Five Proven Stock Market Trading Strategies for Confident Investors

By Dale Gillham

Trading the stock market can be as exciting as it is challenging. Every investor dreams of creating consistent profits, but without a plan, even the most promising opportunity can turn into a costly lesson. That’s where sound stock market trading strategies come in.

At Wealth Within, we’ve spent decades helping traders gain confidence and achieve their financial goals through structured education, mastery of trading psychology, and disciplined risk management. While no strategy guarantees profits, applying the right principles gives you the best probability of success.

As I always say, when it comes to investing in shares, it is not how much you make on any one investment that makes you wealthy; it is how much you do not lose over time.

This guide explores five expert‑endorsed stock market trading strategies, plus insights on market timing, emotional control, and how education transforms speculation into skill.

Understanding the Purpose of Trading Strategies

A trading strategy isn’t just a method for picking stocks. It’s a comprehensive plan that defines when to enter and exit a trade, how to manage risk, and how to evaluate performance. Without one, you’re essentially gambling.

A well‑researched strategy provides structure and consistency by integrating:

- Technical analysis to identify trends and price patterns.

- Fundamental analysis to evaluate business quality.

- Risk‑management tools like stop losses and position sizing.

- Trading psychology to keep your emotions in check.

Thorough investment research is essential for developing an effective trading strategy, as it helps traders understand market conditions and available investment options.

A well-researched strategy leads to more informed trading decisions, allowing traders to maximise profits and manage risks effectively.

Successful trading comes from knowing that markets are unpredictable in the short term, but highly rewarding in the long run for those who follow process over impulse.

When evaluating performance, it is important to consider past performance and use back testing as a critical step to assess a strategy's effectiveness and potential profitability. However, remember that past performance is not always indicative of future results, so ongoing analysis and caution are necessary.

Why a Proper Trading Education Matters

Before we dive into the strategies, it’s worth addressing one crucial truth: there’s no shortcut to trading success.

Far too many people enter the market armed with enthusiasm but without education. They rely on social media “gurus,” get‑rich‑quick schemes, or automated software that promises profits with minimal effort.

In reality, markets don’t reward hope. They reward discipline, patience, and skill. Building strong trading skills through formal education and consistent practice is essential for long-term success.

That’s why Wealth Within’s accredited trading courses emphasise structured education and application. Understanding how the market works helps traders identify genuine opportunities, manage risk, and remain composed under pressure, which are the hallmarks of every professional trader.

Five Expert Stock Market Trading Strategies

Here are five tried-and-tested stock market trading strategies, including some of the most popular trading strategies, that highlight the importance of understanding and applying different trading strategies to fit your individual goals and risk profile.

To find the approach that works best for you, consider trying out different strategies using a demo account before committing real capital.

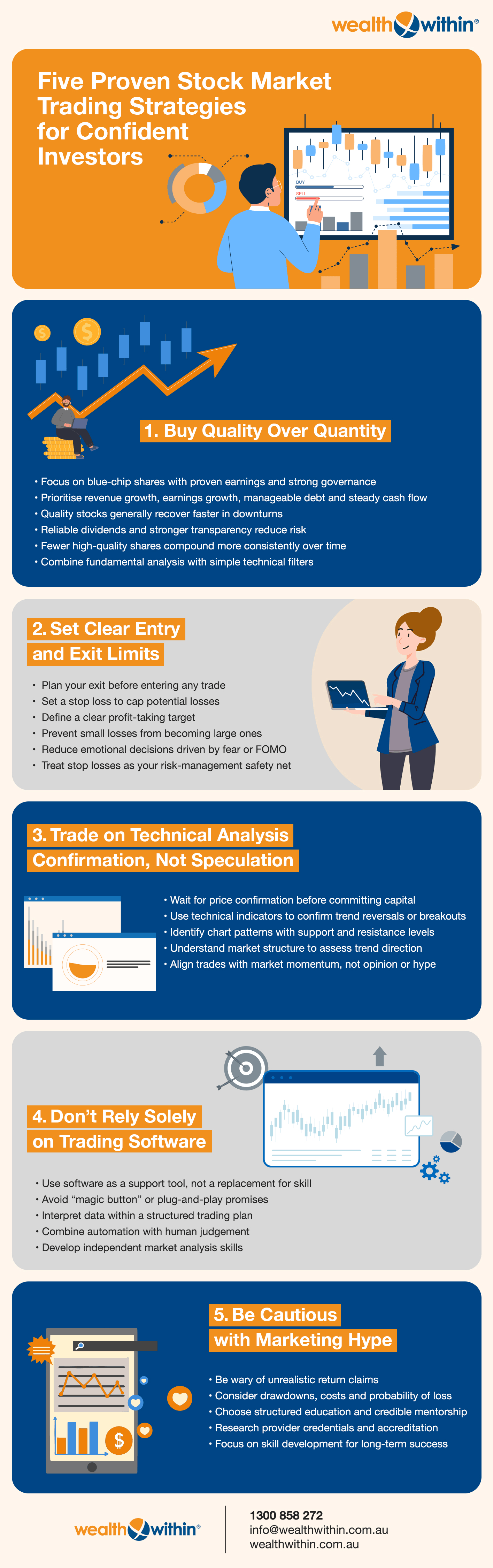

Buy quality over quantity

Every successful investor starts by focusing on quality. Buying blue‑chip shares, which are established companies with proven earnings, strong governance, and consistent revenue growth, will give you a foundation of stability and better liquidity. Revenue growth is a key metric in fundamental analysis, helping investors evaluate a company's financial health for long-term investing decisions.

If a small‑cap stock and a blue‑chip both yield 10 per cent, the return looks identical on paper. But the risk profile is vastly different. Quality companies tend to recover faster in market downturns, provide reliable dividends, and offer greater transparency.

Chasing cheap “penny dreadfuls” might feel tempting, but history shows that consistent returns come from owning fewer, high‑quality shares and compounding them over time. As every Wealth Within mentor reminds students, it’s not about how quickly you make profits, it’s about how well you protect them.

Pro Tip:

Use fundamental metrics such as earnings growth, revenue growth, debt ratios, and cash flow consistency to confirm quality before you buy. Combine these with simple technical filters to detect turning points and trend strength.

Set Clear Entry and Exit Limits

Most traders spend 90 per cent of their time deciding what to buy and only 10 per cent planning when to sell, which is backwards. Knowing when to exit a trade is just as important as choosing when to enter. Executing trades according to a predefined plan is crucial for maintaining discipline and achieving consistent results.

Set a stop loss before opening any position, a pre‑determined price level that limits losses. Setting stop-losses can prevent small losses from becoming large ones by establishing a selling limit when a stock drops by a specified percentage. Likewise, define your profit‑taking point to avoid the common trap of holding winning trades too long.

For day traders, all positions are typically opened and closed within the same trading day to avoid overnight risk, using technical analysis to inform their decisions. Traders should create a set of risk management orders, including a limit order, a stop-loss order, and a take-profit order, to reduce any overnight risk.

Without these limits, emotional decision‑making often takes over. Fear of missing out (FOMO) or the hope that a losing trade will “come good” can quickly erode profits. Setting boundaries helps you manage risk and stay objective.

Wealth Within Insight:

Treat your stop loss like an insurance policy. You hope you’ll never need it, but it’s your safety net when markets move unexpectedly.

Trade on Technical Analysis Confirmation, Not Speculation

Speculation is what tempts many to fail in trading. As the saying goes, “The market can remain irrational longer than you can remain solvent.”

Professional traders don’t guess, they wait for confirmation. This means allowing price to prove direction before committing capital. For example, if technical indicators confirm a trend reversal or breakout, that’s your cue. It's not a hunch, not social‑media tips. Recognising chart patterns is a useful skill for identifying potential trading opportunities, especially when combined with support and resistance levels.

Understanding market structure is also crucial, as it helps traders identify trend direction, support and resistance, and potential reversals to inform their trading decisions. Additionally, traders can use tools such as resistance levels and technical indicators to make informed decisions.

By trading on confirmation, you’re aligning logic with the market’s momentum rather than fighting it. This philosophy separates disciplined trading strategies from emotional gambling.

Key Takeaway:

Speculating without evidence is gambling. Trading with confirmation is intelligent investing.

Don't Rely Solely on Trading Software

Algorithmic platforms and trading software can streamline analysis, but there’s no “magic button” to overnight wealth. Many newcomers invest heavily in software, hoping it will replace skill. But that mindset is dangerous.

Data tools can help identify trends faster, yes. But genuine results come from understanding what the data means and how to apply it within your plan. It’s essential to analyse markets independently, using your trading skills and investment research, rather than relying solely on automated tools for trading decisions.

The false promise of “plug‑and‑play” systems often leads to overconfidence and poor decision‑making. Algorithms can spot patterns, but humans interpret market context.

Smart Use of Tech:

Use trading platforms as a tool to supplement your knowledge, not replace it. The best traders combine automation with human reasoning.

Be Cautious with Marketing Hype

The reality is that not all trading education is equal. Many marketing‑driven programs present impressive returns but fail to mention drawdowns, costs, or probability of loss.

Beware of bold claims like “turn $1,000 into $100k in three months.” Sustainable trading success comes from structured learning, mentorship, and consistent practice. Always research any provider’s credentials, testimonials, and accreditation.

Wealth Within stands apart as an accredited education provider, meaning our training is government-recognised and built around real, tested trading frameworks. Our goal isn’t to sell you dreams; it’s to help you build confidence through genuine skill development.

Our Short Course in Share Trading offers an excellent opportunity to get a head start on becoming a successful trader.

The Psychology Behind Successful Trading

Even the most refined strategies fail if emotions take control. Greed, fear, and impatience are the invisible forces that sabotage traders far more than the market itself.

Developing strong trading psychology means learning to trust your plan and accept losses as part of the process, not as personal failures. Maintaining emotional discipline creates consistency, and consistency builds results. Tracking trading profits and losses is a key habit of successful traders, helping to maintain consistency and discipline across all trades.

Adopting practices such as journaling trades, meditating, or back‑testing can also strengthen decision‑making power over time.

At Wealth Within, psychological mastery forms a key part of our curriculum because the mind is your most valuable trading tool.

That’s why Wealth Within’s Diploma of Share Trading and Investment is Australia’s only government-accredited share trading qualification, teaching a proven, structured 5-step method for profitable trading.

For those ready to move beyond basics, the Advanced Stock Trading Course takes this foundation even further into mastery-level analysis.

Risk Management: The Core of Every Strategy

Every professional trader understands one golden rule: protect your capital first. Profits matter, but survival matters more.

Combine position sizing, diversification, and stop‑loss placement to build resilience. Overleveraging magnifies greed and fear, which are two enemies of profitability. Additionally, be aware that certain strategies, such as pairs trading or those that require multiple simultaneous trades, can incur higher transaction costs.

These increased trading expenses can erode profits if not carefully managed, so always factor them into your risk management plan alongside market volatility and overnight market volatility.

Why Wealth Within?

Founded by award‑winning market analyst Dale Gillham, Wealth Within is Australia’s leading authority in trading education. Our mission is to teach individuals to become confident, independent traders, not signal chasers.

Through accredited courses and personal mentoring, students learn practical share trading strategies, technical analysis, fundamental evaluation, and behavioural finance, gaining the tools to trade any market condition.

If your goal is to build generational wealth through smart trading, it begins with the right knowledge, mindset, and guidance.

Take Control: Learn Professional Stock Market Trading Strategies Today

Don’t let uncertainty or market noise hold you back. With the right education and structured trading plan, you can approach the market confidently and profit consistently without guesswork or hype.

For more insights and weekly analysis from Australia’s most trusted trading educators, explore our Hot Stock Tips videos and ASX video library, where the Wealth Within team breaks down current market setups so you can see these techniques applied in real time.

To learn more about our trading education or how we’ve helped thousands of Australians trade with confidence, visit our About Wealth Within page.

FAQs

What is the Most Effective Trading Strategy for Beginners?

The best trading strategy for beginners is subjective and depends on your individual goals, risk tolerance, and trading style. What works as the best trading strategy for one person may not suit another, as performance can vary under different market conditions.

A popular approach for beginners is trend trading, which involves identifying and following the market's overall direction using technical analysis tools. This strategy aims to capture sustained moves in the market and is often considered straightforward for those new to trading.

Another method is momentum trading, where you enter trades on stocks showing strong price trends, aiming to capitalise on the continuation of existing momentum. This approach is suitable for active traders and can offer quick profits, but also carries higher risks.

How Do Stock Market Trading Strategies Reduce Risk?

A trading strategy outlines how much you invest, where to set stop losses, and when to exit, which limits emotional mistakes. Clear, rule‑based risk management prevents impulsive trades and reduces large losses, ensuring your portfolio remains balanced and sustainable.

Understanding market structure and market movements is essential for effective risk management, as it helps traders identify trend directions, support and resistance levels, and potential reversals. Additionally, different trading styles require different risk management approaches to address the unique risks associated with each strategy.

Should I Use Trading Software to Find Trades?

Software and trading apps can help identify opportunities more efficiently, such as spotting market trends, chart patterns, and rapid price changes. However, while these tools can highlight potential setups, human analysis is still essential to interpret market structure and make informed trading decisions. Always verify signals through independent analysis because relying solely on algorithms can amplify errors rather than minimise them.

Can Certain Strategies Work for Both Long‑term Investing and Short‑term Trading?

Yes. While time horizons differ, the core principles of discipline, quality selection, and proper risk management apply universally. There are several strategies suited to different timeframes:

- Position trading involves keeping a position open for a long period of time, usually weeks, months, or even years. This strategy focuses on capturing major market trends and is less affected by short term market fluctuations, relying heavily on fundamental and technical analysis.

- Swing trading aims to profit from short-term price swings and targets medium term price movements that occur over a few days to weeks. Swing traders look to capitalise on market volatility within this timeframe.

- Day trading involves opening and closing all trades within a single day, with no positions left open overnight. This approach requires quick decision-making and focuses on intraday price movements.

- Scalping is a short-term trading strategy that involves making multiple trades within a very short period to capture small price movements.

- End-of-day trading is a strategic approach where traders analyse market conditions at the close of trading hours. It is suitable for those with limited time and who prefer to analyse markets over extended periods, as it reduces the noise from intraday fluctuations but may miss some short-term opportunities.

Each strategy can be effective when matched to your goals, risk tolerance, and available time.

How Do I Learn Professional Trading Strategies Safely?

Choose an accredited trading education provider with a track record of student success, transparent course materials, and qualified mentors. Practicing with a demo trading platform is highly recommended for beginners, as it allows you to build skills and confidence without risking real money.

Understanding trading volumes and trading hours is also essential, as these factors influence market activity, liquidity, and the effectiveness of your trades. Setting clear goals will help you stay motivated and focused on long-term trading success.

Is Keeping Up With Market News and Trends Important?

In today’s fast-paced financial markets, staying ahead of the curve means more than just following price charts. It requires a keen awareness of market news, economic releases, and evolving trends. For traders at every level, from position traders to swing traders and day traders, being informed is the foundation of every successful trading strategy.

Others who read this article also enjoyed reading:

- How to Become a Full-Time Stock Trader

- Protect Your Portfolio from a Stock Market Correction

- Timing the Stock Market - Debunking the Myth

Purchase my latest book, Accelerate Your Wealth - It's Your Money, Your Choice, which is packed with a number of stock market strategies that will support you to become financially independent.

Alternatively, if you want to learn how to apply some powerful stock market trading strategies so you consistently profit long term, review our accredited trading courses. You can also see what our clients have to say about their stock market success in our reviews and testimonials.