Traders often use tools like moving averages and charts for technical analysis, while investors rely more on fundamental analysis to find valuable opportunities.

Both methods can build wealth, but trading requires stronger discipline and strategy.

What are the biggest mistakes to avoid when learning to trade stocks?

Some of the biggest mistakes people make when learning to trade stocks include:

- Trading without a clear plan or strategy

- Failing to use stop losses or proper risk management

- Over‑relying on hot tips or market rumours

- Ignoring the impact of brokerage fees and over‑trading on short‑term charts

- Letting emotions like fear and greed drive decisions

To become a successful trader, focus on gaining a quality education, developing a disciplined trading routine, start small, analyse every trade, and aim to make objective investment decisions instead of impulsive ones.